Memo Published November 9, 2021 · 12 minute read

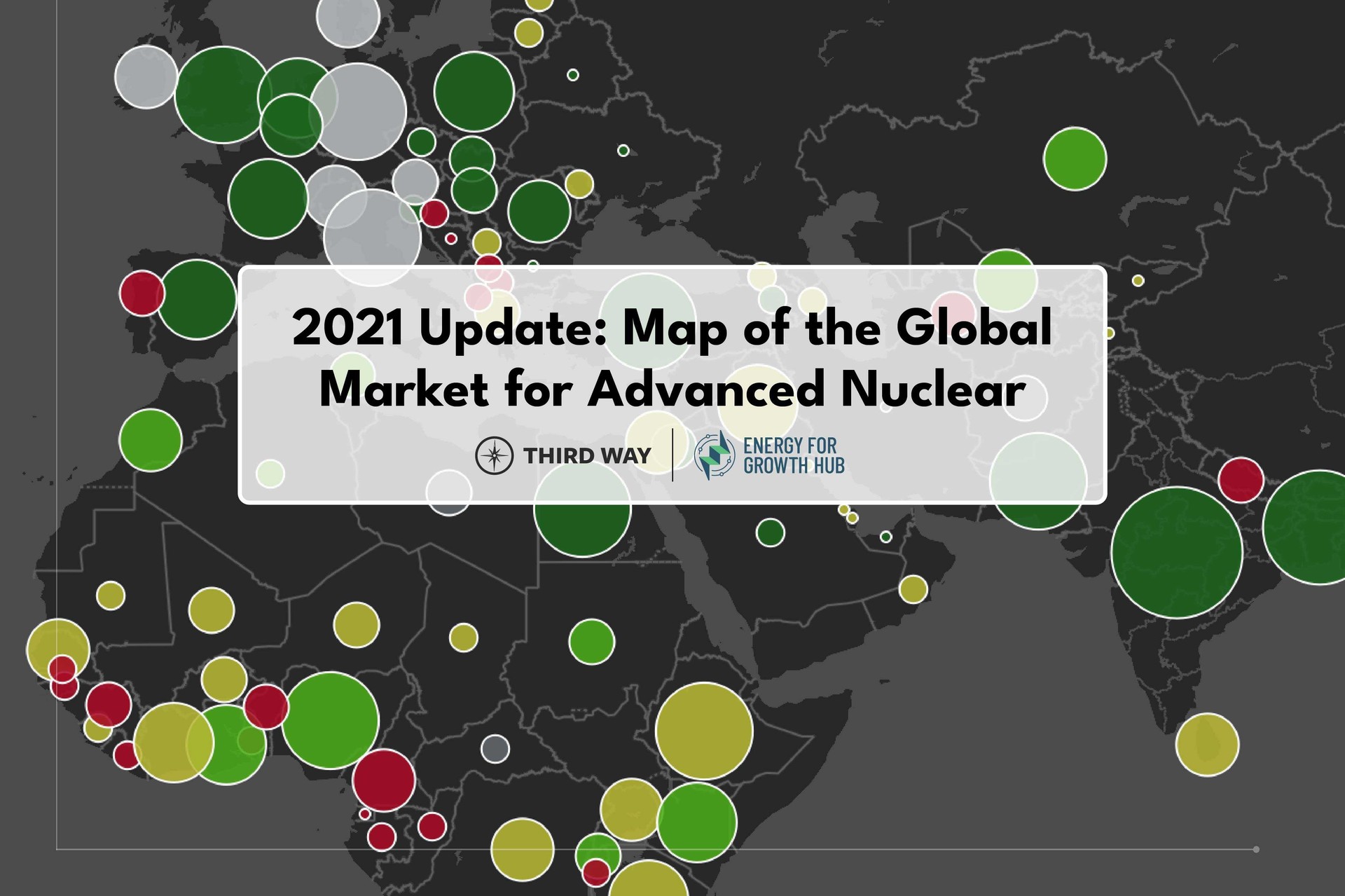

2021 Update: Map of the Global Market for Advanced Nuclear

Alan Ahn, Josh Freed, Jacob Kincer, Jessica Lovering, & Todd Moss

Last year, Third Way, in partnership with the Energy for Growth Hub, launched its map of the global market for advanced nuclear: an assessment of nuclear readiness—using 10 metrics to gauge a country’s relative preparedness and motivation for civilian nuclear development—and projected electricity demand growth by 2050 for 148 countries. The findings of these assessments were clear: there are extensive market opportunities for advanced nuclear globally, and it is therefore essential that we continue to invest in and pursue innovative nuclear technologies to ensure that we maintain our leadership in a sector that has such immense consequences for our climate, national security, and geopolitical interests.

The conclusions from the mapping exercise complement and are consistent with research that Third Way and its partners published earlier this year, which highlighted international programs to develop, demonstrate, deploy, and commercialize advanced reactors, indicating that other countries also recognize the potential for advanced nuclear to meet both climate and development objectives. Moreover, this research also details the rapid progress that has been achieved in the development of advanced nuclear throughout the world, reinforcing that advanced reactors will soon be available as a viable tool to reduce emissions and fight climate change.

For 2021, Third Way and Energy for Growth Hub are pleased to include updates to the demand growth projections and readiness data behind the map, as well as provide more in-depth analyses of regional trends and selected focus countries. As in the 2020 map, the data points to the potential for an expanding international market for advanced nuclear in the upcoming decades, suggesting that advanced reactors may assume an increasingly significant role in global decarbonization efforts—especially relevant in light of this year’s COP26 summit in Glasgow.

Updates for 2021

The 2021 global advanced nuclear markets map includes updates on electricity demand projections and readiness indicators for all countries. In addition, there are also focused analyses on regional trends and developments, as well as a deeper dive into 12 focus countries of particular interest—chosen based on internal assessments, external feedback, and other criteria. The more detailed examinations of the 12 focus countries include information on projected demand for coal replacement, electric vehicles, desalination, and industrial energy applications.

The topline conclusions of the 2021 update are consistent with the findings of last year’s map:

Topline Takeaways

1. Electricity demand is growing rapidly and will continue through the foreseeable future

- Total electricity consumption is projected to almost double to over 50,000 TWh annually. This is like adding five United States’ over the next 30 years.

- This demand won’t come from countries that have already industrialized in Europe and North America. Over 87% of new demand will come outside of High Income countries.

2. Advanced nuclear is well positioned to meet this new demand

- 84% of all new electricity demand will occur in countries we rate as ready by 2030 (“Green”) or potentially ready by 2030 (“Light Green”).

- A total of 49 countries are projected to be markets for advanced nuclear power before 2050. Several more could join depending on changes in internal laws and international standing.

- 10 countries that don't currently have operating commercial nuclear plants are nonetheless considered viable markets today. That means they are either already constructing their first reactors, or could before 2030.

3. The global market for nuclear power could triple by 2050

- It is estimated that around 16% of all new electricity demand could be served by nuclear power by 2050, under baseline assumptions of 20% of new demand supplied by nuclear in Green countries, 10% in Light Green, and 5% in Yellow.

- This percentage of new demand would imply new nuclear generation in the amount of 4,000 TWh annually, and roughly correlate to a potential market size of ~$360 billion per year based on a tariff of $90/MWh.

Additionally, in the process of updating the map, a number of regionally-focused observations were made:

Regional Observations

East Asia and the Pacific

- Electricity demand in East Asia and the Pacific will double by 2050, accounting for approximately 40% of the total global increase.

- On top of countries with operating nuclear plants (China, Japan, South Korea, Taiwan), the Philippines (Green), Vietnam (Green), Indonesia (Light Green), and Thailand (Light Green) are all highly likely to be markets for advanced nuclear power by 2050 or sooner—these four countries represent 13% of projected worldwide growth in electricity demand by themselves.

Sub-Saharan Africa

- While absolute figures are small compared to total global growth, from a relative standpoint, Sub-Saharan African countries will experience the most dramatic changes of any in the world—electricity demand will double by 2030, and quadruple by 2050.

- South Africa is the only country in the region with operating nuclear reactors, but five more—Nigeria, Ghana, Kenya, Rwanda, and Sudan—could be ready by 2030, and likely will be by 2050. Rwanda is a newcomer to this group due to an acceleration in their nuclear energy efforts.

South Asia

- Over a quarter of all new electricity demand will be in South Asia, led by India which has the second largest increase of any country in the world.

- The opportunity for advanced nuclear to meet exploding demand in India, Pakistan and Bangladesh is massive: these three countries alone account for nearly 27% of projected growth in worldwide electricity demand.

Middle East and North Africa

- Although projected power demand growth for this region overall is modest, the Middle East and North Africa has many newcomers to nuclear power—half of the countries surveyed are either already markets for nuclear power, or likely will be before 2050.

- Egypt and the United Arab Emirates (Green) are currently constructing new nuclear reactors, while Jordan and Saudi Arabia could very soon. Algeria, Morocco, and Tunisia (Light Green) are on the path to becoming markets as well.

- Desalination has its most significant role in this region due to growing populations and extremely stressed existing water resources.

Latin America and the Caribbean

- Demand growth in this region will be moderate in absolute terms, contributing less than 10% to the global total, although individual countries will experience substantial growth in their own consumption on a relative basis.

- Three countries—Brazil, Mexico, and Argentina—already have nuclear power (Green), while fifteen other countries in the region have less obvious prospects, but could develop into markets by 2050 (Yellow).

As mentioned, 12 focus countries were selected for more detailed analysis—looking at measures beyond readiness and projected power demand growth, including factors that could significantly affect demand for advanced nuclear, such as coal replacement, electric vehicle demand, desalination, and industrial applications. Data for these focus country metrics can be found in either the updated dataset or through tooltips on the map.

Highlights and Observations of Focus Country Analyses

- Significant coal replacement demand can be found in focus countries in various regions.

- Indonesia and Vietnam have over 200TWh and 100TWh of coal replacement needs, respectively—given both its sizable industrial energy and coal replacement needs, Vietnam’s projected additional demand for clean electricity could more than double.

- South Africa’s coal replacement needs are the highest of any focus country. Nearly their entire current electricity grid is powered by coal, and nearly 200TWh of generation would need to be replaced by 2050 to meet their net-zero goals. This leaves a massive opportunity for nuclear power, which is a logical replacement in the South African grid.

- Poland was selected as the only European country primarily due to its significant coal replacement needs. At almost 150 TWh, this is fully over one-half of the projected potential demand in the country.

- Desalination demand is concentrated primarily in the Middle East and North Africa: both Jordan and Morocco have relatively small requirements (~1 TWh), although Egypt is projected to require over twice as much water as it currently has available. This means the role of desalination could be extremely high, as much as 63 TWh, almost 12% of Egypt’s total projected demand in 2050.

- Nearly all focus countries are projected to experience considerable industrial energy demand growth, with a number of countries with industrial demand requirements in excess of 200 TWh annually (Bangladesh, Indonesia, Vietnam, Mexico).

In View of COP26

Glasgow is an appropriate setting for the 2021 United Nations Climate Change Conference, or COP26, especially given that Europe is in the midst of a debilitating energy crisis, the effects of which have been exacerbated by the combination of colder weather, sagging wind generation, coal retirements, and decreased regional natural gas production—all highlighting an excessive dependence on Russian gas supplies.

Although some view the energy crisis as a justification for putting the brakes on climate action, Europe’s current energy challenges arguably underscore nuclear’s potential to simultaneously stabilize prices, provide energy security and reliability, and reduce emissions. In fact, a number of European capitals have announced their intent to double down on nuclear deployment in response to the crisis, revealing growing recognition of nuclear’s value in fortifying energy security and price stability, to say nothing of climate mitigation.

On the surface, energy security and reliability certainly appear to be the primary drivers for this renewed push for nuclear in Europe. However, pro-nuclear European states have become collectively more vocal in emphasizing the environmental and climate benefits of nuclear energy, particularly in the context of the European Union’s sustainable finance rules and the debate over nuclear’s standing as a green technology. Mounting acceptance of nuclear’s climate utility among the international community—both within Europe and outside of it—has resulted in a more prominent platform for nuclear energy in forums like COP26 compared to the past.

And while there remains measurable interest in large conventional nuclear plants in Europe, greater attention is now being directed towards more innovative and advanced designs. For example, there is budding momentum in the UK on the development of advanced modular reactors, specifically examining potential demonstrations of high-temperature gas-cooled reactor concepts. In France, a part of President Macron’s 30 billion euro industrial and decarbonization investment package will be directed towards the development of smaller reactors and advanced waste management technologies. And Romania announced on November 2nd that they will be partnering with U.S. company NuScale to construct small modular reactors.

In light of this increasing alignment on advanced nuclear between the United States and its traditional allies and partners, it may be both timely and prudent to more intently explore opportunities for international cooperation, including regulatory harmonization, co-financing and investment, supply chain integration, and joint R&D of new fuels, materials, and applications. Ultimately, these partnerships may be necessary to meet the immense global demand as projected in this study, allowing advanced nuclear to maximize its contribution to global climate and development goals.

Enhanced international collaboration should comport with a more cohesive strategy on advanced nuclear at home—proposed as part of the 2020 map release—involving streamlined export controls, continued support for advanced reactor developers, active engagement with emerging and frontier markets, and development of export financing pathways. In the past year, there has been notable progress in this regard, including increased funding for the Advanced Reactor Demonstration Program, the launching of the State Department’s FIRST Program for capacity-building in emerging markets, new agreements on strategic civil nuclear cooperation, and a newly unveiled resource for developers to facilitate compliance with export control regulations and practices on international security and safeguards. Considering the big picture, it is crucial for us to ensure that this momentum continues.

How to Use This Map

Our map includes several features that will make it easy for policymakers and advocates to find useful information on potential advanced nuclear markets around the world. On the map, every country included in our analysis is marked with a circle. The size of each circle represents the magnitude of the projected increase in energy demand for the corresponding country. The color of each circle illustrates a country’s ranking on our 6-stage scale that assesses relative preparedness and motivation for the development of advanced nuclear power. You can find the complete dataset for our analysis here. The map contains seven filters that show:

- A 6-stage scale describing each country’s relative preparedness and motivation for the development of advanced nuclear power.

- Projected percentage growth in national electricity demand from 2018-2050.

- Projected additional electricity demand in TWh for each country in 2050.

- The World Bank’s four Income Groupings: low, lower-middle, upper-middle, and high, based on GNI per capita (in U.S. dollars, converted from local currency using the Atlas method).

- The World Resources Institute’s projected water stress ratings in 2040—nuclear powered desalination could play a significant role in addressing the growing demand for potable water and provide an option for areas with acute water shortages.

- The 2020 NTI Nuclear Security Index ratings that assess actions related to supporting global nuclear security efforts.

- The 2020 NTI Nuclear Security Index rankings of 46 countries with nuclear facilities to assess actions to protect those facilities against sabotage.

In order to understand the potential global market for advanced nuclear technologies, we set out to determine two things: Where is the opportunity (using new energy demand), and where can nuclear power contribute in a meaningful way (using our “readiness” score)?

We define a country as “ready” for nuclear by considering if it could be a customer for an advanced nuclear supplier and credibly negotiate a purchase agreement with an international supplier country. We determine this by using a 10-point checklist covering internal institutions and controls such as policy and regulatory agencies, as well as external signals of interest such as engagement with supplier countries and international institutions like the International Atomic Energy Agency. More information on the scoring methodology can be found here.

To estimate future electricity consumption, we use historical data to establish a trend based on income correlations. We then extrapolate this relationship to 2030 and 2050 for each country, using data and forecasts from the United Nations, International Energy Agency, International Monetary Fund, and the World Bank. More information on the electricity projection methodology is available here.