Report Published March 28, 2014 · Updated March 28, 2014 · 14 minute read

A Tale of Three Cities: How Similar Taxpayers Pay Drastically Different Taxes

David Brown

Consider two mechanics alike in almost every respect. They work equivalent jobs and the same hours. They are also identical as consumers—they live in identical three-bedroom homes, drive the same Ford F-150, buy the same groceries, and put away the same amount into savings. As a result, the two mechanics theoretically have the same ability to pay taxes. But under the U.S. tax code, one may owe thousands in federal income taxes, while the other gets a refund worth thousands.

How can that be? These mechanics have one critical difference—the city in which they live. A mechanic in a low-cost, low-wage city qualifies for certain valuable tax credits, but the mechanic in a high-cost, high-wage city does not. In this report, we demonstrate how middle-class families are subject to price and wage differences in three U.S. cities. We then show how differently these families are treated by the U.S. tax code.

The Tax Code’s Top Six Cost-of-Living Disparities

Earned Income Tax Credit (EITC): Subsidizes wages for working families earning up to $43,000. Its phase-out makes it less beneficial to taxpayers in high-cost cities.

Childcare Credit: Offsets childcare expenses for all families but at higher rates for those earning less than $43,000. That threshold means more families in low-cost cities receive higher rates.

Saver’s Credit: Subsidizes retirement savings for low- to middle-income families. The phase out ends at $59,000, making the credit less accessible in high-cost cities.

Child tax credit: Provides a $1,000 per-child credit for families at most income levels. The flat, nominal amount is of greater relative benefit to families in low-cost cities.

Free File: Allows taxpayers with income up to $58,000 to e-file their returns for free. The flat, nominal cap means fewer taxpayers benefit in high-cost cities.

Alternative Minimum Tax (AMT): Raises tax rates for some upper-middle class families in high-cost cities, although its original purpose was to limit tax benefits for the wealthy.

In Hicksville, New York, workers pay more for everything from apartment rent to a box of Cheerios. Businesses account for these differences by paying higher wages in higher cost-of-living areas. But does the government account for price differences?

The federal tax code—not to mention numerous other federal programs—is full of means-tested provisions that fail to account for regional differences in cost of living. The result is that when two workers who have the same ability to pay—but who live in different places—sit down to do their taxes, the one living in South Texas may qualify for a variety of means-tested family credits, while his Long Island counterpart does not.

In this paper, we present a case study to illustrate and explain how middle-class families are affected by price and wage differences in three representative local economies: high-price, high-wage Nassau County, New York; medium-price, medium-wage Akron, Ohio; and low-price, low-wage McAllen, Texas. We then show the vastly different treatment the U.S. tax code gives families across regions, whether they’re working class or upper-middle class.

In the early stages of tax reform, policymakers have engaged in plenty of discussion on how businesses are treated under the tax code. As they move forward, policymakers may also consider how the tax code treats individuals across regions and whether the code should be amended so that policies designed for the working and middle classes are truly helping their intended beneficiaries.

Many Costs of Living

Wages and prices vary significantly across regions in the United States. To illustrate how much, we will explore the budgets of six hypothetical, but representative, families in three U.S. cities.

The first city, McAllen, Texas, is one of many low-wage, low-cost cities found in the Southern and Southwestern states. Located in the Rio Grande Valley near the U.S.-Mexico border, McAllen’s rapidly growing metropolitan area is home to 800,000. Similarly sized Akron, the second city, is located in Ohio’s industrial northeast. Akron has an area population of 700,000 and typifies the average-wage, average-price cities found across the Midwest. The third city is more accurately described as a large suburb. Nassau County lies directly east of New York City on Long Island and is home to 1.3 million. While less expensive than the city itself, Nassau County has the high prices and high wages common to urban areas on the East and West coasts.

In each city we assess two families: a working-class family and an upper-middle-class family. In McAllen, Akron, and Nassau County, the working-class family is headed by two parents: one working as a nurse’s assistant and the other as a security guard. They earn the median wage for their professions in their city and have two children.

The upper-middle-class families are also two-parent, two-child households. One parent is a sales manager and the other a mechanical engineer. Again, the workers earn the median wage for their professions in their city. These families are doing well in each of their respective economies. Whether or not these families are middle class is a question some would debate. The purpose in this example, however, is not to define the limit of the middle class. Rather, it is to assess how the tax code treats similarly situated, two-earner professional families living in different cities.

Wage Differences Across Cities: Median Salaries for Select Occupations and Representative Families1

Nassau County | Akron | McAllen | |

Working Class Family Income | |||

Nurse’s Assistant | $35,080 | $22,520 | $19,080 |

Security Guard | $27,730 | $22,940 | $20,670 |

Total Income | $62,810 | $45,460 | $39,750 |

Upper-Middle Class Family Income | |||

Sales Manager | $142,680 | $99,000 | $89,270 |

Mechanical Engineer | $97,230 | $69,830 | $54,670 |

Total Income | $239,910 | $168,830 | $143,940 |

Whether families are working class, upper-middle class, or something else, they face substantially different wages in McAllen, Akron, and Nassau County. But those wage differences reflect similar differences in the prices of goods and services in each city. Consider the biggest cost almost any family faces: housing. In McAllen, a working class family can expect to pay $1,041 a month in rent for a three bedroom house. In Akron, the cost would be $1,104, and in Nassau County it would be $2,493.2

Take the upper-middle-class families. Let’s say each owns a four-bedroom home purchased ten years ago. The McAllen family likely paid $122,500 for that home, whereas the Akron family paid $217,500 and the Nassau County family $615,000.3

With respect to other goods and services, prices don’t always vary as much as they do with housing, but they do vary. A loaf of bread costs $1.29 in McAllen, $1.36 in Akron and $1.79 in Nassau County. A gallon of gas costs $3.36 in McAllen, $3.54 in Akron, and $3.85 in Nassau County.

Below we look at how typical expenses vary from region to region.

Representative Prices Across Cities: Average Prices of Selected Consumer Goods and Services4

Nassau County | Akron | McAllen | |

Food and Groceries | |||

One pound of ground beef | $3.85 | $3.62 | $3.24 |

Half gallon of milk | $2.40 | $2.16 | $2.59 |

One dozen eggs | $2.45 | $1.65 | $1.77 |

One pound of bananas | $0.70 | $0.60 | $0.48 |

Loaf of bread | $1.79 | $1.36 | $1.29 |

Orange juice | $3.77 | $3.52 | $3.13 |

Cereal | $4.23 | $3.83 | $2.66 |

McDonalds Quarter-Pounder with Cheese5 | $4.69 | $3.79 | $3.70 |

Energy | |||

Home energy bill | $212.94 | $171.98 | $175.85 |

Gallon of gas | $3.85 | $3.54 | $3.36 |

Health | |||

Doctor visits | $98.11 | $93.30 | $73.33 |

Dentist | $98.12 | $72.25 | $72.17 |

Ibuprofen | $10.18 | $11.19 | $8.31 |

Lipitor | $213.03 | $193.84 | $195.84 |

Services | |||

Hair cut | $12.93 | $14.10 | $9.30 |

Tires balanced | $10.95 | $12.89 | $8.63 |

Dry cleaners | $10.70 | $12.78 | $8.33 |

Babysitter (per hour)6 | $13.25 | $10.00 | $9.75 |

Auto insurance (annual premium)7 | $1,253 | $991 | $1,428 |

Home | |||

Monthly Rent | $2,493 | $1,104 | $1,041 |

Monthly mortgage | $1,581 | $456 | $353 |

Monthly property taxes9 | $618 | $178 | $160 |

Monthly homeowners insurance10 | $77 | $88 | $247 |

What do all these price differences add up to? Economists at the Council for Community and Economic Research have developed a cost-of-living index for U.S. cities. The index shows that a typical working-class family in Nassau County faces prices 34% higher than the U.S. average. A McAllen family faces prices 12% below the U.S. average. And an Akron family faces prices equal to the U.S. average. Prices faced by an upper-middle-class family reveal similar differences. In Nassau County, prices are 34% higher than the U.S. average; in McAllen, they are 14% below average; and in Akron, they are 2% above average.*

These relative cost-of-living statistics, for working class families are from C2ER data and are based on a basket of goods typical for family in the second income quintile. For upper-middle class families, the basket of goods is typical for executive and professional households in the top income quintile.

So do people in McAllen, Akron and Long Island earn wages that reflect the cost of living in their cities? For the most part, they do. Start with Akron, the city with an average cost of living. There, the median-earning nurse’s assistant makes $22,520, and the median-earning security guard makes $22,940. Together the couple makes $45,460. The equivalent McAllen family makes $39,750 (13% less) and the equivalent Nassau County family makes $62,810 (38% more).

In this example, the wage premium that the Long Island workers receive compensates them for the higher cost of living, relative to their McAllen and Akron counterparts. Of course, this wouldn’t be the case for all occupations and locations. Some cities may have a labor shortage in certain skills, causing workers who possess them to earn more and enjoy a higher quality of life than similarly skilled workers in other areas.

Our example also does not consider the preferences some workers may have for living in some cities over others. If you love warm weather and Tex-Mex or want to live near family, you might be willing to make less—even after adjusting for cost of living—to be in a place like McAllen. Some localities may provide better public goods, such as more accessible public transportation or less pollution. Some of these discrepancies, but not all, are reflected in the levels of state and local taxes: to some extent, workers who get more services pay for them through higher taxes.

These caveats aside, the labor market—particularly in the private sector— does a pretty good job of reflecting, through wages, the price levels in various regions. Our examples illustrate this point: that people doing the same work in different cities tend to face prices commensurate with their wages. As a result, they have roughly the same ability to pay federal taxes. But, the tax code is far from uniform in how these families are treated.

One-Size Tax Code

Most parameters in the federal tax code that affect working class families are set at fixed dollar amounts, regardless of regional differences in cost of living. For example, a married couple with two kids, filing jointly, can claim the Earned-Income Tax Credit (EITC) if the earners make less than $43,000, no matter where they live. Similarly, the Saver’s Credit is available for those earning less than $59,000.

Our three families illustrate just how much these parameters matter. The working-class McAllen family is eligible for five popular tax preferences:

- EITC: a refundable credit for low-to moderate-income worker; up to $5,372 is available to a married couple with two dependent children earning less than $43,038 a year.

- Childcare credit: a credit that can be claimed for up to $3,000 spent on care for one dependent 12 or younger or $6,000 for two or more. For families with income less than $15,000, the credit is worth 35% of the expenses, and the rate phases down to 20% for families with income over $43,000.

- Saver’s Credit: a credit of up to $2,000, for contributions made to an individual retirement account (IRA) available to a couple married filing jointly with income up to $59,000.

- Child tax credit: For each child under the age of 17, families receive a credit of $1,000. The credit is limited for jointly filing couples earning more than $110,000 and singly filing parents earning more than $75,000.

- Free File: an IRS service that allows taxpayers earning less than $58,000 a year to prepare and e-file their federal tax returns for free.

Largely as a result of these rules, the South Texas family receives a net gain of $3,289 on its federal income taxes. The working class Akron family is eligible for some, but not all, of the means-tested benefits available to the working class McAllen family. As a result, it nets $1,458 from the federal government. The working class Nassau County family misses out on some of the targeted low-income tax credits, such as the EITC and the Saver’s Credit. In the end, it owes a total of $1,511 in federal income taxes.

Tax Disparities Facing Working-Class Families: A Representative Tax Bill for a Security Guard and Nurse’s Assistant, Married Filing Jointly11

Nassau County | Akron | McAllen | |

Income | $62,810 | $45,460 | $39,750 |

401K contributions | $3,141 | $2,273 | $1,988 |

AGI | $59,670 | $43,187 | $37,763 |

Standard deduction | $12,200 | $12,200 | $12,200 |

Exemptions | $15,600 | $15,600 | $15,600 |

Taxable Income | $31,869 | $15,387 | $9,963 |

Regular tax | $3,888 | $1,539 | $996 |

EITC | $0 | $611 | $1,812 |

Childcare credit | $377 | $273 | $274 |

Saver’s Credit | $0 | $114 | $199 |

Child tax credit | $2,000 | $2,000 | $2,000 |

Federal income tax owed | $1,511 | -$1,458 | -$3,289 |

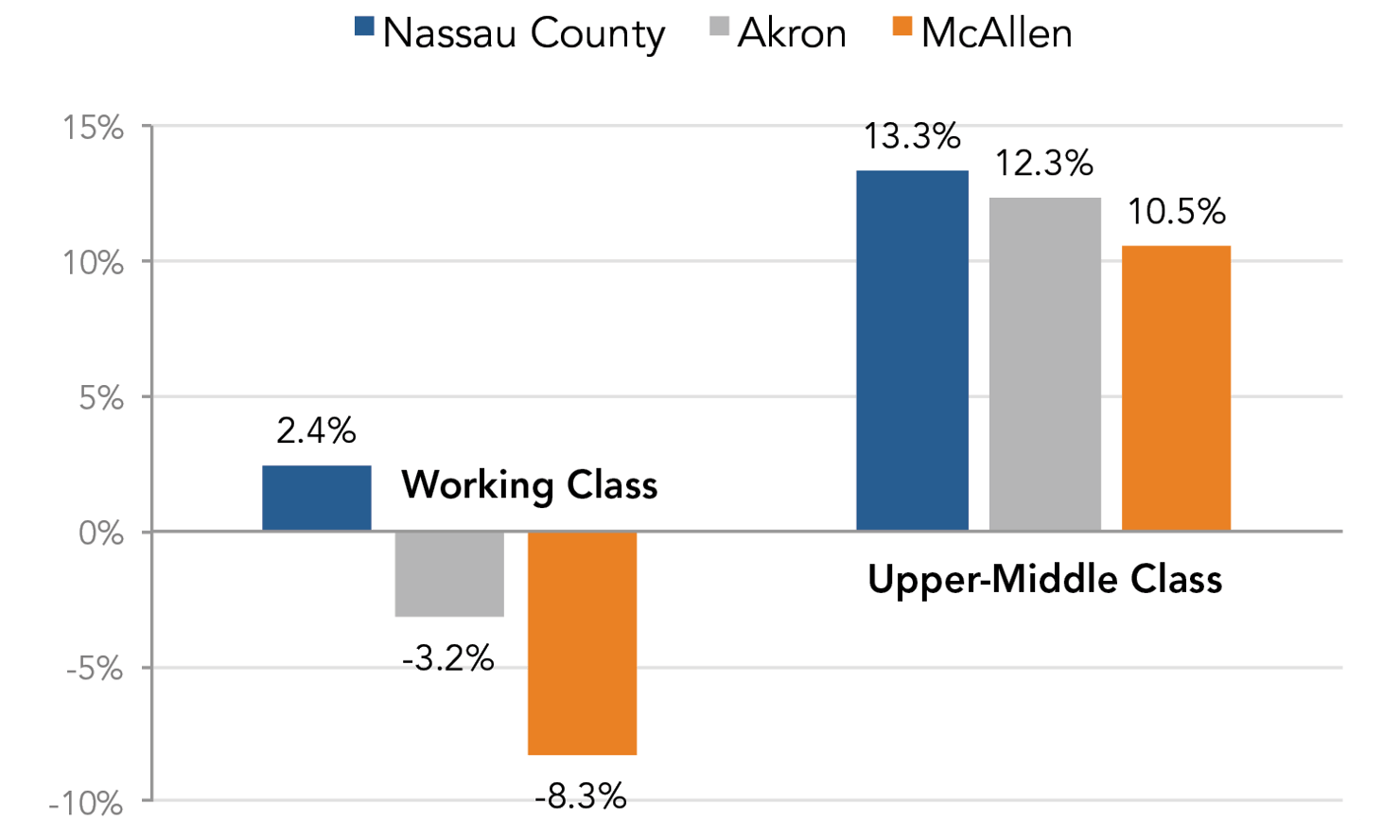

Effective tax rate | 2.4% | -3.2% | -8.3% |

Free File | No | Yes | Yes |

Disparities are also evident in the taxes faced by upper-middle-class families. In the case of the families of managers and engineers, unequal tax treatment results largely from the Child Tax Credit and the Alternative Minimum Tax (AMT). The upper-middle-class McAllen family has income low enough to qualify for a reduced Child Tax Credit of $1,000, whereas the other families do not qualify for the credit at all.

The upper-middle-class Nassau County family lands in a higher tax bracket than the upper-middle-class families in Akron and McAllen, but the higher marginal rates are partly offset by the ability to itemize deductions. The upper-middle-class Nassau family pays significantly higher property and state income taxes, and it pays more in mortgage interest. In the end, however, only the upper-middle-class Nassau family is hit by the AMT. That adds $2,094 to its tax bill, causing it to face an effective tax rate of 13.3%, while the upper-middle-class Akron family pays 12.3% and the upper-middle-class McAllen family 10.5%.

Tax Disparities Facing Upper-Middle-Class Families:A Representative Tax Bill for a Sales Manageand Mechanical Engineer, Married Filing Jointly12

Nassau County | Akron | McAllen | |

Income | 239,910 | 168,830 | 143,940 |

401K contributions | 23,991 | 16,883 | 14,394 |

AGI | 215,919 | 151,947 | 129,546 |

Property tax | 12,350 | 3,563 | 3,190 |

State income tax | 13,009 | 7,016 | 1,836 |

Mortgage interest | 18,472 | 5,328 | 4,121 |

Exemptions | 15,600 | 15,600 | 15,600 |

Taxable income | 156,488 | 120,441 | 101,746* |

Regular tax | 31,282 | 21,968 | 17,294 |

AMT | 1,877 | 0 | 0 |

Tax before credits | 33,159 | 21,968 | 17,294 |

Childcare Credit | 1,200 | 1,200 | 1,200 |

Child Tax Credit | 0 | 0 | 1,000 |

Federal income tax owed | 31,959 | 20,768 | 15,094 |

Effective tax rate | 13.3% | 12.3% | 10.5% |

The McAllen family takes the standard deduction of $12,200.

Effective Federal Income Tax Rates: Representative Families Across Three Cities

Conclusion

Prices and wages vary considerably across U.S. cities. While the labor market mostly compensates workers for the prices they face, the U.S. tax code largely does not. As a result, a working-class family in an expensive area like Nassau County can end up owing thousands on its federal tax return, while an almost identical family in a low-cost city like McAllen gets thousands in return. Similarly situated working-class families, which work the same jobs and buy the same goods and services, can end up owing $1,511 in federal income taxes in Long Island, but get a refund of $3,289 in South Texas. Higher up the income scale, a Long Island family can be hit with AMT, paying a 13.3% average federal income tax rate, while its South Texas counterpart pays no AMT, claims the Child Tax Credit, and gets an average rate of 10.5%.

The tax code is not the only area in which federal means-tested programs fail to account for cost-of-living disparities. That is largely because many means-tested programs are based on the Federal Poverty Line, which does not account for cost-of-living disparities. Such programs include:

Supplemental Security Income: SSI provides monthly cash assistance to people who are blind, disabled, or elderly and have little income and few assets. Unlike many federal means-tested programs, SSI has a uniform federal eligibility formula, which does not account for cost-of-living disparities.13

Supplemental Nutrition Assistance Program: SNAP, formerly known as the Food Stamp Program, provides vouchers for food purchases to low-income Americans. SNAP eligibility rules are largely uniform across the states. To be eligible, a three-person household must have annual income below about $24,800 a year.14

National School Lunch Program: NSLP provides free and reduced meals to children of eligible families attending public or nonprofit private schools. To receive free meals, for example, a family of four—in almost any location—must have annual income less than $30,615.15

All of these programs should be evaluated, and a good place to examine cost-of-living disparities would be the tax reform effort already underway in both the House and Senate. Just as policymakers work to assess the effectiveness of business tax provisions, they should also ask if critical middle class tax provisions need to be amended to help middle-class families—whether they live in Texas, Ohio, or New York.