Blog Published April 23, 2020 · 12 minute read

Code Red: Bracing for Impact

Zach Moller, Jillian McGrath, & Ellen Hughes-Cromwick

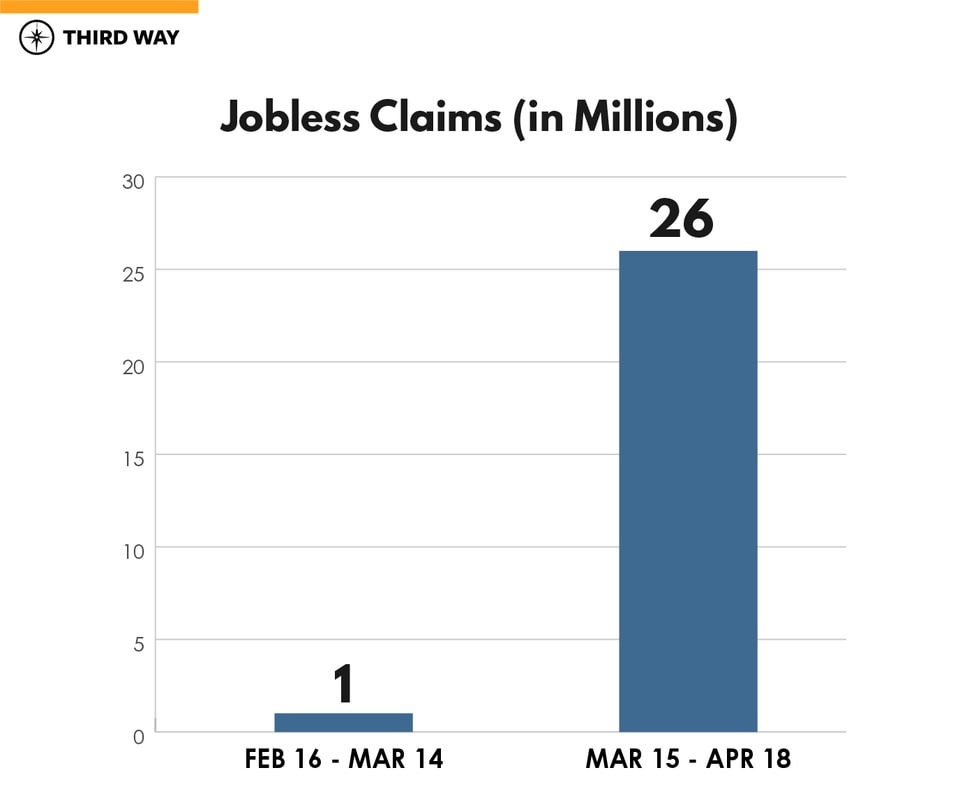

This morning, jobless claims rose again by 4.4 million people for the week ending April 18. This brings the five-week total to well over 26 million—a whopping 16% of the entire labor force. And we are still at the early stages of the unknown unknowns. Many state unemployment offices are still grappling with IT issues and congestion at their virtual and physical locations, hampering sign-ups. You can see this in today’s report. While many states had fewer claims in the last week, Florida’s claims rose by over 500,000, a jump from just 180,000 in the prior week. West Virginia’s claims tripled.

At issue now is the domino effect of layoffs as companies assess their financial circumstances even with the aid they have received through fiscal and Federal Reserve actions. Here is where the rubber meets the road. With uncertainty about re-entry into economic life, whole industries are attempting to determine whether their customers will come back into the market and buy what they are selling. Having been at a company who struggled to do just that during the Global Financial Crisis, I know how that analysis is done. Since there are loads of uncertainty, company planners try to determine what the “most probable” outcome is likely to be. For someone selling furniture, they must come up with a number like the following:

“We sold 2 million couches before COVID and our sales were growing at 5% on a year-over-year basis. If this turns into a longer economic downturn, we may get an initial relief pitch as the economy reopens, but let’s build a plan where sales growth in the following year is closer to 1%.”

At a 1% sales pace, fewer workers are needed in the factory. The planners recommend trimming the workforce now, even prior to re-opening, in order to “save” funds that may be needed if sales dip below the “1% plan.”

As this planning takes place, the health and economic crisis will unleash another wave of layoffs. The Mercury News in the San Francisco Bay area reported yesterday that job cut announcements doubled in the last week, hitting construction companies, movie theaters, and a host of different retail businesses. Sprinkled among the 26-page list of companies are many permanent closures. Beaumont Hospital in Detroit announced yesterday it will lay off 2,475 workers, including 450 permanent job cuts, as COVID has impacted their elective surgery revenues. The North Carolina Department of Transportation cut 300 temporary workers due to construction delays. Each of these announcements highlights the domino effect that results from the shock. Revised company plans are expected to add to the adverse job impacts in the weeks ahead.

To tamp down on this, more is needed. Indeed, isn’t it time to be thinking much bigger?

What was in Phase 3.5 of Government Action?

The most recent Coronavirus relief package provides $484 billion to replenish small business lending, support hospitals, and improve COVID-19 testing capabilities. The bill, passed by the Senate and set to pass the House on Thursday, is being postured as a necessary interim measure to meet immediate needs while Congress negotiates a larger, more comprehensive Phase 4 spending package.

Most of the funding from this “Phase 3.5” package is allocated to the Small Business Administration’s Paycheck Protection Program (PPP), an initiative that originally received $350 billion from the CARES Act but ran dry quickly. Of the package’s $484 billion price tag, the PPP is set to receive $320 billion, meant to provide lenders the ability to continue administering emergency small business loans. Lenders had administered nearly 1.7 million loans since April 3 until the program exhausted its funds only 13 days later.1 Even with the additional funds, banks are not optimistic about the longevity of the program, warning that the program could be exhausted again in mere days.2 Of the $320 billion allocated in the bill, $60 billion is specifically set aside for smaller lending institutions such as credit unions and local banks. This could help expand PPP’s reach to smaller businesses.

In addition to replenishing the SBA’s PPP, the bill provides $60 billion for the Economic Injury Disaster Loan Program (EIDL), an existing SBA lending program intended to help businesses with less than 500 employees cover costs associated with major economic injuries. Phase 3.5 text changes eligibility for the EIDL program, allowing farms and ranches to apply.3

Finally, to continue combatting the ongoing public health crisis, the bill allocates $75 billion to hospitals (specifically those in rural areas) and $25 billion to improve coronavirus testing capabilities. It also mandates that the Trump administration develop a national strategy for state and local testing efforts, which will be a critical step in reopening businesses around the country.

Urgency for Phase 4 and thinking bigger

The interim package that the Senate passed Tuesday and the House will pass today is important, but far more aid is needed. Speaker Nancy Pelosi and Senate Minority Leader Chuck Schumer had been pushing for $150 billion in additional state and local emergency funds in the interim package. But Senate Majority Leader Mitch McConnell stonewalled, blocking needed aid to every governor and mayor in this country. Not providing emergency funding to our communities could be devastating and may prolong this economic crisis.

Our state and local governments are losing a ton of revenue at the moment, from taking in less in sales taxes to getting fewer toll dollars as people stay home. That, paired with state and local governments’ increased safety net spending, is about to decimate their budgets and ability to fight this pandemic. This is what happened in the Great Recession last decade. To respond to the budget challenges of a suffering population from 2009 to 2013, state governments cut hundreds of billions in spending.

As we build out what a real phase 4 package will include, Third Way has come up with three separate plans to rescue the economy and save our workers, employers, and communities.

State and local governments are on the front lines of the COVID-19 crisis. They address the economic calamity hitting our communities, area businesses, and the people they employ. They deal with homelessness, unemployment claims, Medicaid patients, public hospitals, public schools, community colleges and public universities, delivering food aid, enforcing social distancing, and public safety. They also address the urgent needs of the most vulnerable communities where poverty and racial disparities are already present, as we all face the COVID-19 crisis. Our Save Our State (SOS) Rescue Plan provides 7 ideas for the next bill.

For example, we should establish a state and city stabilization fund. The government would guarantee that as state and city revenues fall below their recent average, federal funds would be allocated to make up the difference. The federal government can come in and immediately relieve state budget pressures by putting more federal dollars towards Medicaid spending. This will promote both public health and state budget health. And the federal government could provide an additional $15 billion to help transit agencies cover operating costs beyond the $25 billion in the CARES Act.

Next, we need to dramatically expand support to our workers and families so that they can get through this health crisis with their finances intact. We’ve proposed establishing a Coronavirus Safety Net that can rescue the workforce. For example, we should add additional direct cash payments until the crisis has passed, further expand access to unemployment insurance, and increase food assistance. And many of our front-line workers are struggling with childcare. Congress should provide funding to states to be distributed to daycare centers and other child providers that remain open to care for the children of frontline workers.

Beyond the urgent need for state and local government support and far more for our workers and families, we need to make sure there are jobs for people to go back to—that means supporting our employers. In addition to businesses needing to close for the good of public health, many directly affected industries have been harmed. Now there is a fast approaching second wave of industries facing a likely persistent drop in demand for their goods and services. With consumer confidence and worries about ongoing health risks permeating behaviors as the economy opens up, there is an increasing likelihood that incomes and jobs will fall in sectors like autos, manufacturing, and other cyclically sensitive industries. This is why we have designed a Coronavirus Lifeline for employers.

As part of this, we need to expand and reform the Paycheck Protection Program so that it can more effectively meet the concerns of small employers. We should further expand assistance to the smallest employers and expand access to equity capital for startups that exist all over the country. And, we need to support large employers with loans and grants in return for equity or promises of repayment. But even with liquidity to large employers, we may need to get creative.

With grave concerns about the presentence of this recession, we will need to be creative to spur demand. Another efficient way to support industries hurt by an ongoing recession is to provide temporary consumer incentives to help with purchases, especially for households with low and middle incomes and significant job loss. In 2009, for example, the US government, as well as other countries, implemented a scrappage program that allows car buyers to trade in an old vehicle and purchase a newer, higher fuel economy vehicle. The old vehicle was scrapped and the new one was purchased with a $3,000 incentive. Manufacturers were given access to low interest loans to retool plants and to benefit from a tax credit for plant retrofits. These are temporary programs designed to put a floor under demand so that these businesses remain viable and workers can stay employed.

Updates on Federal Reserve Action and Help for Housing

While the Federal Reserve has made important program announcements timed to Thursday’s jobless claims report, there is little that they have hinted could be in store. No action was taken this morning. But at mid-afternoon today, it issued a statement committing to transparency regarding participants in the CARES Act backed loans, publishing data on a monthly basis. This is encouraging in light of the reported discretion and worrisome bias in the PPP loan disbursements.

What has happened is that the Federal Reserve late last week began reducing their purchases of US Treasury and mortgage backed securities (MBS). Recall early in the COVID outbreak, the Federal Reserve sought to stabilize financial markets by purchasing these securities since investor demand for them had plummeted. As the “lender of the last resort,” the Fed was able to calm down the gyrations in prices and demand, thereby ensuring that long-term interest rates did not skyrocket at a difficult time in history.

When the Fed began this securities purchase program following their March 23rd announcement, they bought a record $625 billion, far exceeding any pace of buying recorded in the aftermath of the financial crisis. Announced purchases for this week have slowed considerably to $75 billion for Treasury securities and $50 billion of MBS. Markets have stabilized, and that is good. What we worry about is the possibility for great volatility in the months ahead. Can the financial system withstand a shock that morphs into a financial crisis? What about the banks—do we worry about their cushions should loan defaults and bankruptcies spread like a virus too? These are questions we hold in our minds as we push for mega-policy action.

In other important news, the Federal Housing Finance Agency announced that they were going to provide some relief to mortgage companies like Quicken Loans, Suntrust, and TD Bank who facilitate the servicing of mortgage payments (companies called mortgage servicers). These mortgage servicers collect mortgage payments and then turn around and pass these funds along to the companies that lent the mortgage money in the first place. The servicers are an intermediary, providing the service—for a fee—of handling these payment streams.

As homeowners got forbearance relief on making mortgage payments, the servicers were still required to pass along mortgage payments to the mortgage originators: Fannie Mae and Freddie Mac. Fannie and Freddie are US government entities called Government Sponsored Enterprises regulated by the Federal Housing Finance Agency. Yesterday, this regulatory agency capped servicers’ mortgage obligations to four monthly payments. After the servicers have made those four monthly payments, they will no longer be required to send checks onward to Fannie and Freddie. This may seem long winded, but that is how a large part of our nation’s housing market works. If the servicers go out of business, there could be chaos in housing markets. Even with this band-aid fix, there are significant challenges ahead as homeowners confront the brutal reality that their incomes could fall short of their monthly obligations. It is becoming very clear that more action will be needed on the housing front. An upcoming blog will examine the policy options needed to address the potential surge in mortgage defaults and mechanisms to alleviate the financial pressures that households will encounter should a protracted recession take hold.

So much has been undone, and we cannot lose a sense of urgency that much must be done in the days ahead. We would not object to a WWII-esque outsized government response, taking our government outlays to record levels temporarily. Everything about our economy is on the line right now, so we must be big and bold.

The problem with recessions is that once they start, they cannot easily be undone. In the 1981 downturn, it took three years to get the unemployment rate back down to where it was when the recession began. In the 1990 recession, six years. In 2001, five years. And then, in the Great Recession, unemployment reached 5% in December 2007 and did not return to that level until September 2015—almost a full eight years later. Looking back on that more recent trajectory, we now know that the power of the government purse was often left on the sidelines as millions of households struggled. What is done cannot be undone. But what is ahead right now can be avoided with government action.