Memo Published September 9, 2025 · 8 minute read

Have Rising Insurance Rates Made Americans More Supportive of Climate Action?

Mary Sagatelova, Emily Becker, & David de la Fuente

Home insurance rates have surged in states like Florida, North Carolina, and Mississippi, as climate change causes natural disasters to increase and intensify. But does messaging referencing the growing cost of home insurance make Americans more likely to support climate action or more enthusiastic about clean energy investments?

Recent research from Third Way shows the answer is…not really.

In a survey of 1,000 likely 2026 voters conducted by Third Way and Impact Research, respondents 1) were concerned about the cost of living, 2) understood that climate change increases the frequency of natural disasters, and 3) knew that natural disasters increase the cost of homeowners' insurance.

But that awareness did not meaningfully motivate them to support investments in fighting climate change.

The survey, which included a 600-voter oversample in Florida, Louisiana, Mississippi, North Carolina, and Texas, showed Americans know climate change is real and want to address it, but they aren’t sure it’s a priority issue for them and their families. Here are a few key takeaways:

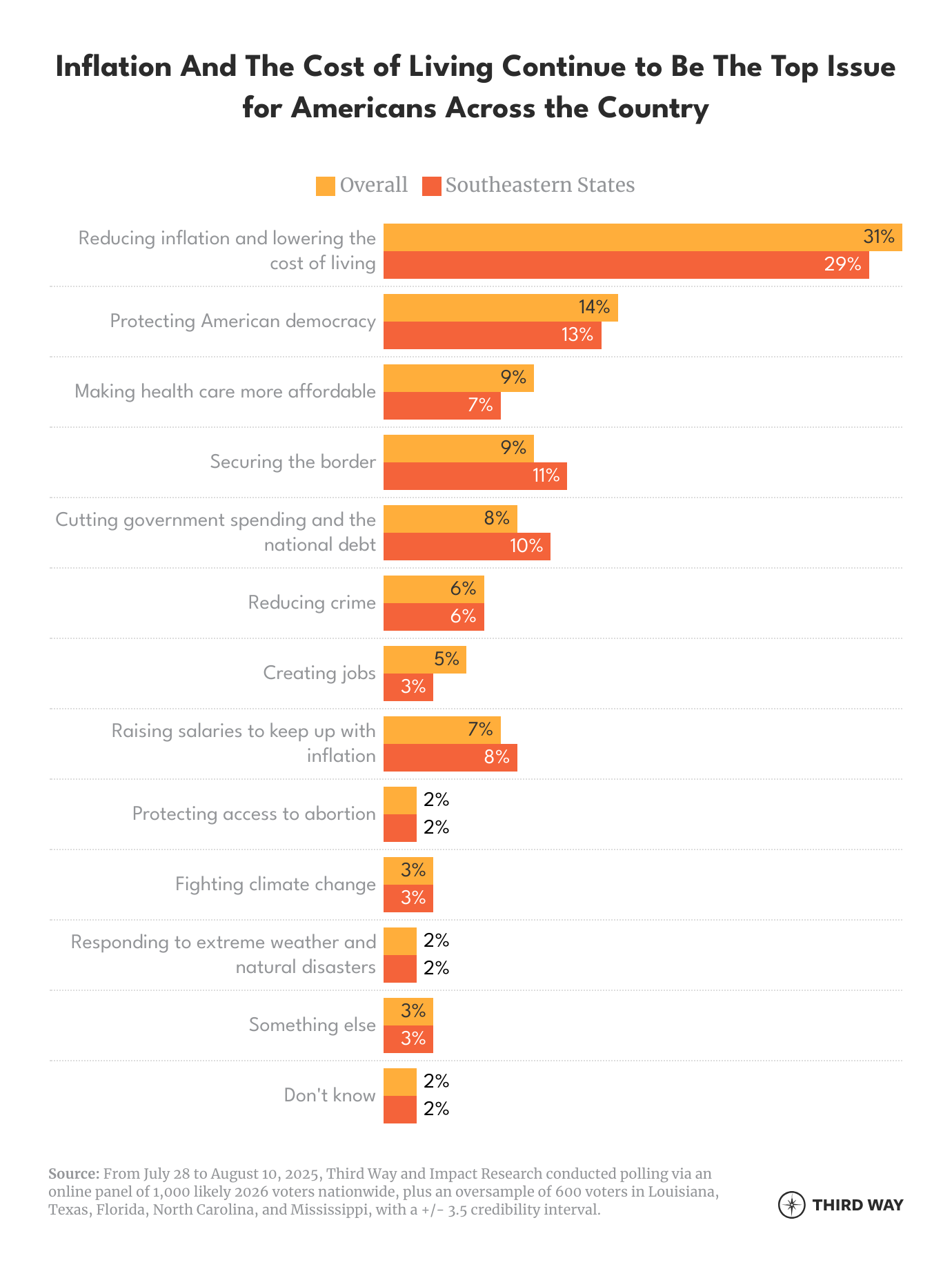

- More than 50% of Americans say climate change is an urgent threat, and 80% think the US is increasingly impacted by serious natural disasters. But just 3% say climate change is their top priority for elected officials today.

- Respondents nationwide found that “preventing natural disasters” was a better reason to support climate action than “lowering insurance costs” by 12 points.

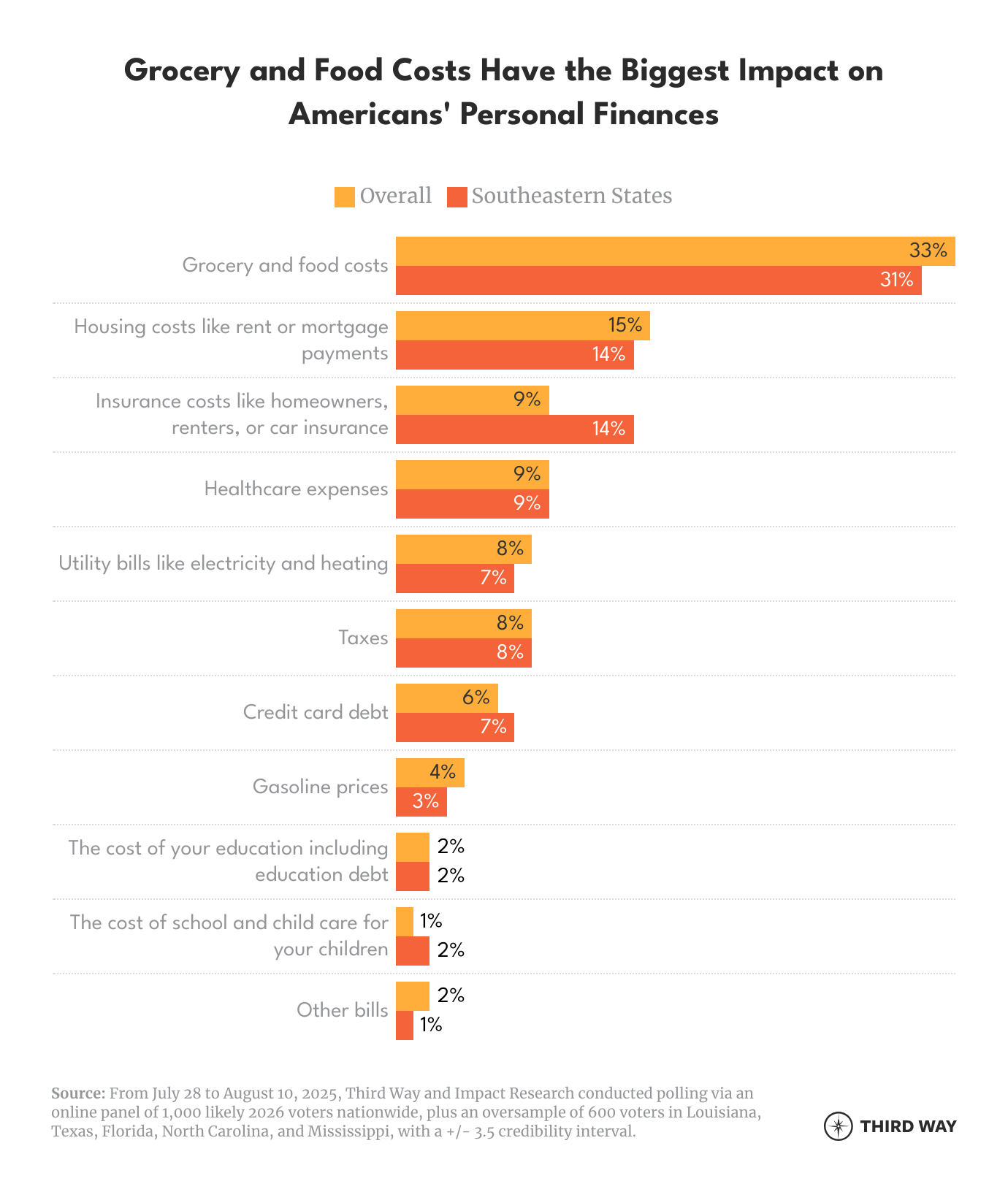

- Among respondents who have homeowners’ insurance, a third (37%) say it is a big expense. In the Southeast, that number is higher, a little over half (51%) say their insurance is a big expense. But all respondents were more likely to rank groceries as a bigger financial concern than insurance or other recurring costs like housing and health care.

- Americans’ cost-of-living concerns remain paramount–but home insurance costs don’t sufficiently motivate respondents to support policy changes for climate action.

Americans Say Climate is Real and Urgent… Just Not Right Now

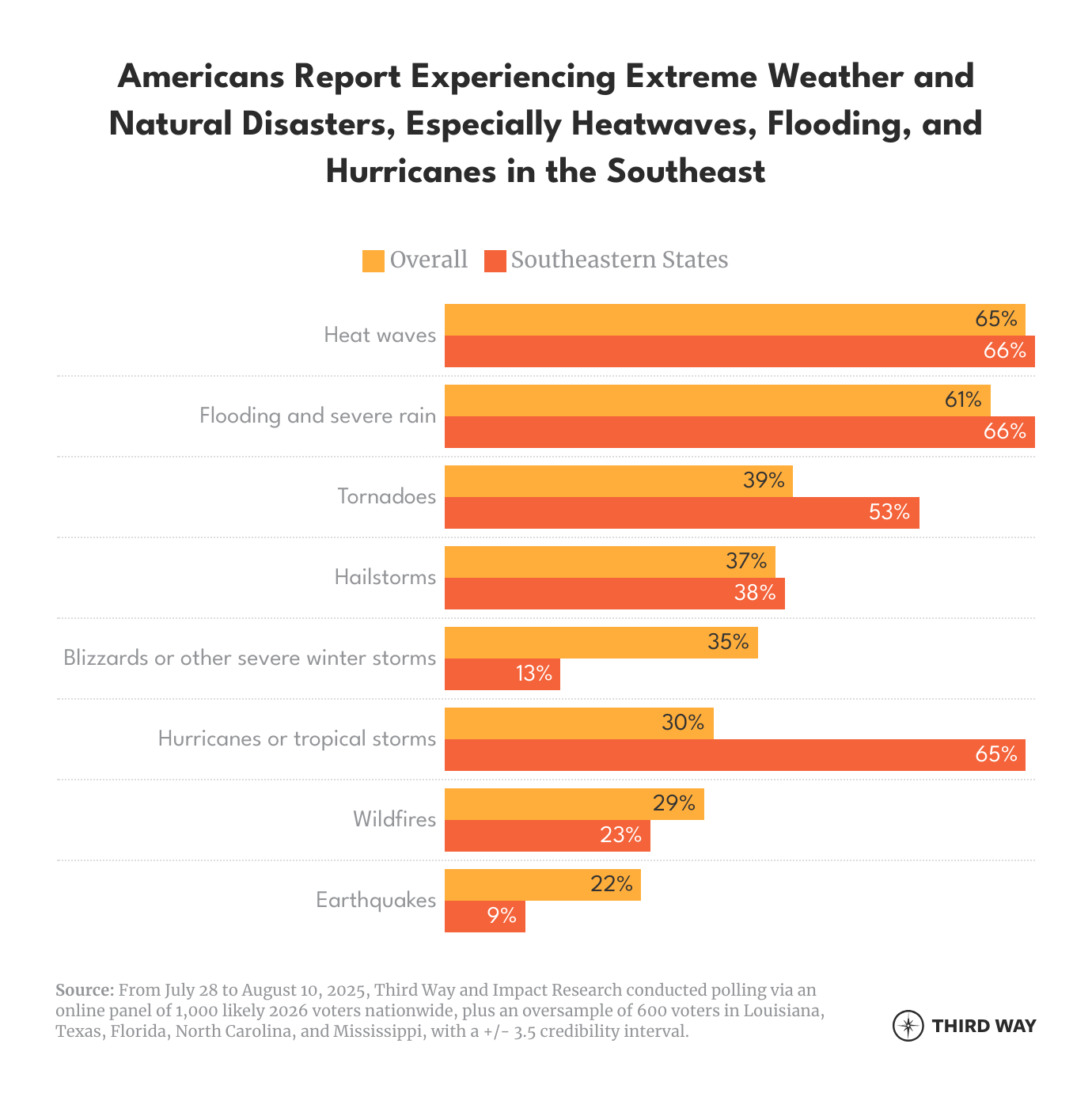

Total climate denial is dead. More than 80% of Americans understand that climate change is real and that its impacts are getting worse. The vast majority of survey respondents (79%) said they saw some impact of climate change in the United States, and most said that extreme weather events in their area had increased in recent years.

In the Southeast, Americans were more likely to have personally experienced severe weather (73%), like hurricanes, flooding, and extreme temperatures, than those in the nationwide sample (66%). Among those who felt natural disasters were more common, the vast majority felt climate change was to blame both nationwide (69%) and in the oversample (63%).

Despite experiencing the direct effect of climate change in their daily lives, just 4% of Americans and 3% of Southeastern respondents view climate action as their top priority for elected officials. More than half of all respondents (53%) said climate was an ‘urgent’ issue–but it simply doesn’t surpass concerns about kitchen table issues and inflation.

Importantly, the plurality of Americans (42%) say climate change is caused by a combination of human activity and natural cycles.

Respondents clearly understand that natural disasters are growing more frequent because of climate change. They know that climate action is urgent, but they feel it is not entirely within their control.

Insurance Costs are Front of Mind in the Southeast

Both nationwide and in our Southeastern oversample, respondents said that grocery costs had the greatest impact on their personal finances. These responses reflect how dramatically grocery costs have increased relative to other expenses. Consumers spent an average of 10.6 percent of their personal income on food, a fraction of what they spend on housing, but the inflation rate for groceries has been five times that of the inflation rate for housing and other essential goods. When they list groceries as their top concern, respondents are not reacting just to the real share of income they’re spending on food but also to the increases they see each week at the grocery store.

Similarly, respondents in the Southeast, where insurance premiums are about 15% higher than the national average and rapidly increasing, cited insurance costs as the second biggest stressor for their family budgets. Home and rental insurance is burdensome everywhere, but Southeastern respondents are especially attuned to increases to their premiums.

Who to trust and who to blame?

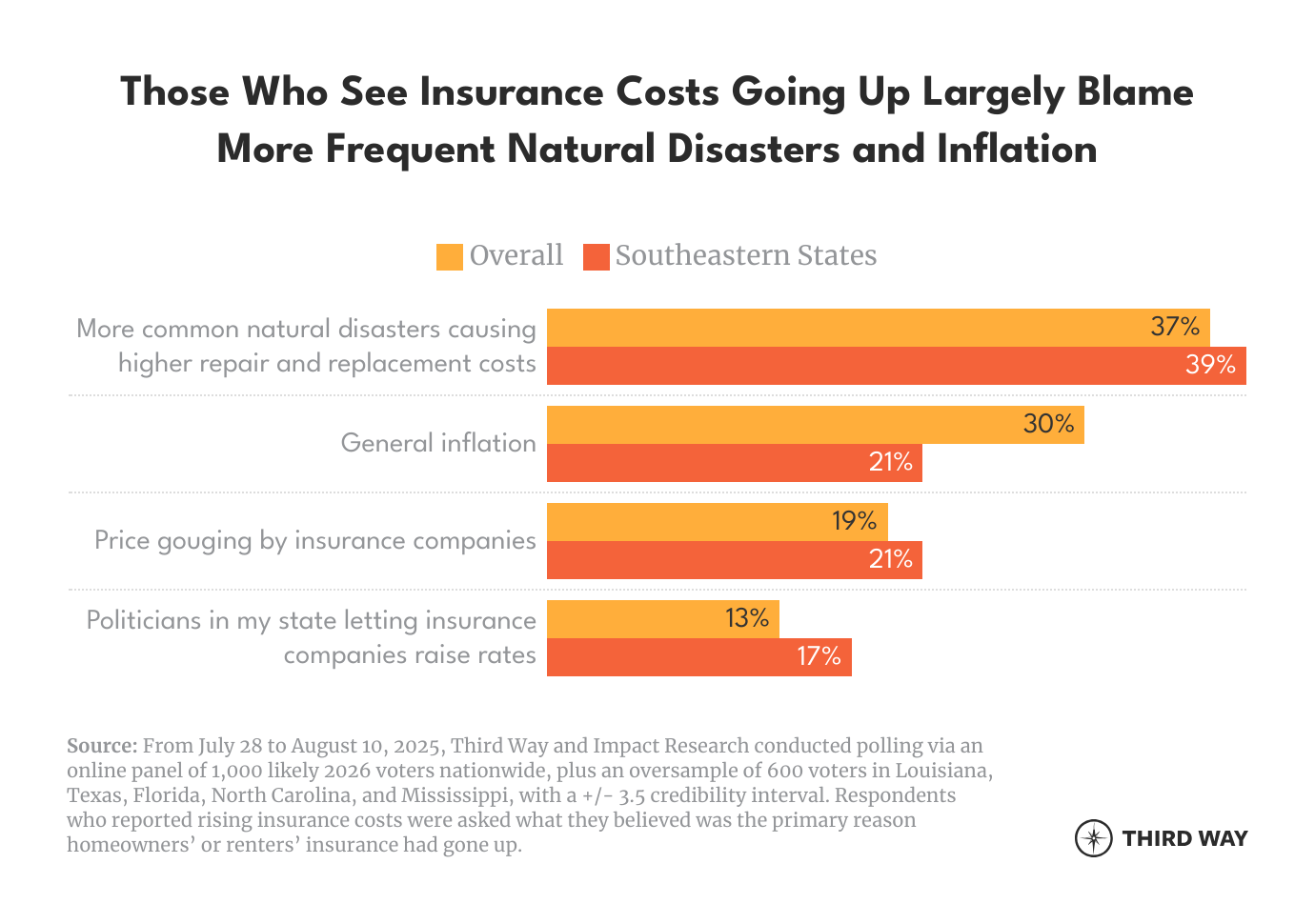

Most Americans don’t blame politicians, or even insurance companies, for their soaring insurance premiums.

Among those who reported that their insurance costs had recently increased, the plurality (37%) cited the growing frequency of natural disasters as the primary cause, followed by inflation. In the Southeast, inflation and price gouging by insurance companies tied for the number 2 spot.

Even if some respondents suspect insurers of excessive rate hikes, their broader reputation remains fairly neutral. Nationwide, insurers have a 50% favorability rating. In the Southeast, the reputation is slightly more negative, with favorability at 46%.

Broadly, Americans seem to understand that many factors drive rate increases and believe that Washington currently has little influence over growing premiums. Nationwide, respondents place more trust in Democrats (41%) to stop insurers from raising rates than in Republicans (34%). In the Southeast, that dynamic flips, with a plurality placing greater trust in Republicans (39%) than in Democrats (33%). A significant percentage of respondents nationwide (16%) and in the Southeast (19%) trust neither party to stop unfair pricing.

Do rising insurance rates strengthen support for climate action?

Respondents 1) were concerned about the cost of living, 2) understood that climate change increases the frequency of natural disasters, and 3) knew that natural disasters increase the cost of homeowners' insurance. But did messaging that referenced the growing cost of home insurance make participants more likely to support climate action or more enthusiastic about clean energy investments? The answer is…not really.

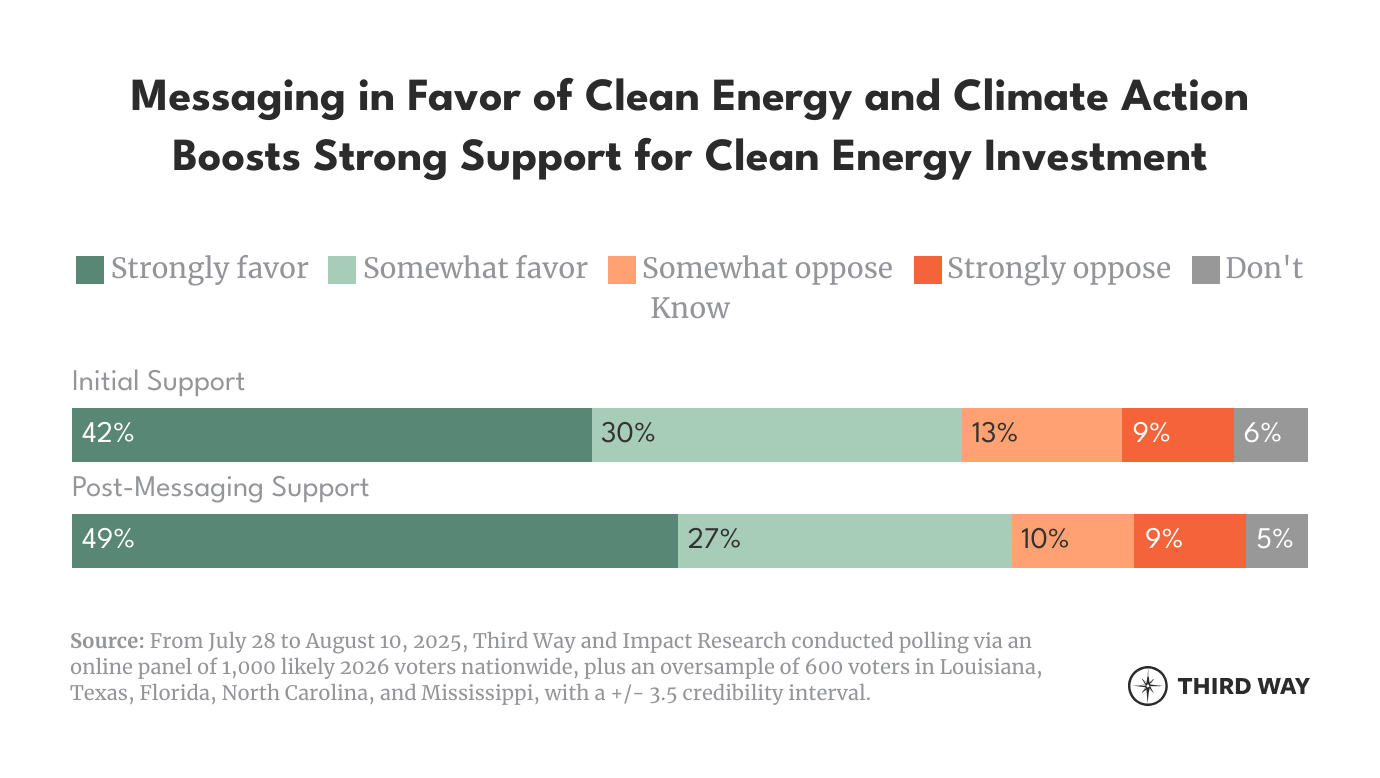

Coming into the survey, respondents were largely supportive of clean energy deployment. 72% supported investing in clean energy manufacturing, with 42% of respondents nationally and 38% of those in Southeastern states strongly in favor.

After seeing messages in favor of clean energy and climate action, strong supporters grew by seven points nationwide and six points in Southeastern states.

Respondents did not, however, find messaging highlighting the growing cost of insurance due to climate change compelling. Just 10% reported that insurance messaging was most effective. That number is slightly higher in the Southeast, with 14% listing insurance costs as the most effective message on fighting climate change.

The top-performing messages highlighted the importance of protecting liveability in regions threatened by climate change and safeguarding future generations from climate impacts.

“Climate change is threatening to make many parts of the country less livable, through flooding in low-lying and coastal areas, dangerously hot temperatures, and more frequent disasters. By 2050, many Americans could be forced to abandon their towns or lose their lives due to the warming planet.”

Conclusion

Americans in the Southeast are keenly aware of the increasing frequency and intensity of natural disasters, see the impact of those disasters on insurance premiums, and acknowledge that human activity plays some role in climate change.

In theory, Americans from the Southeast should be more supportive of climate action, if only to reduce the cost of their home or rental insurance. But, as our survey indicates, messaging urging investment in climate solutions in order to lower insurance premiums falls flat.

Instead:

- Emphasize the broader financial implications of natural disasters, not just insurance rates. Americans, especially in the Southeast, are concerned that parts of their states could become unlivable because of severe floods, storms, and other natural disasters. The cost of direct damage from extreme weather is far more compelling than concerns about insurance alone.

- When talking about clean energy, highlight how clean technologies are lowering household energy costs and creating economic opportunity, rather than emphasizing climate mitigation or environmental benefit.

- Target the right audience. In our research, men, Spanish-speaking Latinos, Southerners, and voters under 50 responded particularly well to messages on the costs of natural disasters writ large, as opposed to climate-specific messages or messaging focused solely on the cost of insurance.

Respondents were clearly looking for relief to address rising costs associated with natural disasters, including strategies to lower insurance premiums. That took priority over their desire to address climate change. In our survey, Americans were less concerned about addressing the root causes of rising prices than about getting relief from prices themselves.

Given how much Americans across the country are hurting financially, policymakers and clean energy advocates must focus more on delivering relief for families’ financial burdens now.

Methodology

From July 28 to August 10, 2025, Third Way and Impact Research conducted polling via online panel of 1,000 likely 2026 voters nationwide, plus an oversample of 600 voters in Louisiana, Mississippi, North Carolina, Texas, and Florida, with a credibility interval of +/- 3.1% at a 95% confidence interval. The margin of error for subgroups varies and is higher.