Memo Published June 10, 2021 · 9 minute read

POLL: Voters Support ‘Buy Clean’ Procurement Policies

John Milko & Jackie Toth

As the Biden-Harris Administration and Congress deliberate the details of an infrastructure package to help modernize our economy and workforce, policymakers have a major opportunity to build climate considerations into these historic public investments. One way the federal government can help address industrial greenhouse gas emissions – which account for roughly one fourth of total emissions in the U.S. – is by incentivizing the use of cleaner construction materials. As a large buyer of these materials, the government can leverage its procurement power to award federal contracts to companies that emit fewer carbon emissions than their competitors.

The first step in establishing a clean procurement framework is collecting reliable and comparable data on embodied carbon, or the cumulative emissions created throughout the manufacturing process of common construction materials like cement and steel. Incentivizing companies to calculate and disclose the embodied carbon of their products allows the government and other purchasers to evaluate project bids based on environmental impact as well as cost.

Once the government has access to an embodied carbon database, it can establish a Buy Clean standard to award contracts to companies that produce verifiably cleaner materials. States, multinational corporations, and other large buyers have already begun implementing procurement and building requirements to reduce the amount of embodied carbon in their project materials. The federal government has the opportunity to scale up these efforts to reduce product lifecycle emissions and help American manufacturers – who generally manufacture cleaner materials than their foreign counterparts – be more competitive in an increasingly carbon constrained global economy. As the demand for cleaner materials continues to grow both domestically and abroad, Buy Clean and related policies can incentivize U.S. companies to stay ahead of the curve and help ensure they have access to these expanding markets.

Key labor, environmental, and industry stakeholders have voiced their support for efforts to establish federal clean procurement policies, but there is one large group missing from this list: voters. To show policymakers that voters back these forward-looking policies, Third Way, with Global Strategy Group, surveyed more than 3,300 voters across six states with a sizable manufacturing presence—Pennsylvania, West Virginia, Ohio, Indiana, Illinois, and Michigan—from May 6–13, 2021, to gauge public sentiment on the federal government using cleaner construction materials for infrastructure projects.1 Each state’s results were weighted to a statewide registered voter model for region, age, race, gender, and educational attainment by race. The sample also includes many respondents from a selection of counties within each state that employ a substantial number of manufacturing employees. Respondents, even those in the more Republican-leaning states, overwhelmingly support policies that effectively reduce emissions and support U.S. workers by making domestic manufacturers more competitive.

Voters want solutions for both domestic manufacturing and clean energy

The primary purpose of Buy Clean standards is to reduce embodied carbon in construction products and facilitate a transition to a cleaner economy. But if designed thoughtfully, Buy Clean and related policies can also reward U.S. companies already taking measures to calculate and reduce the amount of carbon emitted in the manufacturing of their products. Our polling finds that voters want to see these separate, but potentially complementary, concerns addressed.

57% of voters have become more supportive of transitioning to cleaner sources of energy over the last few years. At the same time, 61% of all respondents--including 59% of voters in manufacturing-heavy counties--believe the manufacturing industry in their state is getting weaker.2

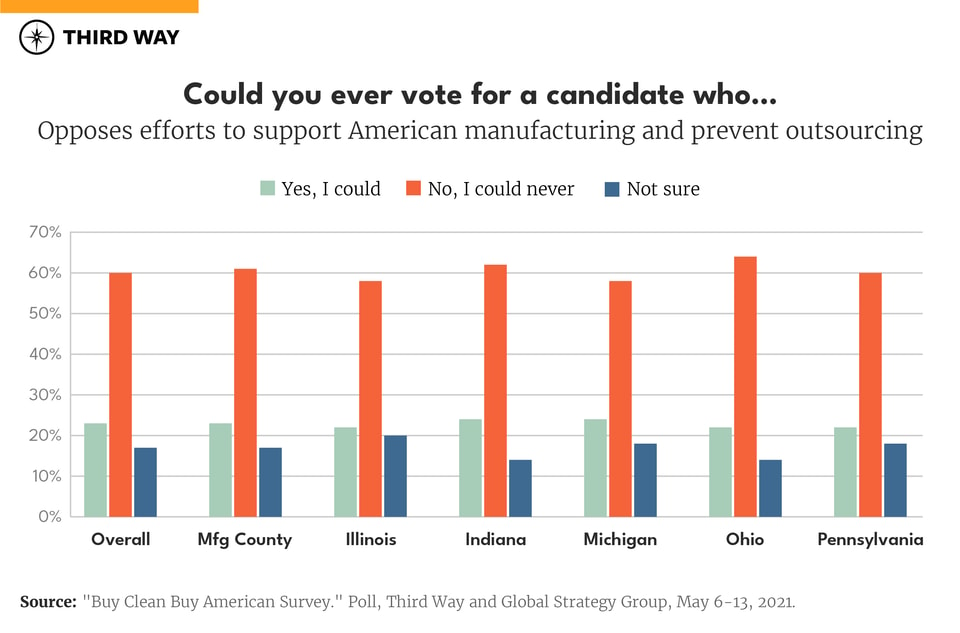

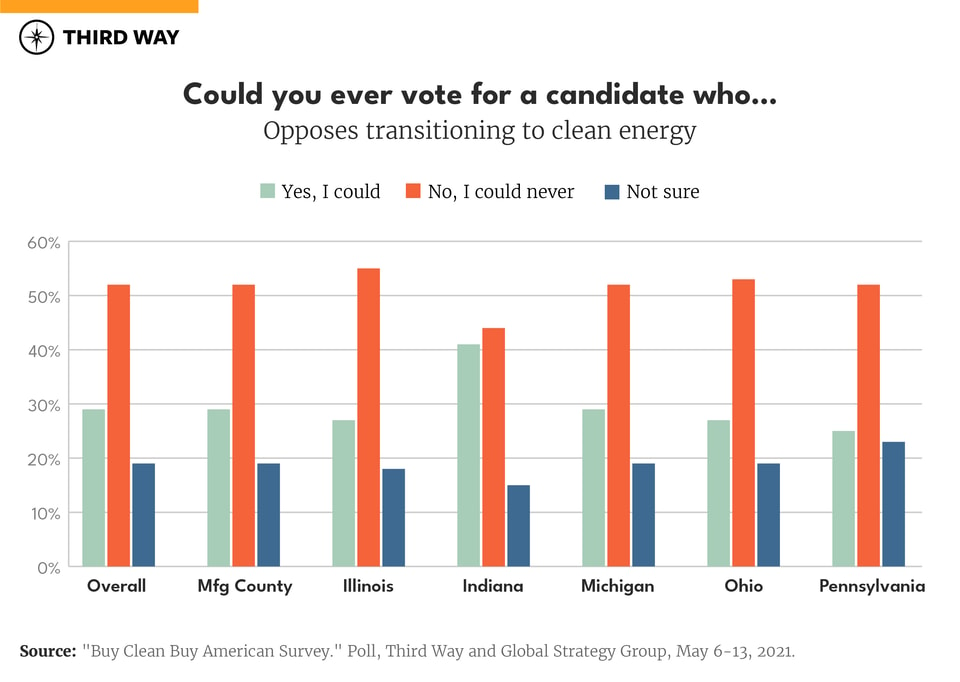

Furthermore, a majority of respondents stated that they could never vote for a candidate that opposes efforts to combat climate change, transition to clean energy, or support American manufacturing and prevent outsourcing.

An effective Buy Clean standard would help address all of these concerns by incentivizing companies to produce cleaner materials, spurring innovation in the manufacturing sector, and creating greater demand for domestic products which, on average, produce fewer lifecycle emissions than similar imported products.3

Voters support increased transparency

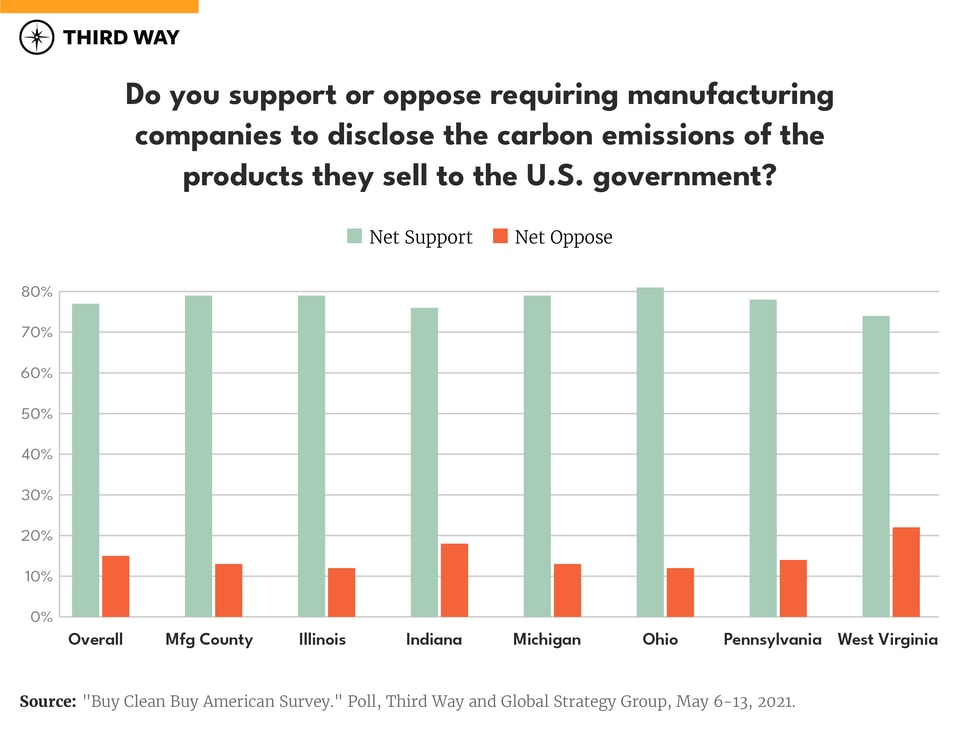

In order to compare the embodied carbon content of products and use that information to make informed purchasing decisions, the government and other buyers need accurate and comparable data on product lifecycle emissions.

Unfortunately, this isn’t something available on Google. Assembling a usable database of this information requires companies, who often lack the necessary resources and expertise, to calculate and share the amount of carbon emitted in the making of their products. The good news? We find that overwhelming majorities of voters in these states agree that manufacturing companies should be required to disclose that information for products they sell to the U.S. government.

Many companies across the country already track and disclose the lifecycle emissions of their products. However, the government needs to invest more time and resources into helping companies calculate their product emissions the same way and supporting a reliable database that makes this standardized information readily available and easy to use while making purchasing decisions. This will help ensure that all companies, regardless of size, remain competitive as both public and private buyers continue to implement carbon transparency requirements for suppliers. Federal agencies like the Department of Energy and Environmental Protection Agency have the expertise to guide companies through this process, and 70% of survey respondents support providing them with the resources they need to offer financial and technical help to do so.

Voters understand the positive impact of cleaner procurement

After dedicating the requisite time and resources to collecting lifecycle emission data for construction products, the government will be able to set a procurement standard that rewards companies that make products with comparatively low embodied carbon content. Survey respondents across all six states overwhelmingly support setting such standards for companies applying for government infrastructure contracts.

When asked about the impact of setting standards to ensure government infrastructure projects use cleaner, more efficient, and more environmentally friendly materials, respondents view the initiative as beneficial for all stakeholders involved.

Even more voters support Buy Clean after hearing the details

By an overall margin of 59/21 percent, respondents support requiring the U.S. government to buy construction materials, like cement and steel, only from manufacturers that create less pollution and use less energy. When asked the question a second time later in the survey after hearing more about clean procurement, support jumps to 74/17 percent. This significant increase in approval after only brief exposure to supportive messaging is encouraging for advocates as they continue to educate policymakers and the general public on Buy Clean.

Furthermore, when asked the same question with the additional qualifier that the products are made in America, support grows to 81/13 percent. While a Buy Clean standard would not explicitly favor domestically-manufactured construction products, American manufacturers on average produce cleaner materials - steel in particular - than those abroad. It’s likely that American companies would gain a competitive advantage over Chinese and Russian steelmakers, for example, under a Buy Clean procurement framework. However, gathering the necessary emissions data to know where to set a standard that does not disadvantage American companies is a crucial part of this process. It allows advocates to fairly and accurately tout the benefits of Buy Clean for American companies and workers, which as public opinion shows, is even more persuasive.

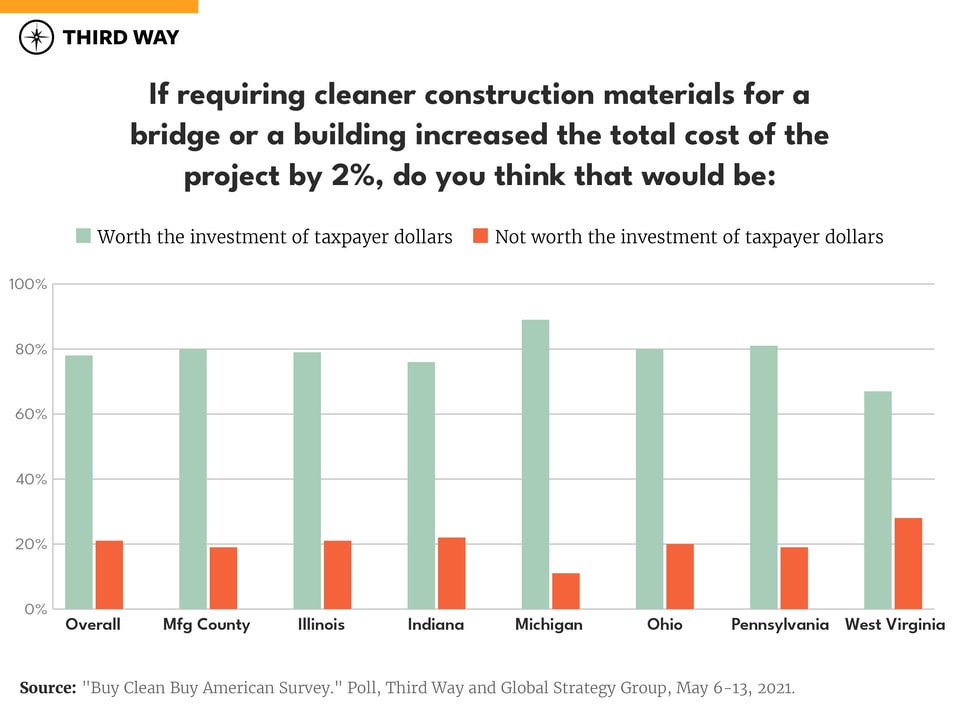

Voters support Buy Clean policies even faced with opposition arguments

The most likely arguments that opponents of clean procurement policies will make involve increased costs, to both companies and taxpayers, and burdensome regulations. They will say that requiring companies to track and disclose the embodied carbon content of its products increases its operational and compliance costs, which are passed down to the consumer in the form of higher taxes. Notwithstanding the fact that multiple studies estimate that the costs passed on to consumers will be minimal, respondents think the environmental and labor benefits outweigh any potential cost increases.4 When asked if requiring cleaner construction materials for a bridge or a building increased the total cost of the project by 2 percent, respondents said it would be worth the extra investment by a margin of 78/21 percent.

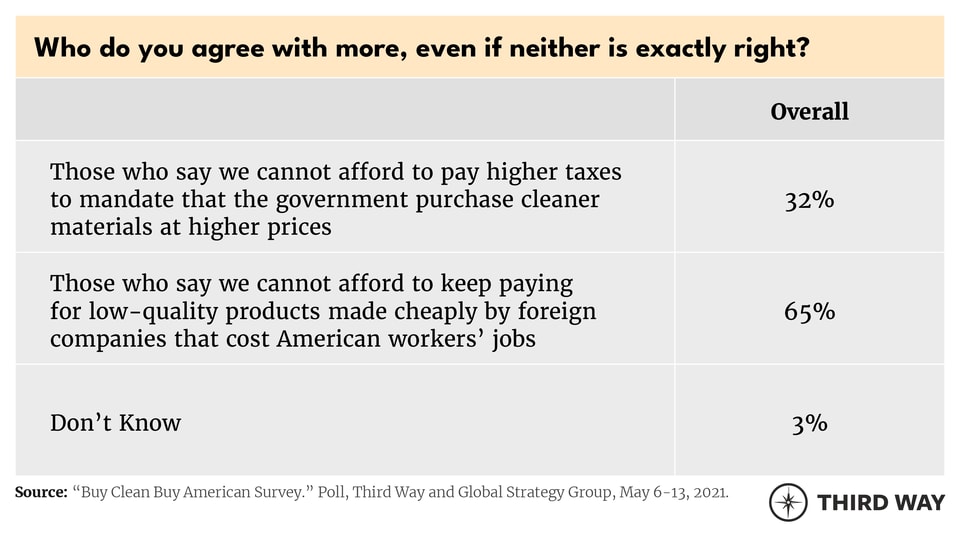

Respondents were also presented with a series of questions that presented opposing arguments and asked to decide with which message they agree. In all three of these questions, the Buy Clean-affiliated message outperformed the opposition message by sizable margins and across all six states.

Voters find a wide variety of arguments supporting Buy Clean convincing

We tested an array of different messages that advocates could use in support of efforts to require the U.S. government to buy better construction materials. Encouragingly, a large majority of respondents in every state found each message convincing. 79% of respondents found the strictly environmental argument convincing that clean manufacturing will help cut carbon pollution, reduce the use of toxic materials, and combat climate change. 78% of respondents found the environmental and economic argument convincing that as one of the world's largest buyers of construction materials, the U.S. government could have global influence by steering taxpayer dollars only toward clean manufacturers, helping prevent climate change and giving American manufacturers an advantage over dirtier competitors.

The message that tested the best, however, highlighted the potential economic benefits of clean procurement. 88% of respondents found the argument convincing that taxpayers deserve to get the most bang for their buck, meaning our tax dollars should go toward supporting good, family-sustaining jobs in America and prevent those jobs from being outsourced. This aligns with our previous finding that support for clean procurement increases when framed as a way to support American manufacturers.

Buy Clean policies present a promising opportunity to both reduce emissions in the industrial sector and encourage important sustainability practices among domestic manufacturers. As foreign governments like the EU and Canada, state governments, and large corporate buyers accelerate their clean procurement efforts, American manufacturers must adopt carbon transparency measures to compete for an already large and growing pool of business. Voters must be made aware of the economic necessity of clean procurement provisions and how Buy Clean policies can support American companies and workers, as well as the environment.