Memo Published February 26, 2025 · 7 minute read

Child Tax Credit: Current Status, Where It’s Heading

Curran McSwigan

A key question in this year’s tax debate will be: what happens to the Child Tax Credit? Without Congressional action, the credit is poised to be cut in half and apply to fewer families. In this fact sheet, we break down the Child Tax Credit (CTC)—where it currently stands, where it’s headed, the core components policymakers need to consider, and two recent approaches to changing it.

CTC: Current Status

The Tax Cuts and Jobs Act of 2017 (TCJA) made a series of changes to the CTC that are currently in effect through 2025. Specifically:

- Doubled the value. The credit went from $1,000 to $2,000 per child.1

- Increased the number of eligible families. Eligibility was expanded to those with at least $2,500 in earnings, and the credit starts phasing out for single filers with incomes over $200,000 and for joint filers with incomes over $400,000.2 For every dollar earned over this maximum, the credit declines by $0.05.

- Made part of the credit refundable. TCJA initially allowed $1,400 of the tax credit to be refundable, meaning even if families don’t owe any taxes, they are still eligible to receive that $1,400 as a refund. Refundability is also tied to inflation, meaning as of 2024, $1,700 of the credit is now considered refundable.3

- Created a non-refundable $500 tax credit for certain dependents ineligible for the CTC. This includes children aged 17 to 18, dependents aged 19 to 24 who are in school, as well as some older dependents.4

The changes to CTC in TCJA were in part driven by the bill's corresponding elimination of personal and dependent exemptions in the tax code.5 By itself, this change would have drastically increased the tax burden of working families—which an expanded CTC program helped remedy.6

CTC: Where It’s Headed

While TCJA increased the CTC, it only did it on a temporary basis through the end of 2025. Absent Congressional action, the CTC will revert to its pre-2017 state.7 That means:

- Smaller tax credit value. The CTC will drop to $1,000 per child.8 This amount will be refundable, meaning that even if a family has no tax burden, they will be able to claim the full credit.9

- Higher earnings threshold. Families will need to have at least $3,000 in earnings to be eligible for the credit, slightly above the $2,500 requirement under TCJA.10

- Quicker phase-out. The credit will begin phasing out at a rate of 5% for single filers with an income of $75,000 and married couples with incomes of $110,00.11

CTC: 6 Core Components

As policymakers debate the future of the CTC, there are a series of policy levers they can shift up or down. Here are six key components to be aware of:

- Refundability: This allows an individual to get a tax benefit even if they don’t owe taxes.12 If a credit is not fully refundable, the lowest-income families (who may not have tax liability) would lose out on the full credit—even if they technically otherwise qualify.

- Phase-in level: Setting a phase-in level means there is an amount of annual earnings individuals/families must have in order to be eligible. Phase-ins around earned income are typically viewed as creating a “work requirement” since an individual/family can’t get the credit if they haven’t earned any income in the last year.13

- Phase-out rates: At a defined income level, families will start to see the value of their credit decrease until it reaches $0. Phase-outs are a tool that can try and target the benefit to families at certain income levels as well as limit costs.14

- Eligibility: One aspect of eligibility is the entire age range of children that is covered by the credit. Additionally, a credit may be higher or lower depending on the exact age of the child (e.g. a higher credit for younger children). Eligibility criteria may also require a Social Security number or a taxpayer identification number.15

- Implementation: The IRS needs resources to effectively implement the CTC.16 Requirements like monthly payments and refundability can help support lower-income families, but they also add a level of complexity to administration that will be expected of an agency that often sees itself on the receiving end of calls for budget cuts.

- Cost: The annual cost of the CTC at TCJA levels was $120.6 billion in 2023. The more generous one-year version under the American Rescue Plan cost around $220 billion in 2021. If the expansions under TCJA expire at the end of 2025, it is estimated that CTC payments under permanent law would equal around $61.5 billion in 2026.17

CTC: Other Versions

Bipartisan Proposal

Bipartisan legislation by Sen. Ron Wyden (D-OR) and Rep. Jason Smith (R-MO), the Tax Relief for American Families and Workers Act of 2024, sought to expand the CTC alongside other tax reforms.18 The bill passed the House but ultimately failed in the Senate. Although not enacted into law, the bill shows areas of potential bipartisan agreement. Proposed modifications included:

- A “per-child” phase-in. The maximum refundable credit amount is currently calculated by multiplying the amount of earned income over $2,500 by 15%. This legislation would take that number and multiply it by the number of qualifying children—increasing the benefit for families with multiple children.19

- Full refundability over time. Currently, the maximum amount considered fully refundable is $1,700. This legislation would lift the cap over several years to $2,000 before adjusting the cap for inflation.20

- Increased credit with inflation. The legislation would increase the $2,000 maximum credit value with inflation.21

- Allowing prior-year earned income. Taxpayers would be able to use their earned income from the prior taxable year in calculating their maximum child tax credit if last year’s income was less than the current year.22

American Rescue Plan

As a part of the American Rescue Plan (ARP), Democrats vastly expanded the CTC for one year to help working families navigate the economic challenges of the pandemic. Changes included:

- Expanded the credit. The credit increased to $3,600 for children under the age of six and to $3,000 for children aged 6-17.23

- Targeted expanded credit toward lower-earning families. The size of the expanded credit slowly decreased at a rate of 5% down to TCJA credit levels for single filers earning more than $75,000 per year, head of households earning $112,500, and married couples earning more than $150,000 annually.24 The credit then operated like the TCJA credit, where at income levels of $200,000 for single filers and $400,000 for married households, it phased out at a rate of 5% to $0.25

- Made the credit fully refundable. Families were able to receive the full child tax credit even if their tax burden was lower than the value of the credit.26

- Eliminated the earnings threshold. Even if a family earned $0 in the last year, they were still eligible to receive the credit.27

- Allowed part of the credit to be paid in monthly installments. Instead of receiving the full credit at tax filing season, families could also get part of the credit during the first six months of the year in the form of a monthly payment.28

At the end of December 2021, the ARP version of the credit expired and reverted back to TCJA levels.

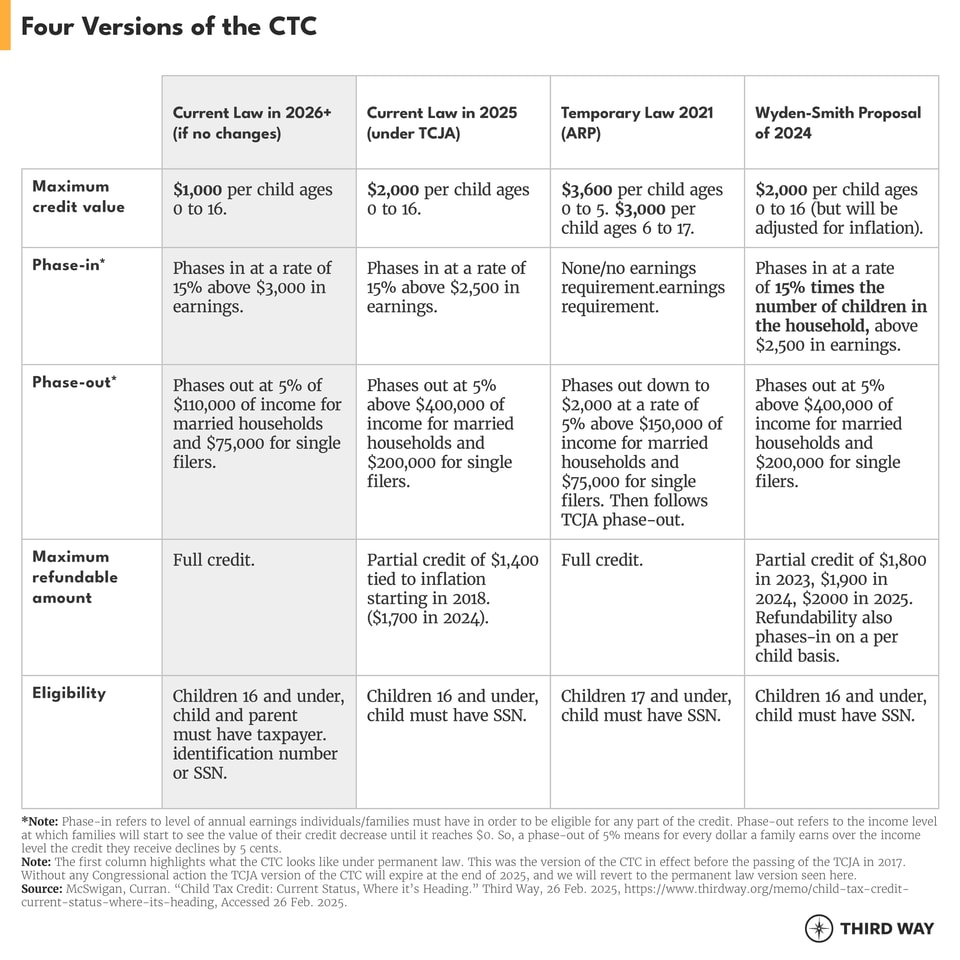

Side by Side: Four Versions of the CTC

As legislators debate the future of the CTC, it is helpful to see where we have been and where we are going. The table below provides points of comparison across four different versions of the CTC: current law in 2025 (under TCJA), current law in 2026+ (if TCJA expires), the temporary increase in 2021, and the Wyden-Smith proposal from 2024. Modifying any of the design components below can have significant impacts on the scope and scale of the policy itself.