Memo Published February 3, 2015 · Updated February 3, 2015 · 6 minute read

PE Ratios: Proceed With Caution

John Vahey & Tanner Daniel

Price-to-Earnings Ratios

Each morning, stock market investors fire up their computers and the stream of global economic news begins. Analysts scrutinize economic reports and corporate earnings to develop a view for where they think the stock market is headed.

The price-to-earnings ratio—or “P/E” ratio—is one of the most frequently used market indicators that sheds light on stock market valuations and investor sentiment. This paper explains the price-to-earnings ratio and highlights what P/E ratios indicate about stock market conditions and the economy as a whole.

What’s a P/E Ratio?

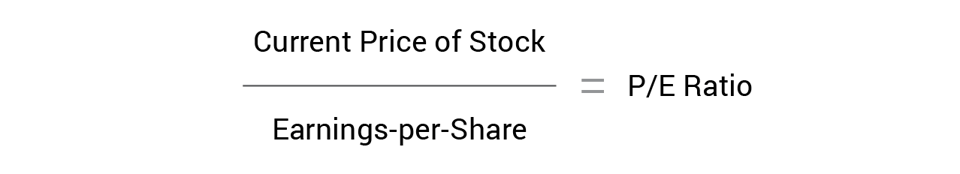

The P/E ratio is very straightforward: it measures the current trading price of a stock relative to the earnings of the company. (The equation looks like this: the price of a stock divided by the per share earnings of that stock equals the P/E ratio.) In reality, this simple P/E ratio has far more significance. In his book, Irrational Exuberance, Robert Shiller describes the price-to-earnings ratio as an indicator “of how expensive the market is relative to an objective measure of the ability of a corporation to earn profits.”1

A finance textbook will teach you that stock market values are forward looking—a stock’s current market price is based on investor expectations about a company’s future profitability. Analysts and the financial media typically cite two different P/E ratio measurements. The “Trailing” P/E ratio uses a company’s earnings-per-share over the previous—or trailing—twelve months. A “Forward” P/E uses analyst estimates for what they believe earnings-per-share will be over the next year.

To better illustrate, let's use FedEx (NYSE: FDX) as an example. Its stock is currently trading for about $171 per share and the company earned $7.89 in earnings per share of stock, according to its latest financial report.2 So, its trailing P/E ratio is 21.7 ($171/$7.89). Analysts believe FedEx is going to deliver increased profits-per-share in the future. Currently, the average analyst estimate for earnings-per-share in the next full year is $10.98. So, FedEx has a forward P/E ratio of 15.6 ($171/$10.98).

A strong correlation between earnings, profit margins, and the overall market exists.3 If companies deliver strong earnings, in line with (or better than) investor expectations, stocks will be on the rise. In good times, when global growth is booming, FedEx will ship more packages, increase revenue, and hopefully (from a shareholder perspective) find ways to cut costs. Its stock price will rise.

But, nobody has a crystal ball that can accurately predict the future. And sometimes investors can get a bit euphoric. Earnings expectations rise to levels that are overly optimistic relative to economic fundamentals or the ability of companies to actually realize profits which is why one should proceed cautiously when looking at this ratio.

To better assess a stock's current value, most analysts will often compare P/E ratios of similar companies operating in the same sector. For example, analysts will compare FedEx's P/E ratio with UPS's P/E ratio to get an indication of comparative value in the expected profitability of international shipping companies. It would not make sense to compare Facebook or Google's P/E ratios with FedEx because tech companies operate an entirely different style of business.

Dotcom Bubble: What Do P/E Ratios Indicate About Economic Sentiment?

P/E ratios can also be helpful when they are used to assess overall market sentiment, as opposed to sentiment on just one stock. A way to do this is to use the price-to-earnings ratio of the S&P 500 index—a stock index that tracks 500 stocks and is often considered a bellwether for the U.S. economy. Currently, the S&P 500 is trading around 2000 and the Forward P/E ratio for the index is 16.3 times its expected future earnings. In a vacuum, this number doesn’t tell us much, but in context we can see that at 16.3, this is 2.2 above the 10-year forward P/E average of 14.1.4

This may indicate one of two contradicting viewpoints. The first is that investors believe the economy is going to outperform expectations and companies will “beat” their forward earnings projections. That is, instead of earning $10.98 per share next year, analysts think FedEx may actually earn $12—and other companies will exceed expectations too. Thus, investors are bullish on the economy.

The second is that stocks are overvalued. Companies will earn about what companies are expected to earn and stock prices will regress to the mean of about a 14.1 P/E. Let’s look at the dotcom days to see both sentiments at play.

At the end of 1995, prior to the dotcom bubble, the S&P 500 index was trading at 615.93 and its forward P/E ratio was 15.5—slightly above today’s 10-year average. Then, for the rest of the 1990s, stock market investors went on a buying spree, corporations exceeded their earnings estimates, and a whole bunch of tech stocks (with no earnings to speak of) seemed poised to break out. When the clock struck midnight on December 31, 1999, the S&P 500 was trading at 1469.25—a 139% increase from the end of 1995. And the forward P/E ratio for the index was 26.6. Stock market prices and investor expectations for future earnings were buoyant.

But earnings did not come close to matching those euphoric expectations and the bubble burst (and so did the economy). Investors quickly turned pessimistic. They sold stocks and analysts adjusted their earnings estimates downwards as economic growth slowed, especially during the recession of 2001. By September 2002, the S&P 500 was back down to 815.28 and the forward P/E ratio had fallen to 15.4.

Conclusion

The P/E ratio is an indicator which provides some insight into investor optimism or pessimism about the ability of companies to produce earnings.

Today, investors are paying more for stocks relative to corporate earnings than they have, on average, over the past decade. The fact that stock prices are trading higher relative to earnings means that investors are optimistic about the ability of companies to realize greater profits in the future. Does this mean profits will materialize and the stock market will continue to rally? Only time will tell...