Memo Published September 24, 2025 · 4 minute read

The Republican Health Care Price Hike

David Kendall

Republican congressional leaders have shown no interest in avoiding a major cost increase for families who get their health care coverage through the Affordable Care Act’s marketplaces. By the end of the year, a tax break that helps people pay for health insurance will end, making coverage too expensive for those who don’t get insurance through their job.

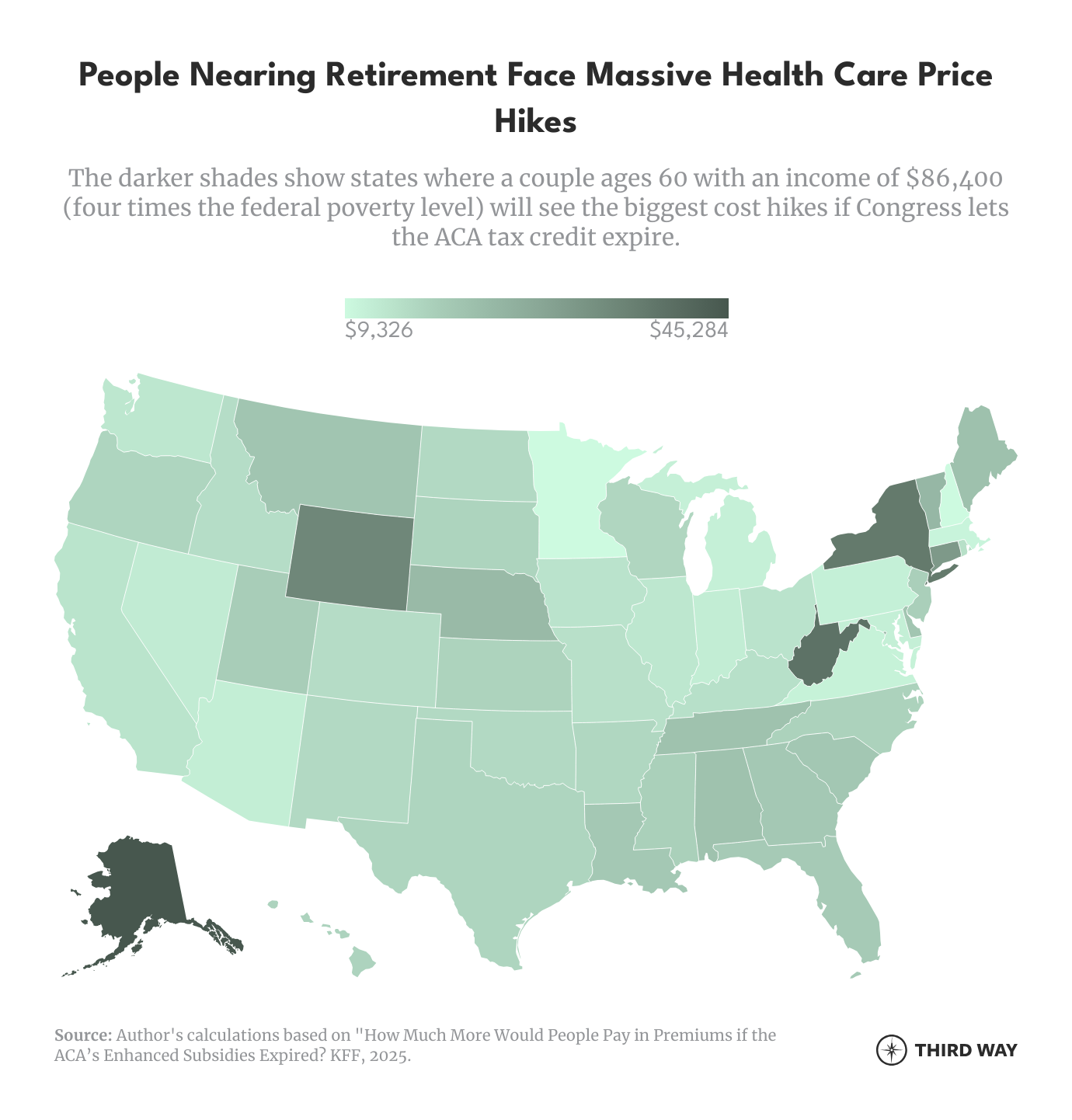

Democrats need to show where the blame lies. Otherwise, many voters will believe false claims from Republicans that the ACA has driven up costs. The clearest way to show the impact of the expiring tax credit is by focusing on consumers who will be most affected. Notably, the top three states where median-income, 60-year-old couples will face the most dramatic increases in their health insurance premiums are: $45,284 in Alaska, $39,309 in West Virginia, and $37,654 in New York.

This memo shows the impact on consumers in every state if the ACA tax credit expires. We explore two cohorts of people (those who are nearing retirement and those who are mid-career), explain why the impact on these couples is severe, and show how Congress can fix the problem.

The Health Care Price Hike for People Nearing Retirement

The ACA tax credits, which were expanded in 2021, cap the cost of health insurance at 8.5% of a families’ income for people with incomes over four times the federal poverty level. Previously, they had no cap on what their insurance would cost. Older workers rely on this protection more than others because they pay a higher premium based on their age.

Without the ACA tax credit, couples at age 60 with an income of $84,601 will face an average increase of $18,114 annually.1 Those increased costs not only impact monthly budgets, but they also reduce what a couple would otherwise be saving toward retirement. The financial hit would come at the time when people start making peak contributions to their retirement account.2

The map below shows the price hike for couples with incomes just above four times the federal poverty level, which is roughly equal to the median income for a two-person family.3

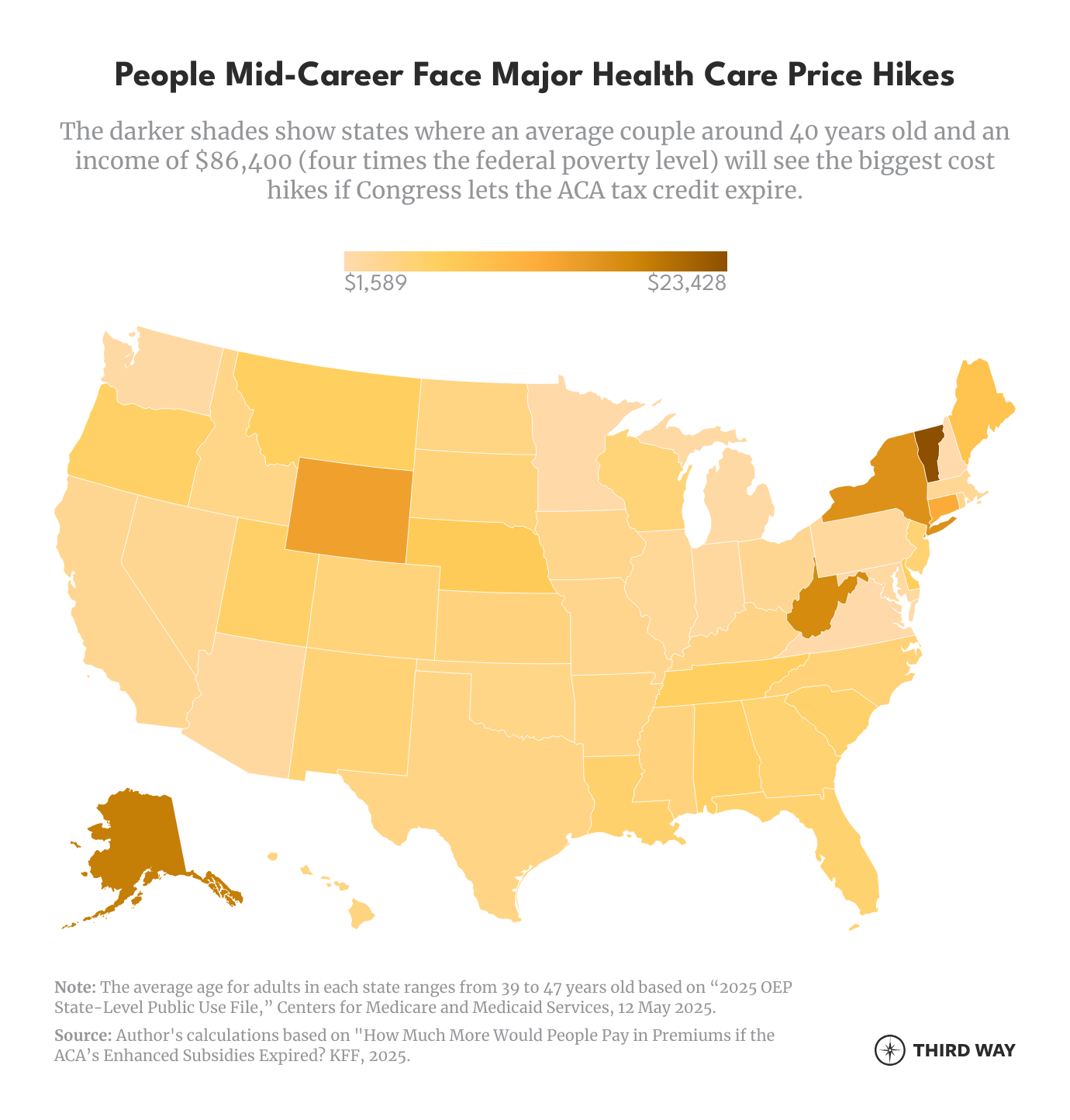

The Health Care Price Hike for People Mid-Career

Younger couples will also see big increases in their health care costs. The average cost increase for a couple who are both 43 years old (the average age) would be $5,462. The map below shows the price hike in every state for a mid-career couple earing four times the federal poverty level.

These increases are based on the cost of coverage in 2025. In 2026, it will be even more since premiums are rising significantly due to market instability.4 Health plans are raising their prices to account for several factors, including the loss of younger, healthier consumers who will cancel their coverage after losing the tax credit. Those cancellations will, in turn, drive up costs for everyone. Millions of American consumers will see higher health care costs as result of GOP inaction.

What Can Members of Congress Do?

Congress should extend the tax credit as soon as possible. It is already very late for health plans to change their prices for 2026, as rate notices have already gone out or will be going out soon. Further, the price shock from losing the tax credit will soon be baked into the online tools that show consumers’ costs for open enrollment, which starts November 1. Still, better late than never, and that’s how Congress should proceed.

If Congress fails to act, Democrats must show where the blame lies. They can build on the fact Republicans have already cut coverage for 10 million people in their budget bill. Another four million will lose coverage from the loss of the tax credit. Republicans have consistently pushed to reduce health care coverage since the failed ACA repeal attempt during President Trump’s first term. Those are the facts Democrats should emphasize.