Report Published July 9, 2024 · 8 minute read

A Case for Republican Fiscal Responsibility

Zach Moller & Annie Shuppy

Republicans claim to be the party of fiscal responsibility. And with budget issues like the debt limit and expiration of President Trump’s tax cuts looming, expect more touting of their economic accolades. There’s one problem: their hands are dripping in red ink. Their record is full of fiscal hypocrisy.

As we’ve written in the past, we’ve reached the point where making progress as a country isn’t possible without a newfound commitment to fiscal responsibility by both parties. In our last paper, we took Democrats to task for their share of the fiscal mess we are living in. Now it’s Republicans’ turn. They need to wake up to their responsibility and be reminded of what is at stake if they don’t change. If debt grows unsustainably and economic instability emerges, Republican interests will be just as vulnerable as Democratic interests.

This report lays out five reasons why Republicans need to get their act together and move from pretending to actually caring about comprehensive fiscal responsibility:

- Republicans have blown up the debt.

- The Republican wish list is pricey.

- Fiscal showdowns inevitably help Democrats and hurt Republicans.

- Republican states and voters overly rely on social assistance programs.

- The “no new taxes” pledge is obsolete.

This report is the second in a series of papers through 2025 focusing on the deep fiscal challenges and opportunities within the United States.

Reason 1: Republicans have blown up the debt.

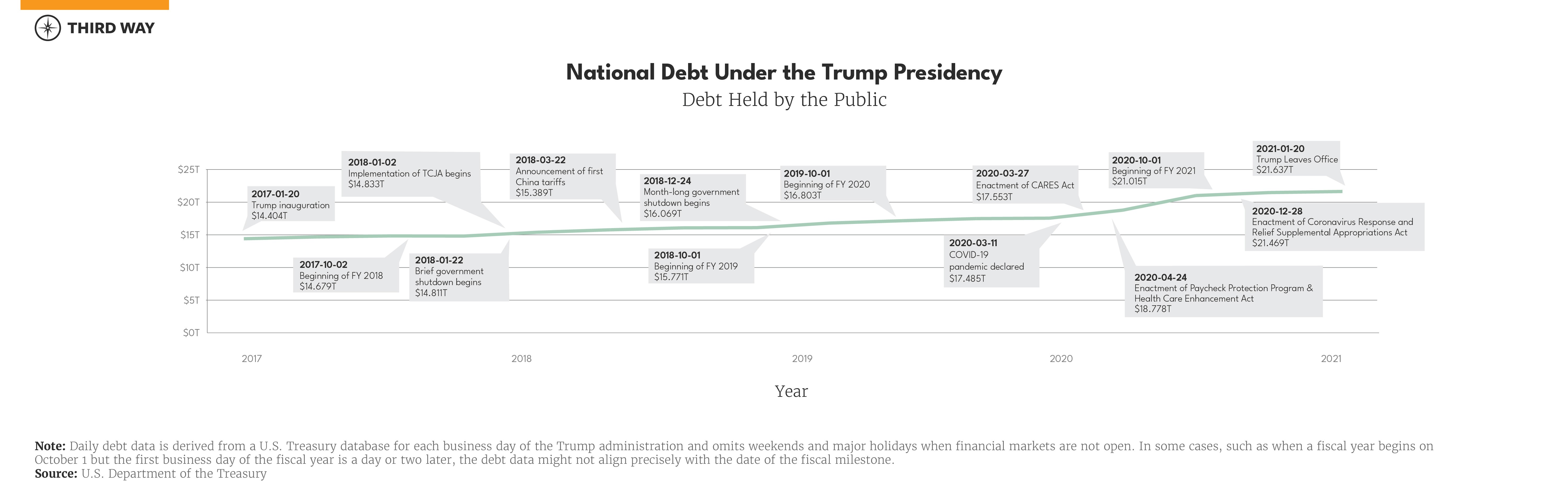

President Trump added $8.4 trillion to the national debt, and the debt-to-GDP ratio jumped 23 percentage points.1 By the end of Trump’s four years in office, the nation reached a debt-to-GDP ratio of 99%, a return to levels unseen since the post-WWII era. In FY 2020 alone, debt-to-GDP grew by nearly 20 percentage points—the second-largest year-to-year increase since 1940.2

Yes, global and domestic crises contribute to growing deficits and debt. That’s a crutch. The policies that an administration and Congress pursue in times of relative stability also shape the nation’s fiscal trajectory. Even before the COVID-19 pandemic, Trump had already added $4.8 trillion to the national debt in three years, with the single largest item being the Tax Cuts and Jobs Act.3

While President Trump is the undisputed king of debt, the Republican legacy of fiscal profligacy predates him. Large, unpaid for tax cuts were also pursued under President George W. Bush who helped turn a budget surplus into a budget deficit. The deficit ballooned again with the 2008 financial crisis at the end of his presidency.

Vice President Dick Cheney once said, “Reagan proved deficits don’t matter.” But President Reagan pursued substantial tax cuts hoping to pay for them with massive cuts in federal spending.4 One of the many issues was that, while most of the tax cuts survived, the spending cuts did not. Money was simply moved from domestic spending to defense spending.

Reason 2: The Republican wish list is pricey.

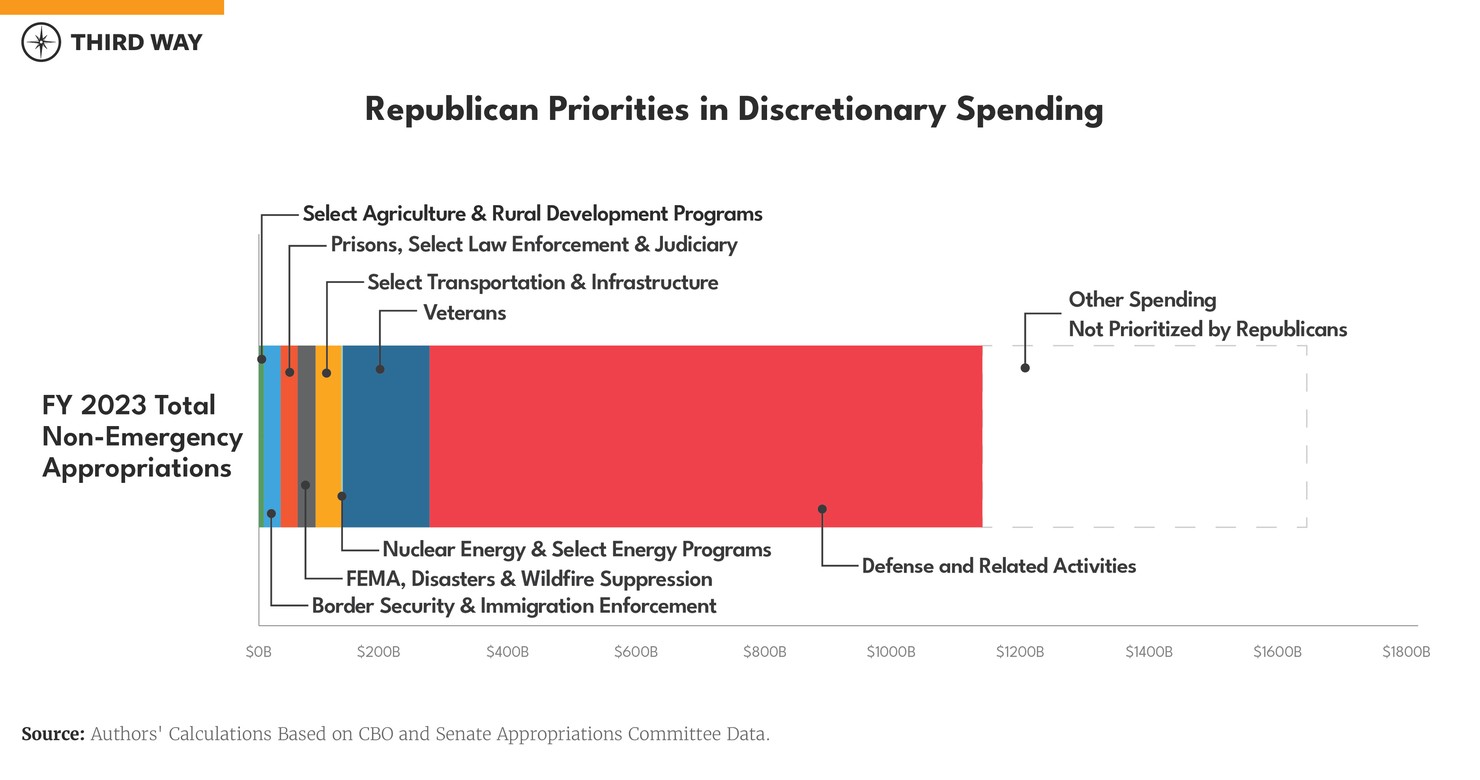

Republicans love to trash discretionary spending, particularly non-defense discretionary spending, but some of their biggest policy priorities are funded through the annual appropriations process. More than half of base discretionary funding in FY 2023 (53%, or $858.4 billion) went to the Department of Defense and related defense activities.5 Most Republicans are loathe to cut any funding for DoD and often want to increase spending.

On the nondefense discretionary side of the budget, Republicans regularly say they want to fund border security, law enforcement, and infrastructure programs—which cost $26 billion, $26.3 billion, and $39.7 billion in FY 2023 discretionary spending, respectively.6 Veterans’ programs, including the growing VA health care programs, accounted for $134.7 billion of FY 2023 appropriations. Republicans never talk about real cuts to the VA. Disaster relief, FEMA, and wildfire suppression—which often provide support to states and districts in the South and the West—received $27.9 billion in FY 2023 appropriations. Smaller pools of money fund other programs that Republicans have advocated for increasing, such as nuclear energy and other energy programs ($2.5 billion) and select agriculture and rural development programs ($7.6 billion).

Add that up and at least 70% of base discretionary spending is on the GOP wish list.7 And that’s being conservative!8

Reason 3: Fiscal showdowns inevitably help Democrats and hurt Republicans

Republicans generally make their fiscal stand during legislative cliffs, like the debt ceiling. When will they learn?

When it comes to fiscal showdowns, Democrats get recognition for avoiding disruptive events like government shutdowns or defaults on debt, and Republicans often get blamed for causing the drama. In multiple instances over the past decade, Republican leaders have needed Democrats’ votes to get legislation passed to avoid brinkmanship, even when they have controlled one or both chambers of Congress.

In the lead-up to both debt limit debates in 2023 and 2011, polling found that a plurality of Americans would blame Republicans if the US government were to default.9 Further, Americans have viewed Democrats more favorably in other major fiscal standoffs since 2010, including the three government shutdowns in that period and the “fiscal cliff” at the end of 2012.10 In January 2019, 52% of registered voters polled blamed Trump for the 35-day government shutdown. Compare that to the aftermath of the 2013 government shutdown, in which 29% of Americans blamed Obama versus 53% who blamed Republicans.

Creating more brinkmanship makes the Republican Party look like the party of chaos and crisis. The outlook for fiscal policy over the next decade, in particular, demands steady guidance.

Reason 4: Republican states and voter overly rely social assistance programs.

The poorest, most heavily reliant states on the federal government are Republican states. Often, these states also have a major imbalance between the benefits they receive from the federal government and the contribution they make in federal tax receipts. The states with the highest proportion of residents on Supplemental Security Income—Mississippi, West Virginia, Kentucky, Louisiana, Arkansas, and Alabama—voted Republican in every presidential election this century. As did eight of the ten states with the lowest per capita income, according to the Federal Reserve. Louisiana, Oklahoma, and West Virginia ranked second, third and fourth for per capita SNAP usage. Five of the top ten states for per capita Medicaid and CHIP usage are Republican.11

Even Social Security Disability Insurance, which isn’t associated as often with the poor as SSI or SNAP but eclipses both programs in federal spending, doles out large shares of its benefits to red states. Florida and Texas received the second- and third-highest proportions of SSDI benefits in 2022, while Alabama, Arkansas, Kentucky, Mississippi, and West Virginia topped the list for percentage of population receiving SSDI.12

While there is nothing wrong with some states needing this assistance, as combatting poverty and supporting those who cannot work are of national importance, the disconnect between the needs of their citizens and federal representation is stark.

When the GOP calls for more restrictions on safety net programs, many red state voters are poised to lose out. The far-right wants to punish the poor—which is terrible politics and policy. Roughly three-fourths of Americans favor retaining or even increasing aid to the poor.13

Reason 5: The “no new taxes” pledge is obsolete.

Why are Republicans committed to cutting taxes for a class of voters they hate, such as George Soros, Mark Cuban, and Taylor Swift? And why are they now fine with President Trump’s new plan to raise costs on everyday Americans with huge import taxes known as tariffs? One estimate of President Trump’s new tariff proposal shows that everyday Americans would see an annual $1,500 increase in costs.14

Once upon a time, the federal government was on a path where tax revenue grew with the economy, but that trend has now been reversed.15 CBO projects that with extensions of the Trump tax cuts, revenue as a share of the economy will remain below a 50-year average.16 Those levels are insufficient for our aging population and the spending needs discussed above.

Amid this, the Republican “no new taxes” pledge has deeply lost the plot. GOP tax policies have not been about economic efficiencies but, rather, about cuts for cuts’ sake. Of the $1.456 trillion in net revenue reductions from the TCJA, roughly 80% was attributed to rate cuts for individual taxpayers.17 Because major Republican tax bills such as TCJA and the two George W. Bush tax cuts were done under reconciliation (and by design were set to expire), they actually harmed long-term planning and economic impacts were just a short-term sugar high.

The Republican electorate has changed but the tax policy is stuck in the past.

Conclusion

Republicans have a ready answer on fiscal responsibility—the balanced budget amendment. But it is a phony, poll-driven platitude meant to avoid fiscal responsibility, not enhance it. Enough of the performance art on the budget.

No matter who is in charge of the White House or Congress, there will be a series of high-profile budget battles in 2025 around the debt limit, taxes, and government spending. Historically, budget battles have not been kind to the Republican party. However, it’s not too late for them to wake up and change course to be more fiscally responsible. After all, the GOP wish list is pricey, their voters rely on social assistance programs, and their tax pledge is completely obsolete.