Memo Published January 24, 2014 · Updated January 24, 2014 · 8 minute read

A Middle Class Job No Longer Supports a Middle Class Life

Jim Kessler & Gabe Horwitz

The Four Middle Class Tickets1

With the economy recovering, Democrats are now rightly focused on building a long-term, post-recession narrative and agenda to address our structural economic problems including income inequality, wage stagnation, low-income mobility, and slow economic growth. As they do so, we recommend that Democrats seek to create a new compact with the middle class.

Why? Because increasingly a middle class job does not support a middle class life. And for the middle class, this problem lies at the heart of the promise of the American Dream and has fostered a deep sense of insecurity and uncertainty.

Based on our analysis of economic trends and public opinion data, we believe the middle class is hoping that Washington focuses obsessively on this particular problem—and that they see a role for both the private sector and government in solving it. A systematic focus on a new middle class compact will harness the best and boldest ideas to significantly expand the number of middle class jobs and bolster U.S. growth, improve the skills of those who seek these jobs, and aggressively work to lower the cost of the American Dream.

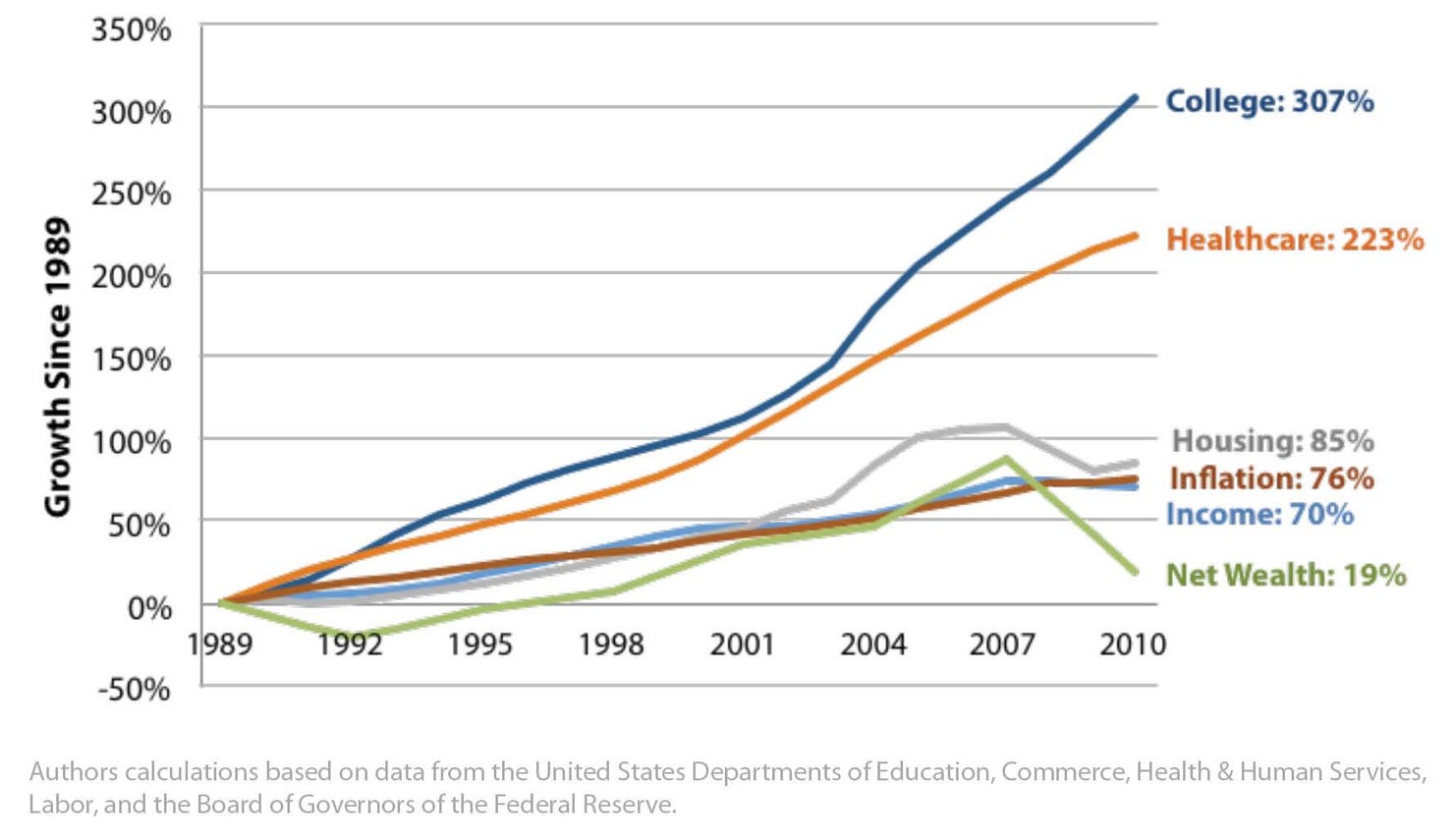

This is the first in a series of products that Third Way will produce from now through 2016 designed to help Democrats talk to—and about—the middle class. In subsequent products, we will offer a number of major policy ideas, but as a starting point, we focus on one critical chart (shown above), as it illuminates the severity of a key problem facing the middle class.

Namely, their incomes have not kept pace with the costs of the four big tickets that we contend are the price of admission into the middle class: college for kids, a home, health care coverage, and savings needed for retirement. Understanding what has happened to these big tickets to the American Dream is, in our view, the cornerstone to building a new compact.

The Four Tickets into the Middle Class

There are four big tickets for a middle class life: sending kids to college, owning a home, possessing health insurance, and saving for a solid retirement. A 2012 survey by the Pew Research Center concurs, concluding that after having a secure job, Americans believe that health insurance, owning a home, a college education, and investments all constitute a middle class lifestyle.2 In its report for Vice President Biden’s Middle Class Task Force, the Department of Commerce focused on the same four big tickets: college, health care, homeownership, retirement—and included two smaller ones: a family vacation and owning at least one car.3

But the price of these four main tickets is rising faster than middle class wages—making it increasingly difficult for families to lead the middle class life they’ve envisioned. While there are many nuances within this data, below we outline some key trends around the rising costs and some consequences of attempting to attain these tickets to the American Dream.

Ticket #1—College

A college education is now the gateway to the middle class. Meanwhile, the goal of putting kids through college and giving them the skills they need is a huge worry for typical families. The sticker price of college has increased faster than inflation for 32 consecutive years.4 College tuition and fees, in nominal dollars, increased 307% for four-year public colleges and 162% for four-year private colleges from 1989-2010 (four times and two times the pace of inflation, respectively).5

The consequences of college now being a necessity while priced as a luxury are severe:

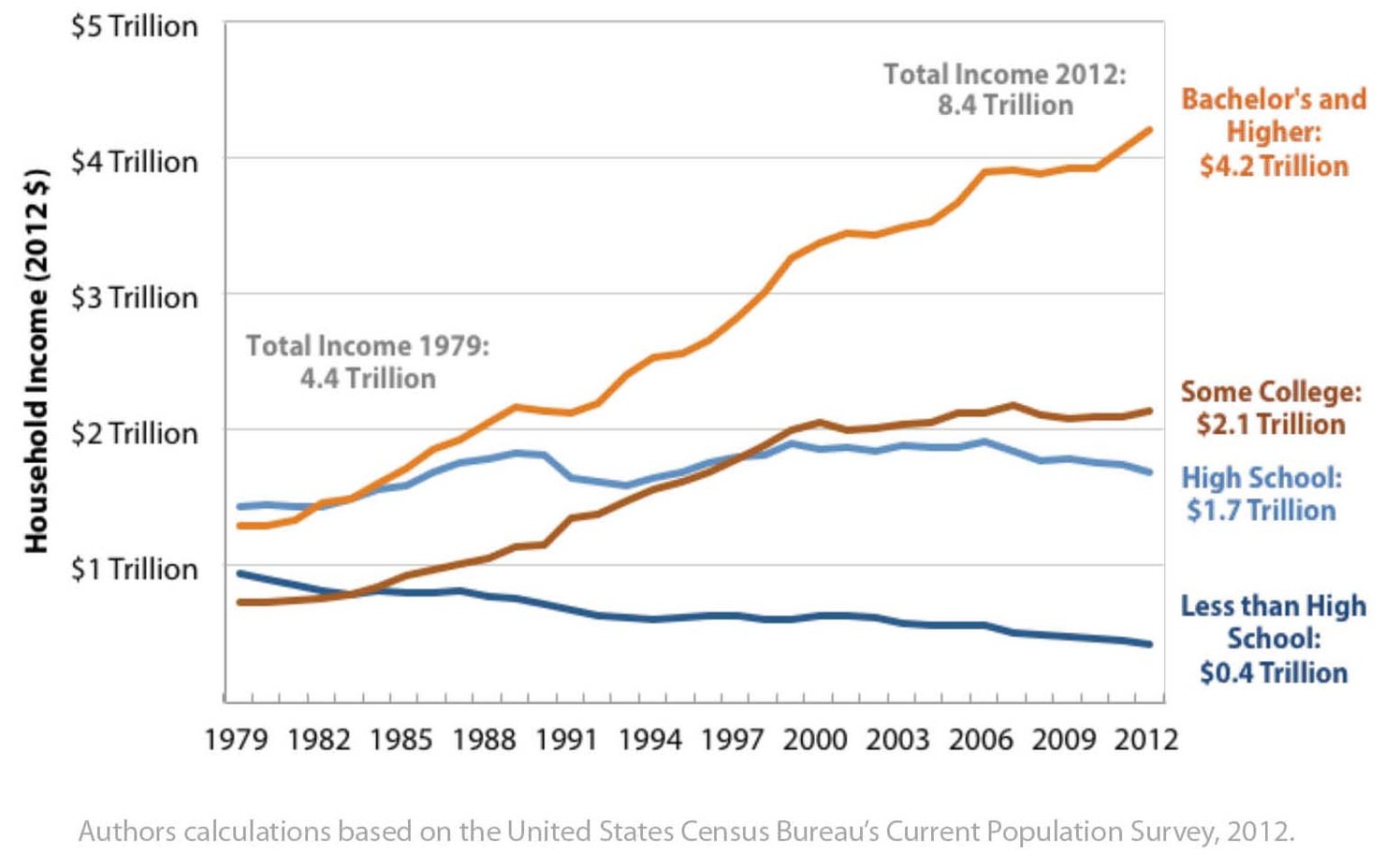

- Individuals with a bachelor’s degree or better are the only group that saw real wage gains over the last 30 years.6 And since 1979, 72% of all new income earned by Americans has accrued to those with at least a college degree.7

- Many colleges aren’t graduating enough students, with 43% of students seeking a bachelor’s degree at four-year public colleges failing to graduate within 6 years.8 This translates into potentially high debt loads without the benefit of a degree.

- Two-thirds of young adults are on track for a precarious economic future, as only one out of three of today’s 30 year olds have a college degree in an economy that puts a premium on education.9

- Families are taking on massive amounts of student loan debt. The number of families with outstanding student loan debt has doubled from 9% to 19% of households from 1989 through 2010.10 Outstanding student loan balances have rocketed $600 billion in just four years, from $730 billion in 2008 to $1.1 trillion in 2012.11

Aggregate Household Income by Educational Attainment12

Ticket #2—Health Care

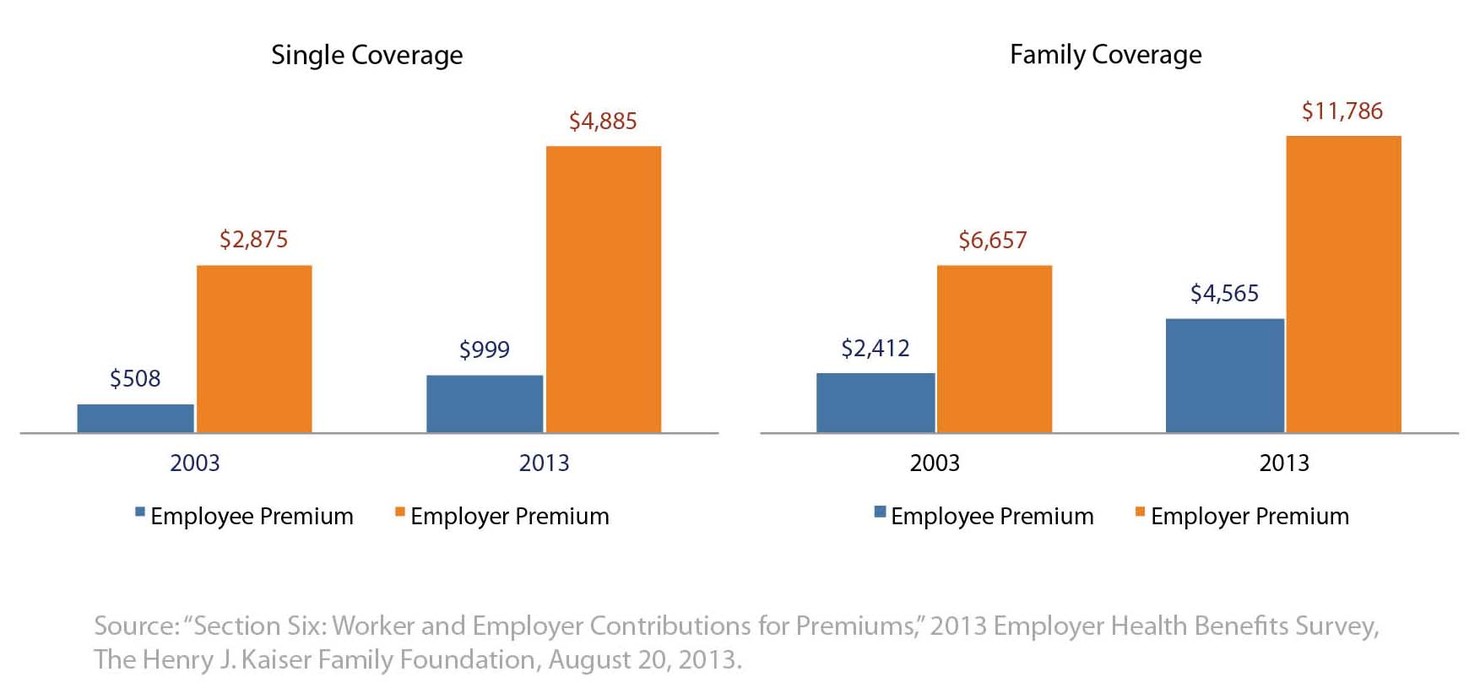

With passage of the Affordable Care Act (ACA), we solved one major problem for the middle class: ensuring stable and secure coverage that can never be taken away. But we have yet to solve the other major problem—exorbitant health care costs that depress wages, eat into family budgets, and make it more expensive for businesses to hire. Personal health care costs grew nearly three times the rate of inflation, ballooning 223% from 1989-2010 in nominal dollars.13

While the costs have moderated in the last several years, the challenge to the middle class remains:

- Fewer individuals are receiving health care through their job. The share of individuals receiving health care through their employer declined from 62.1% in 1987 to 54.9% in 2012.14

- Individuals and their employers are paying significantly more for coverage. Employee premiums for single coverage have increased $491 between 2003 and 2013, and the employer share has gone up by $2,010. For family coverage, employees are paying $2,153 more, and employers are paying an additional $5,129.15

- While more money is being spent on health care, patients aren’t necessarily seeing better care. The Dartmouth Atlas estimates that up to 30% of current spending on health care is wasted.16

Cost of Health Insurance Premiums 2003-2013 (nominal dollars)17

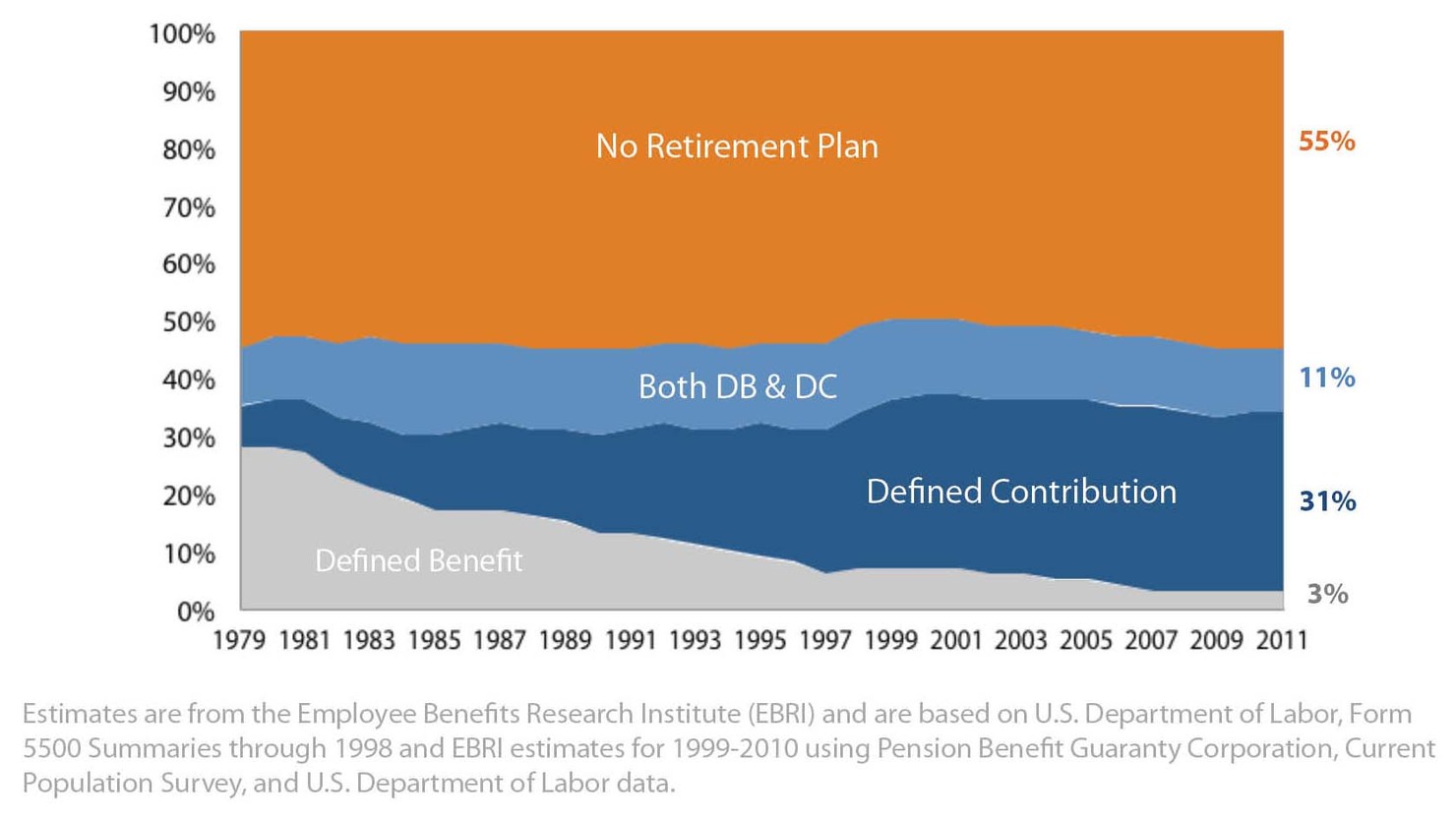

Ticket #3—Retirement

The good news is that Americans are living longer; the bad news is that many haven’t saved nearly enough to enjoy their retirement. The typical couple on the verge of retirement has only $42,000 in retirement assets—along with Social Security, pension and other assets (like a house)—to finance an expected combined 45 years of retirement living.18

That is compounded for the middle class by:

- Less than half of private sector workers are currently participating in a retirement plan.19

- The median net worth of a family headed by a 45 to 54 year old was $117,900 in 2010, a measure which includes home equity. This is $47,000 less than the median net worth in 2001, adjusted for inflation.20

- Social Security will be insolvent in 2031 at which point benefits will automatically and immediately be cut by 23%.21

- Americans are living longer. At age 65 today, men are expected to live to the age of 84.1 and women to the age of 86.4.22

Private Sector Workers Participating in an Employment Based Retirement Plan,

By Type, Among All Workers 1979-2011

Ticket #4—Housing

While in past decades home prices were relatively cheap and stable, they have become expensive and a riskier investment. Despite the collapse of the housing sector, the median price of a home still outpaced inflation between 1989 and 2010.23

This translates into significant challenges to homeownership for many in the middle class:

- For new home buyers, down payments are getting more expensive. In response to the easy mortgage days of the last decade, down payments in 2013 averaged 15.7%24 of the price of a home compared to less than 13% in 2011.25 That would make a typical down payment come to $30,819.26

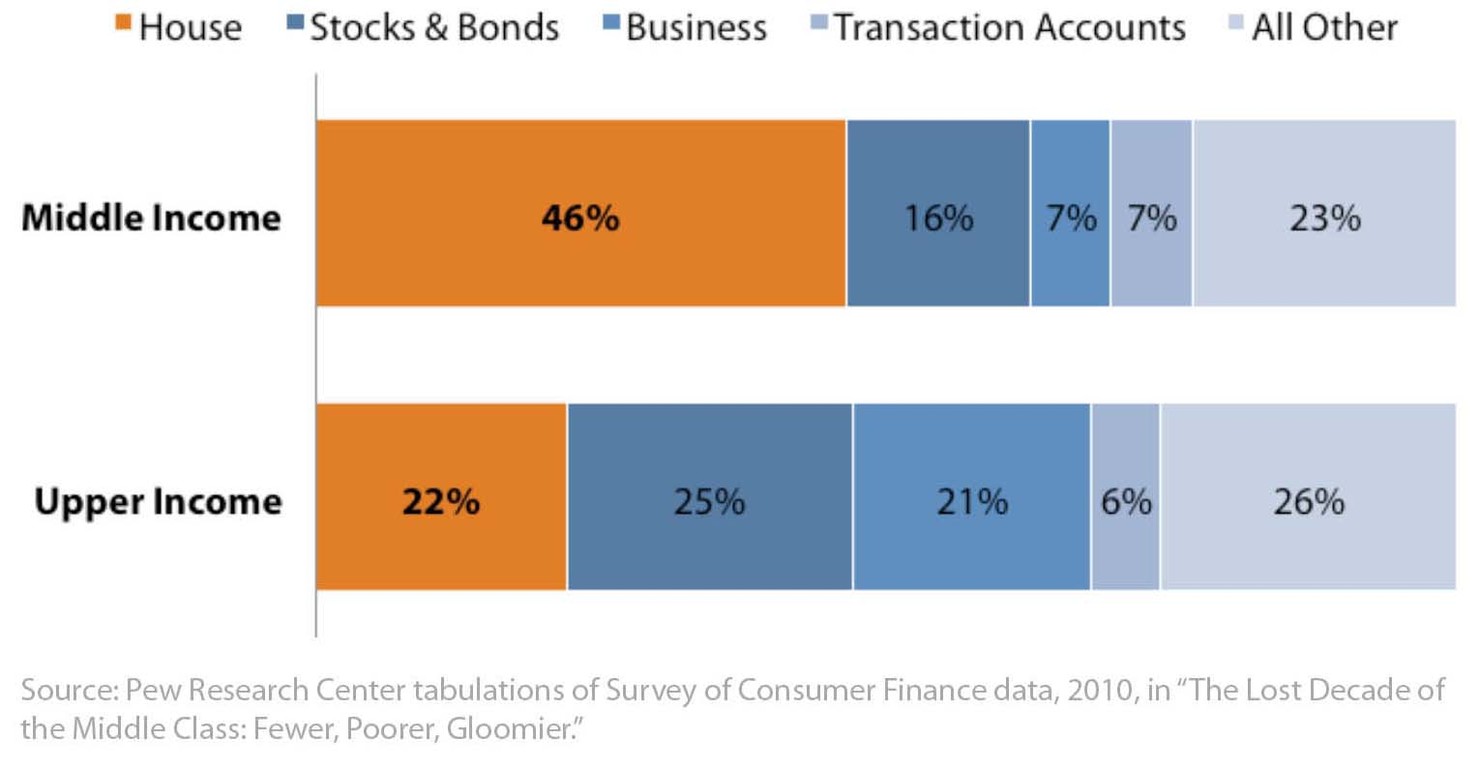

- Middle class families have more of their overall wealth tied to their homes, so the recession hit their wealth disproportionately hard. In 2010, middle income families had 46% of their assets in their homes, compared to only 22% of upper income families who are, on average, more diversified.27

- One in ten mortgage holders are late on their payments, or in foreclosure. While the number of homeowners in formal foreclosure processes has declined by a quarter from 2012, there is still a long way to go before those numbers return to pre-crisis levels.28

Household Assets by Type (2010)29

Conclusion

Eighty-five percent of the middle class say their standard of living is harder to maintain than it was a decade ago.30 This is due, in large part, to the fact that a middle class job does not support a middle class life.

As policymakers address this challenge in the coming years, there are some forces that can work in our favor:

- The recession is in the rear-view mirror with stronger economic growth in 2013 (and likely 2014) including healthy job gains, real median wage increases, and recovering housing prices.

- Average Americans are doing better: they have rid themselves of $1.53 trillion in debt,31 fewer homes are underwater, and Americans have returned to the workforce.

- Of the world’s developed economies, few are better situated for the next decade than the United States. We have a healthier economy and a far better fiscal outlook than Europe and Japan. Our age demographics are better. Our banking and finance sectors are more stable.

- We still have historic American advantages: entrepreneurship, immigration, rule of law, immense natural resources, an abundance of risk capital, and open markets.

Even still, while our darkest days from the recession may be behind us, the middle class feels only marginally better. If we are to be successful and vastly change the circumstances for the middle class in America, Democrats will need to obsessively work over the remainder of this decade to create a new compact. This will entail expanding the number of middle class jobs and bolstering U.S. growth, improving the skills of those who seek these jobs, and aggressively lowering the cost of the American Dream.