Memo Published February 22, 2012 · Updated February 22, 2012 · 15 minute read

Why Italy Matters—Could Europe’s Debt Wash Up On Our Shores?

Lauren Oppenheimer & David Hollingsworth

Greece once again made headlines this week, agreeing to yet another bailout package with Eurozone finance ministers. Its debt crisis is a reminder that markets matter.

Before the development of modern capital markets, money was scarce and borrowers—including sovereigns—were forced to pay dearly to obtain funds. With modern capital markets, countries generally have access to a wider variety of funding sources at cheaper costs. This allows governments to borrow to build infrastructure, educate their population, provide safety nets, and take other actions designed to improve productivity and economic growth.

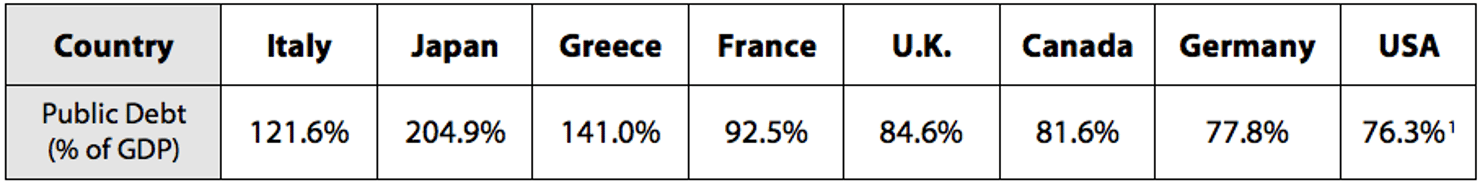

But a country can borrow too much relative to its ability to generate revenue to pay loans back. And that brings us to Italy—the 8th largest economy in the world with the 3rd largest national debt, behind only Japan and Greece. The chart below compares Italy’s debt with other nations’ debt levels, as a percentage of their Gross Domestic Product (GDP).

Selected 2012 National Debt Levels as % of Gross Domestic Product (GDP)1

Access to markets is conditional. Markets can act as a check on the fiscal actions of governments and their policies for economic growth—investors want to be paid back. When markets perceive the policies of a country as harmful and limiting for economic growth, borrowing costs typically increase.

Higher borrowing costs make it harder for the borrower to pay back existing loans and get new ones. In other words, default becomes more likely.

The fear is that unlike a Greek default, an Italian default could be the final straw that causes the banking system of Europe to seize up and sends the world into recession. America would not be immune. This paper will explain why an Italian default could cause an economic catastrophe in Europe, what that could mean for the American economy, and what tools Europeans have at their disposal to prevent the default of Italy and other European sovereigns.

Italy on the Brink: Markets Start to Just Say No

Like Greece, Italy is a member of the Eurozone, the 17 European nations that share a common currency—the euro. And similar to other Eurozone countries, Italy was able to sell its bonds cheaply because investors thought that a European common currency meant common risk. That is to say that a bond offered by a country with a strong economy like Germany bore the same risk as a country with a weaker economy like Greece. There was a belief that Eurozone leaders would not allow a country to default.

However, the financial crisis exposed cracks in the Eurozone as well as the weaknesses of these overleveraged economies. As a result, markets reacted by pushing up the borrowing costs of these countries. Making matters worse, these countries do not have access to tools that countries routinely use to stimulate their economies in the face of a recession.

For example, pre-Eurozone, Italy could depreciate its currency. When a country devalues its currency, its exports become cheaper on world markets, stimulating demand for those products. But as a member of the Eurozone, Italy can no longer devalue its currency—just like Texas can’t depreciate its currency because it uses the U.S. dollar.

In addition, Italy cannot lower interest rates. In the United States, the Federal Reserve can lower interest rates to help stimulate the American economy, but Italy and the rest of the Eurozone must rely on the European Central Bank to dictate interest rates for all 17 nations.

With a lack of economic growth for a number of years even prior to austerity measures, many investors worry that Italy will not be able to pay off its significant outstanding debts.2 Italy has a debt to GDP ratio of 120%, and was recently paying a 7% interest rate on its 10 year bonds—the same interest rate that forced Greece, Ireland and Portugal to seek bailouts from the International Monetary Fund (IMF) and the European Union.3

The Italian Job: A Tipping Point for Europe’s Financial System

While the default of a smaller country like Greece posed significant problems for Europe, Italy poses a much larger problem due to its sheer size and interconnectedness to the European and world economy. An Italian default has the potential to cripple the European economy and tip the world into recession.

Italy has a €1.9 trillion ($2.6 trillion) bond market, making it the 3rd largest in the world after the United States and Japan.4 This means that Italy has the 3rd largest amount of outstanding sovereign debt in the world, six times the size of Greece’s debt.5# Additionally, a significant portion of Italy’s sovereign debt must be renewed (rolled over) this year—that is to say, the maturation date for some of its bonds are coming soon. In 2012, Italy will have to refinance €360 billion($500 billion) of maturing debt.6 If Italy cannot find any buyers when it rolls over this debt by issuing new bonds, then it could be forced to default.

Italian bonds are held largely by European banks. If Italy defaults, European banks are holding—collectively—hundreds of billions of dollars in bad loans, significantly more than their Greek holdings.7 According to Newsweek, if Italy were to default, “The fallout could be tumultuous. A default would probably cause mass failures among Italian banks, which hold €164 billion (more than $220 billion) of Italian government debt. Depositors might stage a run. French banks, with €53 billion of Italian debt (nearly $72 billion), would also be imperiled.”8

With sizeable exposure to Italian debt, investors are worried that major European banks do not have enough capital reserves to withstand a decrease in the value of the bonds they hold, otherwise known as a write down. This is especially true now, because European banks have not fully recovered from the financial downturn in 2008 and are still highly leveraged, meaning they have a high level of debt relative to their equity.9

In addition, if Italy were to default, it would put serious pressure on other Eurozone economies, particularly struggling ones like Spain. That is because if Eurozone leaders can’t save Italy, they won’t be willing or able to save other, less important economies. As former IMF chief economist Simon Johnson points out, “There is no way to have just a little debt restructuring for Italy. If Italian debt involves serious credit risk—i.e., a nonzero probability of default—then all sovereign debt in Europe will need to be re-priced, downwards.”10

With banks having to write down the bonds of multiple European countries at the same time, the damage would be multiplied. According to Gary Jenkins, a strategist at Evolution Securities in London, “As sovereigns go, so the banks will go…If the sovereign situation deteriorates, the entire banking sector will deteriorate with it very quickly.’’11 The result could be much worse than merely a decrease in lending, but could lead to a rash of bank closings across Europe with severe disruptions in capital flows.

In short, Italy matters because of its size and its importance to the Eurozone economy. An Italian default would cascade throughout Europe, straining the resources of the financial system.

A Threat to America’s Economy

Banks in the U.S. are better capitalized—meaning they have higher levels of equity relative to their outstanding loans—than their European counterparts. However, there are a number of ways Europe’s sovereign debt crisis could set back the American economy.

1. The European Union is the largest trading partner of the United States and a sinking European economy will decrease demand for our exports.

In 2009, the United States exported $287 billion in goods and services to Europe, and European direct investment in the United States totaled over $120 billion.12 After the financial crisis, the U.S. experienced double digit increases in our export numbers to Europe—21% from 2009 to 2010 and 17% from 2010 to 2011.13 During the first 6 months of 2011, the U.S. exported $153 billion to the Eurozone.[14#

Our export numbers will be certain to fall if European economies continue to falter. A banking crisis in Europe will also likely weaken the value of the euro which makes our exports more expensive, magnifying the effects of decreased European demand for our products.

2. If one or more countries default on their debt, the euro itself could dissolve.

This could lead to an unruly breakup of the world’s second-most important currency, with a devastating impact on the global economy.

A recent ING report outlines possible scenarios for a breakup of the euro. If Greece were to leave the euro, besides further devastation to the Greek economy, other Eurozone economies could see falls in output of up to 5% of GDP. However, a complete breakup of the euro would send the entire Eurozone into a deep recession, with a 12% reduction of cumulative output in the Eurozone predicted over the first two years. Under this scenario, due to lower growth and an appreciating dollar that makes our goods more expensive overseas, the U.S would experience at least a mild recession—hardly what our fragile economic recovery needs.15

In addition, the euro is the second most widely held reserve currency by central banks around the world, behind only the U.S. dollar.16 Many assets throughout the world are denominated in euros. If countries begin to leave the euro and revert to their former currencies, it could cause widespread havoc in world markets as countries and financial institutions that hold euro denominated assets liquidate euro holdings.

3. American financial institutions and investors are tied to the European banking sector.

Depending on exposure, American financial institutions that lend to European banks could take enormous losses if there are widespread European bank failures. The Bank for International Settlements reports that U.S. banks have more than $220 billion at risk through investments in German and French banks alone. In addition, the IMF reports that the risks to U.S. banks could rival the financial crisis of 2008 the more deeply the debt crisis spreads to core Eurozone economies.17

In addition, the total number of outstanding credit default swaps (CDSs)—insurance against a bond default—remains murky. Without knowing the total exposure in the entire system, credit default swaps could add strain to the American financial sector. According to credit rating agency Fitch in November 2011, “the top five U.S. banks had $22 billion in hedges tied to stressed markets…(but) disclosure practices also make it difficult to gauge U.S. banks’ risk.”18

Bailing Out Europe: Who Could Step Up?

The countries most under market pressure—Portugal, Ireland, Italy, Greece, and Spain—have to roll over €537.1 billion ($683 billion) of debt in 2012 to avoid default.19 If the private market won’t buy European sovereign debt, then some entity must step in to buy the bonds in order to prevent these countries from defaulting.

Since avoiding defaults is a foremost concern, the question becomes which institutions are capable of providing support to the sovereign debt market by purchasing bonds for the foreseeable future. Below is a look at the institutions with the potential to aid European sovereigns and their banking system as the crisis continues to unfold.

1. The European Financial Stability Facility/European Stability Mechanism

The European Financial Stability Facility (EFSF) was created in May 2010 as a temporary institution with a mandate “to safeguard financial stability in Europe by providing financial assistance to euro area Member States.”20 Many were hopeful that the EFSF would lessen the debt woes of the Eurozone, but it has only €440 billion at its disposal, with €250 billion already committed to Greece, Portugal and Ireland.21

The European Stability Mechanism (ESM) was created on July 11, 2011 to take over the role of the EFSF on a permanent basis in mid-2013. Given market pressures, the ESM will now begin operation in July 2012. The ESM will have €500 billion ($650 billion) at its disposal. However, besides concerns about the size of the fund, market participants are worried this funding could come too late to prevent a disaster.

2. The International Monetary Fund (IMF)

The IMF was created after World War II with the intention of serving as a lender of last resort for the world and to ensure that the wheels of global commerce would turn smoothly. Indeed, the IMF has already participated in loan packages to Greece, Ireland, and Portugal to help stem the current European sovereign debt crisis. However, the IMF currently has only $390 billion in uncommitted reserves.22 The IMF has 187 member nations, including the United States, and while these nations could provide the IMF with additional funding, they’ve been reluctant to do so. With dwindling reserves, European leaders are hopeful that the IMF will “match and support the new firepower of the European Financial Stability Facility.”23 Yet it is unclear whether the IMF has the resources necessary to stop the financial bleeding.

3. China

With Europe in disarray, some commentators have mentioned that China or another nation with a budget surplus could provide funding to Europe to stem the crisis. However, whether China has the interest or capability to save Europe by buying their bonds is unclear. First and foremost, China might not feel it is a good investment, and could use its immense reserves to purchase undervalued assets if European economies collapse. And according to New York University professor Carl Weinberg, the Chinese may not have the ability to anyway. “China is just not big enough to move the Italian bond market much, or to save the entire economy.”24

However, as the European debt crisis has dragged on, China has expressed some interest in helping with rescue funds, without firmly committing to a specific amount.25 As Feng Zhongping, Director of the Institute of European Studies at the China Institute of Contemporary International Relations, said, "China has no appetite or ability to 'buy up Europe' or 'control Europe'…(and) China has from the beginning strongly supported the EU and the euro.”26

4. European Central Bank

The European Central Bank (ECB) manages the euro, conducts monetary policy, and maintains price stability for the Eurozone.27 It is the European institution that most closely resembles America’s Federal Reserve. Because it is the only institution that can create euros in unlimited amounts, some economists feel that only the ECB has the capability to provide a backstop for the crisis by purchasing large amounts of sovereign debt.28

So far, the ECB has remained reluctant to print money to purchase government bonds on an unlimited basis. This is because the ECB was designed as a lender of last resort to the Eurozone banking system, not to governments. The ECB is barred by treaty from buying sovereign debt directly, though it can purchase government bonds on the secondary market. In fact, it has already purchased small amounts of sovereign bonds under its Securities Markets Program, most recently to keep interest rates down on Italian and Spanish bonds.29 But the ECB has made clear that the purchasing program is temporary. It has no intention of printing money to buy European debt in unlimited amounts as it worries that such purchases would violate its charter.

The ECB also worries that if it commits to unlimited sovereign bond purchases, it will cause significant inflation throughout Europe. Further, the ECB worries it will lose both its credibility and its independence—two indispensable attributes for central banks.30 If markets perceive the ECB as willing to print money any time there is market turmoil, it will not be seen as a bulwark of low inflation and stable monetary policy—causing economic instability and low growth in the future.

In addition, the ECB feels that the debt crisis will end when these troubled countries get their budget deficits under control. There is a feeling that countries such as Italy and Greece were profligate in their spending, and purchasing European sovereign debt without strings attached would be encouraging irresponsible fiscal behavior among the weaker European economies. According to the ECB, these countries need to change how they manage fiscal policy in order to get investors to return to the sovereign debt market.31

Instead of unlimited purchases of sovereign debt, the ECB launched a long-term refinancing operation in December 2011 to strengthen bank balance sheets. The ECB allowed European banks to obtain three-year loans at 1% interest rates, with the goal of improving bank liquidity and encouraging these banks to purchase European sovereign debt.32 523 European banks took out €489.19 billion ($640 billion) worth of loans during the operation, and since then European stock markets have risen and the yields on European sovereign bonds have decreased.33

However, many experts believe that this is not a long-term solution, and there are indications that the banks that took ECB loans have not been using them to make additional loans or purchase sovereign bonds.34 The ECB is scheduled to have another long-term refinancing operation on February 29th, and some analysts expect demand to be roughly double what it was in December.35

So as it stands, the ECB is not willing to make the unlimited bond purchases for which many market participants are clamoring. However, if the crisis threatens to spin out of control, the ECB may be forced to intervene further.

Conclusion: Why Italy Matters

Italy matters because it is a very large economy that has financial and business ties throughout Europe and the world. Unlike smaller European countries, an Italian default would drag the value of other European sovereign bonds down, severely strain the entire European banking system, tip the continent into severe recession, and endanger the existence of the euro.

An Italian default is possible because investors are expressing serious reservations about the wisdom of lending to Italy, and could cut off all access to funding from capital markets if fiscal and economic concerns are not addressed in the near future.

Therefore, Eurozone leaders need to pull together and use their resources to prevent Italy and other Eurozone nations from defaulting. Without a viable solution, they could face the possibility of economic calamity and the breakup of the euro.

Whatever the outcome, America’s economic future is intertwined with Europe, and their problems could easily wash up on our shores. How European leaders handle this current crisis will affect American job opportunities and economic growth in the future.