Blog Published July 9, 2020 · 7 minute read

Innovation Sparks Advances Toward a Clean Energy Future

Ray Rothrock, Ellen Hughes-Cromwick, & Farah Benahmed

At every turn, we see the way new ideas and technologies are growing in all parts of the country and in our lives. We’re now witnessing new, large-scale investment initiatives turning toward clean energy, helping build momentum to get the United States on the fastest, fairest path to net-zero CO2 emissions by 2050.

Potential of Venture Capital for Clean Energy

PRIME Impact Fund recently announced a $50 million round of fundraising to invest in early-stage “breakthrough climate technologies,” including energy storage, industrial decarbonization, and energy efficiency. Amazon just announced a $2 billion fund, managed internally, to invest in technology and industries that are targeting decarbonization. Called the Climate Pledge Fund, they will invest in transportation and logistics; energy generation, storage and utilization; manufacturing and materials; circular economy; and food and agriculture, with an overarching goal of reaching net-zero carbon emissions by 2040.

Professional venture capital (VC) has long played a critical role in accelerating innovation. What was traditionally wealthy family money from the Rockefellers, Whitneys, or Bessemers, has evolved to a sophisticated investment category of over 1,000 VC firms deploying about $100 billion a year in new company investments. VC’s founding was based on the philosophy of providing precious capital to great entrepreneurs with world-changing ideas for solutions against big problems.

The number of successful companies spawned from these ideas is staggering. VC-backed companies represent a record of success. Recent research data by Stanford Graduate School of Business1shows that 43% of today’s public companies were originally venture-backed. And these companies represent 57% of the public market capitalization and represent 38% of all employees at public companies. Most importantly, these companies represent 82% of all the corporate R&D. While there is always risk in investment, there is tremendous leverage in backing entrepreneurs with great ideas.

More and more, investors are understanding both the urgency and opportunities that come with a clean energy transition. While this is encouraging, clean energy investments are still too minimal to meet the needs of the climate crisis. Accelerating this pace could be enabled by federal policies that establish or scale up the commercialization of clean energy technology and entrepreneurship programs. Programs focused on building public-partnerships, creating jobs, sharing expertise, and leveraging private investment can help unleash a wave of capital toward clean energy.

With the demand for innovative solutions to combat climate change, scores of clean energy startups such as advanced nuclear companies Oklo and TAE Technology are pursuing innovative ways to make electricity without carbon. But there is much more invention we don’t yet know about as dedicated entrepreneurs work on their early-stage technologies to eventually reach global net-zero emissions. Entrepreneurs know the challenge. Organizations with the capital like those backing PRIME are paying attention and beginning to take action.

Emerging investment trends in the clean transportation industry that are worth your attention:

- Nikola, a startup developing an electric heavy-duty truck, has a stock market valuation of nearly $24 billion as of June 18th – just shy of Ford’s valuation of $25.2 billion. To put things in perspective, Nikola will make its first E-truck next year, while Ford has over 65 plants worldwide and sold over 5 million vehicles last year.

- In this recent Bloomberg article, the CEO of Volta Energy Technologies claimed, “The train’s left the station on both renewable power generation and electric vehicles, and no one is going to put that train in reverse.” Jeff Chamberlain led the energy storage research at Argonne National Laboratory which has been instrumental in the technology transfer of batteries that enabled the ramp to EVs for the auto industry.

- Chinese company CATL is working on breakthroughs to invent the first 1-million-mile battery.

- Rivian, an electric vehicle startup with capital infusions from Ford, Amazon, T. Rowe Price (yes, a mutual fund company), and BlackRock (an institutional investment management firm), is set to launch an electric pickup truck in early 2021.

Private Capital Shifting Away from Oil

While new private investment is flowing toward clean energy innovation, there is an evaporation of capital support for fossil fuels. Investors look at the long-term trends for oil and are concluding that the returns are dwindling. Already oil investing is getting hit – labeled as the new tobacco and theorized to be entering the “death knell phase.” The risks of climate change and the actions needed to mitigate it are shifting investors’ appetite for fossil fuel bets.

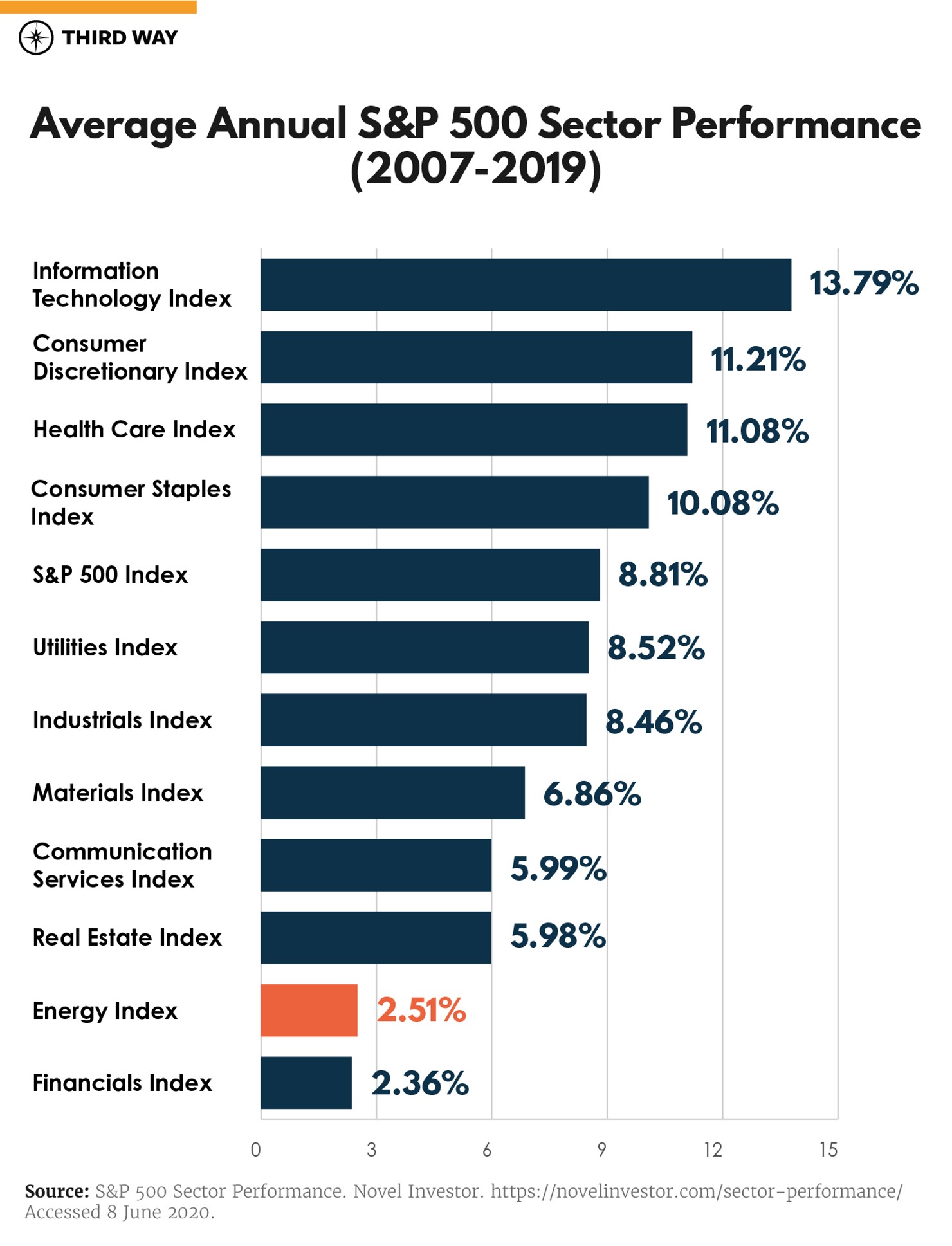

Since 2007, the S&P 500 energy sector, comprised of 26 oil and gas-related company stocks, was at the bottom in terms of returns. On top of this poor performance, this index is down 39% in the 12 months ending July 6, 2020.

Oil and gas companies are becoming shut out of the capital markets and many firms are going bankrupt. In Texas, job losses mount and bankruptcies are on the rise. In a last-ditch effort, big oil companies like BP and Shell, are publicly committing to net-zero emissions by 2050.

These companies have begun by putting capital in clean energy technologies like charging infrastructure and batteries. The trend is massive. With the global industrial capabilities and tremendous balance sheets, the oil industry leaders can and should change the status quo and play a big role in the energy market. Whether they’re making serious, long-term commitments or PR moves to win back favor remains to be seen.

It is possible that struggling oil companies could sell their bonds directly to the Federal Reserve. The Federal Reserve (Fed) recently launched two facilities and began buying individual corporate bonds to provide companies with financial relief. These facilities could provide oxygen to fossil fuel companies that were running thin on cash, but the funds are more likely be used to pay down a mountain of debt than for further investment. In fact, the Institute for Energy Economics and Financial Analysis estimates that, as of early 2020, the US oil and gas industry has over $700 billion of debt on their corporate balance sheets.

Above all, it is important to ensure that oil and gas workers losing jobs are supported financially and given new clean energy opportunities for their marketable skill sets. But why plow money into fossil fuel companies that are pursuing a value proposition that, over time, will be of no value anymore? Not to mention, if these companies had to pay for their climate damages or made the climate risks of their activities transparent (consistent with the guidelines laid out by the Task Force for Climate-Related Financial Disclosure), their financial conditions would be far worse.

Bottom Line: Investment Trends Fit Squarely at the Intersection of Climate and the Fastest Path to Net-Zero Emissions

Frontier capital – from venture capital firms to established companies investing in clean energy technologies – is sitting at the cusp of a big wave. One that will play a significant role in the vitally important transition to completely lowering CO2 emissions. At the same time, fossil fuel investment trends are responding to the low returns outlook for the industry. Equity market investors are shortening up their holdings of oil and gas companies’ stocks and the sector’s performance is one of the worst on record during the last decade. With a huge debt burden, oil and gas companies are an investment that has reached its “sell by” date. Recent announcements like the PRIME Impact Fund and Amazon’s Climate Pledge Fund are just a few examples of private capital beginning the march toward a clean energy future. As is often said in VC, a little capital in the hands of the right entrepreneur goes a long way. In our case, toward a better, cleaner future.