Report Published November 14, 2012 · Updated November 14, 2012 · 28 minute read

American Shale Gas: Keeping it Affordable, Stable, and Accessible

Josh Freed, Robert Walther, & Jeremy Twitchell

The shale gas revolution has turned the American energy sector on its head. In just the last few years, private industry, with the help of government-backed research, has solved the supply side of the natural gas equation by unlocking the nation’s vast shale gas reserves.1 Electric utilities and manufacturers are rushing to embrace this affordable, relatively clean, domestic source of energy. And natural gas prices have plummeted from historic highs in 2008 to historic lows today.

Yet the production boom has created real challenges along with great promise. In some states, the government, regulators, and the public have raised questions about the safety of new production techniques. And a glut of natural gas has led to unsustainably low prices, threatening continued price volatility.

We believe it is critical for the American economy, public health, and the environment that the safe development of natural gas is not derailed. There is an important role for the federal government to play by helping ensure access to—and stable demand for—natural gas. Policymakers can develop safety valve policies to ensure the U.S. is able to take advantage of affordable, price-stable natural gas. These include enabling the export of limited quantities of liquefied natural gas (LNG), encouraging long-term contracting in the electric utility sector, accelerating the use of natural gas in both fleet transportation and electricity generation, and ensuring the environmental protections now being developed are adequately enforced.

Shale Gas is a Net Positive for the U.S.

In just a few short years, natural gas developed from hydraulic fracturing, or fracking, has dramatically improved the U.S. energy outlook. It has provided consumers with an abundant, low-cost source of power and heat that is cleaner than coal- and oil-based energy sources2 and more economical.3 It has created thousands of direct high-paying jobs and enhanced the wealth of landowners across the country.4 It is driving a resurgence of American manufacturing thanks to reduced fuel and input costs.5 It has already diversified the U.S. fuel mix by reducing our use of coal and has the potential to further reduce our reliance on oil as a transportation fuel. It is playing a large part in carbon emissions reductions, bringing the U.S. into compliance with the Kyoto Protocol targets.6

There are potential costs to the development of shale gas. The biggest concerns involve the impact of fracking on the local environment around the wells, including groundwater, air quality, increased truck traffic, and greenhouse gas emissions. The other major concern is its impact on the renewables sector; while natural gas has primarily displaced coal in the electricity sector, renewable energy has also had a tough time competing in the market against the $2–$3 price. Despite these real concerns, the reductions in conventional pollutants and carbon emissions brought about by the transition to natural gas make the gas revolution a net positive for the United States.

Environmental and public health concerns about fracking persist

Perhaps the biggest threat to the future of natural gas is the concern about the environmental and public health threats posed by hydraulic fracturing. Some of these concerns have merit. And just a few bad actors can shift public perception and have an enormous impact on government scrutiny and regulation. While neither side has proven its case, the evidence suggests the natural gas industry is losing the public debate. Vermont has banned the practice of fracking outright,7 New Jersey’s Assembly passed a bill that would do likewise,8 and New York has severely limited it.9 At least eight other states have passed strong fracking regulations, and the Interior Department is considering stricter regulations for fracked wells on public lands.10 The Environmental Protection Agency (EPA) is also reviewing the practice, with a draft report planned for publication in 2014.11 Research suggests there might be a link between hydraulic fracturing and salt water, not fracturing fluids, drifting upward into the water table.12

Questions about the impact hydraulic fracturing is having on aquifers, other water sources, and air quality are legitimate. There are, however, safe and available technologies and practices for mitigating these challenges. Many major producers are adopting these practices and methods without federal government regulation.13 Companies are already beginning to install water treatment infrastructure that treats and allows for reuse of water in fracking wells because transporting water via truck is too expensive and installing pipeline capacity makes financial sense.14 Fugitive emissions, also a significant concern surrounding gas production, likely will be adequately addressed by EPA’s new “green completion” rule, the first regulations to reduce emissions at the well-head of hydraulically fractured wells.15

The industry may need to take more aggressive measures to demonstrate the safety of fracking to preempt states from erecting more barriers to developing shale deposits. The sector will have to determine if the marginal costs of using the best available fracking technologies and engaging communities on the production process are worthwhile to avoid potential bans on production and right of entry. The federal government may also need to impose more requirements upon producers not only to protect public health and local air and water quality, but also to help ensure that local authorities allow the production that is critical to keep natural gas prices at an affordable level.

Renewables could get left behind in the dash to gas

The U.S. has experienced what happens when a critical part of the economy is captured by one fuel source: witness the economic impact of rising oil prices in the transportation sector. As early as 2009, policymakers and analysts warned that the electricity sector could face a similar fate if it made the “dash to gas."16 They argued that the wholesale switching of the coal fleet to natural gas could create a situation where natural gas becomes as inelastic as oil in the vehicle fuels market. Utilities could turn to alternatives to natural gas if prices spiked. Switching fuels, however, is not quick or easy. Building out alternatives to natural gas requires large upfront capital costs and lead times. History has shown that it is hard to shutter existing power plants in favor of alternatives even when fuel costs spike. Instead, the higher costs are passed through to consumers.

Technological advance is an unintended victim of low gas prices as well. Research into energy storage is being scaled back in response to the low prices,17 as are efforts to develop viable carbon capture and sequestration (CCS) technology.18 Ironically, the decline of CCS research could jeopardize the long-term viability of natural gas, which may become dependent on CCS in order to remain an option in an increasingly carbon-sensitive world.19

Despite the dramatic declines in the cost of solar and wind, renewable energy sources are also finding it tough to compete in a natural gas-dominated market. Despite significant gains in the past four years, neither solar nor wind generated electricity can match the price per kilowatt hour of electricity generated by $2 or even $3 natural gas. This is having a ripple effect in innovation. Companies are building low-priced natural gas into their short- and medium-term plans. As a result, they are slowing or eliminating efforts to develop more efficient and cheaper clean energy sources. Over the long term, this will jeopardize American companies’ ability to compete in the emerging $2.3 trillion global clean energy market.20

Despite these concerns, the shale boom is good for the United States. But the natural gas sector faces another real challenge that could derail the revolution: ensuring that demand matches the supply.

The American Gas Revolution Faces Real Challenges

Thanks to fracking, the U.S. now has more gas than we know what to do with. This oversupply has depressed prices, causing producers to reduce production and capital investments. Historically, this type of imbalance has led to periods of price volatility in the sector. While most analysts expect the price of natural gas to gradually rise to $4–$6 and settle there, volatility would pose a serious threat to the U.S. economy and could slow or roll back some of the environmental and health benefits of the switch from coal to gas. To provide a backstop against this possibility, the U.S. must adopt market-based policies if it is to fully reap the strategic and economic benefits of the shale gas windfall.

Price volatility is a threat

In the early 2000s, natural gas prices were extremely volatile.

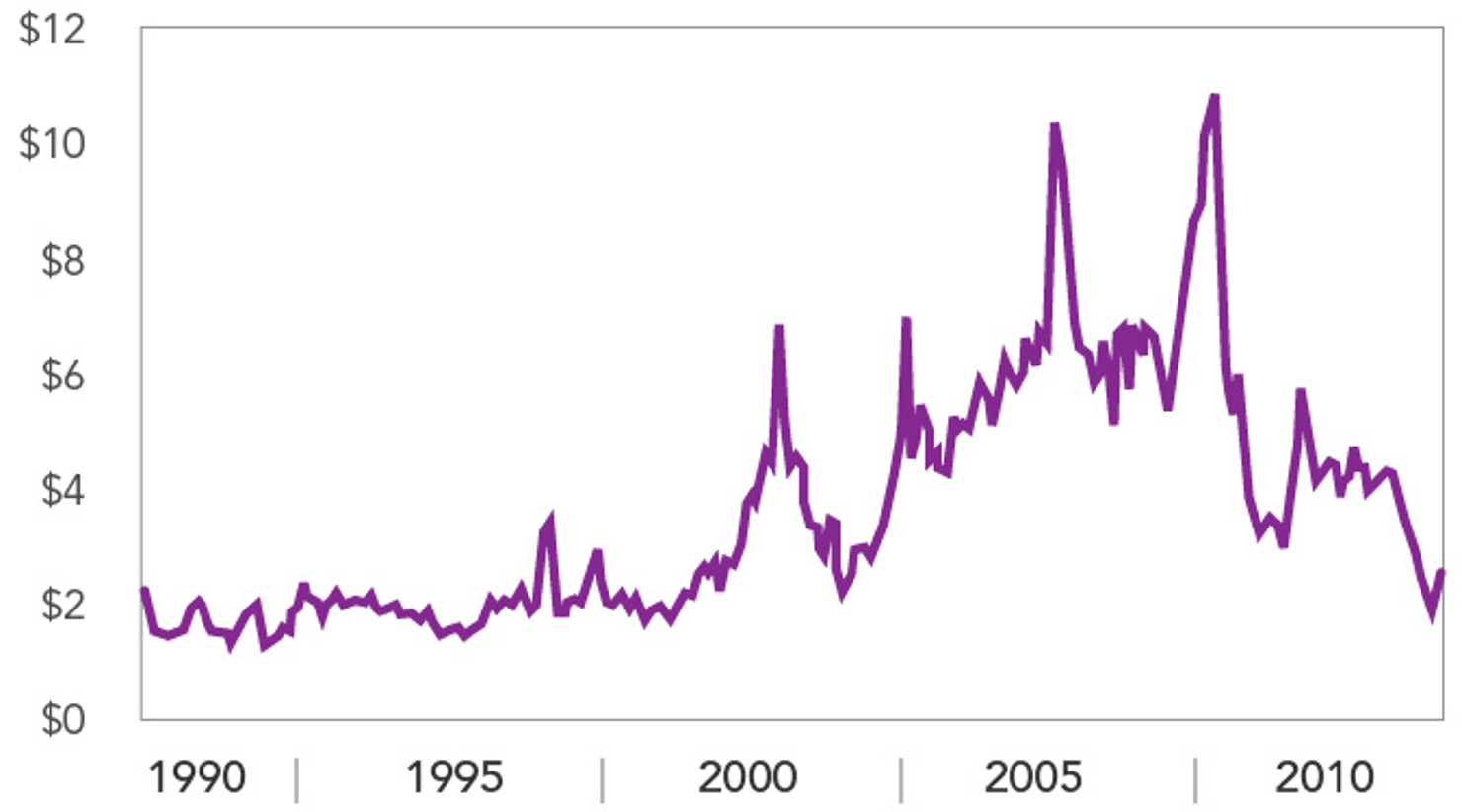

In 1978, Congress began to deregulate the natural gas sector and the market quickly adapted to the fuel’s increasing availability. For the next twenty years, price fluctuations driven by seasonal demand cycles were regular, predictable, and relatively small—even after the complete removal of government price controls in 1993.21 In the new millennium, however, prices tripled from December 1999 to January 2001—the result of a perfect storm of high economic growth and an extremely cold winter in 2000–2001 that drove demand, coupled with a small natural gas industry that was unable to rapidly increase production in response.22 Where prices had moved like a pendulum during the previous two decades, they became erratic, with each swing bringing new highs and the magnitude of the swings constantly changing. Prices, which averaged $1.96 over the previous 21 years, have risen to an average of $5.05 per thousand cubic feet since 2000,23 and the standard deviation—a measurement of volatility that expresses the average distance between each observed price and the average price—has quadrupled from 43 cents to $1.79. So not only have prices increased in the last twelve years compared to the previous twenty-two, but they have seen much larger swings.24

Shale gas has driven prices to record lows since 2008.

Since 2008, two factors have tempered natural gas price swings—the recession and the shale gas revolution. Just as the U.S. economy began to slow down in 2008, shale gas production entered “drill baby, drill” mode and produced 2.3 trillion cubic feet of natural gas, accounting for 9% of all U.S. natural gas production.25 By 2010, that amount had increased to 4.3 trillion cubic feet—23% of total U.S. production.26 But while total U.S. gas production has risen 21% since 2006, demand has only increased 12% in the same period.27 The resulting oversupply has reduced the degree of volatility, but prices remain more volatile than they were pre-2000.28

Natural Gas Wellhead Price, 1990-201229

Source: U.S. Energy Information Agency

The supply glut has further depressed prices.

From 2001–2006, 6.9% of all natural gas produced in the U.S. was not consumed domestically; it was exported, burned as waste, or placed in storage. Since shale gas began to enter the market in 2007 that figure rose to 16.7% from March 2011 to February 2012.30 Currently, producers are storing a significant portion of this excess gas. The amount of natural gas stored in the U.S. increased by 24% in the last year,31 spurred by a mild winter that resulted in reduced demand.

This growing supply glut is straining domestic storage capacity, and if capacity is reached, prices could be further depressed32 as producers are forced to take whatever market price they can get to dispose of their product. While providing a boon for consumers and electricity providers, these low prices are causing producers to scale back production and in some instances reduce their investments in exploration and pipeline infrastructure33—two trends that could hamper producers’ ability to increase production if and when demand catches up with supply and leaves the door open for volatile price swings.

Dry gas has become too cheap to produce.

In response to these trends, major natural gas producers have changed strategy. As an example, Chesapeake Energy Corporation, the nation’s second-largest producer of natural gas, announced in early 2012 that it would reduce drilling and exploration to focus on its existing shale gas plays,34 sell two of its pipeline subsidiaries, and reduce its capital expenditures by $3 billion over the next three years.35 The company cited low gas prices as the driving factor in all three decisions; at least a dozen other natural gas companies have announced production cuts and reduced capital budgets within the last year for the same reason.36

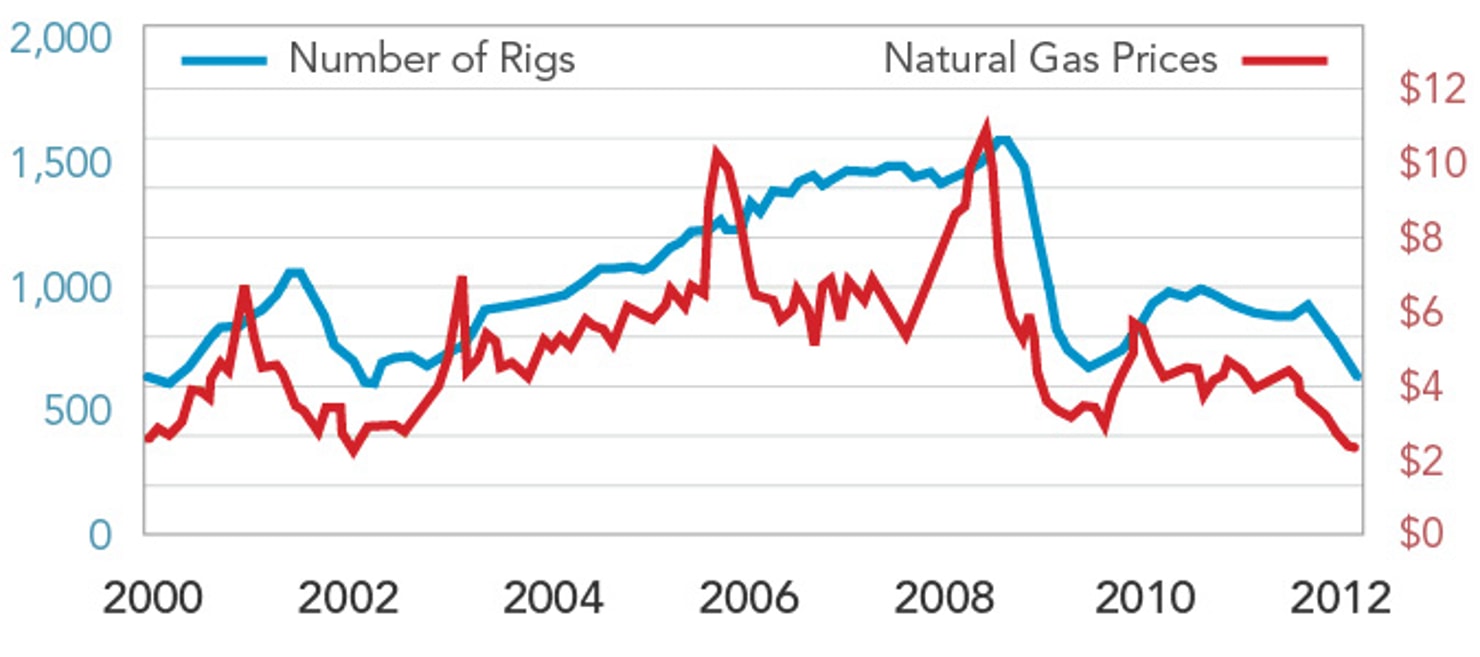

As a result of the changes, the number of active natural gas rigs in the U.S. has fallen to 541, down 38% from last year37 and 66% from their peak count in 2008.38

Most of these cuts affect dry gas wells (wells that only produce natural gas in a gaseous state, without the more valuable natural gas hydrates or crude) and the overall growth rate of U.S. natural gas production, while still positive, is beginning to slow down.39

As the focus has shifted from less-valuable dry gas to the more-valuable resources, the amount of natural gas that is burned off at oil wells as waste—a process known as “flaring”—has skyrocketed. At present, U.S. oil and gas companies burn off enough natural gas on a daily basis to heat 500,000 homes.40 The gas simply isn’t valuable enough to justify investment in a pipeline to collect and carry it.41 The problem is particularly severe in North Dakota’s Bakken Shale, where almost 40% of natural gas withdrawn is flared.42 Overall, 32% of natural gas in North Dakota was flared in June 2012, compared with only 0.49% in Texas in May 2012.43

Analysts expect the price of natural gas to rise to $4–$6 level.

Recent developments suggest the era of price volatility may be giving way to a period of price stability for natural gas. Analysts at Goldman Sachs and Jepsen are returning scenarios that show natural gas supply and demand balancing in the U.S., easing the price to the $4–$6 range for a prolonged period.44 The Energy Information Administration (EIA) went so far as to suggest prices could remain between $4 and $6 for at least another decade.45 And the manufacturing sector that was so badly burned by natural gas volatility that it sent jobs and capacity overseas is now coming back. Companies like Dow and DuPont, which rely on natural gas as a feedstock for chemical production and are extremely price sensitive, are moving facilities back to the U.S. or building new facilities to take advantage of persistent, low natural gas prices. As Dow CEO Andrew Liveris explained, “For the first time in over a decade, U.S. natural gas prices are affordable and relatively stable."46

There is no certainty in predicting commodity prices.

Policymakers should retain some skepticism about analysts’ predictions on the future of natural gas prices. Long- and even medium-term trends of commodity markets can be difficult to forecast. The collapse of the housing market only four years ago is the starkest example of how market consensus is no guarantee of accuracy.47 Volatility could rear its ugly head as production ramps up and down with price fluctuations. Severe weather and geologic events, or accidents and lawsuits that restrict access to reserves, can have a significant disruptive impact on prices. In fact, one equity options trader from Houston warns that 2012-13’s expected cold winter weather combined with higher-than-reported well decline rates could drive gas to $8.00 within six to eight months.48 Federal policy backstops would help cushion the impact of unexpected events on price and access, helping to protect our economy and the longer-term positive impacts that the natural gas revolution is providing the country.

The Federal Government can Help Keep Demand and Access Stable

Public apprehension about the environmental and health impacts of natural gas extraction, the possibility of unanticipated demand spikes, and the possibility of a decline in fuel diversity in electricity generation all could darken the bright future of natural gas in the United States. There is a role for the federal government to play to help mitigate the impact of these events. It does not require a heavy hand as many critics of natural gas would advocate. Instead, federal regulators and policymakers should focus on protecting the balance of supply and demand that appears to be forming in the market after a period of volatility. Fail-safes should also be developed to ensure industry’s development does not outpace its ability to safeguard public interests in clean water and air. This would not only protect the public, but also ensure local communities allow the development of natural gas that is vital to the national interest of a reliable, independent, and clean energy sector.

Moderate increases in demand will lead to price sustainability

While the extreme volatility of the last decade makes it difficult to determine where price stability lies, one method is to track how changing prices have affected the number of drilling rigs in operation.49 From April to May 2003, natural gas prices increased from $4.47 to $4.77 per million British thermal units (mmbtu) and the number of rigs in operation jumped by 8.7% to 865. Both continued to increase while natural gas prices worked toward a then-record high of $10.33/mmbtu in October 2005, but even after prices retreated to the $5–$7/mmbtu range for the next two years, the rig count continued to steadily climb. However, when the price of natural gas plummeted below $5 in 2009, the rig count also fell. The number of rigs recovered in late 2009, when gas prices rebounded to the $5 range, before falling back again as prices began their slide to the current trough.

Tracking Natural Gas Rigs and the Wellhead Price, ‘00-’1250

Source: U.S. Energy Information Agency

So, at minimum, a $5/mmbtu price point appears to make production worthwhile for many natural gas producers, suggesting that equilibrium falls in that price realm.51 It is worth remembering that the monthly average price of natural gas since 2000 is $5.05/mmbtu. The market remains capable of maintaining an equilibrium over the long run. The challenge for policymakers is to design policies that will ensure a stable demand for natural gas at around $5/mmbtu and reduce the volatility that has been the hallmark of the natural gas market without overly compensating for today’s low prices.

Fortunately, the threat of unsustainably low gas prices are matched by a menu of minimally invasive policy options to insure that supply and demand will exist to maintain stable natural gas prices. This will provide both the pedal and the brake as prices climb and diminish over the long term. Many of these options require no new government spending, and some of them offer the potential for increased revenues or significant cost savings. While some options may create short-term price increases for consumers, they offer the tradeoff of long-term stability and predictability.

Allow the limited exporting of liquefied natural gas.

The global market offers many possible trade partners that are interested in purchasing excess U.S. natural gas. The issue of exporting natural gas in a liquefied state (LNG) is both complex and contested, so any policy that allows for the exportation of U.S. natural gas must be carefully crafted and closely monitored.

LNG exports require federal approval on two fronts: the Department of Energy (DOE) must issue an approval for a company to export a fixed quantity of LNG and the Federal Energy Regulatory Commission (FERC) must issue a permit for the construction of a liquefaction facility. To date, 10 companies have requested export permits from DOE and one has been granted; five companies (four of which also requested exportation permits) have applied for permission to build a liquefaction facility and one has been granted permission.52 Collectively, the export requests total 14 billion cubic feet (bcf) per day—roughly 17% of the natural gas produced in the U.S.53

DOE and FERC should coordinate their reviews to create a phased-in approach to LNG exportation that limits it to 6 billion cubic feet per day. At that level, EIA projects that, at most, LNG exports could cause U.S. natural gas prices to rise by 13% by 2020, with the increase falling back to only 8% by 2035.54 Other analyses have estimated that LNG exports in this volumetric range would increase the average household’s energy bill by merely $4 a month.55 It must be noted that as new LNG volume comes online around the world, we can expect to see global prices decrease. Whether it be from Canada, Mozambique, Australia, or another export nation, it is likely the amount of natural gas making its way to foreign markets will increase dramatically. Any amount of U.S. LNG exports beyond 6 bcf is unlikely to prove profitable enough to make the upfront capital costs of terminals appropriate. The market may already provide sufficient forces to keep exports at or below 6 bcf. The federal government, however, should be ready to ensure that U.S. natural gas exports do not rise to a level that would adversely affect prices here at home.

The added revenue from exports should provide an influx of capital to domestic natural gas companies and signal a need for added production. This could offer greater certainty; when American demand is down due to a price depression, there will be an outlet for domestically produced gas. Such certainty would sustain investment in domestic infrastructure and environmental controls, like water management systems at their well sites.

Critics argue that allowing LNG exports would turn natural gas into a global market, causing U.S. prices to rise to parity with the receiving nations, much like the market for oil. But natural gas production in the U.S. can cover the extra 6 bcf advocated by Third Way. U.S. natural gas prices would not be significantly impacted unless gas was diverted from domestic markets to export markets. If export market demand is met almost entirely by increasing production, the price impact will be minimal. At 6 bcf per day, for example, the U.S. would be exporting only about 7% of its current production level. Some of the potential markets for U.S. LNG exports (particularly Europe) have shale gas reserves of their own.56 In many of these regions, however, public opposition, a lack of expertise, and the absence of pipeline infrastructure suggest that these resources are unlikely to develop on the same scale as the U.S.57 and that the market for LNG imports will remain strong.

Encourage long-term gas contracting.

Price volatility is making potential natural gas customers wary of committing to the fuel. To overcome these concerns, producers have begun offering long-term gas contracts. These contracts are mutually beneficial arrangements; major consumers receive protection from drastic price swings, and producers gain access to a larger market58 and generate more capital for pipeline and infrastructure investment.59

However, significant regulatory hurdles have prevented electric utilities from entering into long-term contracts.60 State public utility commissions (PUCs), which are generally charged with regulating utilities and maintaining low prices, have been unwilling to allow utilities to charge rates based on long-term gas contracts. The PUCs argue that at times the contract price of the gas may be higher than the spot price, which would hurt consumers. Preventing utilities from recouping the cost of a long-term contract through their rate structure creates a system of “asymmetric risk,"61 which exposes the utilities to potential risks that outweigh the potential rewards.

The risk of long-term contracts, however, could be mitigated if PUCs based rates on long-term gas contracts. This is what Colorado did in 2010 when it became the first state in the nation to require its electric utilities to sign long-term gas contracts and its PUC to set rates based on those contracts.62 At first blush, this may seem like a raw deal for customers—potentially paying years of above-market prices for electricity while other utilities’ customers pay below-market prices. But it is worth noting that in the late 1990s natural gas prices were similar to today’s prices. Yet subsequent years brought sustained prices above $6 with peaks near $11, well above the price structure outlined in the Colorado contract. And even when long-term contracting does not deliver the lowest cost to consumers, it does provide predictability of their future energy costs.63 Using long-term contracting in this circumstance is similar to using fixed income products to provide certainty of return on investment in a balanced investment portfolio.

Lead by example in the transportation sector.

Using natural gas as a vehicle fuel, either in compressed (CNG) or liquefied (LNG) forms, offers an enormous potential market for U.S. natural gas producers and an opportunity to further reduce our reliance on oil imports. Yet the Energy Information Administration projects that by 2020 only 3% of all U.S. natural gas consumption will be in the transportation sector.64 By converting vehicle fleets to CNG and heavy duty vehicles to LNG, that share can be significantly increased.

The easiest place to transition to CNG fuel is in fleet vehicles, since the owner of the vehicle can also own the fueling station. This would allow the fleet and station owner to capture the savings from switching from gasoline to CNG—which work out to about 40%65—and provides a revenue stream to pay off the cost of a CNG fueling station quickly. A National Renewable Energy Laboratory study suggested that a fleet owner can repay the cost of a CNG station in four years from fuel savings alone,66 and the centralized nature of fleets means that fleet managers have to build fewer fueling stations.

While federal, state, and local governments only account for about 6.5% of the fleet vehicles in the United States,67 converting them to CNG could provide an important leadership example to private businesses (80.6%) and utilities (12.9%) that own the bulk of fleet vehicles. Federal regulation directs the government to increase its fleet alternative fuel usage by 2020; a clarifying policy statement that 25% of federal government travel should be done in CNG vehicles by 2020, if also adopted by state and municipal governments, could create an additional demand of 1,300 mmbtu of natural gas per year.68 While this would only represent a minor increase in demand, it would signal natural gas producers to invest in delivery infrastructure and private fleet managers to adopt the same cost-saving (and demand-driving) measures.

The consumer market for CNG-fueled vehicles will likely remain small for two reasons: (1) CNG vehicles have shorter ranges than their gasoline counterparts and require more frequent refueling;69 (2) CNG infrastructure is expensive—fueling stations can cost up to $4 million70—and private fueling station owners cannot capture the savings of replacing gasoline with natural gas to pay for the station. This is why there are so few public CNG fueling stations.71

Heavy duty and freight72 diesel vehicles present another market for natural gas producers. The prices of oil and natural gas have decoupled in the U.S. and diesel has quickly outpaced natural gas in cost per gasoline gallon equivalent (GGE).73 Given that cost advantage, analysts predict that the number of LNG heavy duty vehicles will grow by 10% without additional policy mechanisms74 and the freight, heavy duty, and medium duty vehicle sector alone could present a market of 2.1 billion cubic feet per day.75 With a minor change in tax policy, the federal government could allow LNG to capture a larger share of the heavy duty vehicle market. While the federal excise taxes on diesel and LNG are currently the same per gallon, LNG has only about two-thirds the amount of energy as diesel in each gallon. Since more LNG is required to go the same distance, taxing on an energy basis would place LNG at parity with diesel.

Encourage the retirement of outdated coal plants.

The recent record-low price for natural gas has contributed to a huge shift away from coal to natural gas by electric utilities. EIA has warned, however, that an increase in natural gas prices would reverse this trend, with coal recapturing as much as 65% of natural gas’s share of the electricity generation market.76 It is important that policies are in place to avoid a dash back to coal.

This development would not only be detrimental to the environment, but would also go against consumers’ stated preferences. In focus groups with swing voters in traditional coal-powered states of Ohio and North Carolina earlier this year, Third Way found a strong desire to replace coal with modern, cleaner fuels.77 Voters’ desire to move beyond coal makes sense. Natural gas produces fewer emissions and is more compatible with renewables (because it is more efficient than coal plants at coming on or off line, making it a better partner for the intermittent nature of renewable energy).

To accelerate the retirement of existing coal plants, policymakers could incentivize utility companies to mothball their existing coal plants by offering expedited environmental reviews for proposed natural gas plants, as well as renewable energy generation, which often is paired with natural gas. This would further reduce the cost of replacing coal plants without requiring any new government spending.

Preventing new coal plants would effectively be addressed by the EPA’s proposed New Source Pollution Standards (NSPS)78 on new electricity generation facilities. If finalized, this rule would limit emissions from all future plants to the levels of current natural gas plants.79 If the EPA adopts NSPS, it would also have to address limiting emissions from existing plants, since the Clean Air Act requires the agency to set standards for existing sources of pollution once it has adopted standards for future sources of pollution.80

Establish minimum safety standards for hydraulic fracturing.

The major natural gas producers are deploying environmental safety practices to prevent the risk of water contamination, air pollution, and significant fugitive emissions of greenhouse gasses. Hydraulic fracturing, however, is still a maturing technology. The sector still has some small “mom and pop” companies that have not adopted best practices. The fracturing process is managed by a patchwork of state and local regulations. As a result, it is difficult to determine where there are failures to deploy environmental safeguards and capture fugitive emissions and how widespread these failures are. Regulations at the federal level and in many states are equally nascent. The industry has an opportunity to establish backstops to ensure that the enormous economic promise of natural gas is not derailed by an accident or bad actor. This is particularly important given the spotlight on hydraulic fracturing and the overall lack of public understanding of the process (or even the uses) of natural gas.81

The natural gas sector should take a page from the nuclear energy industry and create a self regulatory organization (SRO) similar to the Institute of Nuclear Power Operations (INPO) to establish and promote the highest levels of safety and environmental stewardship. INPO was created in 1979, following the Three Mile Island accident, to specify “appropriate safety standards including those for management, quality assurance, and operating procedures and practices, and that conducts independent evaluations."82 Today, not only does INPO set very high standards, it conducts some of the most rigorous inspections and grading of its members’ performance of any industry in the country. This has helped the nuclear industry in the U.S. maintain an extremely high safety record and avoid overly burdensome federal regulation.83

Creating an SRO similar to INPO could help the natural gas industry avoid a high-profile accident and the economic consequences that would follow it. Secretary Chu84 and the National Petroleum Council have already called for the creation of a similar organization.85 If this model was applied to natural gas producers, it would greatly increase safety at well-heads, serve to highlight those actors not in compliance with self-imposed standards, and provide the public and federal government greater certainty that the industry is acting in good faith to protect both public and environmental health. It could also reflect the work already being done at the state and non-governmental organization level, such as the regulations being developed in Colorado86 and the multidisciplinary group being led by the Environmental Defense Fund.87 The recently formed Institute for Gas Drilling Excellence (IGDE) in Pennsylvania provides a hopeful sign that the industry may be headed in this direction.

Self-imposed regulations do not have to be prohibitively expensive. The International Energy Agency (IEA) offered a suite of policies and technical changes that would address the public’s concerns. It estimated that adopting all of these policies would add only 7% to the cost of the average unconventional well across all countries.88 In the U.S. alone, IEA found that natural gas production would still increase 62%89 even when the most rigorous policies, practices, and technologies are used. This suggests that even with these new costs, natural gas production would remain profitable.90

Conclusion

In some states, the debate over natural gas is focused on whether to allow or regulate hydraulic fracturing. At the national level, we need to have a different conversation. When it is developed safely, shale gas provides a significant net benefit to the American economy, public health, and the environment. But the current low price of natural gas is not sustainable. The existing trend of decreased production and capital investment could lead natural gas prices to sharply rise as demand catches up with supply. This puts the country at risk of price and supply volatility. The federal government has a role to play to promote smart, limited demand-side policies that will help ensure that any increase in price is gradual and stabilizes at an affordable level. This should be matched by industry safety standards that help ensure public support of natural gas production and not outright bans on the practice of hydraulic fracturing. In combination, these actions would help to ensure domestic natural gas reaches an affordable and stable price and remains an integral part of the American energy mix.