Memo Published September 11, 2025 · 6 minute read

ACA Expirations Will Trigger a $23 Billion Middle-Class Tax Hike

Darbin Wofford, Blair Elliott, & David Kendall

In 2021, Democrats expanded the Affordable Care Act (ACA) to make health insurance premiums more affordable for middle-class families by enhancing premium tax credits. However, these expanded credits are set to expire at the end of 2025. If Congress does not act, millions of Americans will see their premiums spike dramatically—effectively triggering a $23 billion tax hike on the middle class next year.

Below, we explain how any inability to extend these tax credits would be a detrimental tax hike on the middle class, how their premiums would skyrocket, and who would be most hurt.

The Success Behind Expanding the ACA

Initially, ACA premium tax credits did not apply to anyone making over 400% of the federal poverty level ($62,600/year for individuals or $106,600 for a family of three), leaving many middle-class families with unaffordable premiums.

In 2021, Democrats capped ACA premiums at no more than 8.5% of income for all enrollees, regardless of income level—increasing affordability and eliminating the arbitrary line that cut middle-class families off from assistance. This expansion especially helped older Americans and middle-income families whose employer doesn’t provide health insurance.

As a result of this expansion, enrollment in the ACA’s Marketplace doubled, with more than 24 million Americans now enrolled. Now, the rate of uninsured Americans is at a historic low.

What’s at Stake: A $23 Billion Tax Hike on the Middle Class

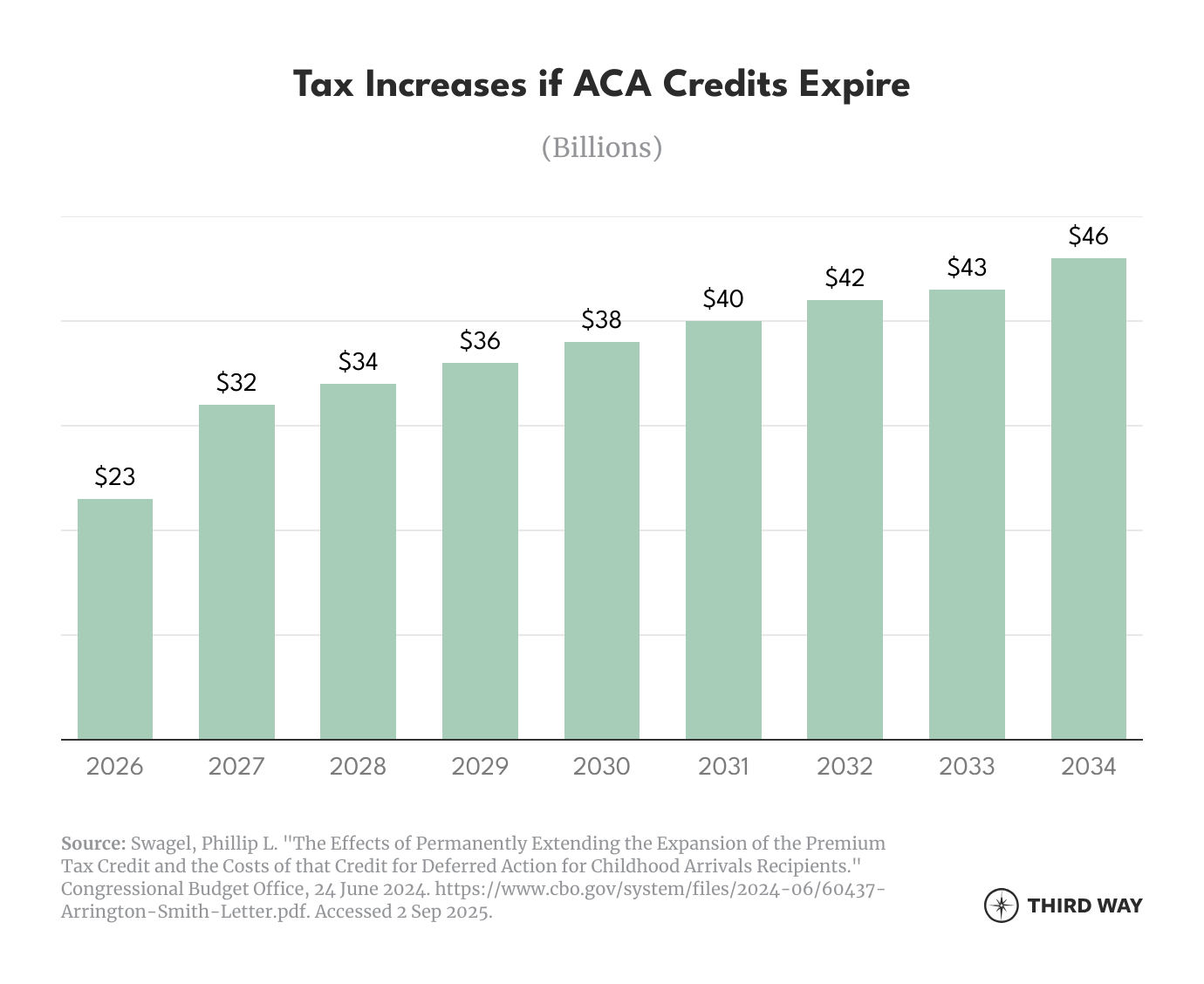

If Congress allows the ACA tax credits to expire, federal taxes will go up on working families. Specifically, Americans would see their tax credits reduced by $23 billion in 2026 and by $32 billion in 2027. Over 10 years, Marketplace enrollees will pay $335 billion in higher premiums due to the loss of these tax credits.

Families who receive ACA tax credits will see an average tax increase of $4,051 in 2027, significantly affecting affordability. Nearly one-in-four ACA enrollees are ages 50 to 64—a group particularly vulnerable to premium hikes without Medicare eligibility. One-in-ten are children, whose parents do not have access to employer-based coverage, and most make too much to qualify for CHIP.

Small business owners, gig workers, and those without access to employer coverage options would also bear the brunt of the cost increases. For example, there are over six million people in the ACA marketplace who are either self-employed or work for small businesses that would face annual tax increases without an expansion of the ACA tax credits.

Further, higher premiums would push many to drop coverage altogether, reversing years of progress in protecting people from the high cost of medical care through affordable coverage. The Congressional Budget Office estimates 4.2 million Americans would lose coverage. This is on top of the 1.8 million projected to lose coverage as a result of the Trump administration’s Marketplace Integrity and Affordability Rule and the 7.7 million Americans losing Medicaid due to Republican cuts.

The Impacts

Under the expiring tax credits, premium costs are capped at 8.5% of a family’s annual income, regardless of how much they make. If Congress lets the enhanced tax credits expire, middle-class families making slightly above 400% of the Federal Poverty Level—$82,000 for a couple or $125,000 for a family of four—will fall on the wrong side of an arbitrary income line. That means they will no longer qualify for any help covering their monthly premiums. And middle-class families will see affordable coverage slip out of reach.

A household income above 400% of the Federal Poverty Level is the median income for a family of four, which means half of those families make above that level. The expiring tax credits will leave those families spending an unsustainable share of their annual income on their premiums.

Here’s exactly how some families would feel the impact of Republicans allowing the premium tax credits to expire:1

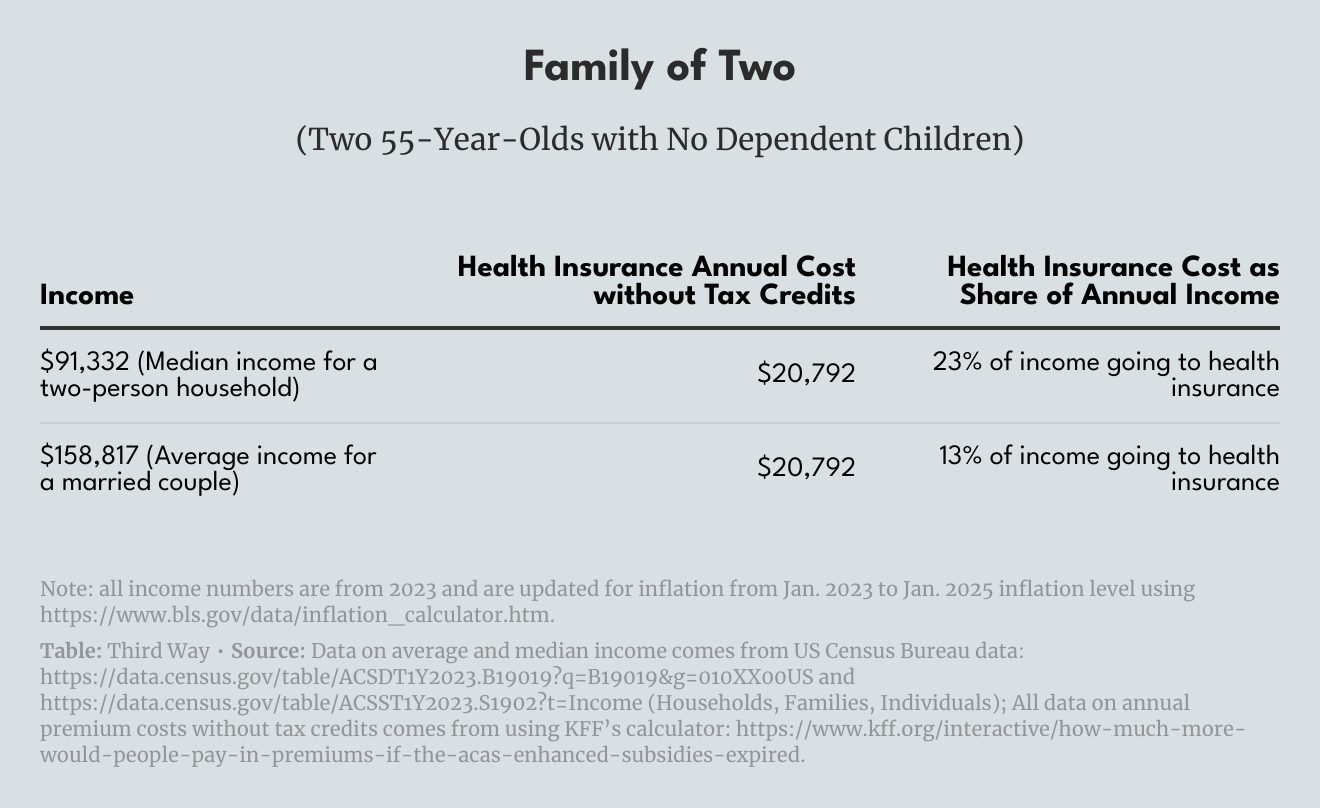

- An older couple not yet eligible for Medicare coverage making the median income for a household of two, about $91,000, would fall just above the income line to qualify for premium assistance. As a result, they will need to spend nearly $21,000 annually on their premiums, eating up 23% of their annual income.

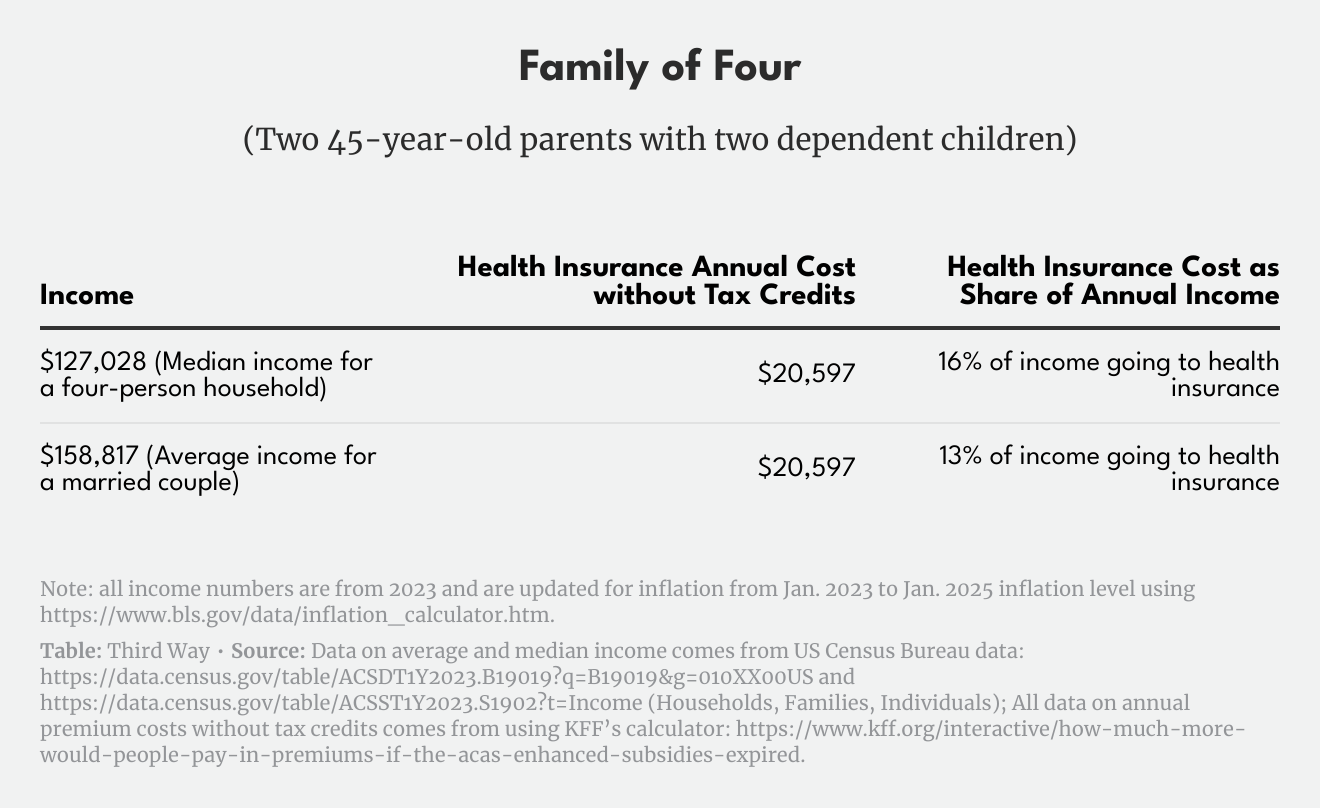

- A family of four making $127,000, the median income for a family of four, would similarly find themselves on the wrong side of the arbitrary income line and would be stuck spending about 16% of their annual income on their monthly premiums.

- Even those making the average household income, about $159,000 a year for a married couple, would be forced to spend 13% of their income to afford coverage.

Letting ACA Tax Credits Expire Would Explode Health Insurance Costs

Once middle-class families pay their rent or mortgage, take care of their kids, purchase groceries, and fill up their gas tanks, finding more than 20% of their income to put toward their health care premium could easily feel impossible. The rising cost of living and growing potential for an impending economic downturn will only compound families’ financial challenges. The result of those tough choices will be clear: more people will lose their health care coverage, and families will have less ability to establish and grow wealth.

ACA Tax Credits are Better Targeted

Republicans have complained that rich people are benefitting from the tax credits. Irony aside, only 6% of people receiving ACA tax credits earn more than eight times the poverty level ($169,ooo for a married couple). Put another way, 94% of people receiving the tax credits are working class or middle class. Even for the small number of upper middle-class recipients, the amount they receive is capped so that their premiums don’t exceed 8.5% of their income.

Compared to other tax breaks for health coverage, the ACA tax credits are far better targeted:

- Employment-based coverage. Tax breaks for people with employer-provided coverage and higher incomes cost taxpayers more than the ACA tax credit. Individuals receive a much larger tax break through employer coverage because, unlike wages, their health benefits are free from income and payroll taxes. For people making over eight times the poverty level, employer-based coverage costs taxpayers $2,580 compared to the $730 for the ACA tax credit.

- Health savings accounts. Republicans have enacted and expanded tax breaks for health savings accounts (HSAs), in which contributions and investment earnings are not taxed along with any withdrawals for health care costs. They are coupled with high deductible health plans, which makes them attractive to higher-income individuals who can afford to take the financial risk. Higher-income individuals receive far greater benefits from tax breaks for HSAs than they do from ACA tax credits.

The Bottom Line

Congress must act now to extend the ACA tax credits to prevent a massive tax hike and premium spike for millions of middle-class families. Letting the credits expire would have an immediate impact on working Americans. It wouldn’t just be a tax increase—it would drive up health insurance premiums, burden small businesses, push millions off coverage, and saddle families with higher out-of-pocket costs and medical debt.