Blog Published June 23, 2025 · 3 minute read

Slashing Clean Energy Credits Could Cripple American Manufacturing and Energy Jobs—Especially in Red States

John Hebert & Ellen Hughes-Cromwick

New data released today from the Clean Investment Monitor (CIM) shows that planned clean energy investments are projected to support hundreds of thousands of jobs, ranging from building new facilities to day-to-day operations and beyond. But those jobs may never come to be if Republicans succeed in cutting clean energy tax incentives through reconciliation, putting clean energy investments across the US at risk of cancellation.

CIM, a collaborative project between Rhodium and MIT’s Center for Energy and Environmental Policy Research, tracks investments in clean energy and monitors new projects from their initial public announcement through completion. Their latest release provides a first-of-its-kind look into the types of jobs at stake if these investments do not proceed as planned, showing a breakdown of manufacturing jobs and jobs related to clean energy deployment on a state-by-state basis and with Congressional District granularity.

The data demonstrates just how much is at stake in the GOP tax bill—for clean energy and for the American economy. By sunsetting key tax credits, eliminating the ability for developers to sell their tax credits to other firms through transferability, and creating unworkable restrictions on the use of tax credits, President Trump’s new tax package puts all of this outstanding investment in jeopardy.

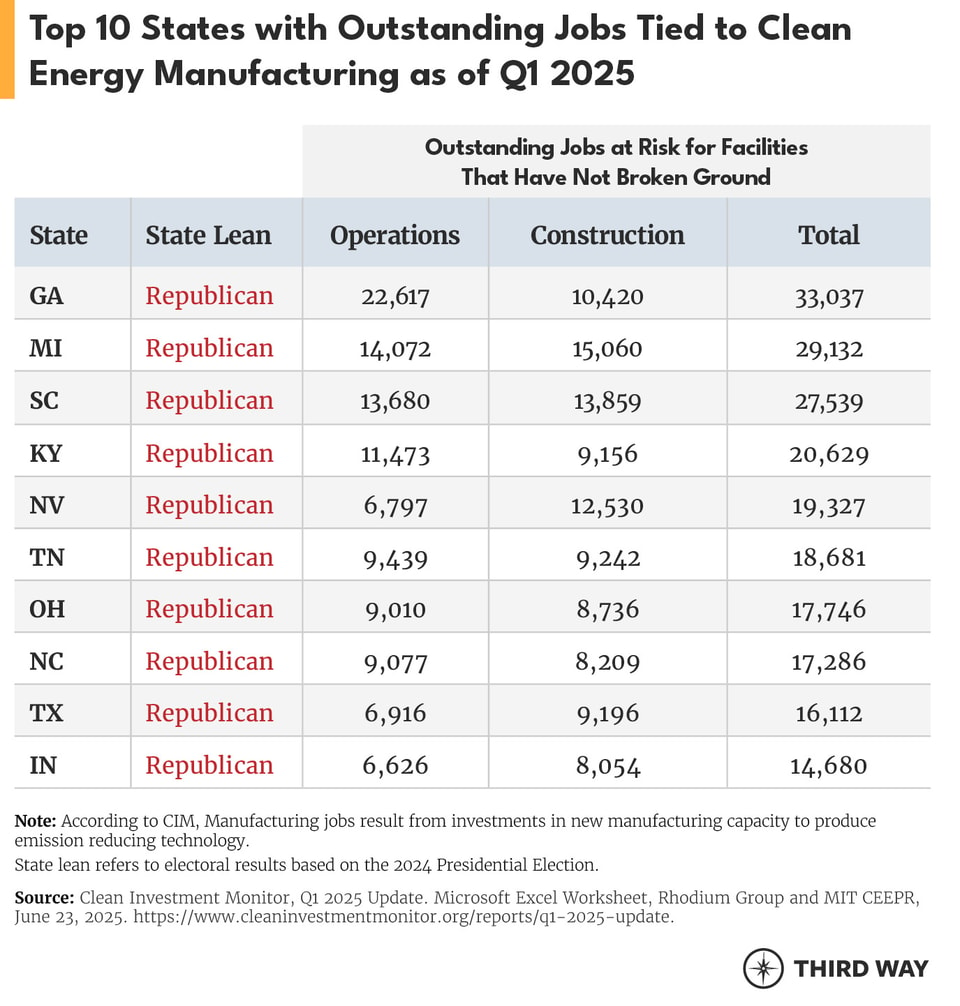

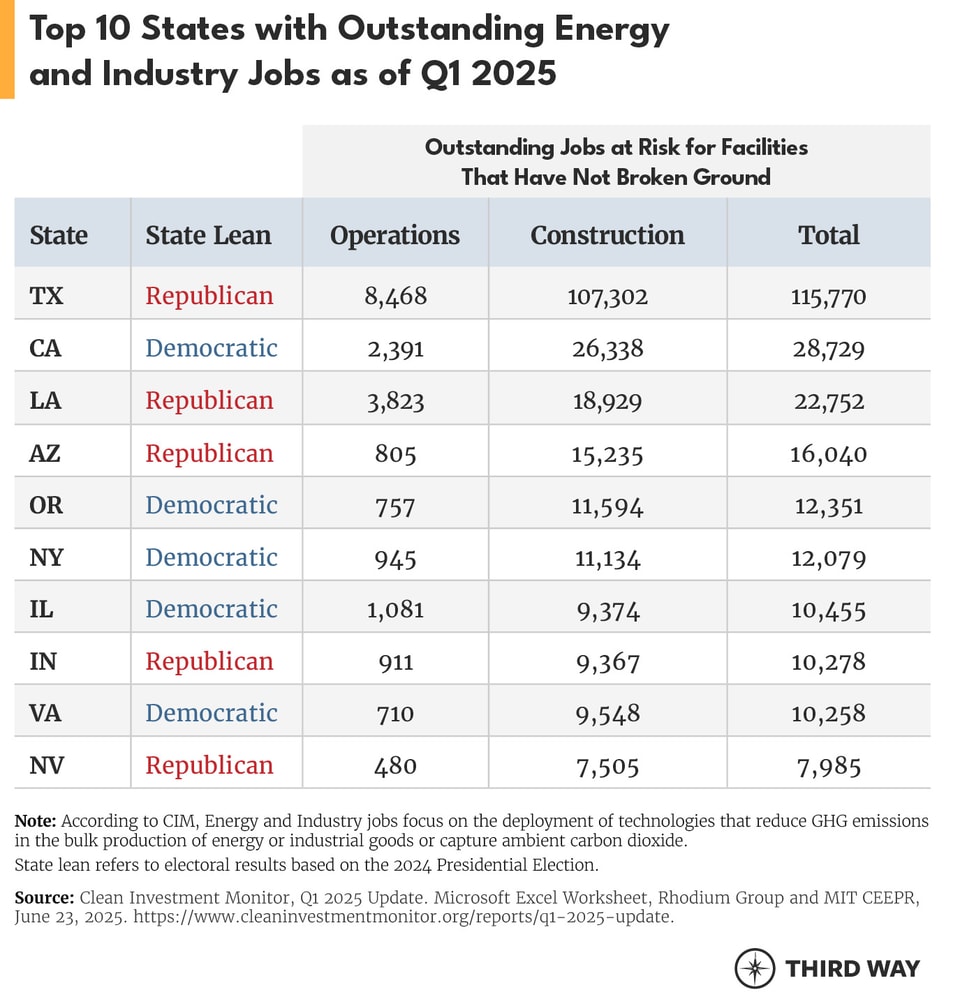

As we noted in a previous memo, over $600 billion has already been invested in clean energy since the Inflation Reduction Act (IRA) passed, but more than $500 billion in clean energy investments have still yet to break ground. The vast majority of that investment (77 percent) is planned for GOP-held districts, while the remainder is for Democratic-held districts. Similarly, CIM’s new data shows that 83 percent of all outstanding jobs related to clean energy manufacturing and 60 percent of all outstanding jobs related to clean energy deployment are in Republican-leaning states.

These aren’t just speculative jobs. Battery plants, solar supply chains, and EV component producers are already putting Americans to work building innovative new technologies and helping the United States build a competitive edge in these emerging industries. Tax incentives help existing projects secure continued investment and stay in business. Without them, both established and early-stage projects are vulnerable.

President Trump has said he wants to catapult the United States into a new manufacturing renaissance. But as currently drafted, his signature legislation is slated to become one of the largest job-killing packages for U.S. manufacturing in a generation. CIM’s data, included below, shows that eliminating clean energy incentives has consequences: fewer jobs, less investment, and a retreat from global competitiveness in key industries.

Conclusion

The Inflation Reduction Act has spurred unprecedented levels of investment in clean energy, creating hundreds of thousands of jobs across the country. The United States is now on track to be a global leader in clean energy innovation, so if Republicans in Congress succeed in rolling back these tax incentives, it’s American workers and thousands of small businesses that stand to lose.