Report Published January 10, 2023 · 20 minute read

End Medical Debt

Ladan Ahmadi, David Kendall, Kylie Murdock, & Jim Kessler

Takeaways

Medical debt is far-reaching, involuntary, and often financially devastating to American families. Third Way’s plan to end medical debt will resolve the medical debt crisis affecting millions of Americans and prevent it from happening again. We propose Congress:

- Forgive debt for patients with adequate coverage.

- Refinance bad debt with a provider tax.

- Make adequate coverage fully affordable.

The national conversation on debt in America has largely been focused on Biden’s student loan cancellation announcement. But a more pervasive debt has flown largely under the radar: medical debt.

Medical debt affects more than 100 million adult Americans and totals $195 billion.1 More than half of all bankruptcies in the United States are tied to medical issues.2 And medical debt tends to plague the most vulnerable, including the uninsured, those who are chronically ill or disabled, and minority communities. Those with insurance can also fall victim to medical debt due to high deductibles, fights between providers and insurance plans over coverage, services that aren’t covered by insurance, and high health care prices. Yet, our current system does nothing to prevent this problem or to curb it from happening in the future. Hospitals and other providers collect debt, often forcefully and unsuccessfully, while patients remain without adequate coverage leaving them vulnerable to future or compounding debt.

It’s an issue many Americans know all too well, as reported in a National Public Radio (NPR) and Kaiser Health News (KHN) partnership on medical debt: Nick Woodruff worked for a truck dealership in a small city in upstate New York while his wife Elizabeth completed her degree in social work. He had been diagnosed with diabetes in his 20s, but he had a good job and health benefits. When a small infection on his foot related to his diabetes spread to the bone, he was hospitalized with heart and kidney damage. After being discharged, he slipped going down the stairs and shattered his foot. Doctors had to amputate. They were hit with medical bills totaling nearly $20,000.3 They withdrew money from their retirement accounts to pay, and Elizabeth got a job as a social worker at the hospital, but it wasn’t enough. The hospital sued Nick and he was ordered to pay more than $9,000. The Woodruffs have been able to pay down some of their debt, but Nick is no longer able to work, leaving them dependent on Elizabeth’s salary as a social worker and his disability benefits.

A health care system that sends Americans into massive debt and financial ruin over life-saving care is broken. In this report, we examine America’s medical debt problem, who has medical debt in this country, and a new way to end medical debt forever.

Medical debt is far-reaching, involuntary, and often financially devastating to American families.

America’s Medical Debt Problem

Medical debt is far-reaching, involuntary, and often financially devastating to American families. While more than half of US adults have had medical debt in the past five years, some are more affected than others. Here’s what we know about medical debt:

- It’s widespread. In the past five years, more than half of US adults have reported going into debt because of medical or dental bills.4 Twenty-five percent of adults with health care debt owe more than $5,000, and 13% owe more than $10,000.5

- It’s the leading cause of bankruptcy. In 2019, 66% of all bankruptcies in the United States were tied to medical issues.6

- Black and Hispanic adults have more medical debt. Sixty-nine percent of Black adults and 64% of Hispanic adults have had medical debt in the past five years.7 Black adults are 50% more likely than white adults to owe money for health care.8 People of color are also more likely to be uninsured and have lower incomes, making them more susceptible to medical debt. They also see higher incidence rates of chronic illness, necessitating more care.

- Those without health insurance have more medical debt. Uninsured and underinsured Americans are some of the hardest hit. Seventy-one percent of uninsured adults have had medical debt in the past five years. And while insurance can be a strong indicator for medical debt, even 61% of insured adults have had medical debt in the past five years.9 The issue is further exacerbated in the South and Midwest where state governments have refused to expand Medicaid, leaving thousands of low-income Americans without insurance.10

- People with chronic illnesses and disabilities have more medical debt. Illness is a stronger predictor of medical debt than either poverty or insurance.11 People with chronic illnesses require more medical care than the average American, meaning they rack up more medical bills. With 52% of Americans suffering from at least one chronic illness, it’s no wonder America has a medical debt problem.12

- The majority of low-income people have medical debt. Sixty-eight percent of those with a household income less than $40,000 have had medical debt in the past five years. Fifty-seven percent of those making less than $90,000 have held debt as well.13 Low-income Americans are more likely to be uninsured, leaving them more vulnerable to medical debt.

- People living in rural areas and the South have more medical debt. Thirteen percent of adults living in rural areas and 12% percent of adults in the South have medical debt, compared to 8% in the Northeast.14 This is partly due to the failure of Southern states to expand Medicaid and the lack of access to regular care for those in rural areas. Medicaid expansion in non-expansion states would help curb medical debt.

- Adults aged 30-49 have more medical debt. Sixty-nine percent of adults aged 30-49 have had medical debt in the past five years.15 While 37% of those above 65 have medical debt, likely due to access to affordable insurance through Medicare.

- Most people with medical debt owe less than $5,000. Seventy-four percent of adults with medical debt owe less than $5,000, with the highest share owing between $2,001 and $5,000 at 22%.16 But many don’t have the resources to pay such a high bill—40% of people of color said they’d need to borrow money to pay a medical bill of more than $500.17

The stories behind these statistics are heartbreaking. Also originally reported by NPR/KHN, Ariane Buck was looking forward to celebrating Father’s Day with his wife and three young children. But shortly before, he became extremely sick—he couldn’t eat without vomiting and there was blood in his stool. He had fallen behind on the health care bills, and his doctor’s office refused to see him. His wife had no choice but to seek expensive care in an emergency room where he was diagnosed with a serious intestinal infection. He wasn’t a stranger to emergency rooms—he had taken his wife, Samantha, to the ER twice before for painful cases of endometriosis. Ariane and Samantha were hit with $50,000 in medical bills.18 They took out loans, maxed out their credit cards, and cut back on expenses, including clothes and Christmas presents for their kids. But it wasn’t enough. Ariane and Samantha are preparing to file for bankruptcy.

While there is a diverse range of people impacted by medical debt, there are also many reasons why debt is ballooning in America.

To start, we know patients are being grossly overcharged for services. For example, the top 100 hospitals by revenue charged patients seven times the cost of service on average.19 And for-profit hospitals charged twelve times. While those with insurance are often protected from these outrageous prices, those without insurance aren’t.

Some hospitals then deploy predatory practices to pursue patients with unpaid bills. Between January 2018 and July 2020, ten hospitals filed 97% of all court actions against patients throughout the country, which added up to nearly 40,000 lawsuits.20 These hospitals were primarily governmental and nonprofit hospitals, which receive a large portion of their funding from taxpayers. Nonprofit hospitals are required by the Affordable Care Act (ACA) to have a financial assistance policy and are prevented from engaging in “extraordinary debt collection.”21 These hospitals receive tax exemptions in return for providing charitable care. By suing patients, those nonprofit hospitals are likely violating the ACA and clearly failing on charity care.22

Despite the overly aggressive action by a few hospitals, most hospitals do not collect most of their debt. According to a recent report, hospitals tried to collect $72 million through court action over a two and one half-year period.23 But that amount pales in comparison to the $42 billion cost of charity care and bad debt that hospitals incur.24 The simple fact is that most medical debt is not collected. A national charity called RIP Medical Debt, which buys and retires bad debt from providers, says it spends one dollar for every $100 of debt it eliminates for patients.25

Sixty-three percent of indebted adults had to cut back on spending on food and other basics and 48% had to use all or most of their savings.

Whether the debt is collected or not, the billions in unpaid medical bills hanging over the heads of patients have dire consequences. Patients have to sell their belongings, cut back on necessities, and dip into their savings. Sixty-three percent of indebted adults had to cut back on spending on food and other basics and 48% had to use all or most of their savings.26 Seventeen percent declared bankruptcy or lost their home.27 Credit reporting companies have started to recognize that medical debt is not a reliable indicator of being financially responsible. The agencies have voluntarily curtailed their use of unpaid medical debt in their credit reports on consumers.28

Debt also discouraged people from seeking out future medical care, and some were even denied care. One in seven people with debt said they’ve been denied access to hospital, doctor, or other provider because of unpaid bills.29When so many of those with medical debt have chronic illnesses, missing out on care can be life-threatening.

How to End Medical Debt

We need to end medical debt while ensuring people get better coverage so that this crisis does not continue. There have been steps taken since the Affordable Care Act (ACA) passed, which barred insurance companies from setting a dollar limit on annual or lifetime coverage expenses, protected patients from onerous charges and made coverage more widely available and affordable. The Biden-Harris administration has been implementing the No Surprises Act, which protects people from receiving surprise medical bills that can sometimes total thousands of dollars. Additionally, the Administration is holding providers and debt collectors accountable for harmful practices, reducing harmful effects of medical debt on credit access, and some medical debt forgiveness for veterans.

Now it’s time to go further and end medical debt for good. To do that, here’s what Congress should do:

1. Forgive debt for patients with adequate coverage.

Here’s how that works: To have medical debt forgiven, an individual must have adequate insurance coverage through the marketplace exchange, their employer, Medicare, or Medicaid. This requirement is key to ensuring that medical debt does not continue to harm millions of Americans in the same way it has for decades. Once an individual with medical debt has secured this insurance coverage, it greatly reduces the risk of them going into future debt because they will now have access to affordable and quality care that will protect them from exorbitant costs, regardless of what their ailment may be.

Once an individual has certified they have adequate insurance, they will be able to apply for medical debt relief from the government.

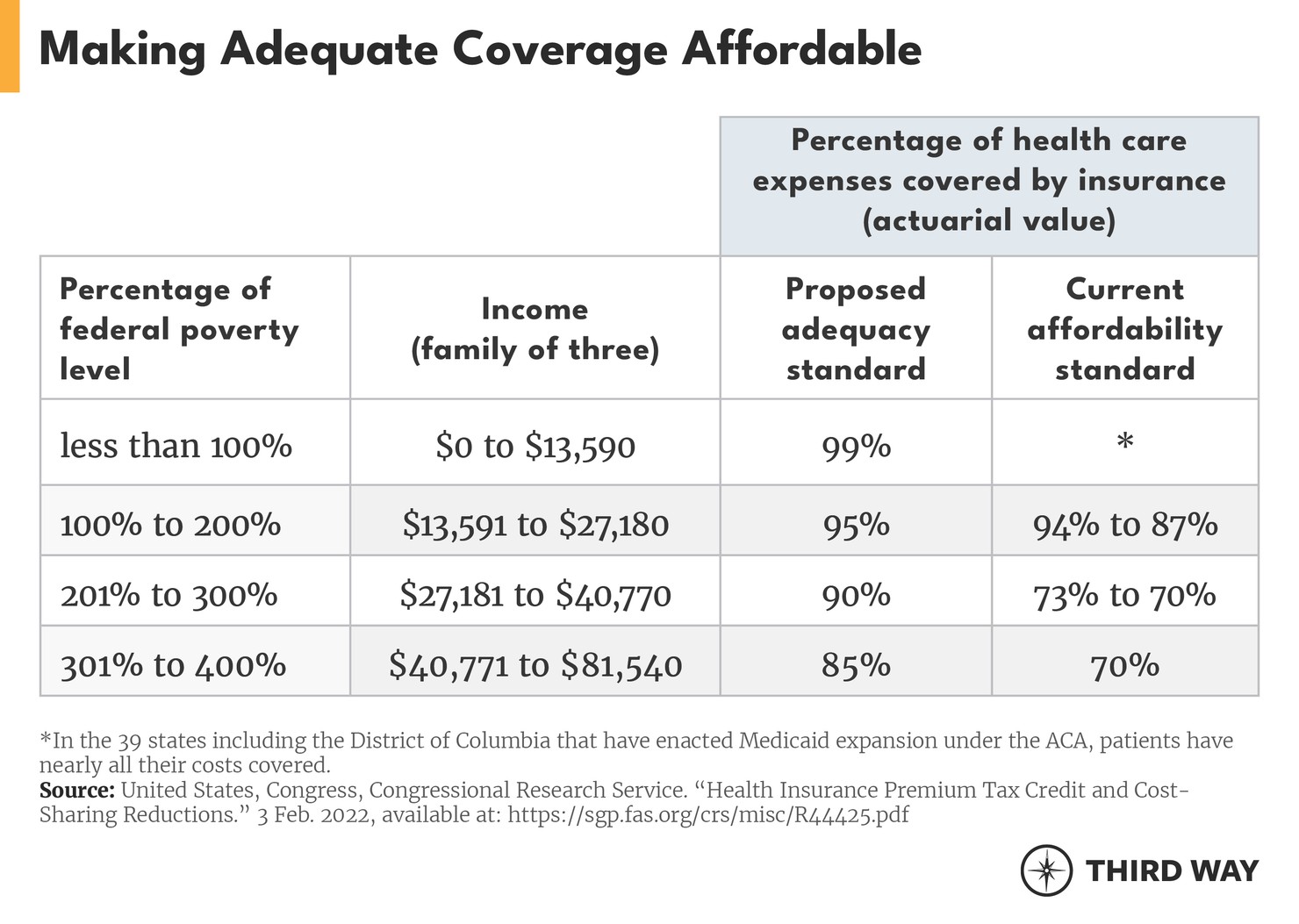

Additional details: We define adequate coverage according to income level. A family with a lower income cannot afford a portion of their earnings going toward health care costs, and therefore needs more insurance coverage. The formal measurement for the adequacy of insurance is the percentage of total health care costs that the average person would have to pay out-of-pocket, which is known as the actuarial value. The current standard for affordable coverage through the exchanges is a silver plan, which covers 70% of costs. That protection increases for people with incomes of 250% of the federal poverty level or less, which is an income of $32,200 for the 2022 enrollment period. Although a silver plan does not provide adequate protection from high out-of-pocket costs for many people, it is the highest level of coverage that is affordable (at least for the next three years as provided in the Inflation Reduction Act).30

Once an individual has certified they have adequate insurance at the silver-tier level, if they are living at 200% or less than the federal poverty line and owe $500 or more, or if they are living at more than 200% of poverty with a debt of $1000 or more, then they will be able to apply for medical debt relief from the government. See the questions and answers below for details on the certification and forgiveness process.

Insuring previously uninsured people or upgrading people to adequate coverage isn’t only good for the consumer, it’s also good for health care providers who now will be treating a sufficiently insured population that can seek care earlier and more frequently—resulting in better outcomes and bills that get paid.

2. Refinance bad debt with a provider tax.

Here’s how that works: The federal government would relieve providers of bad debt owed by any patient with certified adequate coverage. The cost of this relief would be offset with a provider tax on patient revenues, similar to the way Medicaid and care for the uninsured is financed in nearly all states. Providers would no longer be trapped between two bad choices: trying to collect debt from families who cannot afford it and foregoing revenue they need to keep the doors open. Instead, bad debt should be a public responsibility once providers have made reasonable efforts to collect patient’s copays and deductibles.

Additional details: The cost of refinancing bad debt would be pennies on the dollar. Many providers already sell their debt to third parties who use aggressive tactics to collect from whomever they can.31 Like these third parties, the government would be paying what this debt is worth after it goes through an initial collection process. The charitable work by RIP Medical Debt indicates that bad debt is worth one percent of its original value.32 Other debt purchasers say the price of older debt can be as little as two-tenths of one percent of the original value.33

A provider tax to finance the debt purchase would be much less than the tax level assessed by states to finance Medicaid. State provider taxes typically range from 3.5% to 5% of a provider’s revenue from patient services.34 The cost of buying all the reported bad debt for one percent of its value would require a provider tax of two-hundredths of one percent.35 If a hospital passed the extra cost along to patients, which they could do only for patients with private sector health coverage because Medicare and Medicaid prices are regulated, the extra cost would be 30 cents for an average hospital bill.36 Any price increases could be mitigated with limits on hospital prices for commercial insurance as Third Way and others have proposed.37 After five years, the provider tax would decline as medical debt declined with expanded access to affordable, adequate coverage.

3. Make adequate coverage fully affordable.

Here’s how that works: The standard for adequate coverage should be based on the gold tier standard instead of the silver tier as currently defined in the ACA. Right now, a person with an income of three times the poverty level is only guaranteed affordable coverage that covers 70% of their costs. That level of coverage is known as a silver plan in the marketplace exchanges. Instead, a gold plan that covers 80% of actuarial value would be a better standard for adequate coverage as Senator Jeanne Shaheen (D-NH) and Representative Kim Schrier (D-WA) have proposed.38 A gold plan would be closer to coverage typical for employment-based coverage and actually cover the adequate care necessary to ensure future debt doesn’t reoccur.39 The coverage for people for lower-income households should also be increased. For example, we believe that an individual with an income of $40,770 (which is three times the 2022 federal poverty level) should have insurance that covers 90% of patients’ costs instead of 70% under the current standard (see Q&A for more).

Additional details: Third Way has proposed universal cost caps and coverage to make adequate coverage affordable.40 This plan would ensure that everyone would have the same standard for coverage regardless of whether they have it through the workplace, the exchanges, Medicare, or Medicaid.

To offset additional federal costs for a universal cost cap, Congress would need a comprehensive solution to stop the many ways the health care system nickel and dime patients through multiple bills, excessive prices, and wasteful care. A universal cost cap would finally end the medical debt crisis.

Equity Improvements

Ending medical debt would have big implications for advancing health equity.

- Lower health care costs. Increasing coverage rates means more people have access to affordable health care. With the ACA subsidies, patients’ health care premiums will be capped at 8.5% of their income or less, ensuring they don’t accrue medical debt again.

- Increase coverage rates among people of color. Our idea would help uninsured adults, primarily people of color, sign up for health insurance with adequate coverage.

- Decrease medical debt and the racial wealth gap. Black and Hispanic adults are much more likely to have medical debt than white adults. Our idea would forgive their medical debt and eliminate the threat of bankruptcy. This will protect their credit, homes, livelihoods, ability to take out loans, and more. It will allow them to focus on paying for other things like rent, childcare, or tuition. Wiping out medical debt will also help close the racial wealth gap, which is driven by several factors including debt accumulation.41

- Improve health outcomes. Due to medical debt, people of color are discouraged or unable to seek treatment. Forgiving medical debt will remove this barrier and encourage more people to seek out the medical care they need. Increasing coverage rates and lowering health care costs will have the same effect. This will, in turn, improve health outcomes for patients.

Conclusion

Medical debt affects millions of Americans, with and without insurance, often sending them into a cruel spiral of debt collections, default, and bankruptcy. The medical debt crisis in America must be addressed. Third Way’s plan to end medical debt would ensure that millions of struggling Americans can come out from the shadows of debt and gain better coverage to protect themselves in the future.

Quality, debt-free health care in America should be a right, not a privilege.

Questions & Answers

How would consumers certify they have adequate coverage?

Certification of adequate insurance would build off the current annual reporting of coverage to the IRS. As part of the ACA, health insurance plans provide individuals with a certificate of insurance. The original purpose of these certificates was to show compliance with the ACA requirement to have coverage. The Republicans repealed the financial penalty for the individual mandate, but the reporting system for coverage is still in place. The coverage certification would need to include an indication of the adequacy of coverage in terms of actuarial value. Health plans would need to provide this certification upon request from a consumer.

What if an employee does not have access to coverage that meets the adequacy standard?

Most employment-based health plans will meet the adequacy standard of a silver plan, which is 70% actuarial value, because their average actuarial value is 89%.42 If an employee doesn’t have access to a silver-level plan, they would receive a one-time exemption to the rule to prevent employees from having to leave their coverage at work. If they found themselves in debt trouble again, then they would have to purchase adequate coverage through the marketplace exchanges. Employees with an offer for coverage from an employer currently cannot purchase coverage on the exchanges because of an important provision in the ACA that prevents healthy employees from seeking lower-cost coverage outside their employers, which would drive up insurance premiums for sicker employees left behind in the employer’s coverage. This provision, known as the firewall, would not be undermined with a limited exception for employees who need debt relief.

How would consumers get their debt forgiven?

Once a consumer has a certificate for adequate insurance, they would present the certificate to an organization authorized by the Department of Health and Human Services to forgive debt. These organizations could be collection agencies or financial institutions who would arrange for debt refinancing through a federal purchase of the consumer’s debt. These organizations could also work with health insurance navigators or brokers to help consumers get the certificate of adequate insurance. They would have an incentive to help consumers get adequate coverage in order to relieve the debt.

How would the price for purchasing bad debt get set?

The Department of Health and Human Services (HHS) would have two options: 1) negotiate a set price with provider organizations; or 2) contract with third parties who negotiate the price with providers. Provider organizations would have an incentive to keep a negotiated price low so the provider tax would be low. Using third party organizations, however, might produce lower prices if HHS rewarded tough negotiators. In either case, providers would not be able to demand higher prices than they get today from selling debt if Congress also took steps to limit collection tactics like wage garnishment against patients with certified adequate coverage.

What if a provider refuses to refinance the debt through the debt forgiveness program?

Congress should authorize the Administration to ensure any consumer with certified, adequate coverage would not face any negative consequences for future collection efforts on the debt.

What should be done about collection efforts before a medical bill becomes bad debt?

In addition to debt forgiveness, patients need more protection from overly aggressive debt collection before unpaid bills become bad debt. For example, while hospitals are prevented under the Affordable Care Act from charging the highest price to people eligible for financial assistance, the terms for qualifying for financial assistance are not specified in federal regulations according to Community Catalyst, a consumer advocacy organization.43 Several states are developing new protections that can serve as models for new federal action.44

Won’t consumers stop paying their medical bills if debt is forgiven?

Consumers should not have trouble paying their medical bills if they have adequate coverage for their income level. But some people may still try to avoid paying even the deductibles and other out-of-pocket costs. For such irresponsible behavior, the consequences for not paying should be strengthened. For example, credit reporting companies could include non-payment of medical debt on a consumer’s credit report who had their debt forgiven or has adequate coverage.

What if a consumer gets overwhelmed by medical debt a second time?

In order to prevent abuse, consumers could only be eligible for debt forgiveness once during a set number of years and only if they maintain adequate coverage. Debts owed for deductibles and other out-of-pocket costs including out-of-network care would not be forgiven a second time, although Congress also needs to make adequate coverage affordable for all as described below. More research is needed to determine the right balance between consumer protection from unelected medical debt and proper payment for services rendered.

What about Medicare’s reimbursement for bad debt?

Medicare currently reimburses hospitals for 65% of the cost of bad debt from Medicare patients.45 The process for getting reimbursed is cumbersome, however.46 This new approach to dealing with bad debt could eventually replace that system.

What about adequate coverage that isn’t affordable?

The standard for affordable coverage as currently defined in the ACA differs from what the standard should be to make adequate coverage affordable. For example, the individual with an income of three times the poverty level is only guaranteed affordable coverage that covers 70% of patients’ costs. That level of coverage is known as a silver plan in the marketplace exchanges. The chart below compares our proposed adequacy standard with the current affordability standard in the ACA for each income level.