Memo Published July 20, 2016 · Updated October 3, 2017 · 4 minute read

Trump’s Estate Tax Plan Gives $7 Billion Windfall to One Family. His.

Joon Suh

“My tax plan is going to cost me a fortune,” Donald Trump said at press conference in Trump Tower last September. It won’t.

One feature of Trump’s tax plan would bestow a $7.1 billion tax cut on the Trump family dynasty. That’s just through his proposed elimination of the federal estate tax—not counting other changes, such as the elimination of the Alternative Minimum Tax (AMT), which would also disproportionately favor the wealthy and, altogether, increase the national debt by $2.6 trillion in just 10 years.1 Even if one assumes that his net worth doesn't increase at all, his family would still reap a whopping $4 billion windfall.

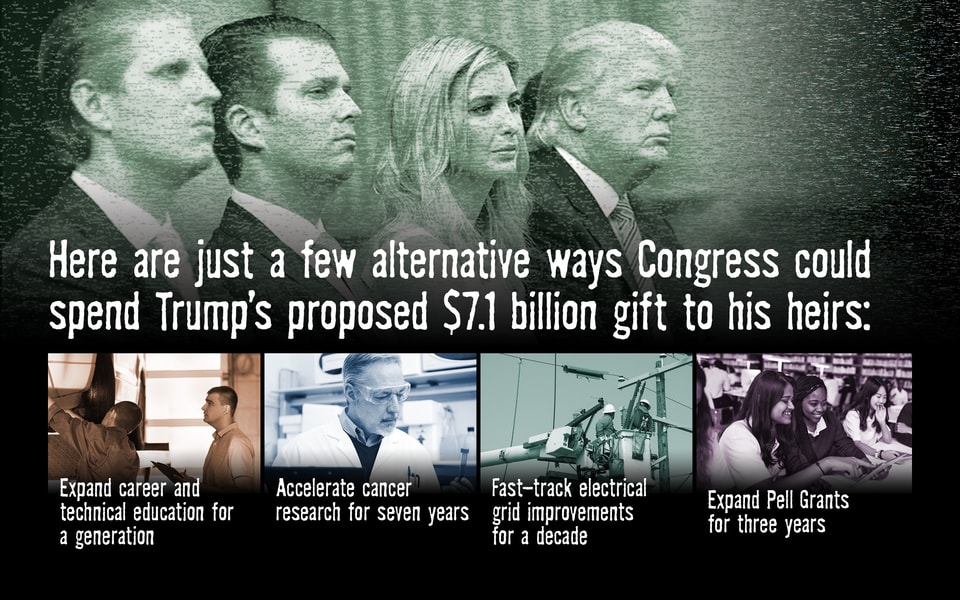

Put aside the other billionaires that scrapping the estate tax would benefit. The staggeringly high value of the tax cut for the Trump dynasty alone carries the same price tag as multiple high-value national priorities. Here are just a few alternative ways Congress could spend Trump’s proposed $7.1 billion gift to his heirs:

- Expand Pell grants for three years: The Obama Administration’s proposal to increase Pell Grant awards and make them available for summer courses has an annual cost of $2 billion.2

- Fund the search for a cure for cancer for seven years: President Obama’s cancer “moonshot” proposes investing an additional $1 billion per year to support the search for a cure.3

- Finance career and technical education for a generation: A new bill would raise federal spending on career and technical education and skills at the secondary and postsecondary levels to $1.3 billion per year.4

- Support investments in electrical grid modernization for more than a decade: $5 billion over a decade would help states invest in updating the grid and enhance security by providing more efficient, affordable, and reliable energy.5

Yet Trump proposes to shower his heirs with a massive gift compliments of the American taxpayers. How exactly does he propose to do so?

The estate tax is responsible for less than one percent of annual federal revenues. The tax applies to only 0.2% of the very wealthiest taxpayers per year, and for these families it is a 40% tax on joint assets above $11 million ($5.5 million if unmarried). Because the estate tax applies to only a very small portion of taxpayers with the greatest means to pay, the tax is regarded as one of the most distributionally fair parts of the code. To do away with the estate tax would mean adding $270 billion to the federal debt just in the first decade, or $320 billion with interest.6 To Donald Trump and his family though, a repeal would be particularly beneficial.

Here’s the math:

Mr. Trump estimated his own net worth (his total asset value including cash and securities, real estate, insurance, trusts, annuities, and business interests minus total debts, mortgages, and other liabilities) at $10 billion.7

If that were to remain the value of Trump's estate, his tax bill under current law would be about $4 billion. But we considered a separate and fairly conservative scenario that incorporated broader economic factors. If his fortune were to grow at the historical average rate of U.S. stocks, that would afford Mr. Trump a 4.2% real, after-tax rate of return.8 The total value of his $10 billion estate would grow to over $17.7 billion by the time actuarial tables estimate his family will inherit his fortune, in 2030.9

By that time, the estate tax threshold will exempt $15 million (or $7.5 million if he filed as unmarried) from taxation.10 The rest would be subject to the 40% estate tax, which means the total size of the Trump dynasty’s windfall paid for by the American people through the federal tax code would be $7.1 billion.11