Report Published September 17, 2025 · 8 minute read

A Bipartisan Framework to Lower Health Care Costs

Darbin Wofford & Blair Elliott

Budget reconciliation is an inherently partisan exercise. But now that reconciliation is behind us, opportunities may arise for bipartisan compromise. If they do, Democrats should be ready—especially when it comes to health care.

Notably, the Republican budget failed to include an extension of the Affordable Care Act (ACA) tax credits. If a bipartisan compromise is available later in the year, Democrats should do all they can to lessen the impact of the Republican reconciliation package and make health care more affordable by preserving gains made through the ACA.

In this report, we look at two looming issues: an upcoming ACA cliff and high hospital prices that are harming seniors and other patients. We then propose a framework for what a deal might look like, which includes the following:

- Extend ACA tax credit enhancements.

- Pass bipartisan hospital reforms that would lower patients’ health care costs and offset the extension of enhanced ACA tax credits.

- Codify and incentivize the use of Individual Coverage Health Reimbursement Arrangements.

- Reduce waste, fraud, and abuse in the individual health care Marketplace.

- Use any excess savings to reduce deficit spending.

The Looming Affordable Care Act Cliff

If Congress does not act soon, the cost of health care for Americans who get their coverage through the ACA’s Marketplace will spike drastically.1 Here’s a quick primer on the issue:

Original ACA Support: The ACA included tax credits that capped the cost of health insurance for individuals and families based on their income. However, these tax credits were only available for households with incomes between 100% and 400% of the Federal Poverty Level (FPL).

The Problem: Marketplace enrollees with incomes above 400% of the poverty line did not qualify for the program and could not offset their health insurance premiums with the tax credits, leaving middle-income Americans vulnerable to high premium costs. Further, the tax credits for those with incomes below 400% of the poverty line were often not large enough to make coverage truly affordable.2

The (Temporary) Fixes: In 2021, the American Rescue Plan significantly expanded these tax credits through 2022. The enhanced credits capped premium costs at a maximum of 8.5% of a family’s household income for all Marketplace enrollees, regardless of income. In 2022’s Inflation Reduction Act, Congress reauthorized the program through 2025.3 As of 2024, more than 19 million Americans were benefiting from these credits and saving an average of $800 per year on their premiums.4

The Results: Due to this lowered cost of coverage, Marketplace enrollment has doubled since 2020.5 These massive gains in Marketplace coverage helped the rate of uninsured Americans fall to historic lows.6 Without an extension of the tax credit enhancements, more than four million Americans are expected to lose their coverage, and millions more will see their premium costs skyrocket.7 The enhanced tax credits are also broadly popular across party lines, with 82% of voters, including 77% of Republican and Independent voters, supporting their extension.8

High Hospital Prices for Seniors

Across the country, hospitals are taking over independent doctors’ offices and consolidating local health care markets—creating monopolies for outpatient care. As a result, patients are being nickel and dimed for standard services, and seniors are paying more for the same routine services, simply because they are delivered in a hospital-owned clinic instead of an independent doctor’s office.

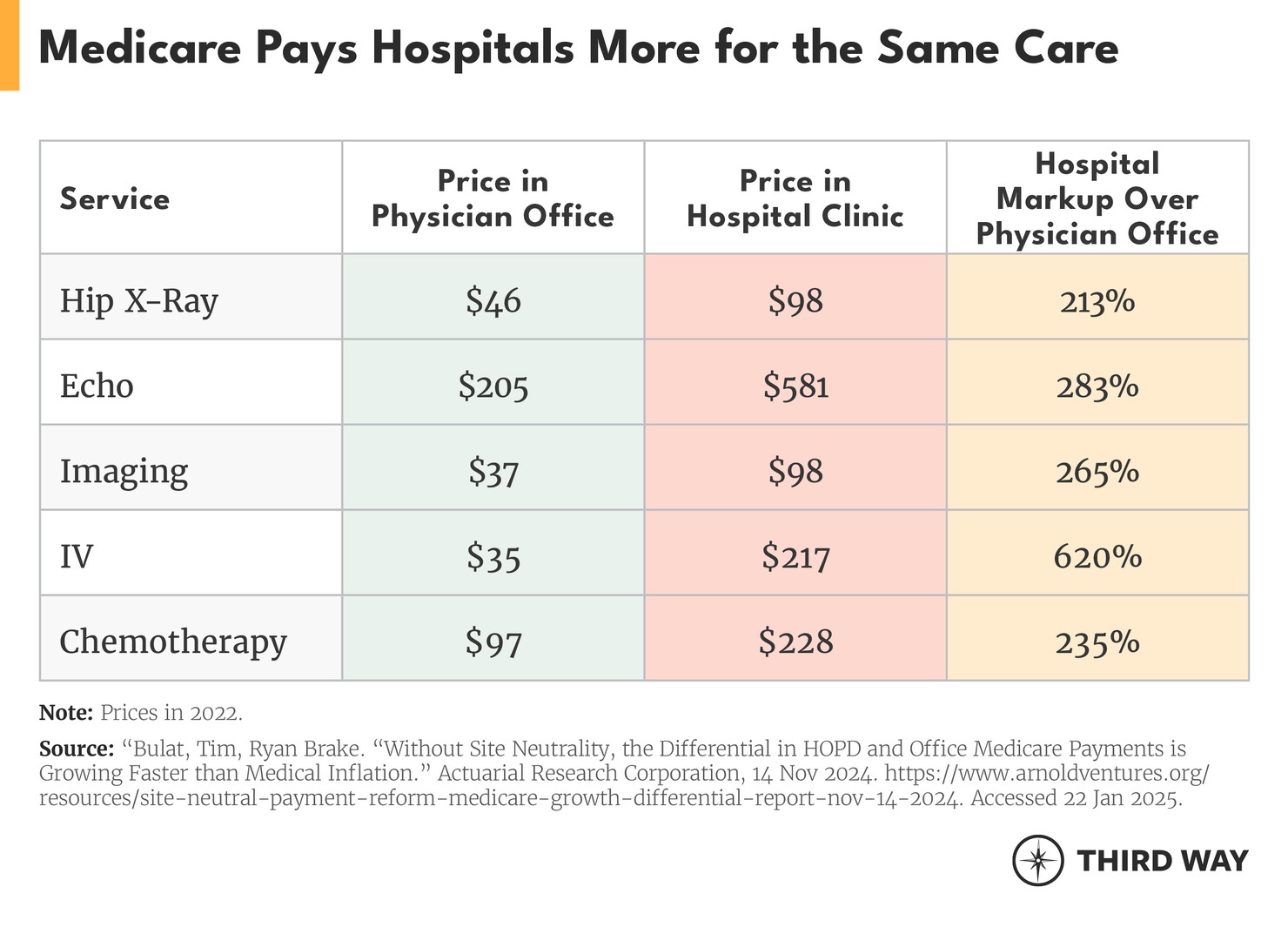

Much of this stems from the fact that Medicare pays hospital-owned clinics more than independent doctors’ offices for the same services, such as routine visits, telehealth appointments, labs, and many others. Under the Medicare Part B payment structure, seniors are required to pay their provider a 20% coinsurance for those outpatient services. This means that seniors are forced to pay more out of pocket because Medicare overpays hospitals for these routine services, despite no difference in quality. This overpayment is also resulting in higher premiums for seniors since they are on the hook for 20% of their Part B premiums.

The cost disparity between physician offices and hospital-owned clinics isn’t limited to seniors in Medicare—it also extends into the private sector. As hospitals are incentivized to acquire physician offices to increase payments from Medicare, the resulting consolidation provides hospitals more market power to demand higher prices in negotiations with employers and private health plans for outpatient services. This forces patients and employers to pay higher premiums and out-of-pocket costs.

This disparity in payments also strains the federal budget. Paying hospitals more than independent physician practices for the same services is an inefficient use of taxpayer dollars. A simple fix—known as site-neutral payment reform—would align Medicare payments across all settings, ensuring that the same service is reimbursed at the same rate, regardless of where care is provided.

Congress took a first step toward this policy with the Bipartisan Budget Act of 2015, which reduced payments to newly established hospital outpatient clinics. Broader reforms could yield much greater savings. For example, we could see:

- $40 billion in savings if site-neutral payment policies were applied to all hospital-owned clinics located outside the hospital, which are no different than an independent physician’s office.9

- $178 billion in savings if site-neutral payment policies applied across all common outpatient services provided by independent physicians in Medicare, expanded to services provided by clinics located within hospitals.10

In addition to savings to the federal government and Medicare, seniors would also save money. Reductions in hospital payments could save seniors up to $137 billion through their Part B premiums and out-of-pocket costs, roughly $400 a year per beneficiary.11

If Congress were to implement site-neutral payment policies, the increased leverage for employers and other private payers would reduce premiums and out-of-pocket costs in the private market by up to $466 billion over the decade.12

A Framework for Bipartisan Reform

Democrats and Republicans agree on one thing: we need to lower costs. Democrats see value in building on the ACA while Republicans need to show results while they control Washington. Here’s how both sides can come together:

First, extend the ACA’s expanded premium tax credits for somewhere between two years and permanently. This would keep in place the 8.5% premium cap for all households. According to the Congressional Budget Office, a two-year extension will cost $55 billion, and making them permanent would cost $335 billion.13

Second, pay for these ACA credits by lowering Medicare’s rates for outpatient services in hospital-owned clinics. As discussed above, hospitals charge higher prices than independent clinics for the same services, which is raising the cost of premiums and the overall cost of health care. Site-neutral payment reform, supported by Republicans and Democrats, would provide a bipartisan offset between $40 and $178 billion over 10 years, depending on how it is scaled.14 In addition to paying for tax credits, part of the savings could be reinvested to support rural and other high-needs hospitals as laid out in the bipartisan framework proposed by Senators Bill Cassidy (R-LA) and Maggie Hassan (D-NH).15

Third, codify and incentivize the use of Individual Coverage Health Reimbursement Arrangements. In 2019, the Trump Administration enacted a rule to allow employers to reimburse workers for premiums paid for individual coverage purchased through the ACA exchanges, also known as Individual Coverage Health Reimbursement Arrangements (ICHRAs). The House-passed version of the Republican tax bill would have codified the rule that created ICHRAs, allowing the purchase of plans on the Marketplaces while providing small businesses with monthly tax credits to encourage their use.16 But that provision was dropped from the final legislation that was signed into law. Including this proposal in a bipartisan agreement to extend the premium tax credits would give employers more options to provide coverage benefits and increase enrollment in the ACA Marketplaces.

Fourth, strengthen Marketplace integrity to prevent waste, fraud, and abuse. One way to do this is to crack down on insurance brokers who misrepresent enrollees’ income information or change enrollees’ coverage without their consent, allowing the brokers to fraudulently profit from higher tax credits. In the last Congress, Senator Ron Wyden (D-OR) introduced the Insurance Fraud Accountability Act to hold these brokers accountable.17 Investing in oversight is another option for cracking down on improper payments.18

Fifth, decrease the national debt. Savings from larger-scale site-neutral payment reform and Marketplace improvements would cover the cost of the two-year ACA extension. Any excess savings should be used for debt reduction. Longer extensions of the ACA tax credits would require additional savings.

Conclusion

Headed into the 2018 midterm elections, Democrats had a clear message about protecting the Affordable Care Act and lowering prescription drug prices. Now, while Republicans are pursuing unpopular policies, such as draconian cuts to Medicaid, Democrats should start putting forward an alternative vision to make health care more affordable. Beyond extending enhanced ACA tax credits, Democrats should be pursuing policies to further reduce premiums and out-of-pocket costs for all Americans.