Report Published October 1, 2024 · 11 minute read

Revenue Won’t Solve It All

Zach Moller & Annie Shuppy

There is a popular and pervasive feeling among many progressives that all our fiscal and policy problems can be solved with tax increases on the wealthiest Americans.1 The problem is that sentiment is riddled with flaws.

Let’s be clear: taxes must play an essential and central role in restoring fiscal stability. But let’s also be honest: we cannot expect that revenue alone will solve our fiscal needs, and we shouldn’t reflexively shut down other policies. In this report, we lay out four reasons why tax policy shouldn’t be the only tool to fix our fiscal issues. Specifically, we show:

- The math just doesn’t add up.

- Growing the economy still matters.

- Not all spending cuts hurt people.

- Successful budget laws leaned on spending and revenue.

This report is the third in a series of papers through 2025 focusing on the deep fiscal challenges and opportunities within the United States. Third Way has already described why both Democrats and Republicans need to be fiscally responsible.

Reason 1: The math just doesn’t add up.

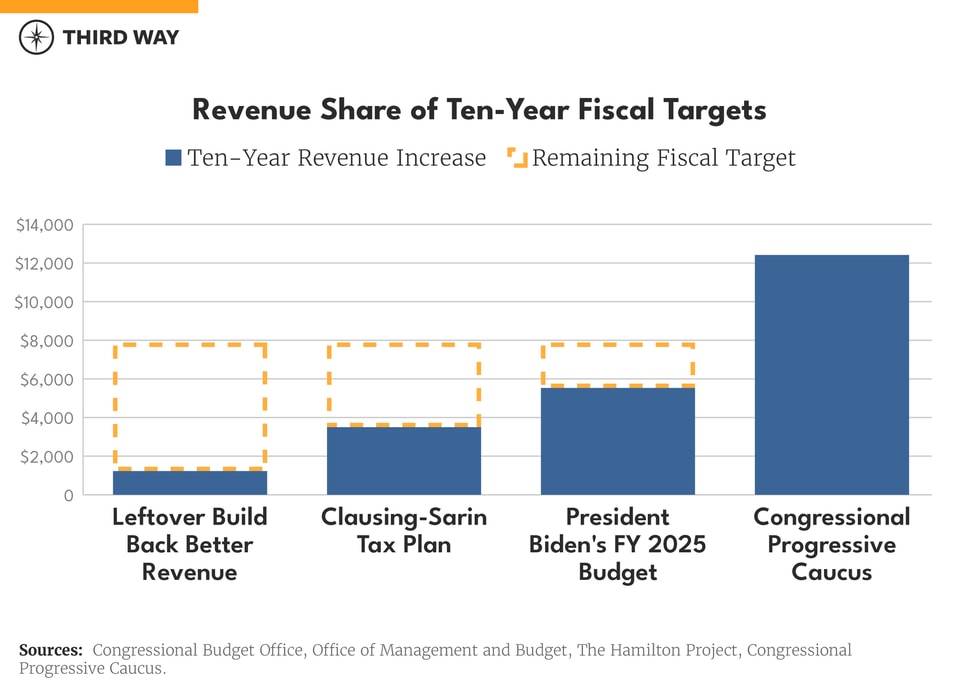

There’s simply only so much revenue the federal government can raise, even if all tax policies that many Democrats favor were enacted. Politics aside, three mainstream Democratic proposals show how popular plans wouldn’t come close to the revenue needed to stabilize our debt.

- There are several revenue policies included in the Build Back Better Act that were ultimately not enacted in the Inflation Reduction Act. They would raise around $1.2 trillion over 10 years.2 These include application of net investment income tax to some pass-through business income, limitations on excess business losses, a surcharge on high-income individuals, estates and trusts, and changes to international tax laws.

- Tax policies in President Biden’s FY 2025 budget would raise $5.5 trillion over 10 years. These include tax policy items such as raising the corporate income tax rate to 28% ($1.35 trillion) and a range of policies targeting the wealthiest taxpayers ($1.4 trillion), as well as changes to international tax provisions. Once policies that reduce revenue, such as an enhanced child tax credit, are included, however, the net revenue increase would dip to $4.9 trillion.3

- An alternative tax plan proposed by former Biden Administration officials Kimberly Clausing and Natasha Sarin raises $3.5 trillion over 10 years. It includes some of the items in the Biden budget and Build Back Better Act and also incorporates tax policies that have long been popular within the Democratic policy circles, such as a financial transactions tax and a corporate carbon fee.4

While the tax policies on a far-left wish list raise more, such plans would also accompany massive expansions of social programs that would increase spending. A Congressional Progressive Caucus tax plan from recent years, for example, was estimated to raise roughly $10.9 trillion over 10 years (or $11.7 trillion with the current budget window).5 It included tax policies such as marginal tax brackets on high earners of close to 50%, a financial transaction tax, and a significant increase to the taxation of capital gains and dividends.6 But the plan is likely to have less support in Congress than those previously mentioned.

How much is needed?

To stabilize the projected debt-to-GDP ratio, a feasible fiscal goal, we’d need roughly $7.9 trillion in deficit reduction over 10 years to close the fiscal gap of 2.2% of GDP.7 Mainstream Democratic tax plans would only cover as little as 15% of it and at best as much as 70% of it. With the limited exception of Clausing-Sarin, these estimates assume no extensions of the Tax Cuts and Jobs Act.8 Extending the Tax Cuts and Jobs Act for those making under $400,000 would cost at least $2 trillion more.

Spending cuts alone won’t realistically stabilize the debt either.

Attempting to fix the fiscal situation only through spending cuts is deeply unrealistic, terribly unpopular, and creates major tradeoffs.

Stabilizing the projected debt-to-GDP ratio with just spending cuts would be about an 11% ($7.9 trillion) cut to all non-interest spending, from Social Security to the VA. If we assume Social Security, Medicare, Defense, and veterans spending would be held harmless, then all remaining spending would need to be cut by 32%. Extending the Tax Cuts and Jobs Act (as Republicans are pushing for) would raise the spending cuts needed to 17 and 49% respectively.9

Reason 2: Growing the economy still matters.

Innovation, rising wages, and full employment are all products of a growing economy. Democrats are already fighting against a perception that they are more antagonistic to growth than Republicans, so they should tread carefully around certain revenue-raising policies that may excessively stifle growth.10 Here’s why:

- Different revenue policies have different effects on long-term growth: Robust long-term growth deeply matters for sustainability of the national debt.11 The Yale Budget Lab recently scored and estimated the macroeconomic effects of two TCJA extension scenarios against the Clausing-Sarin tax plan. They found that the full and partial TCJA extension scenarios increase real GDP temporarily, but the fully paid-for Clausing-Sarin plan resulted in a faster path of real growth after five years. By the end of 2054, GDP would be 0.85% larger under the Clausing-Sarin plan, compared to 0.35% lower and 0.5% lower from partial and full extensions respectively. Not only was the Clausing-Sarin plan more pro-growth in the long run due to increased business investment, and the plan also lowered interest rates due to deficit reduction.12 In addition, Democrats should be wary of tariff increases that could slow the economy, hurt the job market, and raise prices.13

- Revenue policies have an impact on competitiveness: Tax policy sets the stage for business investment, hiring, innovation, and expansion. The argument for lowering the corporate tax rate from 35% centered on global competitiveness. Lower rates in other countries incentivized US business to expand and house capital overseas. While the ideal corporate rate and deductions will constantly be up for debate, there needs to be a balance between raising adequate revenue while also ensuring US businesses can compete and grow.

- Some wealth taxes can have unintended consequences: We need to increase taxes on the wealthy, but it needs to be done in the right way. For example, wealth taxes might raise a ton of initial revenue, but there is a real risk they damage investment incentives and deplete our capital stock. The largess from an heir or heiress’s conspicuous consumption is one thing, but if certain wealth is being put to productive use (e.g. to build more factories in the United States or create more innovation), then a wealth tax could have unintended consequences. Further, many countries that have implemented wealth taxes have later abolished them due to implementation difficulty, inefficiencies, and even liquidity problems in paying the tax, especially during economic downturns.14 Finally, there is robust debate regarding the constitutionality of some of these forms of taxation. Regardless, various types of capital income or transfer taxes might be a more precise approach to limit economic harms.

Reason 3: Not all spending cuts hurt people.

Traditionally, Democrats have resisted spending cuts, insisting that cuts are “austerity” and harm people.15 Sometimes they are right to fight cuts, especially as Republicans have demanded draconian reductions to food stamps, health care for children, and infrastructure investment.

But not all spending cuts are created equal. It’s important to show the American people that reducing spending can be smartly done, in part to be a foil against the unrealistic and damaging spending cuts Republicans call for. Here are four good types of spending cuts that can be paired with revenue for a bigger fiscal impact:

- Program integrity: Some spending cuts focus on improving program quality and making sure payments and benefits go to the intended recipient. When fraudsters bilk the federal government for billions in unemployment insurance funds, for example, that’s bad and should be stopped. Or when we design bespoke software for the federal government when something off the shelf will do, money is wasted. Program integrity is an effort to reduce waste, fraud, and abuse.

- Cost growth control: Some spending increases over time as more people need a given service. But some spending growth is due to inflation and rising costs of the same service or item. Take health care, for example. We can be smarter about health care spending without reducing benefits. Spending on hospitals unrelated to the care received accounts for notable portions of federal health care expenditures, including Medicare, Medicaid, and subsidies for private coverage. Addressing hospital consolidation would curb high prices and produce budget savings—improving value for seniors and everyday Americans without sacrificing health.

- Entitlements for the very well off: Will Elon Musk and his fellow billionaires need all of their entitlement benefits while they are still wealthy?

- Interest payments: Interest payments on the debt are the costs of past decisions. The next generation has no say on the choices that led to these expenses. The federal government spends more on interest than on children, Medicaid, or even the Department of Defense. Reducing interest spending can happen two ways—lower interest rates on federal debt and reducing the deficit through revenue increases or other spending cuts. The latter is directly in the hands of policymakers.16

Reason 4: Successful budget laws leaned on spending and revenue.

Historically, when policymakers acted in a fiscally responsible way, they looked at both sides of the ledger. For example:

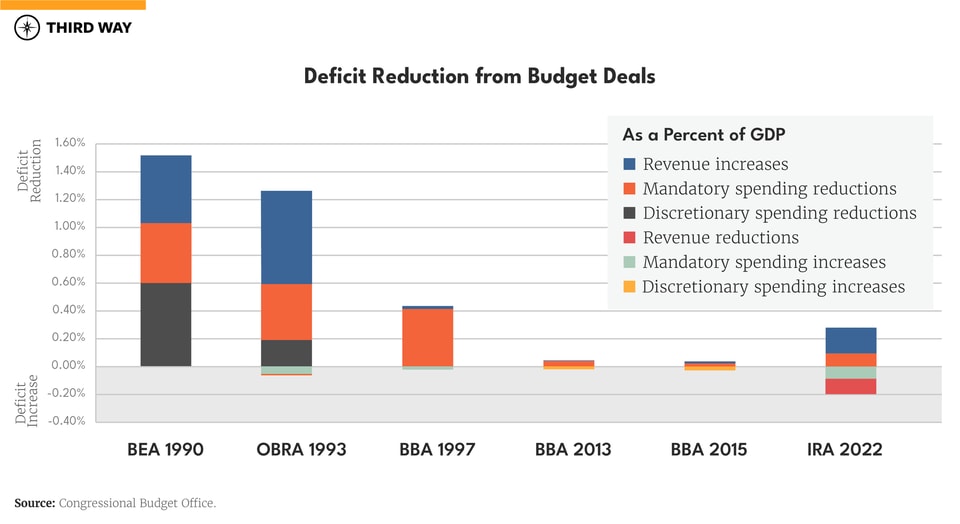

- The mix of deficit reduction from the Budget Enforcement Act of 1990 (1.5% of GDP over five years) consisted of roughly 32% from revenue increases and 68% from reductions in both mandatory and discretionary spending.17

- The Omnibus Budget Reconciliation Act of 1993 was tilted slightly more in favor of revenue. Deficit reduction from OBRA-1993 (1.3% of GDP over five years) consisted of roughly 53% from revenue increases and 47% from reductions in both mandatory and discretionary spending.18

The budget agreement that followed, the Balanced Budget Act of 1997, was smaller in its fiscal impact (0.4% of GDP over 10 years) and tilted more towards spending reductions. Roughly 5% of the deficit reduction from the 1997 agreement came from revenue increases, and 95% came from spending reductions—most of those changes came from Medicaid benefit calculations.19

- The 2013 Bipartisan Budget Act included $85 billion in gross deficit reduction/offsets, 8% of which consisted of revenues and 92% of which consisted of spending. After accounting for $62 billion in increased discretionary spending, net deficit reduction was roughly 29% revenues and 71% in net spending reductions.20

- The 2015 Bipartisan Budget Act produced nearly $86 billion in gross deficit reduction/offsets over 10 years—roughly 38% revenues and 62% mandatory spending reductions. It also increased discretionary spending by $79 billion and mandatory spending by $5 billion, leaving a marginal deficit reduction.21

- The Inflation Reduction Act was one of the largest balanced deficit reduction bills in recent history. IRA’s total deficit reduction was split between 66% revenue increases, including revenue from IRS enhancement, and 34% spending cuts.22

These examples show that, if history is a guide, expect a mix of deficit reduction policies as a path forward. To be sure, two budget deals of the past 15 years (the Budget Control Act and the Fiscal Responsibility Act), exchanged discretionary spending caps for debt limit increases. However, both of those deals were repeatedly revisited with various bipartisan adjustments, including the two listed above, to further adjust the discretionary changes.

A balance between revenue and spending cuts is also evident in plans put forward by well-regarded budget experts on both sides of the aisle. The Peterson Foundation asked experts from seven think tanks across the political spectrum to develop budget plans that put the debt-to-GDP ratio on a more sustainable course. All of the proposals included both revenue increases and spending reductions.23

Conclusion

As policymakers turn their attention to the 2025 tax debate, they must realize they have to do more than “do no harm” when it comes to tax revenue. The federal fiscal challenges will not be solved without substantial contributions of revenue above and beyond paying for whatever extensions of the Tax Cuts and Jobs Act policymakers decide on.

But Democrats must realize broader fiscal health won’t be solved solely on the back of tax revenue either. The political will for the level of tax increases needed is not there, and eye watering tax increases that don’t consider the impact on the economy are not smart politically or substantively. Further, the spending cuts do not need to greatly harm the general public and are often included in successful budget legislation as part of the mix.