Report Published October 27, 2022 · 7 minute read

Four Ways America’s Retirement System is Failing Workers

Curran McSwigan

Takeaways

Currently, only half of workers in America have access to a retirement plan at their job. Inequities in our retirement system are holding workers back from achieving economic security during their later years. Specifically, our new analysis finds that:

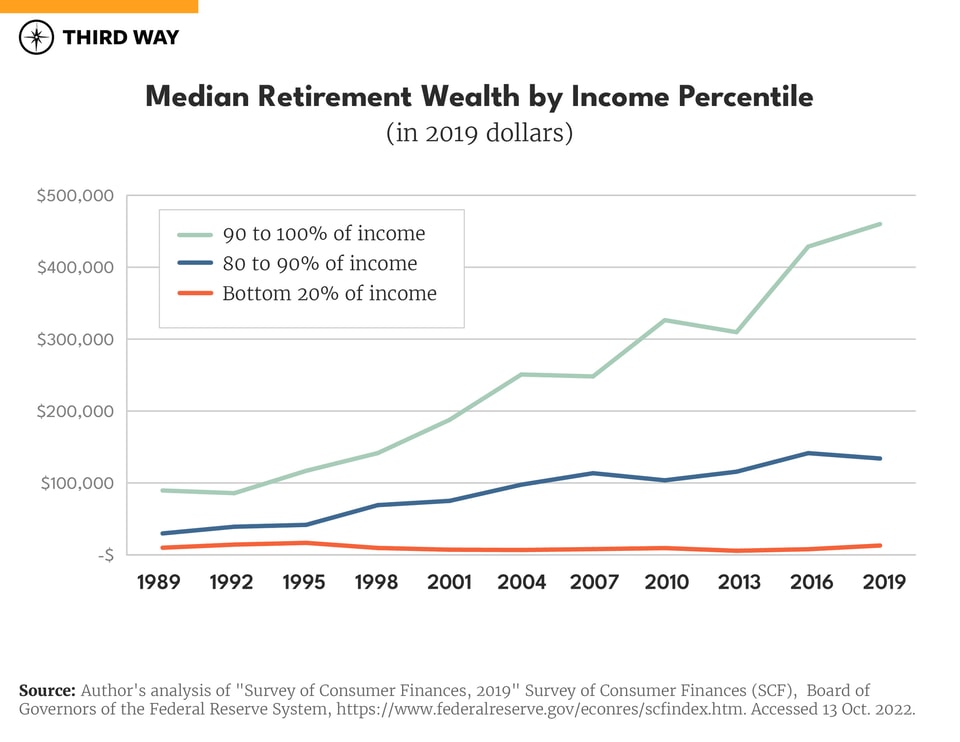

- Retirement savings for the top 10% of earners have increased by more than 400% over the past 30 years—compared to an increase of just 30% for the bottom 20% of earners.

- White households’ share of retirement wealth is 40% higher than their share of the US population.

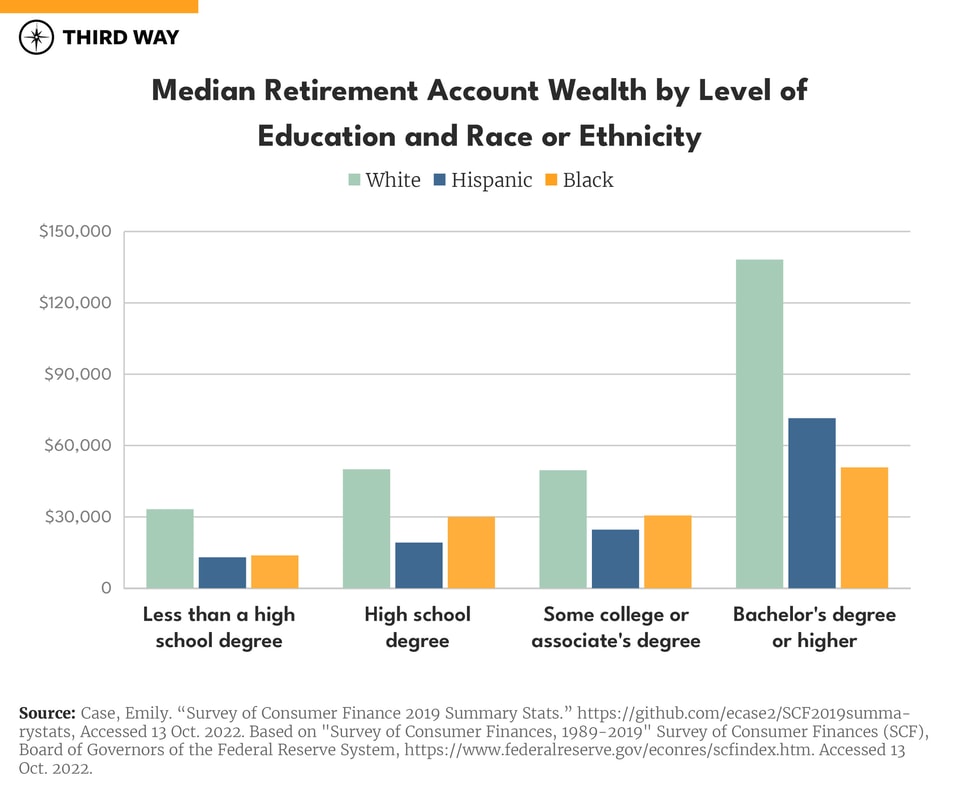

- Black households with a bachelor’s degree have the same amount of retirement savings as white households with just a high school degree.

- And near retirement, workers with a bachelor’s degree overall have 13 times the savings as those who didn’t finish high school.

Every American should reach retirement with a comfortable nest egg. But millions of older Americans are struggling to afford their basic needs.1 These struggles are a sign of a broken system, one where many Americans are not given the opportunity to age with dignity.

Retirement accounts, such as 401Ks and Roth IRAs, help workers maximize their retirement wealth. Employees will end up with significantly more money in these accounts than they ever contributed, and even more with employer contributions.2 But inequities in access to these accounts mean some workers benefit more than others.

The pandemic’s devastation to the economy and impact on inflation resulted in significantly fewer people saving for their futures. While 93% were saving pre-pandemic, now only 63% say they are still contributing.3 With more and more workers confronting a financially unstable future, addressing the retirement crisis needs to be top of mind for policymakers. Below we outline four big ways America’s retirement system leaves workers behind.

1. The wealth gap is widening. That’s bad news for Millennials’ retirement savings.

The median value of retirement wealth held by top earners has grown much faster than it has for lower-income workers.4 Over the past 30 years, the retirement account values held by the top 10% of earners have increased more than 400%, while the bottom 20% of earners in America saw their retirement wealth increase by just over 30% during the same time.5

Growing inequities in retirement wealth spells trouble for Millenials. Their generation is approaching the level of wealth inequality Boomers are seeing in their retirement years, but much earlier. The top 10% of Millenial households already own 55% of their generation’s total wealth, and in the absence of dramatic changes, the gaps between high and low earners are likely to worsen.6

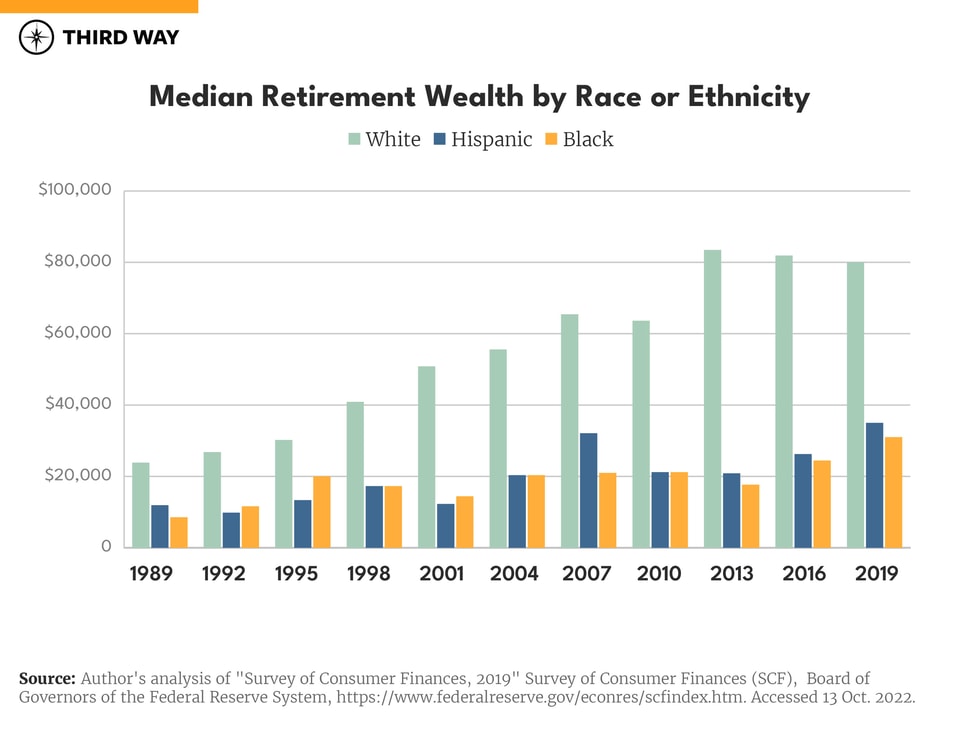

Over the past several decades, the gap in retirement wealth held by households of color and white households continues to widen. In 1989, white households had around $12,000 more in retirement accounts than Black households (adjusted for inflation). In 2019 that number was almost four times larger at $45,000.7 Times of economic distress hurt households of color the most—Black families took twice as long as white families to recoup retirement savings that were lost during the Great Recession.8

Growing disparities in the retirement wealth of white households and households of color contribute to heightened financial insecurity for aging households. Currently, more Hispanic and Black individuals are at risk of falling short in retirement compared to their white peers.9 Older Black adults are over four times as likely and older Hispanic adults over five times as likely to have an income below the federal poverty line than older white adults.10 Ensuring households of color are able to build retirement savings during their working years is essential for financial stability later in life.

2. White households hold a disproportionate amount of retirement savings.

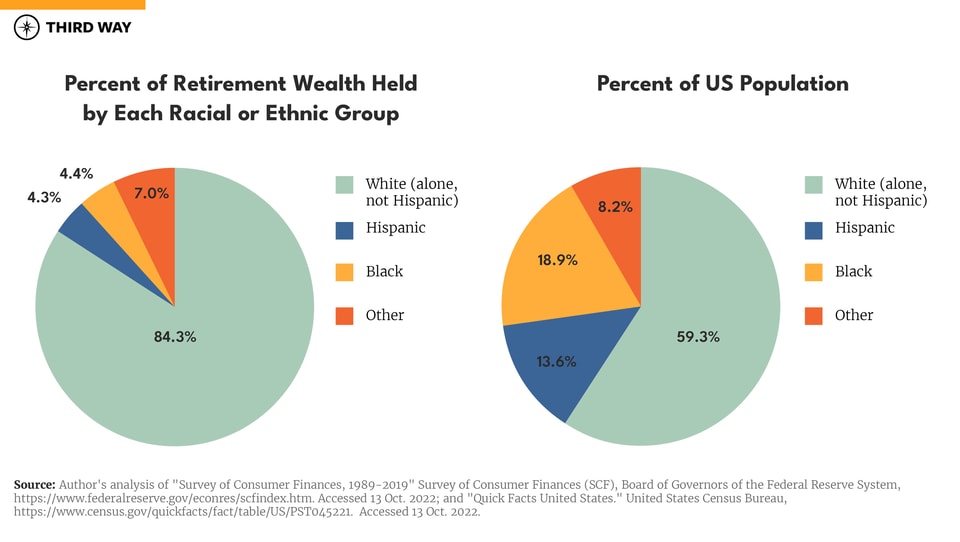

Over half of white households have retirement accounts, while only just over a third of Black households and a quarter of Hispanic households do.11 Not only are white households more likely to have retirement accounts, they also have much more saved up. The average retirement account value for white households is $300,000, while Black and Hispanic households have just over $100,000 saved on average.12 These gaps mean white households are responsible for 84% of the total retirement account wealth in the United States, even though they represent just under 60% of the population. And while Hispanic and Black individuals represent 19% and 14% of the US population, respectively, each group holds just over 4% of total retirement wealth.13

On top of being more likely to have a retirement account, white households are also much more likely to own their own homes. While almost three-fourths of white families have equity in their residence, less than half of Black and Hispanic families do.14 Homeownership plays an important role in an individual’s ability to feel secure in retirement. It gives retirees a certain amount of safety that renters do not have: an asset they can sell, if necessary. Lower rates of homeownership, combined with less wealth in retirement accounts, mean households of color are much further behind by the time they reach retirement age and at risk of outliving their savings. Older white households have a net worth almost six times that of older Black households and over three times that of older Hispanic households.15

3. Black households with a bachelor’s degree have the same retirement wealth as white households with a high school degree.

Although achieving a bachelor’s degree (or more education) translates to increased retirement wealth for all racial and ethnic groups on average, it benefits white households much more than the rest. White households that obtain a bachelor’s degree after finishing high school have on average a higher retirement wealth by $88,200. For Hispanic households, wealth jumps by $52,300, and Black households just $20,800.16 This means the average value add for when someone in a white household is awarded a bachelor’s degree is over four times the gain in retirement wealth than if that same bachelor’s degree was awarded to a Black householder.17

Even at lower levels of education, people of color have much less saved for retirement than their white peers. Unequal rewards of educational attainment widen an already sizable retirement wealth gap between white households and households of color. As a result, Black households with a bachelor’s degree or higher end up with the same amount in retirement wealth as white households who received only a high school education.18 Social and systemic factors, such as family support and unequal pay gaps, impact households of color’s ability to save for the future, contribute to retirement accounts, and grow their wealth.19

4. Workers with only a high school degree are much less prepared for retirement.

A person’s level of education greatly impacts their career options and whether they have access to certain retirement offerings.20 For example, fewer than one-fourth of workers without a high school degree have access to an employer-provided retirement plan, compared to two-thirds of workers who hold a bachelor’s degree or higher.21

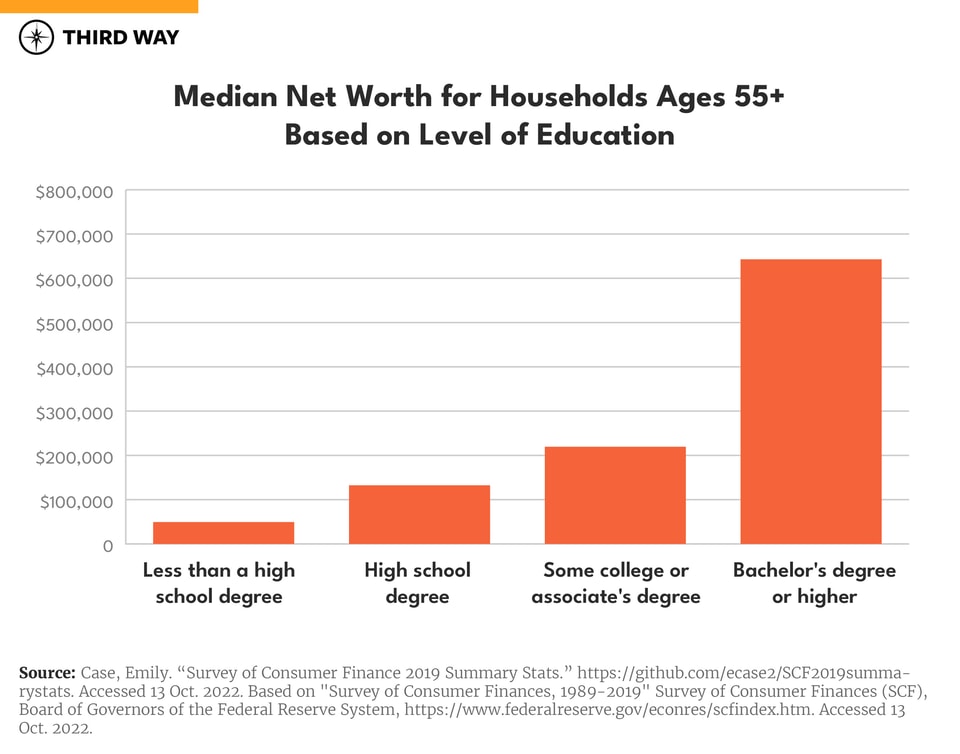

Because of that, households with lower levels of educational attainment have significantly less wealth at retirement age than their more educated peers.22 The net worth for households near retirement age:

- With less than a high school degree: $49,400

- With a high school degree: $132,400

- With some college or an associate’s degree: $219,500

- With at least a bachelor’s degree: $642,800.23

That means at, or near, retirement age, workers with a bachelor’s degree have 13 times the retirement savings compared to workers who did not finish high school.

Workers with higher educational attainment are also more likely to take on a workplace retirement plan when it is offered to them.24 Less-educated workers can be cash strapped and may find it more difficult to make voluntary deductions from their pay.25 And decisions around how much to contribute to 401ks or how to allocate money can be hurdles for those who may have less familiarity with financial investments.26

Conclusion

More than ever, a comfortable and secure retirement remains out of reach for too many American households. Our private retirement system continues to benefit high earners the most, the racial retirement wealth gap in this country is widening, and education greatly impacts the retirement options available to workers. Boosting retirement wealth for more Americans will help address the inequities in our current system. Every American deserves the chance to live a comfortable life post-retirement.

We’d like to acknowledge Emily Case for her contributions to this report. Her original analysis of the Survey of Consumer Finance 2019 data anchors much of our findings.