Memo Published July 3, 2025 · 6 minute read

Summer 2025 Update: Tracking the Growth of the EV Industry in the US

Alexander Laska & Ellen Hughes-Cromwick

In October 2021, we mapped the manufacturing footprint of the EV industry to show its growth from a fledgling industry into a true economic engine. Since then, EV and battery manufacturing in the US has taken off like a rocket. Policy support through the Bipartisan Infrastructure Law (BIL) and Inflation Reduction Act (IRA) helped us get to this point. In combination with private sector breakthroughs that have brought down costs, federal policy has given automakers and their suppliers greater confidence to invest in new and expanded facilities to produce EVs and everything that goes into them.

What does that progress look like? Here's what’s happened since October 2021:

- The number of jobs directly supported by the EV industry has doubled from 125,000 across 40 assembly plants to nearly 250,000 jobs at 63 plants. Each manufacturing job at these plants helps to foster as many as nine more jobs in these communities.

- Automakers have announced 15 new EV plants since 2021. Of those, a dozen are for battery production, creating tens of thousands of jobs and onshoring part of a supply chain otherwise controlled by China.

- There are hundreds of new EV suppliers making batteries, e-motors, inverters, and other components. The EV supply chain is present in 44 states and the District of Columbia, supporting jobs in every region of the country.

Below, we’ve included two maps visualizing the sheer magnitude of the EV industry and its supply base. These maps show that EV manufacturing is anything but a niche industry: it is a driver of jobs and economic growth in every part of the country. But policies being pushed by Republicans to raise the cost of EVs and eliminate support for the facilities that manufacture these vehicles and their components, including through their now-passed reconciliation bill, risks stunting the growth of this impressive domestic industry, and will likely put existing jobs and investments at risk.

Mapping the EV industry

The first map shows all light-duty vehicle assembly and parts plants owned by auto companies, both for EVs and gas-powered vehicles, along with information about which vehicles are produced where and how many people are employed at each factory. The dot colors provide a quick way to tell whether the plant produces EVs, internal combustion engine vehicles (ICEs), or both.1

What’s new: Back in 2021, there were 40 plants producing EVs across 15 states. Twenty-seven of these only produced EVs, while the remaining 13 produced both EVs and non-EVs. Fast forward four years later, and there are now 63 plants producing EVs across 17 states, 47 of which only produce EVs or EV parts like battery cells. The industry has expanded into three new states, with Korean automakers Hyundai and Kia beginning production in Georgia and US startup Rivian announcing a facility there; GM retooling its Fairfax Assembly Plant in Kansas to produce the new Chevrolet Bolt EV; and Nissan shifting its Canton, Mississippi plant to produce EVs.

In addition to new facilities, OEMs are also expanding existing plants to produce EVs for the first time. These include Honda in Marysville, Ohio and Toyota in Georgetown, Kentucky. We’re also seeing new entrants, such as Volkswagen-supported Scout Motors building an assembly plant in Blythewood, South Carolina and Bezos-backed EV startup Slate in Warsaw, Indiana.

We’ve seen a doubling of jobs in facilities that produce EVs, growing from roughly 125,000 jobs in 2021 to nearly 250,000 in 2025.2 Auto assembly has the largest job multiplier of any manufacturing industry, meaning that in addition to the occupations in these plants, the EV industry is creating hundreds of thousands more across the economy.

Perhaps the biggest success story over the past four years is in battery manufacturing. Thanks in large part to policies in the bipartisan infrastructure law and the Inflation Reduction Act to support domestic battery production, we have seen tremendous growth in this industry. Today, there are 56 plants producing batteries for the EV industry. Thirty-five of these are owned wholly or in part by automakers, while the remaining 21 are owned by suppliers (those are included in the second map). These plants directly support well over 140,000 jobs.3

In the map below, you’ll see the OEM-owned battery facilities, including several that have been announced since 2021. These include Toyota Battery Manufacturing North Carolina, slated to begin production in 2025; BMW’s new battery facility under construction in Woodruff, South Carolina; Hyundai’s forthcoming battery factory with SK in Bartow, Georgia; and BlueOval battery facilities in Glendale, Kentucky and Stanton, Tennessee to be operated by Ford and SK.

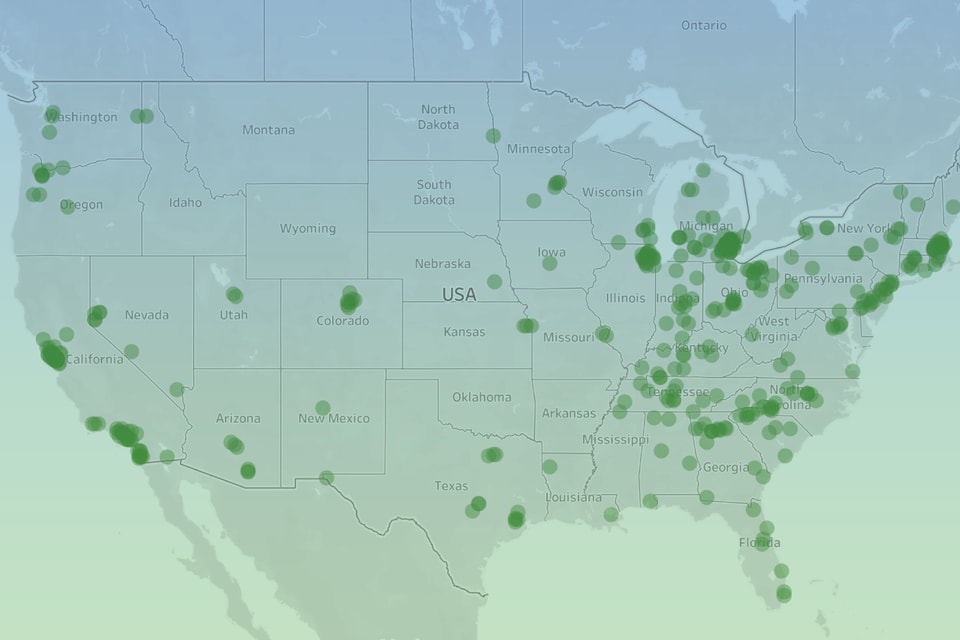

But this map only tells half the story. The second map displays the location of independent suppliers that sell EV parts to automakers. This includes everything from electric drive motors and powertrain systems to batteries and battery components.4 This is a crucial part of the manufacturing ecosystem, and one that it is critical we continue to onshore so we can reduce our reliance on China for these parts and so that Americans can reap the economic benefits of growing consumer interest in EVs.

What’s new: With 429 facilities making parts for EVs in 43 states and the District of Columbia, the EV industry is now benefiting every region in the country. Growing interest in EVs, coupled with the onshoring of EV and battery manufacturing driven by tax incentives with content sourcing requirements, has caused a surge in demand for American-made parts. Of note, American Battery Solutions is producing lithium-ion batteries in Springboro, Ohio; Albermarle is planning to reopen a lithium mine in Kings Mountain, North Carolina; and Diamond Electric is now producing thermal management system parts for EVs at its facility in Eleanor, West Virginia.

Unfortunately, due to data limitations this map does not list the specific products made at each facility, nor does it show the number of jobs supported at each.

Conclusion: Progress at Risk

The EV industry, supported by tax incentives and other policies in the IRA and BIL, has grown to support hundreds of thousands of jobs across the country. We have also seen a rapid onshoring of the EV supply chain, with hundreds of facilities now producing batteries, e-motors and other parts here in the US. This growth has not only created jobs and economic opportunity for communities, it has also made our auto industry more competitive in the global marketplace. Eliminating the very policies that are driving this progress risks slashing jobs, making cars more expensive, and increasing our reliance on foreign competitors like China. The reconciliation bill now passed by Congressional Republicans could very well make it harder to maintain the EV industry as an American manufacturing and jobs success story.