Protecting the Affordable Care Act

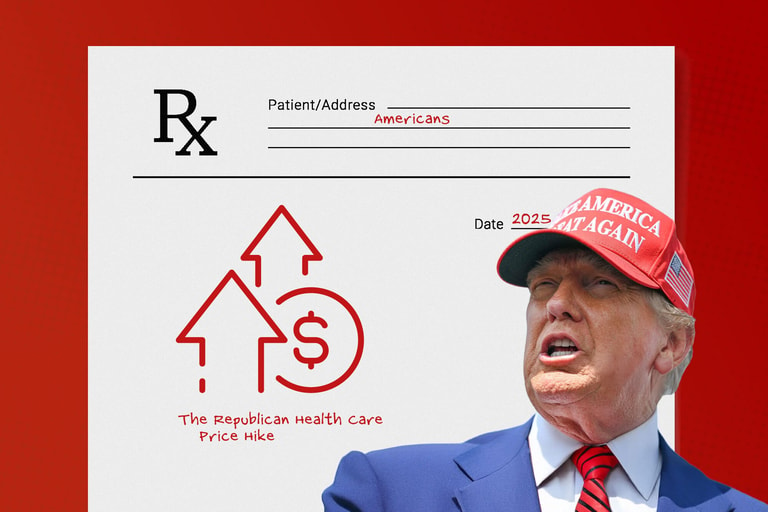

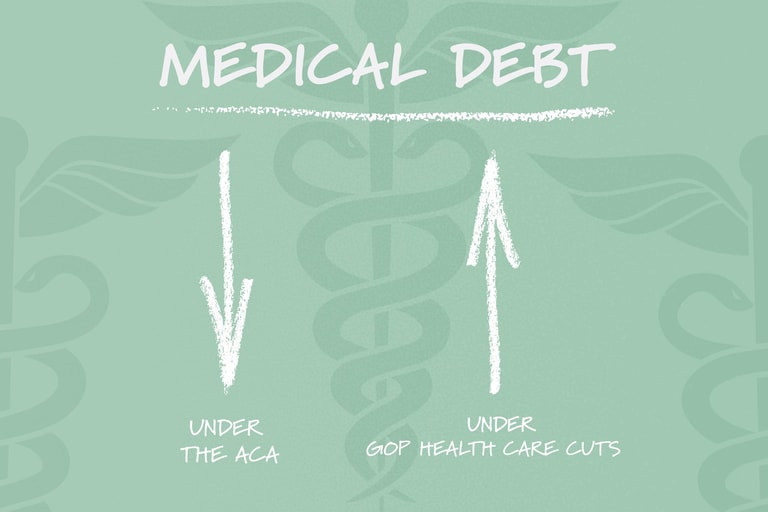

Tax credits that help people afford their health insurance premiums have expired. Now, over four million Americans will lose their coverage and 15 million will see their premiums spike by hundreds of dollars per year. These enhanced premium tax credits under the Affordable Care Act are critical to ensure access to affordable coverage for middle-class families, as well as small businesses owners and employees. Without Congressional action to reinstitute the ACA tax credits, the health care affordability crisis in America will continue to worsen.

Learn more about Third Way’s work to extend the ACA’s premium tax credits below.

Filters

Our Products

In the News

Darbin Wofford, Former Deputy Director of Health Care

David Kendall, Senior Fellow for Health and Fiscal Policy

Gaby Hartney, Health Policy Advisor