Memo Published September 9, 2025 · 6 minute read

Middle Class Millionaires: A Revolution in Wealth Attainment for Working America

Jim Kessler & Zach Moller

Work should mean wealth. Period. For most people who work, it does not.

Six-in-ten non-college educated Americans have $0 saved in private retirement funds at age 55.1 Among those over 55 who do have retirement savings, the median account balance is a meager $73,300.2 For college-educated adults, the numbers are better but not stellar. Roughly one-third have $0 in retirement savings at age 55.

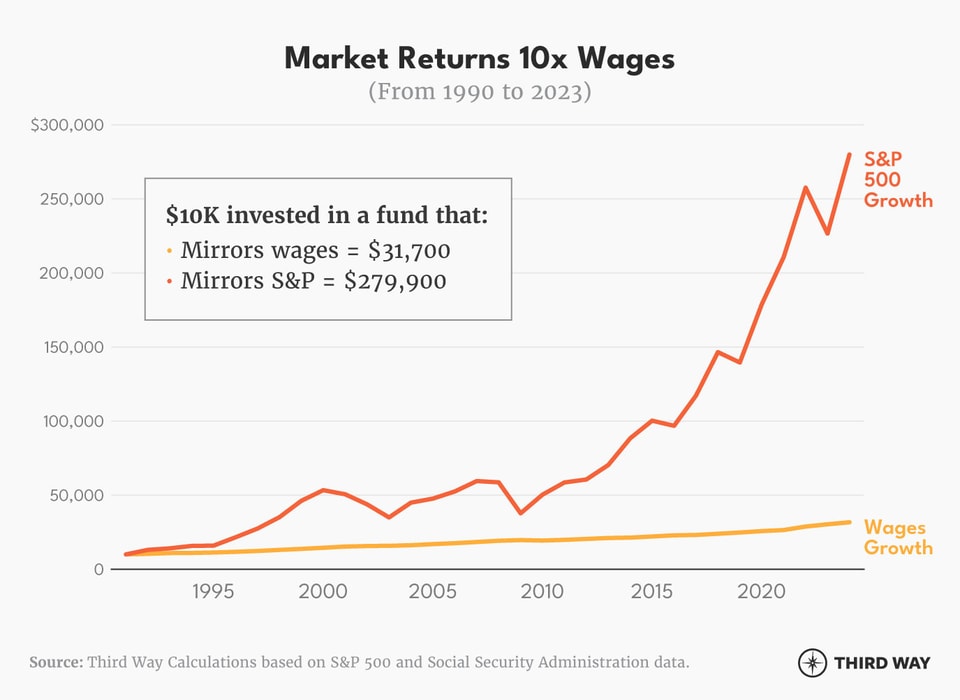

The reality of the American economy is that work without some universal instrument of personal savings and wealth creation is not enough. The people who are doing financially best do so because they have savings that can grow. Wages grow at an analog pace; investments grow at a digital pace.

If a person invested $10,000 in 1990 in a fund that tracked average American wages, the value of this fund would be $31,700 at the start of 2024.3 If this same person invested $10,000 in 1990 in a fund that mirrored the S&P 500, the value would be $279,900 at the start of 2024.4 There is nothing on the horizon that should make anyone believe that diverging trend will change. The power of the markets, the growth of the US economy, and the benefits of the world economy should not solely accrue to the already rich and those in windowed offices.

We call for a revolution in wealth attainment for working America—wealth attainment should be universal, not episodic. A working family with stable employment should routinely amass $1 million of wealth by the time of retirement age. That wealth should belong to the individual and be able to be passed on to heirs at death. It’s time for middle-class millionaires.

Middle-Class Millionaires in 4 Steps

Here is how to create middle-class millionaires in retirement:

First, provide every American with a wealth-building account just like a 401(k) at birth. A new child should immediately get two things: a Social Security number and a long-term, private Personal Wealth Account. Over time, this would give nearly every American their slice of the growing economy. This account would be for retirement only.

Second, fund the accounts at birth with an initial government contribution of $5,000. Creating wealth for a new child is not a fundamentally new idea. This path has been included in major proposals over the years, from Third Way to “baby bonds” from Senator Cory Booker. However, this proposal is different because the money is intended to grow over a lifetime and would be invested in life-cycle index funds instead of Treasury Bonds.5 And, unlike the Trump Accounts created in the One Big Beautiful Bill Act, this is a universal and permanent proposal meant to revolutionize retirement wealth and savings—not a fake way to provide benefits to the wealthy with inferior and complicated accounts.6

Third, grow the accounts with contributions on top of and separate from Social Security. Every worker—from a delivery driver to a cashier to a C-suite executive—should get contributions to their retirement account from their employer. Let’s face it, nearly everyone in the professional class has this benefit from their employer right now.

Here are several robust policy proposals for funding these accounts:

- Employers or platforms could be mandated to contribute a minimum amount (such as 50 cents an hour) like Third Way has proposed. Further details can be found in our policy brief on Universal Private Retirement Accounts (also known as UP Accounts) and the companion legislation, the Saving for the Future Act, from Senator Chris Coons (D-DE) and Rep. Scott Peters (D-CA).7

- Employers or platforms could voluntarily contribute to workers’ accounts.

- The government could match personal contributions for low- and medium-income workers whose employers do not help out, like in the Retirement Savings for Americans Act from Senators John Hickenlooper (D-CO) and Thom Tillis (R-NC).8

- The government could match via the refundable amount of the existing (or an expanded) Savers Match which is scheduled to start in 2027.9

- Companies could be incentivized to distribute their stock to their lowest-paid employees, as outlined in the Share Holder Allocation for Rewards to Employees (SHARE) Plan Act from Reps. Tom Suozzi (D-NY) and Mike Kelly (R-PA). This stock could be placed in Personal Wealth Accounts.10

- Unions could also make contributions into these accounts on top of current retirement benefits like defined benefit plans.

Fourth, keep Social Security solvent and secure.

Nothing in this proposal will touch Social Security in any way, shape, or form.

The Middle-Class Millionaire

A $5,000 investment in a fund that mirrors the S&P 500 would amount to $2.5 million in nominal dollars by age 65 if stocks in the next 65 years perform like they did in the last 65 years, according to estimates made by an S&P calculator.11 A married couple could have double that amount. Personal Wealth Accounts will revolutionize how the middle class thrives in retirement. A long-term savings vehicle, where the government gives you a little at birth and private contributions flow in during working years, will create a new generation of middle-class millionaires. This is wealth that can be passed on to heirs, creating chain of generational wealth for those who get up every day and work at a job.

Democrats need to be the party that builds and strengthens the middle class. This is a bold way to do just that.

How to Pay for It

The initial seeding for children’s accounts, based on projections of US births would cost $15 to $20 billion a year and, including administrative costs, would come in around $200 billion in direct costs over the next decade. This cost could come down if the proposal was tailored to only children of working- and middle-class families or if the initial contribution was less.12

Importantly, initial contributions should be paid for so they don’t hurt the national debt and increase that burden on future generations. This can be done in a number of ways. For example, lawmakers could close an intergenerational transfer loophole for the wealthy known as stepped-up basis. In 2024, the Congressional Budget Office (CBO) estimates that moving to carryover basis instead of stepped-up basis would raise around $200 billion from 2025-2034. Or there could be a small increase in the long-term capital gains and dividend tax rates. CBO estimated that increasing the taxes on long-term capital gains and qualified dividends by two percentage points would raise $100 billion from 2025-2034.13