Report Published May 1, 2010 · Updated May 1, 2010 · 26 minute read

Enjoying Career and Family

Cristy Gallagher, Jim Kessler, & Tess Stovall

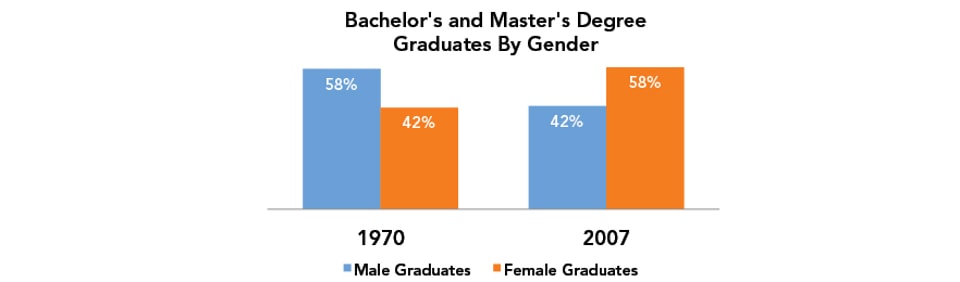

In 1970, three out of every five college and graduate degrees were awarded to men. By 2007, three out of five degrees were awarded to women.1 This one fact shows how our workforce has dramatically and permanently changed. With education as the lead indicator, moms with young children used to stay home; now they work. The traditional household had one breadwinner; the new traditional household has two. As people put off marriage until later and life expectancies stretch, many families now raise children, take care of elderly parents, and work two paying jobs. Time to care for children and aging parents is the new scarce resource for families.

THE PROBLEM

Family roles have changed, but workplace policies haven’t caught up.

Work/family balance policies have generally been viewed by those in the business community as costly concessions that reduce productivity. In the 1990s, businesses almost unanimously opposed the Family and Medical Leave Act which allowed parents to take up to six weeks of unpaid leave after the birth of a child.2 But in the decade after the law was signed, a record number of women had entered the workforce.3 As a result, the notion of work/family balance as a concession will need rethinking because our workforce is continuing to change dramatically.

In 2007, 62% of associate’s degrees, 57% of bachelor’s, 61% of master’s, and 50% of professional and Doctoral degrees were awarded to women,4 and in each higher education category, the education gap is widening.5 This is a significant difference from thirty years ago as the graph below shows.6

Source: U.S. Census, Statistical Abstract of the United States: 2009, Table 288

In an economy that rewards education, these statistics mean that in the coming decades, the majority of doctors, lawyers, professionals, and managers will be women. In fact in a recent study done by Pew Research Center, 28% of married women had more education than their husbands, compared to only 20% of married men.7

As women make remarkable strides in the workforce, they are still often the primary caregivers at home. Perhaps that will change in the future, but the greater likelihood is that married households will continue along the trend of two-earner families working greater hours. For policymakers and business leaders, making this work/family balance work will mean stronger businesses and thriving families.

The relationship between family and work has changed significantly.

Over the course of thirty-five years, the typical married family added nearly twelve hours to the average work week.8 In 1970, only two in five women with children under six worked outside of the home.9 Today, over 60% of women with children under six are working outside of the home,10 and two-thirds of married couples with children are dual-earner couples,11 compared to less than half in 1970.12 On average, these couples work a combined 63.1 hours per week, and almost 70% of such couples work more than 80 hours per week.13

More families are relying on child care and elder care to take care of their loved ones.

More families today are relying on child care to watch over their children as the number of dual-earner couples grows. In fact seven out of every ten children live in households where all adults are in the labor force,14 which requires child care to be a part of the family discussion. In 2005, nine in ten children under the age of five were in a regular child care arrangement,15 and the average cost of child care ranges from $4,000 to $16,000 annually,16 a significant amount for most middle-class families.

As more Americans are living longer and having children later in life, the phenomenon of the “sandwich generation” has grown as well. In 2001, the most recent data available, as many as 44% of adults aged 45 to 55 had aging parents or in-laws as well as children under 21.17 Roughly seven out of ten adults between the ages of 41 and 59 have at least one living parent, up from 60% in 1989.18 Nationwide, 21 million full-time and 5 million part-time workers provide unpaid care to an elderly, disabled, or chronically ill family member or friend, and their numbers are expected to rise by 85% between 2000 and 2050.19

Balancing work life and family life is as much of an issue for employers and businesses as it is for families.

Two-thirds of working caregivers say they’ve had to rearrange their work schedule, decrease their hours or take unpaid leave. One in five says they’ve switched from full-time to part-time work. Twenty-nine percent of caregivers say they’ve forgone a promotion, training or assignment and 22% say they passed up a chance to acquire new skills.20 And 16% of all caregivers say they’ve even quit a job to meet caregiving obligations.21

For employers, some industry experts say that U.S. employers lose between $11.4 billion and $29 billion a year in lost productivity and employee time because of employees’ caregiving obligations.22 One study suggested that employee stress about what to do with children after school is associated with decreased productivity and increased absenteeism, amounting to costs of $496 to $1,984 per employee per year.23

All told, absenteeism costs businesses an average of about $660 per employee per year and results in as much as $1 million in losses per year for some large companies.24 But employee turnover is even more costly. According to a separate study, for every employee who quits, a company incurs, on average, $40,000 in costs hiring and training a replacement.25 Other figures indicate that the costs of replacing a skilled worker are typically .75 to 1.5 times higher than the worker’s annual salary.26 Turnover costs can be especially high for professional workers: replacing an experienced law firm associate can cost between $200,000 and $500,000.27

Helping businesses, workers and families find a better balance between home and career will not only help the bottom line for business but better enable families to maximize their earning potential while getting more satisfaction from their jobs. Below, we provide ideas that governors can use to encourage businesses to help their employees to balance work and family and help individuals with the day-to-day challenges they face in raising a family.

THE SOLUTIONS

Balancing family responsibilities at work.

While more employers are beginning to recognize the value of putting “family-friendly” policies into place, public policy fails to reward or encourage these efforts. Indeed, current public policy fails to recognize the issue of work/family balance as a policy priority at all—despite its very real economic impacts on individual workers, their families and their employers. We offer ten ideas to help make work work better for families.

1. Provide paid leave for new parents.

The United States is one of only five countries, along with Australia, Liberia, Papua New Guinea, and Sierra Leone in a survey of 190 countries, which does not guarantee paid maternity leave.28 A state can create a parental leave benefit funded by employee contributions, or through the state temporary disability insurance, provided to parents to care for a newborn or newly adopted child.

Best Practices

- In 2004, California enacted paid family and medical leave requirements funded by employee contributions. The law provides workers with a maximum of six weeks of partial pay each year (approximately 55% of wages up to a maximum of $840 per week) while taking time off from work to bond with a newborn baby, newly adopted or foster child, or to care for a seriously ill parent, child, spouse, or registered domestic partner.29

- In March 2008, the New Jersey state legislature passed a bill providing paid leave to workers caring for a newborn or sick relative. Those taking leave would be eligible to receive two-thirds of their salary, up to a maximum of $524 a week, for 6 weeks. It would be financed by an employee payroll deduction that would cost a maximum of $33 a year per worker. The legislation took effect on January 1, 2009 when eligible New Jersey employees began contributing .09% of their regular paycheck. To be eligible, an employee must have earned at least $7,200 or more during the 52 weeks immediately prior to the week an employee takes family leave.30 It is estimated that 38,000 New Jersey workers will take advantage of the law each year, at a cost of $98 million.31

- In April 2007, Washington became the second state to pass legislation assuring paid family leave for all parents to care for a newborn or newly adopted child.32 Though the implementation was supposed to begin in October 2009, it has been pushed back until 2012 because of funding problems and budget shortfalls.33

2. Guarantee paid sick leave for all workers.

Even though employees sick at work costs the national economy $180 billion annually in lost productivity,34 currently no state requires employers to give paid sick leave to their employees.35 With the spread of the H1N1 virus in 2009, the need for paid sick leave became even more apparent. A state could require that businesses over ten employees allow their employees to accrue an hour of paid sick leave for every 30 hours worked, for a maximum of five days. For businesses with fewer than ten employees, the maximum amount of sick days able to be accrued could be capped at three days.

Best Practices

- In San Francisco, California, voters passed a law in 2006 to allow workers to earn one hour of paid sick leave for every 30 hours worked. Workers in businesses with fewer than ten employees can earn a maximum of five paid sick days, while employees at businesses with less than ten employees would earn a maximum of three days.36

- In Washington, DC, the City Council in 2008 passed a law that requires businesses to allow employees to earn paid sick leave to take if they are sick, need to care for a child or family member who is sick or need to seek routine or preventative medical care. For businesses with less than 24 employees, workers can earn up to three paid sick days a year. For businesses with 24 to 99 employees, workers can earn up to five paid sick days a year. And at businesses with 100 or more employees, workers can earn up to seven sick days a year.37

3. Reward flexible work schedules.

Two out of three working parents say they don’t have enough time with their kids, and nearly two-thirds of married workers say they don’t have enough time with their spouses.38 Ninety-two percent of American workers feel they do not have enough flexibility in their schedules to take care of anticipated or unanticipated family demands, such as caring for a sick child or parent or attending school functions.39 But while as many as four in five workers say they’d like to have more flexibility at work,40 in 2004, only 28% of full-time workers actually had access to a flexible work schedule that allowed them to vary the time they began or ended their day.41

Employers are slowly recognizing that adopting these kinds of policies is good for business. For example, family-friendly work policies can help to recruit and retain top employees—a priority that has become increasingly important for new economy companies that rely on the unique talents of their workers to stay competitive. One survey, for example, found that 46% of companies that offer these policies say they do so in order to attract and keep talent.42 Telecommuting alone reduces turnover by 20% on average, boosts productivity up to 22%, and trims absenteeism by nearly 60%.43 And mothers working for bosses who offer flexibility are seven times less likely to quit than those who work under less flexible conditions.44 The accounting firm of Deloitte & Touche calculated savings of approximately $41.5 million in turnover-related costs in 2003 thanks to the firm’s flexibility programs.45

States could reward businesses that offer flexible work schedules or telecommuting to their employees through tax credits and other financial incentives.

Best Practices

- In 2007, Georgia became the first state to adopt a telecommuting tax credit. The Georgia Telework Tax Credit, a part of The Clean Air Campaign, gives employers up to $20,000 in tax credits for program set-up. An additional credit of up to $1,200 per new teleworker is also available. In the past two years, more than 130 Georgia businesses have qualified for the credit.46 Since 2004, the campaign has created almost 3,500 new teleworkers and helped more than 50 employers start or expand telework programs.47 In calendar year 2010, the telework tax credit is estimated to cost the state of Georgia $2.5 million.48

- The state of Virginia offers employers up to $35,000 in tax credits and reimbursements for the costs associated with setting up telecommuting for employees.49 Eligible costs include laptops and broadband for employees and remote connectivity infrastructure.

4. Create a State Task Force on Work/Family Balance.

Governors can appoint a task force consisting of business, labor, professional workers, and academics to seek out best practices to ensure both a vibrant workplace and family balance for employees. The goal would be to maximize economic productivity for business while relieving stress on parents. The task force could look at the best ways to incorporate off-site work, flexible hours, leave policies, and shared schedules.

5. Implement a three-fourths work day for state workers.

For some workers, full-time is too much and part-time too little. States could implement a 30-hour work week for employees who would work from 9AM to 3PM. Workers under this schedule could receive three-fourths of regular full-time pay and benefits, including health and pension. The program could be designed so that it adds no additional cost to the taxpayer.

6. Provide tax credits to businesses that ensure parity between part-time and full-time workers.

According to the Bureau of Labor Statistics, 22% of workers were employed part-time in 2008, including 30% of women,50 and because of the economic downturn, the number of workers who are involuntarily working part-time has increased with many workers having seen their hours cut.51 For many, working less than 40 hours a week means not having access to health and retirement benefits offered by employers. A study by the Center for American Progress found that only one in five married mothers who work part-time and only 3% of married fathers who work part-time had access to parity in benefits.52 The National Women’s Law Center has called for Congress to ensure that part-time workers are given parity with their full-time counterparts,53 and a state could encourage parity between full-time and part-time workers by providing tax credits to businesses that offer health benefits and retirement benefits to part-time workers. A business could require an employee to work a certain number of hours a week, and in return, the employee could receive benefits proportionate to the amount of time they worked.

7. Create a tax credit to encourage small businesses to pool their resources in order to provide child care services to their employees.

Convenient and quality child care is a must for most parents and having their child care centers close to their places of work is the ultimate convenience. Parents can visit their children during lunch or other breaks in the day, and they wouldn’t have to drive multiple places to drop off and pick up their children. But for a small business, setting up a child care center for their employees can be a costly expense. States could provide a tax credit to help small businesses pool their resources with other small businesses to create a child care facility available to the employees of all of the companies.

8. Create shared-leave funds for state employees.

Shared leave is a great way for employers to support employees and possibly prevent employees from quitting. The Society for Human Resource Management reported 21% of employers in 2005 offered shared leave whereby one worker can donate their sick-time to a co-worker in need.54 States could create shared-leave funds for their state employees to use, and states could also incentivize private businesses that do so.

Best Practices

- North Carolina allows its state employees to donate leave days to another eligible employee if the employee has a serious medical condition or if a member of the employee’s immediate family will need care for an extended period of time.55 Additionally, Washington56 and Kansas57 are examples of two other states that have shared-leave programs for their state employees.

9. Reward businesses that provide emergency child care for sick children.

Even relatively minor family obligations—such as having a child with a cold—can have big impacts for workers. Seventeen percent of workers report to work when ill, in order to save their sick days so they can stay home when their children are sick.58 Thirty-four percent of working parents report that caring for their sick children has led to difficulties at work, 12% say it has led to lost pay, and 13% report it has led to the loss of a promotion or a job.59

States can help employees manage the unanticipated events such as having a sick child by incentivizing businesses through tax credits to invest in “sick” child care centers or to reimburse workers for last-minute in-home care for a parent or child who is ill.

Best Practices

Companies such as Pfizer, DuPont, and AstraZeneca contract with a program called “Just in Time Care” that offers last-minute, back-up child care and elder care for their employees. Companies will subsidize part of the cost of the services, since emergency care tends to be much more expensive than regular care. Most companies subsidize 80% of the costs with the employees paying the other 20%. In 2008, more than 26,000 work days were saved because of employee use of “Just in Time Care.”60

Abbott Laboratories in Illinois and Fannie Mae offer their employees on-site emergency back-up care for their children. Fannie Mae awards employees 25 days each year where they can use the child care facilities in emergency cases.61

10. Encourage employees to bring their infants to work.

States could allow their workers to bring nursing infants to work and encourage other employers to do the same. Finding care for infants can be hard on new parents and may deter them from going back to the workplace. The Parenting in the Workplace Institute has structured babies-at-work programs in at least 125 organizations in over 30 states, encompassing more than 20 different types of businesses. These programs are great for employers since they enable employees to return to work earlier, improve retention, attract skilled employees, and help reduce health costs.62 Allowing infants up to the age of six months in the workplace, where appropriate, could make returning to work easier for new parents.

Best Practices

- In Kansas, 21 state agencies allow parents to bring their babies into the workplace. The employee must identify two co-workers who are willing to pitch in and help if the baby needs a back-up caregiver while at work.63

- In 2002, the Arizona Department of Health Services adopted a breastfeeding policy for its employees. New mothers returning to work at the department may be authorized to bring infants to work until the child is four months old. This period can be extended in one-month increments, depending on the employee’s job performance and the infant’s activity level. A designated breastfeeding coordinator informs employees of the policy and provides education and support to any employee expressing an interest in breastfeeding at work.64

- Hometown Quotes, an insurance company in Tennessee, established its “Babies in the Workplace” Program in 2008. Hometown Quotes worked closely with the Parenting in the Workplace Institute to implement the program meant to retain those employees who might have otherwise decided to leave the company. The company believes that the program will help parents to continue progressing in the workplace, give babies bonding time with their parents, and help Hometown Quotes to retain parents and reduce the expenses and time associated with training new employees as replacements.65

Helping families succeed and get ahead.

Governors can design policies to ease the challenges that families face in their day to day lives as well as help them to achieve success. Third Way proposes seven ideas to help families care for their children and their aging relatives.

1. Create a child care tax credit and allow pre-school and early education costs to be eligible uses of the credit.

States could establish a tax credit for child care expenses so that families can find some relief from large out-of-pocket expenses. If states already have a child care tax credit, states could make pre-school and early education costs, such as private pre-kindergarten, not just child care costs eligible for the tax credit. Currently 27 states offer either a tax credit or a tax deduction for the expenses incurred in child care.66

Best Practices

- The Louisiana House of Representatives introduced a bill in March 2009 that authorizes an income tax deduction for tuition for enrollment in certain early childhood development and enrichment activity classes.67

- The Dependent Care Expense Account (DCEA) in Minnesota allows parents to set aside pre-tax dollars to pay for pre-kindergarten/nursery school.68

2. Offer a voluntary state accreditation or rating program for child care excellence.

States have minimum requirements for child care programs, however, these often tell little about the quality of care provided. Research shows that children who attend top quality child care do better in school. One study showed that 66% of students who had access to quality child care between infancy and age 5 never repeated a grade versus 34% of their cohort. In the same study, 36% of those students who had received child care attended college versus 13% of their cohort.69 In order to provide parents with the knowledge and information to choose a safe, quality child care program, states could develop a voluntary state accreditation program for child care centers. The program would be voluntary and would not be related to state licensing requirements, but it would provide parents with information in order to make the best decision on where to place their child.

Best Practices

- Florida currently offers the Gold Seal Quality Care Program which is voluntary and designates centers that exceed the minimum child care licensing standards established by the Florida law. The benefits of the program include a sales tax exemption, an increased reimbursement rate for children participating in school readiness programs, and a positive marketing tool towards parents.70

- Washington created the Department of Early Learning in 2007 to develop an early childhood education plan for pre-school children in Washington.71 The Department licenses over 7,000 child care facilities in the state.72 Recently Governor Gregoire proposed the creation of an “All Start” preschool program to ensure that all preschools in the state operate under the same set of standards since preschools are not currently regulated by the state.73

3. Provide more after-school activities for adolescents.

Once a child is school age, the caregiving problems don’t end there. Less than a third of voters believe there are enough or more than enough after-school programs in their area, while a majority (55%) believes there are not enough.74 Parents of school-age children find it difficult to arrange child care for the hours when they are still expected to be at work, but their children’s schools are closed. As a result of these mismatched schedules, more than 60% of children (ages 5-14) with full-time working parents currently care for themselves after school.75

Most after-school care focuses on children and pre-adolescents but after-school programs are important for teenagers too. In fact, only 15% of school children grades kindergarten to 12th, or 8.4 million, participate in after-school programs.76 If quality after-school programs were available in every community, an additional 18.5 million school students could participate.77 Adolescents who are unsupervised at home are more likely to engage in problem behaviors than those who are supervised at home.78 More than 14 million students grades 6th through 12th care for themselves after school every day.79 Many parents cannot take off of work early to supervise their teenagers nor can they find quality after-school programs to send their teenagers to. To relieve parents’ stress during after-school hours and help teenagers be productive and stay out of trouble, states could provide grant funding to local education agencies that create afterschool activities for adolescents.

Best Practices

- New York supports Advantage After-School Programs which provide services to school-aged children, including teenagers. These programs are designed to improve the social, emotional, academic and vocational competencies of the participants as well as reduce negative behaviors such as violence, tobacco use, teen pregnancies, school suspension, and truancy.80

- The Adolescent Health and Youth Development (AHYD) of Georgia provides a network of community-based support to help adolescents succeed. AHYD targets youth aged 10-19 and in 2006, provided services to over 63,000 youth in the state. Teens can take advantages of programs such as After-School Tutoring, After-School Enrichment Programs, Karate Outreach Program, Health Education Information, and Peer Educators.81

4. Create an elder care tax credit for caregiving expenses.

Many people in the sandwich generation are facing the need to care for an elderly parent or relative that does not live in their house and is not their dependent. Fewer than half of caregivers live with the person they’re caring for, and 10% live more than an hour away.82 A 2006 study published by MetLife Inc. found that 15% of people caring for an older adult quit their jobs and 39% took early retirement. The estimated cost to employers for workers engaged in caregiving was $33.6 billion in 2006 between unpaid leave and absenteeism.83 A state could create an elder care tax credit to help individuals and families pay for qualified elder care expenses for someone who does not live in their home. If a state already has an elder care tax credit, eligibility for the credit could be expanded to include non-dependent parents or grandparents.

5. Provide state tax credits to help people age in place.

Many elderly individuals prefer to live with loved ones or in their own home rather than moving to an assisted living facility or a nursing home. But in order to remain at home, some high-cost modifications need to be made. As a result, less than half of homes with disabled elderly people have been modified to make it easier for the individual to live in.84 It is estimated that, on average, home modifications cost $2,000 per household.85 A state tax credit or deduction could defray the modification costs and encourage families to do the construction right.

Best Practices

- In 2007, Hawaii passed a bill that established an income tax credit for individuals and couples who make modifications to their home to increase accommodations for aging parents and those with disabilities.86

6. Create a state registry of qualified elder care workers.

For most people, finding a qualified and trustworthy person to care for an aging parent relies on a lot of guesswork. States could create an online registry of home care aides so that individuals and families have an easier time finding a qualified worker to help care for their loved ones. The registry can include previous employment information, training information, and background check information. The state can also develop a better certification and background check process so that families know that individuals in the registry have the basic skills to be a caregiver.

Best Practices

- Recently, the Governor of New York signed into law a bill that creates central registry of home health and personal care aides. The registry lists the names and contact information of the aides along with background information, employment history, and training information.87 Illinois, Oregon, and Washington also have variations of home care worker registries.

- Minnesota’s Department of Health has created a Health Care Facility and Provider Database where people can access the directory of licensed and certified health care providers. The database includes addresses, phone numbers, administrator names, state registration or licensure status and federal certification classifications. Provider types included in the directory are boarding care homes, home health agencies, home care providers, hospices, hospitals, housing with services, nursing homes and supervised living facilities. Non-long term care providers are also included.8889

- The Florida legislature has proposed a new law that will require uniform nationwide background checks for all caregivers before they are allowed to begin work. Under the current law, caregivers must be rescreened every five years, but State Representative Ari Porth has argued for reducing the period to three years and the inclusion of unannounced inspections of care providers receiving federal money.90

- Missouri passed Proposition B in 2008, with over 75% of the vote, which created the Missouri Quality Homecare Council. This Council works to ensure that the home care services that Medicaid recipients receive are quality by improving the recruiting and training of the home care workers and reducing turnover. This enables the elderly and state residents with disabilities to continue living in their own homes. Cost is estimated at half a million dollars annually.91

- With almost 74% of the vote, Washington passed Initiative 1029, Long-Term Care Service for the Elderly and Persons with Disabilities. The initiative requires that all long-term care workers for the elderly or disabled hired after January 1, 2010 be certified by the State Department of Health as a “home care aide” within 150 days of being hired. Other requirements to satisfy training approved by the state Department of Social and Health Services must also be completed within 120 days of employment. Washington will no longer pay for long-term care services for providers who do not comply with the initiative and will also terminate any contracts with those providers.92

7. Appoint a cabinet-level position for volunteer service and create a “Summer of Family Service.”

Many Americans want to volunteer in their communities but don’t know where to start to find volunteer opportunities. With myriad volunteer options available, many interested individuals find the search for a good fit to be daunting and get easily discouraged. Governors can appoint a cabinet-level position to encourage volunteer service by the citizens of the state and help to match interested individuals with volunteer opportunities. The volunteer service cabinet member could coordinate volunteer opportunities throughout the state as well as ensure that during natural disasters, volunteers are matched with the needs of communities.

Additionally, governors and volunteer service cabinet members could initiate a “Summer of Family Service.” Even though volunteering can help families spend more time with one another while serving the community, many families who want to volunteer find it difficult to locate kid-friendly service opportunities. A “Summer of Family Service” can help families spend more time together, complete tasks that will benefit the community, and instill the importance of volunteerism in our youth.

Best Practices

- In California in 2008, Governor Schwarzenegger appointed the first-in-the-nation cabinet position in charge of service and volunteering. The Secretary of Service and Volunteering is responsible for improving coordination of volunteer activities around the state and helping to facilitate volunteer groups in case of an emergency or natural disaster. A website, www.californiavolunteers.org, was also created to help match potential volunteers with service areas.93

- Shortly after California’s appointment, Governor Paterson of New York created a cabinet-level position to address issues related to national and community service. Like California, New York has a website, www.newyorkersvolunteer.org, to match interested citizens with volunteer opportunities.94