Blog Published May 15, 2025 · Updated June 12, 2025 · 14 minute read

US Advanced Nuclear Hangs on the Fate of the Tech-Neutral Tax Credits

Alan Ahn, Ryan Norman, & Ryan Fitzpatrick

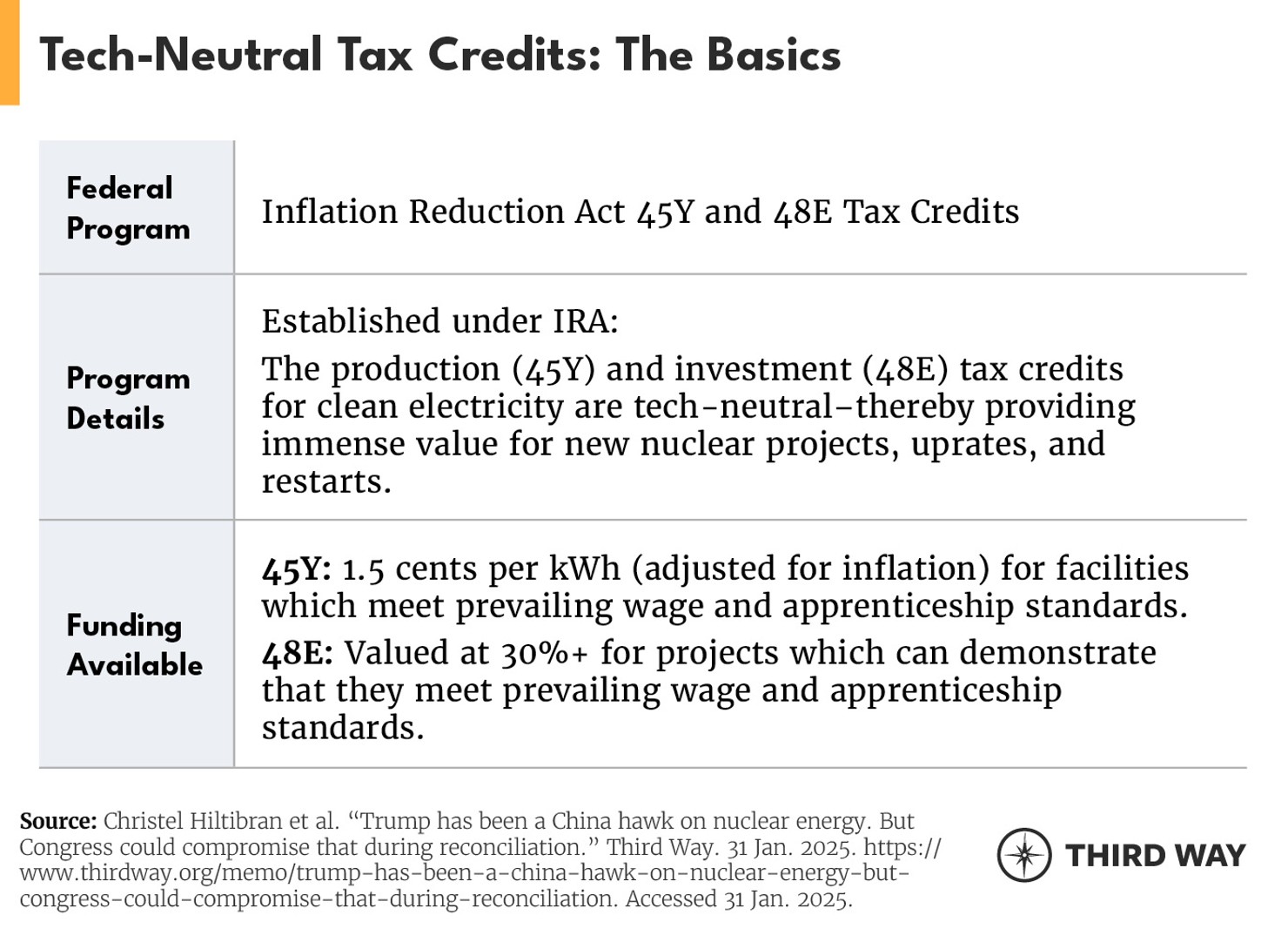

Nuclear energy projects are eligible for the technology-neutral production (45Y) and investment (48E) tax credits established in the Inflation Reduction Act (IRA). These credits are invaluable for American nuclear energy: decreasing the costs of nuclear power and enabling the US nuclear sector to meet soaring power demand brought by the Age of Artificial Intelligence and compete with China on the global stage. For advanced nuclear, these credits are especially pivotal, as they are necessary to attract private capital and investment at a critical stage of development of these technologies—as we reach first-of-a-kind (FOAK) milestones for different reactor designs and scale them up to commercial maturity.

Despite nuclear being a rare area of bipartisan support and a core pillar of the Trump Administration’s energy agenda (as evidenced by the administration’s recent nuclear executive orders and recent statements from Secretary of Energy Chris Wright that nuclear tax credits should be maintained over the long term), Congress is now considering changes to these credits that would weaken their benefit or render them unusable for new nuclear facilities. All of this runs counter to the urgency of the moment—we are now at a critical inflection point at which we must double down support for US advanced nuclear rather than back down, lest we fall behind China and other international competitors.

The State of Play on the Clean Energy Tax Credits

For months, speculation has circulated around how these tax credits would be affected by the Republican Congress through the budget reconciliation process, ranging from full repeal to the addition of various adders and eligibility rules that would reduce the budgetary score of these credits.

With House Republicans passing the reconciliation bill in late May, it is clear that, unless Senate Republicans change course, the tax credits—including those critical to the development of new nuclear—will be gutted by the following broad provisions:

- Earlier Sunset Dates: The tech-neutral tax credits as currently enacted are set to phase out for projects that start construction in 2033 or when US carbon emissions drop below 25% of 2022 levels; but the House’s bill would sunset the tax credits much earlier—projects would have to commence construction within 60 days of enactment and be placed in service by the end of 2028. And although advanced nuclear facilities (Gen III+ and Gen IV facilities, but not uprates or restarts) received an exemption from the “placed in service” by 2029 provision (they only need to commence construction before 2029 to be eligible), this exemption would still only result in one, possibly two of the leading commercial projects qualifying for the credits.

- Eliminating Transferability: While the House-passed bill preserved the ability of project owners to sell/transfer credits and monetize them, the bill’s accelerated phaseout of the credits effectively neuters the benefits of transferability.

- Foreign Entities of Concern (FEOC) Restrictions: Lawmakers have proposed a new set of extremely complex, ambiguous, and broad requirements to prohibit projects from accessing the credits if they leverage supply chains from or associated with a covered nation. These requirements did not get corrected between the clearing of the bill through the Ways & Means Committee and its passage on the House floor, and would be particularly challenging to meet for projects electing to use transferability.

While these moves are “scored” as saving billions of dollars in the federal budget, they would lead to far greater losses of private investment in domestic energy sources. They would also seriously disadvantage nuclear energy—particularly in relation to other energy technologies that can access the credit—unless the Senate can address these issues in its budget reconciliation process.

Sunsetting Before New Nuclear Can Get Going

Under current law, a project is eligible for the full value of the tech-neutral tax credits if it starts construction before 2033 or when US carbon emissions drop below 25% of 2022 levels (whichever is later). At that point, the credit value is reduced each year until it is completely eliminated five years later. Under these rules, it is very likely that the credit is available for nuclear projects well into the 2030s.

However, the “One Big Beautiful Bill Act” passed out of the House would terminate the credit for projects unless they: (1) commence construction within 60 days of enactment, and (2) are placed in service before the end of 2028. On the latter deadline, the House’s bill doesn’t just require that a project start construction prior to the end of 2028—it requires the project to be completed and putting electricity on the grid. By switching to a “placed in service” deadline, a taxpayer essentially will have to accomplish more in less time to receive any incentive.

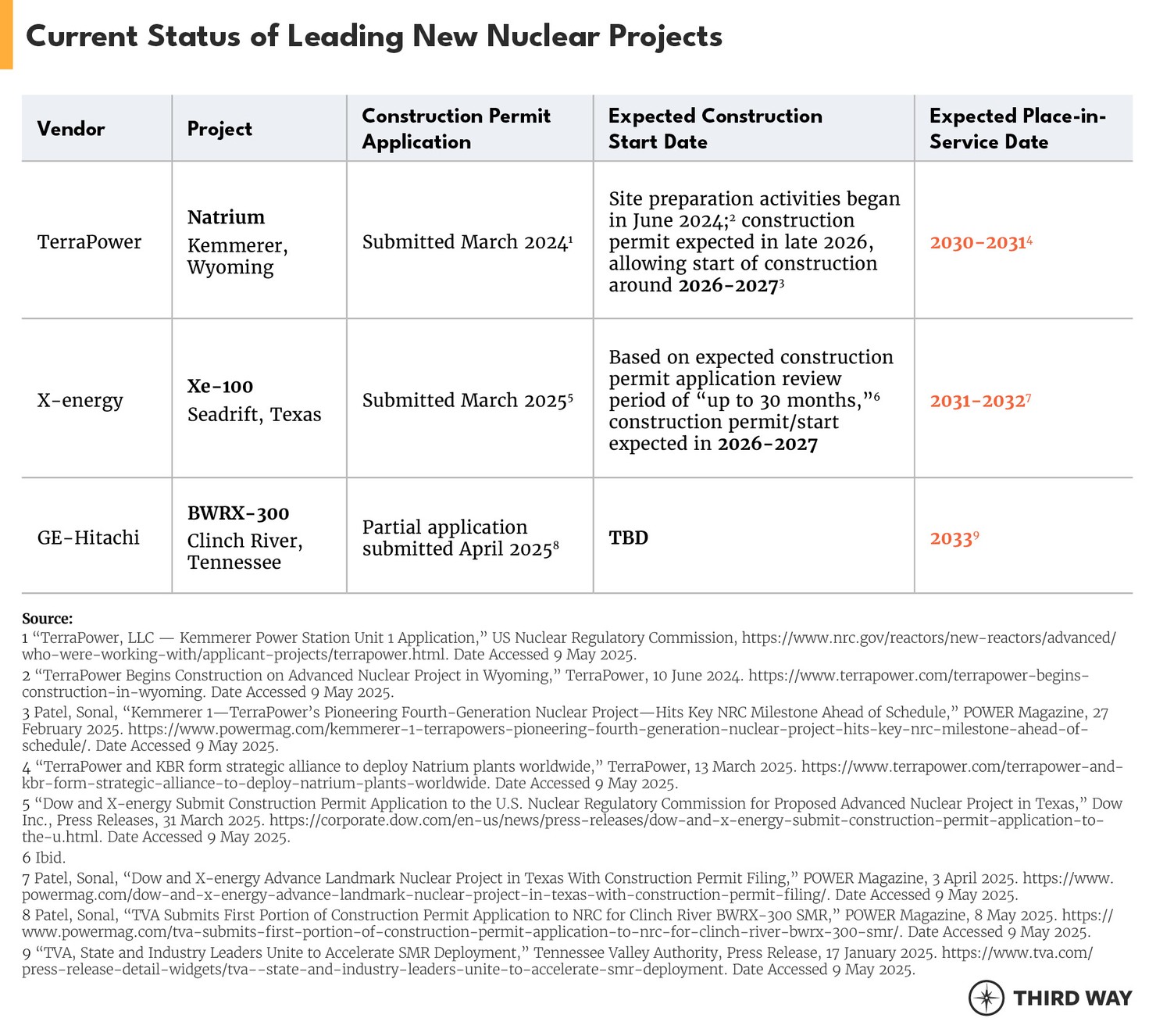

And although advanced nuclear energy projects received an exemption from the 60-day start of construction and the 2028 placed-in-service deadlines—they only have to commence construction before the end of 2028 to be eligible for the credits—this commence construction deadline essentially blocks all but one or two of our front-running commercial projects from accessing the credit. Below is a table of new advanced nuclear projects with construction permit applications in process or under review, and with a line of sight towards construction/operational start:

The phase-out of the credits passed by House Republicans would certainly prevent any new nuclear projects from receiving the credit outside of perhaps one or two of our pioneering commercial advanced reactor demonstrations. No uprates or restarts of current-generation technology that commences construction after 60 days after the bill is enacted would be eligible for credits. Even more importantly, a premature credit sunset would remove eligibility for any advanced nuclear projects starting construction in the early-and mid-2030’s, which will be a critical period for scaling up advanced nuclear technologies immediately following the completion of our first advanced nuclear demonstration projects.

Indeed, if we maintain IRA sunsets and eligibility rules as they are currently in law (i.e., start construction before 2033 or when emissions levels drop to 25% of 2022 levels, whichever is later), it is probable that projects associated with recent notable announcements (on plans to build out advanced nuclear at scale) are able to receive the credit, such as:

- The Google-Kairos agreement in October 2024 to build an “orderbook” of six to seven Kairos Power reactors totaling 500 MWe of capacity,1 with the “first SMR online quickly and safely by 2030, followed by additional reactor deployments through 2035.”2

- The X-energy-Amazon partnership announcement in October 2024 to support a four-unit 320 MW project with Energy Northwest, “with the option to increase that project to 12 units and 960 MW”3 and a broader collaboration “to bring more than 5 gigawatts of new power projects online across the United States by 2039.”4

- The Google-Elementl agreement in May 2025 through which Google and Elementl Power would collaboratively develop three project sites for advanced nuclear of at least 600 MWe each.5

However, the House reconciliation bill would preclude any of the projects connected with the announcements listed above from benefiting from the credits.

Failure to seize this window of opportunity for scale-up immediately following our vanguard demonstration projects would come with a cost and put us further behind China in the race to deploy advanced reactors. For example, according to the US Department of Energy’s report on commercial liftoff for advanced nuclear, “waiting until the mid-2030s to deploy advanced reactors at scale”6 would make it significantly more challenging and costly to reach our nuclear deployment goals by midcentury—“a five-year delay in scaling the industrial base could lead to a 50% increase in capital required to achieve the same amount of capacity”7 by 2050.

What Nuclear Needs from the Senate: To support early commercial deployment of advanced nuclear reactors, the technology-neutral tax credits must remain in place as long as feasible. Projects must be able to qualify for the credit until at least 2033 before any phase-out takes place, with that deadline based on when construction of the facility begins (rather than when it is “placed in service”).

Neutralizing Transferability: Inordinate Harm to Nuclear

Transferability allows energy project developers without a tax liability to monetize their federal tax credit benefits by trading them to a company that does have a tax liability in exchange for cash. This is especially critical for new manufacturing and advanced energy projects, such as nuclear, as these high-cost projects will need access to substantial amounts of cash to manage the project's capital expenditures for construction, supply chains and financing costs. Typically, tax equity can be leveraged within a project finance approach to raise capital for energy projects by allocating the projected tax credit to cover liabilities of the financing partners. However, this type of tax equity financing is prohibitive for nuclear projects for a number of major reasons:

- Structural Restrictions: US civil nuclear regulations require investors to acquire an ownership stake in the project and meet specific financial and national ownership criteria. Under the Atomic Energy Act, the owning entity or investor must also obtain a license from the US Nuclear Regulatory Commission (NRC) through a thorough and time-intensive licensing process that can take years to complete. These additional structural challenges impose a higher burden on investors, thereby making models for tax equity financing largely unworkable.8

- Potential Market Distortion: Nuclear projects will yield larger amounts from the investment tax credit than most other projects due to their high capital intensity. At scale, nuclear projects that are structured to take advantage of tax equity financing would generate high value credits that could overwhelm tax equity market demand. This distortion could make it more difficult to finance other projects through this mechanism by attracting an excessive share of partners with tax liabilities.9

As analyses have shown, newly eligible technologies such as advanced nuclear, CCUS, and others made up 72% of the direct tax credit transfer market in the second half of 2024.10 One reason for this is that projects featuring emerging technologies like advanced nuclear are largely being developed by small companies that generally have no tax liability. Without transferability, a nuclear project would likely be forced to forgo this value, as restructuring the project to incorporate more tax equity partners would expose investors to regulatory constraints and make financing more difficult.

Because of advanced nuclear’s unique financing challenges and constraints, preservation and effective utilization of transferability provisions is particularly important. However, the House bill, while preserving transferability, prevents virtually all nuclear projects from benefiting from these provisions by limiting transferability to within a significantly truncated credit period. Moreover, as explained below, the FEOC provisions would be particularly challenging to meet for any project using transferability, thereby reducing the availability of tax credit buyers even for those projects that manage to commence construction by 2028.

What Nuclear Needs from the Senate: To support early commercial deployment of advanced nuclear reactors, transferability must be allowed for the full duration of the tech-neutral tax credits beginning at the start of construction, with the period of eligibility for the tax credit extended appropriately (i.e., until at least 2033, as noted above). FEOC rules must be revised to eliminate the unique and undue burden on projects using transferability.

FEOC Provisions: A Slippery Slope for Nuclear

It is imperative that we reduce our reliance on adversaries and malign foreign actors for critical nuclear supply chains; for example, efforts are underway to increase domestic production of nuclear fuel and limit imports from unreliable suppliers.

Clear and targeted restrictions on foreign entity access to tax benefits in service of reducing dependencies on geopolitical rivals (e.g., China) are reasonable. However, foreign entity-based restrictions on access to the tech-neutral tax credit that are ambiguous or complex put the ability of nuclear facilities to access the tax credits at risk. The nuclear energy supply chain is inherently international, and so ambiguous or overly-broad foreign entity restrictions will leave most nuclear utilities uncertain about their ability to access tax credits and, therefore, significantly limit the ability for facilities to obtain financing.

The House reconciliation bill contains unworkable, complex, and ambiguous FEOC requirements. The restrictions—detailed over 10 pages of dense legislative text, relying on overlapping definitions and numerous undefined, yet ambiguous terms—look not only to whether the owners of nuclear utilities have close ties to adversaries like China, but also to the origin, stock owners, board members, debt holders, service providers, royalty holders, and IP rights of every single component and subcomponent that makes up a nuclear power plant (including those outside the nuclear island, like cabling, transformers, and steam turbines, and related control systems). This type of supplier due diligence is far more complex than would be feasible, particularly on the timeline for which the credits remain available. It goes beyond what is required by existing national security-focused nuclear supply chain restrictions, let alone other types of energy projects.

For example: the US nuclear sector does not directly procure major nuclear components and services from covered countries, but will source critical items such as reactor pressure vessels and steam generators from friendly and allied nations (e.g., Japan, South Korea). These component manufacturers may source inputs from countries like China—often these are small inputs of specific minerals (like manganese used to improve structural integrity of piping and pressure vessels or zirconium used in fuel cladding) for which much of global production comes from China, but on the basis of this indirect and minor touchpoint, these nuclear projects would be disqualified. And given the complexity and ambiguity of the restrictions, even this possibility risks chilling investment.

The restrictions are particularly onerous for projects that need to use transferability to secure financing. The FEOC restrictions in the House reconciliation bill make ineligible any entity that makes payments for anything other than goods—services, IP, dividends, debt repayment—to an entity that meets one of these convoluted definitions of a prohibited foreign entity. In other words, it effectively requires nuclear developers to ask all of their business counterparties about the individual and corporate citizenship of all of those entity’s owners, and those owners’ owners, as well as all of those entities’ (corporate and human) family members. While this is challenging enough, the House bill also puts the buyer of tax credits in a transferability deal on the hook for the nuclear facility’s compliance with this program—if a supplier runs afoul of any of these eligibility requirements at any point during the 10-year period the tax credit is being claimed, any and all credits transferred to the buyer would be voided. These restrictions and risk of recapture will make it extremely challenging to get potential buyers to commit to purchasing credits. Put simply, even if transferability is technically allowed, there may not be any willing buyers, putting financing for nuclear projects at significant risk.

Also of concern, the unclear language in the House bill would require the Treasury Department and IRS to issue guidance before taxpayers know whether their suppliers meet or violate these restrictions—guidance that is unlikely to come in the next year, if it comes at all. This further compresses the eligibility timeline for projects: it will take years before tax lawyers can bless deals and financing can be secured, at which point it will be too late to take advantage of the credits before they expire.

What Nuclear Needs from the Senate: To support early commercial deployment of advanced nuclear reactors, any foreign entity-related restrictions on the tech neutral tax credit must be clear and administrable, enabling taxpayers to know whether they are eligible, without additional Treasury guidance or unreasonable expectations that they (or the potential buyers of their tax credits) know the national identity of their suppliers’ common stock owners, debt holders, service providers, etc. There are ways to promote US security and geopolitical goals without ham-handed restrictions that jeopardize US nuclear and other energy projects. The House’s approach must be scaled back to FEOC requirements that are sufficient but workable.

Conclusion: Nuclear is Disproportionately Harmed by Current Tax Credit Provisions

What has emerged from the budget reconciliation process in the House would undermine longstanding bipartisan momentum on nuclear and the Trump Administration’s objectives with regards to nuclear energy deployment.

While the House passed the reconciliation bill prior to the announcement of the administration’s executive orders on nuclear energy, if the Senate now fails to address these tax credit issues in its reconciliation proceedings, it will be willfully undermining the administration’s explicitly stated goals for civil nuclear deployment.

The House’s reconciliation legislation on the clean energy tax credits will make the budding resurgence of new nuclear energy impossible. These moves make even less sense when one considers that the future US of advanced nuclear is massively consequential for our international leadership and national security, far beyond just issues of meeting energy demand and our industrial development goals. The Senate now has the opportunity to correct these issues, and it must respond appropriately and decisively to ensure America’s national interests.