Memo Published June 23, 2025 · Updated September 9, 2025 · 5 minute read

GOP Health Care Cuts: A Recipe for Medical Debt Disaster

David Kendall, Blair Elliott, & Timothy Kusuma

This memo updates the previous version of this memo published on June 23, 2025.

Republican proposals to slash health care by one trillion dollars would push millions more Americans into medical debt. Third Way estimates that the Republican One Big Beautiful Bill Act would push 5 million people into medical debt and increase the total medical debt that Americans owe by $44 billion—a 13% jump.1 This memo explains the relationship between health insurance coverage and medical debt, how Republican proposals would reduce coverage, and the impact of health care cuts on medical debt.

Health Insurance Coverage Reduces Medical Debt

Medical debt currently affects 100 million people in the United States.2 Patients, doctors, and hospitals struggle with $269 billion in unpaid medical bills.3 The threat of medical debt also weighs on those who are lucky enough not to carry that burden. Six-of-10 people worry that medical bills will overwhelm their family’s budget if they get sick or have an accident.4

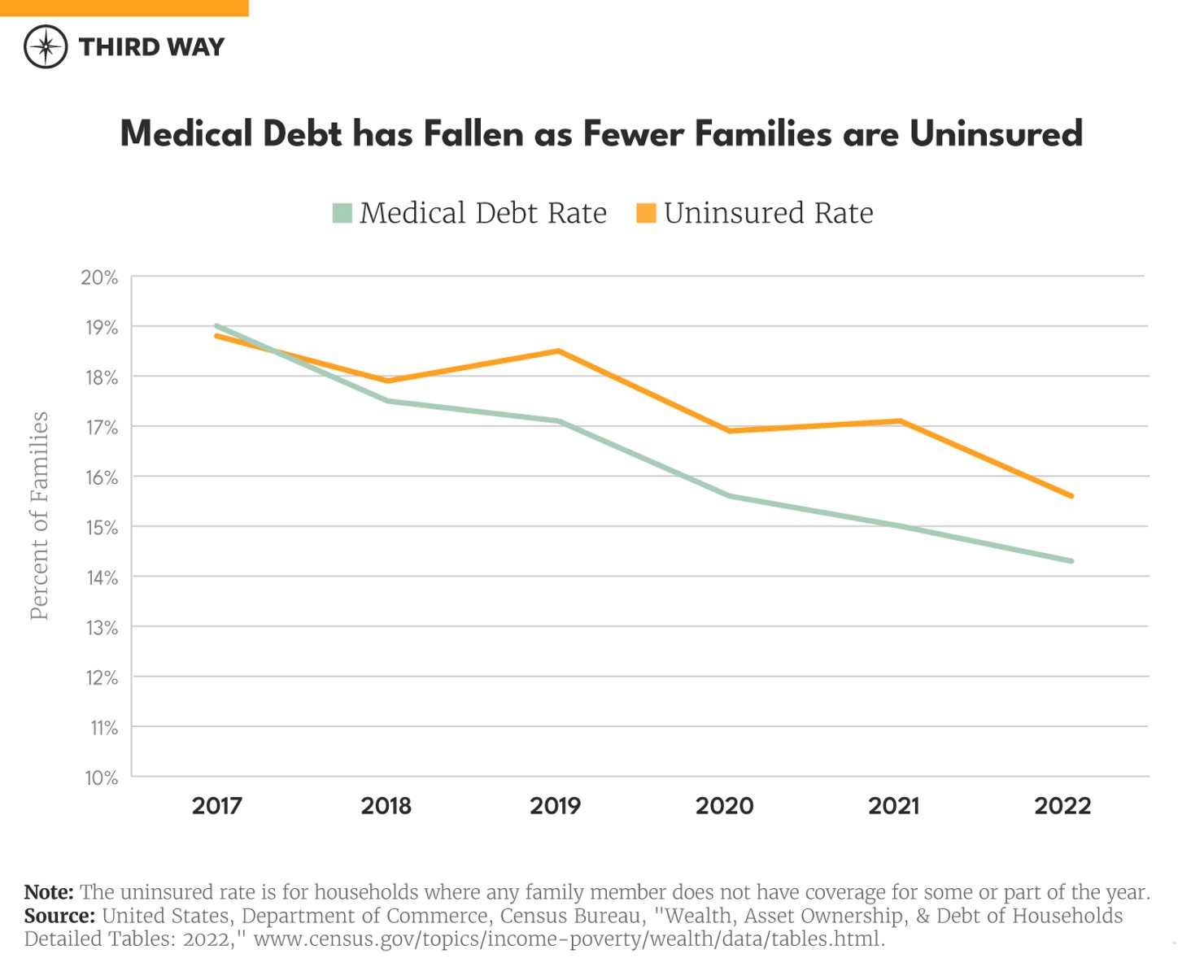

The treatment for medical debt is adequate health insurance coverage. Coverage protects families from unforeseen costs and gives them access to care that keeps them healthy. As shown below, medical debt has declined in the United States as fewer families are uninsured.5

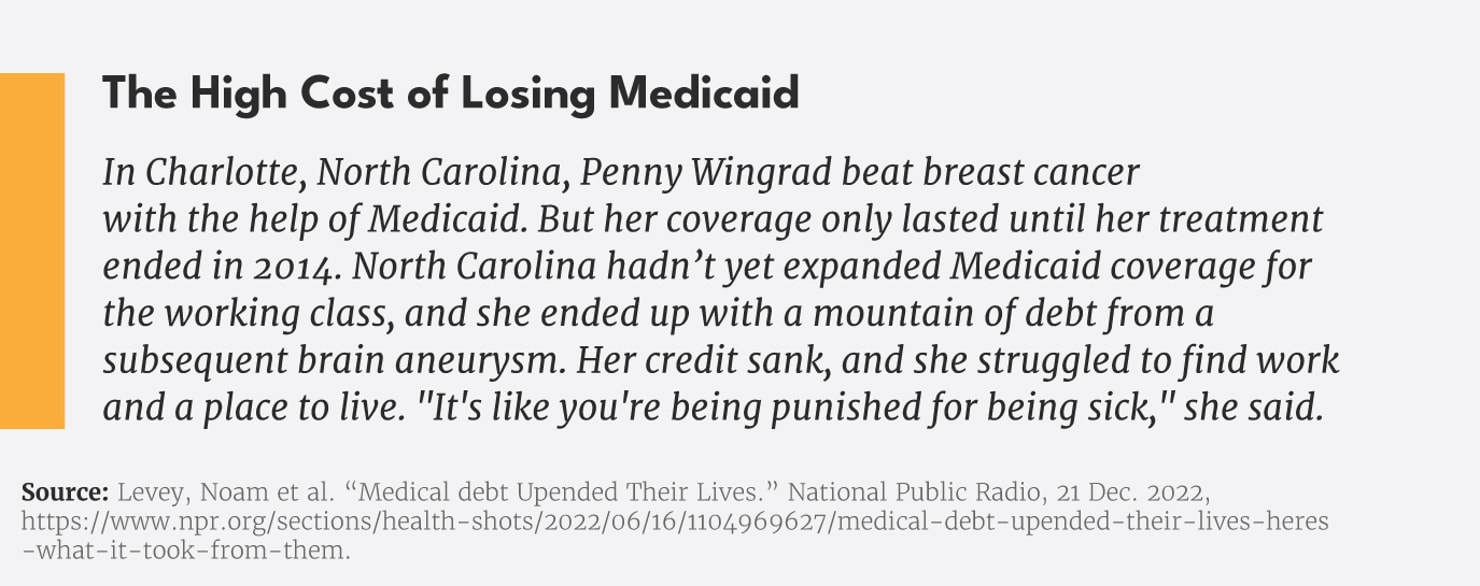

In fact, a key study called the Oregon Health Insurance Experiment found that Medicaid coverage reduced medical debt rates by 13.3 percentage points.6 Researchers looked at how people fared with Medicaid coverage compared to a control group without Medicaid coverage. The rate of medical debt fell from 56.8% for those without coverage to 43.5% in the group with coverage.

The US Census Bureau’s Survey of Income and Program Participation also shows how medical debt declines as insurance rates go up. Census data shows that medical debt declined by 18.6% as coverage increased for families with incomes in the middle three-fifths of income quintiles from 2017 to 2022.7

Millions Would Lose Health Coverage Due to Health Care Cuts

The Republican One Big Beautiful Bill Act would slash $1.1 trillion from Medicaid, the ACA, and other health care programs over 10 years. The nonpartisan Congressional Budget Office (CBO) estimates that 14.2 million people will lose their coverage due to those cuts and the failure to extend existing programs that lower the cost of coverage for families.8 That number includes 6.5 million losing Medicaid and 7.7 million losing ACA marketplace coverage.

Republican policies will cause families to lose coverage in three ways:

- Medicaid Work Requirements: Despite the poor track record of Medicaid work requirements at the state level, Republicans have uniformly supported adding this unnecessary bureaucratic burden to the program nationwide. It will cause five million people to lose coverage and will not increase employment rates.9

- Medicaid Eligibility and Enrollment Restrictions: The One Big Beautiful Bill Act would add hurdles for families to get coverage through Medicaid. For example, it will reverse Biden-era efforts to make Medicaid enrollment simpler and automatic. It will also stop states from using their own money to provide care to undocumented workers. Such provisions would lead to 3 million more people without coverage.

- ACA Cuts: The ACA caps the cost of health coverage at 8.5% of a family’s income (or less for families with lower incomes). That cap is set to expire and won’t benefit families during the next open enrollment, which starts in November, unless Congress acts. Republicans chose not to extend the cap in the One Big Beautiful Bill Act, which means health insurance premiums will skyrocket, especially for middle-class families.10 CBO estimates 4.2 million people will lose coverage as a result.11 Other changes that would make enrollment harder and more expensive would cause 900,000 people to lose coverage.

Less Coverage Means More Medical Debt

Republican health care policies will increase the number of people in families with medical debt by 5 million.12 This estimate is based on medical debt in households—not just individuals—because one person with medical debt affects everyone in a family. For example, if an adult in a family loses coverage and needs health care they cannot afford, the whole family takes on the burden of medical debt.

Of the 5 million expected to lose coverage, 2 million more households will have medical debt because they specifically lost their Medicaid coverage. The ACA cuts will lead to 3 million more people with medical debt. The problem is worse for middle-class families because they are more likely to take on medical debt than the poor, who more often skip the care they need altogether.

Families losing coverage could see their medical debt increase by as much as $22,800 depending on whether they already had medical debt.13 We estimate that:

- 87% of households would accumulate an average of $22,800 in medical debt because they previously had none.

- 13% would accumulate an average of $8,790 in new medical debt on top of $13,490 in existing medical debt, despite having had coverage.

Medical debt across the nation would increase by $44 billion due to Republicans’ health care cuts.14 That amount would be an increase of 13% over the current amount of $340 billion.15

The projected medical debt increase in each state is below.

Conclusion

Under Republican cuts, millions of Americans will lose their health insurance coverage, and the burden of medical debt will grow more intense for American families. After years of declining medical debt thanks to coverage gains under the Affordable Care Act and Democratic improvements, Republicans are about to erase this progress and put the health and financial security of millions of working families at risk.