Blog Published March 23, 2020 · 9 minute read

Critical Mass: Federal Reserve Now on the Curve But Not Ahead

Ellen Hughes-Cromwick

As we enter the third week of substantial disruptions in economic activity, including quarantines and shelter-in-place orders closing businesses, evidence is mounting that the job losses will be “in the millions” without a huge fiscal thrust to combat companies’ urge to lay off workers. While the Phase 3 stimulus package is being negotiated, more companies are reducing their workforces. GE today announced 2,500 job cuts in its aviation business. Boeing has shut down its production in Puget Sound, Washington today. And countless restaurants, barbershops, gyms, and more have had to shut their doors. Challenger, Gray & Christmas reported that they have seen 9,000 job cuts in several industries.

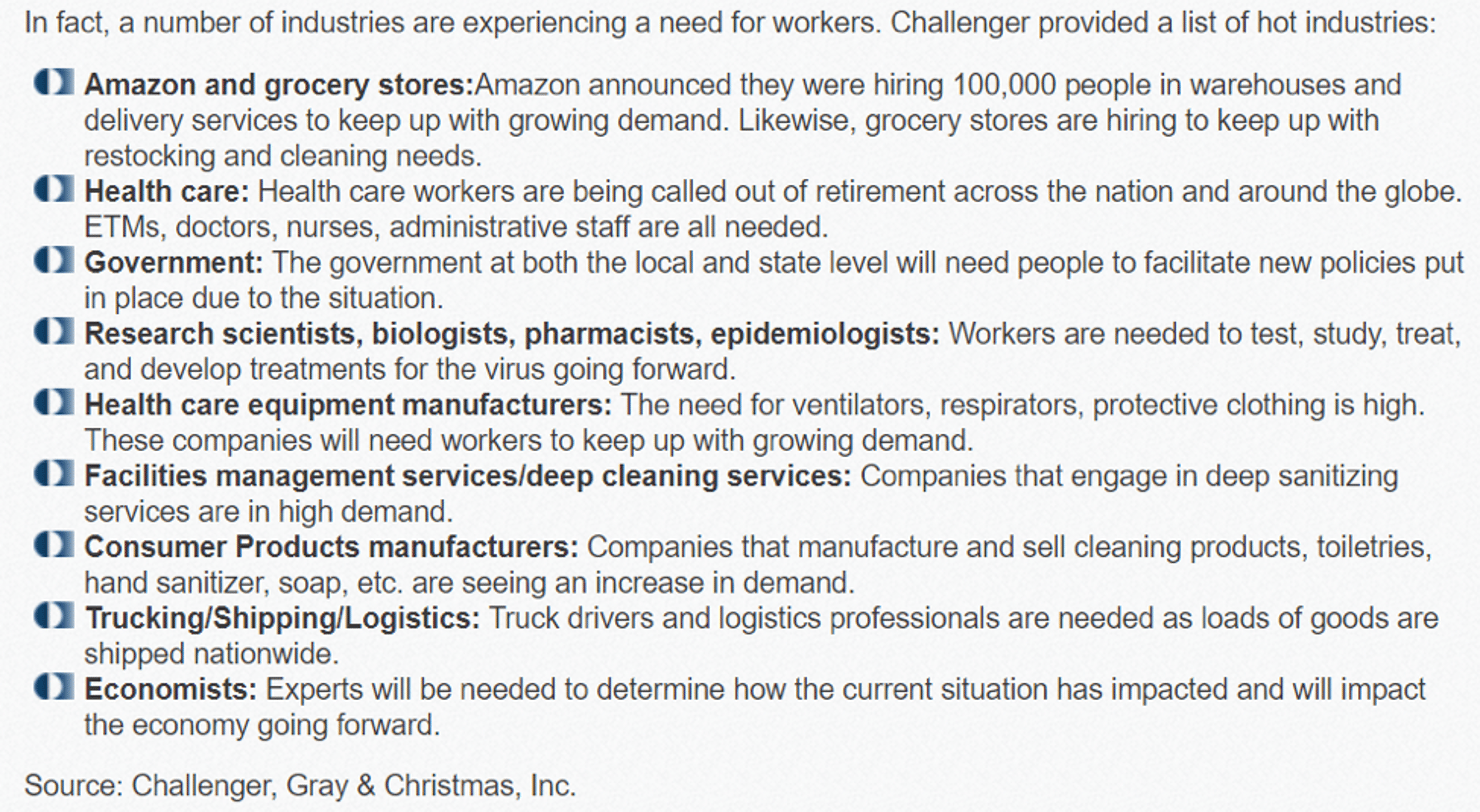

At the same time, they track job additions in several sectors (see table below). But these job additions likely pale in comparison to the layoffs due to business shutdowns.

The Federal Reserve’s injection of support for an ailing workforce and economy reached a critical mass this morning. As we have emphasized in prior blogs, go big and go fast were the clarion calls for action. As the stimulus package makes its way through Congress, the Fed made haste over the weekend to prepare an onslaught of liquidity facilities that covers practically every corner of the financial markets.

Of note is the focus on consumer loans and action by the Fed to support student loans, credit card loans, auto loans, and any loan that is guaranteed by the Small Business Administration, as well as “other assets” (to be defined). Up front I will say that this is great on the backend plumbing of the markets – but we need the fiscal front end. For example, we need businesses to defer payments, we need rent and mortgage deferrals for those who have lost their jobs. It is encouraging to see what Bedrock, a development company, has done in Detroit, jumping on a program to defer lease payments for small businesses in the city until July.

The Fed actions need to tango with the upcoming fiscal actions. At present, they are on the dance floor alone.

Here is a look at today’s Fed actions.

More Quantitative Easing

The Fed announced unlimited purchases of US Treasury bonds and agency mortgage-backed securities (MBS). Prior to this morning, this program was limited to $500 billion for Treasury purchases and $200 billion for MBS. In the schedule of purchases, they have indicated they will buy $125 billion each day this week, totaling $625 billion in just one week. Who does this help? These purchases help the entire financial system stabilize and keep borrowing costs from skyrocketing.

Primary Market Corporate Credit Facility

The Fed, under this program, will provide investment grade companies with 4-year financing and will also defer interest and principal payments for up to 6 months. This is for new loans and new bond issuances by these companies. This is unlike anything the modern-day Fed has done. Typically, the Fed veers away from offering funding for anything that has a modicum of credit risk. US Treasuries are, in principal, risk free and most financial market participants think that agency (i.e., Fannie Mae and Freddie Mac) MBS is risk free since these securities are backed by the US government. But corporate bonds? Well they have risk because those bonds depend on the financial health of the company. Some companies are low risk, AAA credits, but even those companies will encounter risks begining to escalate. On net, this lending program will help to support companies as they seek to bolster their funding in order to keep their businesses operating.

Secondary Market Corporate Credit Facility

This program is similar to the primary market facility, except it will allow the Fed to purchase existing investment grade corporate bonds that are traded in the secondary market. These are bonds that have already been issued and are traded by investors in the marketplace. Again, this is a historic move and opens up liquidity to any investment grade company encountering difficulty in the credit markets. The Fed will, with this facility, offer the ability to buy corporate bonds that are rated at least BBB-/Baa3. In other words, they will purchase bonds that have a credit quality which is lower than a top-notch AAA bond. This is meant to help the flow of funding for corporate credit based on existing, prior issuances of bonds. This is another way that the Fed is simply opening up the lines of funding for companies that issue bonds in order to raise money for capital spending and other business activities. It is a way for companies to go directly to the capital markets in order to raise funds, instead of, for example, going to a bank for a conventional loan.

Term Asset-Backed Securities Loan Facility

The Fed deployed this facility during the financial crisis in 2008-09 and is resurrecting it today. This loan facility will provide support for the issuance of all types of consumer and business loans, including student debt, auto loans, credit cards, and loans guaranteed by the Small Business Administration. What does this mean for students with loan balances, consumers with credit cards? This program will ensure that the interest rates on these loans won’t skyrocket in the future because of the health crisis we are currently battling. Making funding available means that the costs of borrowing will remain much lower than if the Fed did not come to the rescue.

Expansion of the Money Market Mutual Fund Liquidity Facility

This facility will now support an even larger range of securities, including municipal variable rate demand notes, and bank certificate of deposits. In normal times, these are very liquid financial instruments – they are easily traded and are very much like cash. But as redemptions at money market funds has increased, so too has the hesitancy of investors to buy these assets. In a crisis, everyone worries about the worth of any asset. Much depends on how far down the economy can go. It brings home the importance of providing these facilities when there is heightened uncertainty. We simply do not know how the COVID crisis will evolve in the coming weeks.

Expansion of the Commercial Paper Funding Facility

This liquidity facility helps provide support for commercial paper, a short-term security that many companies use to help with payroll obligations and other short-term outlays they need to make for business activities. The Fed expanded this facility today to include any commercial paper whose credit quality may have been downgraded since March 17, 2020. They also reduced the pricing for this funding by a full percentage point. For companies that issue commercial paper, this lending program means that the market will stabilize, again offering funds at reasonable cost in order to finance daily activities like making payroll.

Usually companies don’t put their cash in a vault, but rather can offer it to investors, even on an overnight basis, in order to get some positive return on the money. Sitting in a vault would mean they earn no interest on this “idle” money. This facility will foster growth in demand for this commercial paper once again and give companies some relief from an extreme tightening in this market since the COVID crisis began.

Next Up: Helping Main Street

Finally, the Fed announced it will launch a “Main Street Lending Facility,” however no details are yet available as it will depend on provisions in the Congressional stimulus package. This reportedly will dovetail the small business support administered through the Small Business Administration. This is not verified, just speculation at this point.

Where Do We Stand?

This plethora of lending programs is unprecedented and well beyond what we saw during prior crises. The Fed is supporting financial transactions and pricing for most higher quality credit and the US Treasury bond market. Further, with the reduction in interest rates to near 0% on March 15th, they have conducted monetary policy to extreme easing. It is a massive display of support and done quickly by historical comparison.

However, our nation’s businesses are quickly sliding toward low credit quality and rising defaults and bankruptcies. More Fed action will be needed because of the likely surge in credit downgrades. Already companies are experiencing credit rating downgrades because of the COVID crisis. This means that these companies will be shut out of the credit markets and will face severe business continuity challenges. The Fed’s mandate says that it is the “lender of the last resort,” however the lending programs for companies has always been an emergency backstop. And that backstop is available for higher credit quality companies. We face an even more unusual situation whereby business shutdowns are causing usually healthy companies to be impaired and downgraded. At some point soon, the Fed will need to open lending pipelines to these credit impaired companies, otherwise huge swaths of the business economy will be wiped out.

It is certainly true that a fiscal package, including direct support to companies with a requirement to keep people in their jobs, will be another life-supporting backstop for US workers and businesses. But I think the Fed will need to step further and support lower credit rated issuers in commercial paper, asset-backed securities and indeed corporate bonds so that we all can weather this health and economic crisis. To do anything less could fall far short of preventing an extended and protracted downturn. As of today, the Fed has jumped on the curve. Now we hope to see it get ahead of the curve in the coming days.