Blog Published May 28, 2020 · 4 minute read

Investors Pile Into Clean Energy Stock Index Funds

John Milko & Ellen Hughes-Cromwick

Among the many consequences of the COVID-19 shutdown, global demand for energy has collapsed. As businesses scale back their operations out of concern for public health and safety, they require less energy. However, in analyzing market trends, we found something interesting. Publicly traded clean energy companies’ stock prices have outperformed the overall stock market, as measured by the S&P 500, and have vastly outperformed fossil fuel companies’ stock prices since the beginning of the year. This is a big development to watch as the economy begins to reopen.

The per-barrel cost of crude oil (WTI) has fallen roughly 50% after opening the year above $60. While many investors have abandoned their investments in oil-related securities, they certainly have many alternatives from which to choose. They could sell these fossil fuel plays and hold cash or invest in other sectors of the economy.

One way to measure these shifts is to look at the performance of exchange traded funds, or ETFs. These funds allow investors to buy a basket of stocks issued by companies in a particular category or sector. Instead of buying just one company’s stock, ETFs allow investors to purchase a basket of equities or other financial assets. Investor returns come when the ETFs grow in value as their stock prices go up. ETFs can be a package of equity securities, or bonds, or even financial assets at future points in time, like oil futures. These are contracts for which the market trades and prices the delivery of oil at a future date.

For example, the United States Oil Fund (USO), a large oil ETF, holds futures contracts for crude oil. Instead of owning oil company stocks, it contains a host of these oil futures. An investor can purchase oil to be delivered in September 2020 at a price of $33.73.1 The USO oil ETF includes many of these futures contracts, instead of just one. USO has lost 75% of its value since the beginning of the year. Just this week, USO communicated to the Securities and Exchange Commission its intention to hold larger amounts of US Government Treasury bonds (considered a very safe investment) and cash to protect investors in this ETF should oil prices remain highly volatile.2 And yes, ETFs have the flexibility to include other assets that stray very far from their main sectors. Even an oil ETF is moving to reduce its holdings of oil company stocks.

According to a recent survey of oil industry executives conducted by the Federal Reserve Bank of Dallas, 80% of executives reported a deteriorating outlook for their firms and falling expectations for business activity, production, and capital expenditures in 2020 as a result of COVID-19.3 Many companies will be forced into bankruptcy if these low prices persist.4

Given the supposed bear market for energy, we might expect clean energy companies to fare similarly to those in the fossil fuel industry. However, that does not appear to be the case.

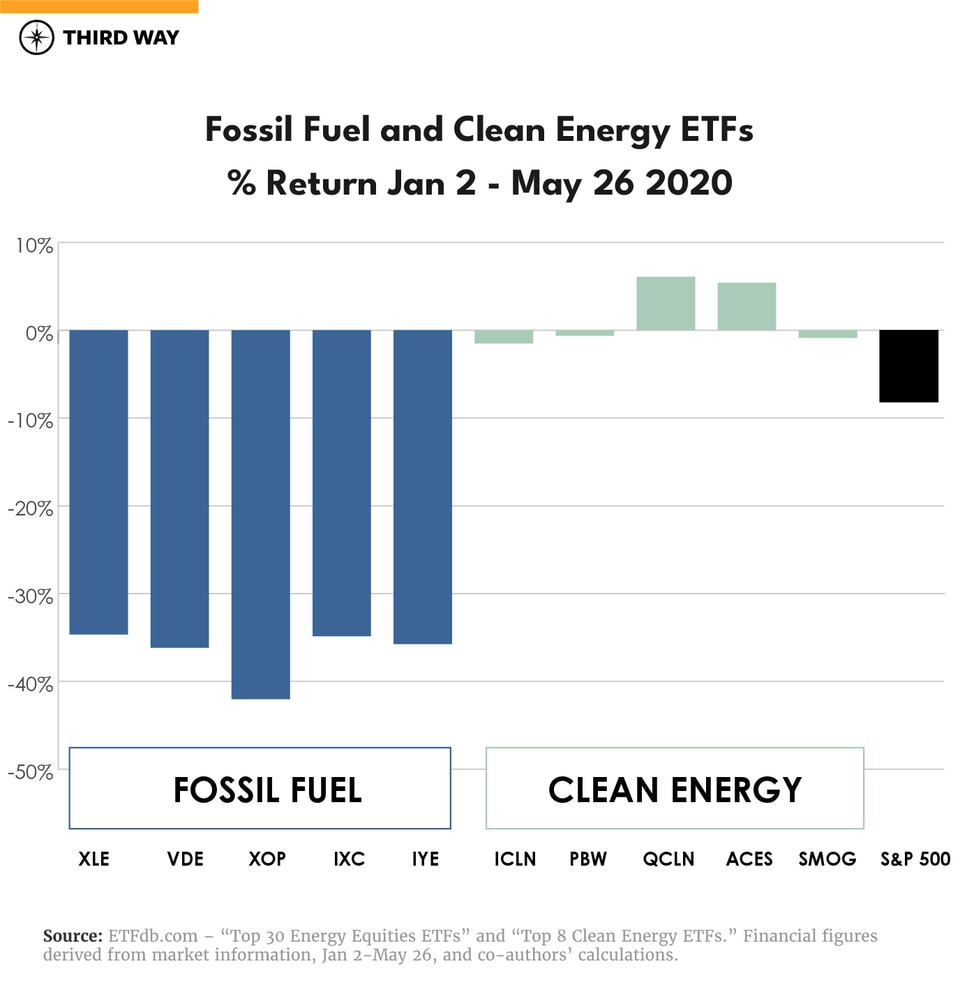

In order to capture a broad snapshot of these sectors, we looked at the five largest (by assets) equity ETFs in the “Fossil Fuel” and “Clean Energy” asset classes.5 The Clean Energy ETFs (which contain stocks of companies conducting business throughout the clean energy supply chain) far outperformed the Fossil Fuel ETFs and even beat overall market returns.

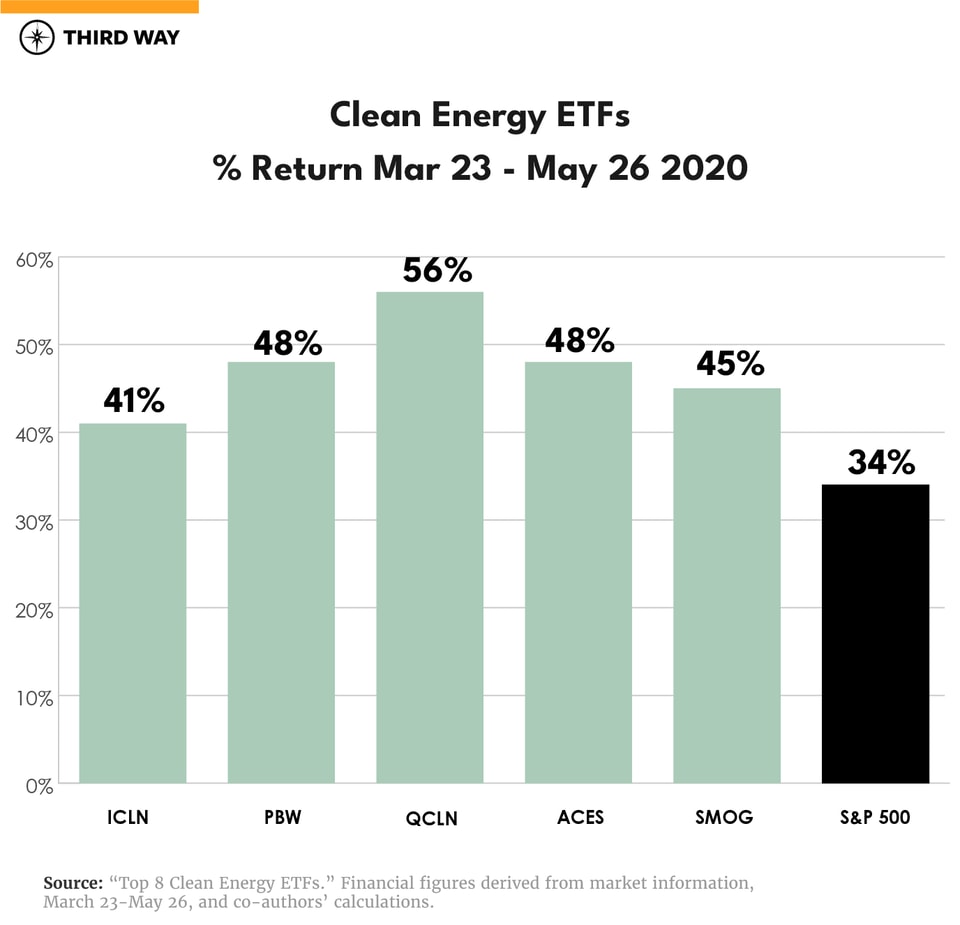

In fact, over the past two months, as the health crisis has caused the economy to falter, the Clean Energy ETFs saw increases between 41-56%, again outperforming the S&P 500.

Conclusion

Although this is certainly no time to celebrate, it is an encouraging sign for the clean energy industry that many companies in its cohort have been able to weather this economic storm—and even grow in the face of it. As we emerge from this crisis and energy demand increases, we should be looking toward clean energy sources of the future rather than the dirty sources of the past. And as we’ve seen over the past five months, the markets appear to agree.