Memo Published May 15, 2025 · 11 minute read

How the Loan Programs Office Lowers Consumer Costs and Speeds Clean Energy Deployment

Ryan Norman & Shane Londagin

President Trump’s Day One Energy Emergency declaration, while stocked with pointed, partisan attacks on the Biden Administration, correctly highlighted one important truth of the current moment: "The integrity and expansion of our Nation’s energy infrastructure—from coast to coast—is an immediate and pressing priority for the protection of the United States’ national and economic security. It is imperative that the Federal government puts the physical and economic wellbeing of the American people first.”1

Yet, in the months since, we’ve seen exactly the opposite from leadership in the Administration and Congress. The Administration’s Department of Government Efficiency (DOGE) initiative has made deep cuts to the federal workforce and crippled key programs for energy development, notably including the Department of Energy’s Loan Programs Office (LPO). LPO’s Title 17 loan programs are among the most powerful tools the federal government has to respond to today’s energy challenges, providing low-cost financing to credit-worthy large utilities and smaller companies alike for projects that improve the integrity and security of our energy system. From advanced energy to grid infrastructure, LPO supports critical projects that strengthen domestic energy supply chains and build long-term economic resilience. Despite flawed attempts to criticize the office based on decades-old failures–failures that the independent Government Accountability Office (GAO) confirmed LPO has addressed through meaningful reforms—the modern LPO has proven its value as the federal government’s sole infrastructure bank.2

This memo highlights how LPO’s Title 17 programs support advanced energy deployment and energy infrastructure investment to help lower energy costs for US ratepayers, foster economic opportunities across the country, and provide energy markets with options that reduce emissions. Additionally, this piece highlights how LPO is particularly crucial to deployment of advanced nuclear and grid modernization projects–areas that have drawn consistent bipartisan support in Congress and the Trump Administration.

Title 17 Energy Programs

Title 17 was created by the Energy Policy Act of 2005 and has since been amended by the Infrastructure Investment and Jobs Act in 2021 and the Inflation Reduction Act in 2022. It is comprised of two programs:

- 1703 Program: The Innovative Clean Energy Program (known as Section 1703) provides financing for projects that deploy “new or significantly improved technology” that is technically proven but not yet commercialized. These applicable projects include advanced nuclear energy, carbon management, advanced fossil fuels, electrical generation, transmission and distribution projects, and critical minerals development. This program is essential for financing supply chain innovation that will help US industries compete globally.

- 1706 Program: The Energy Infrastructure Reinvestment Program (known as Section 1706) guarantees loans for “projects that retool, repower, repurpose, or replace energy infrastructure that has ceased operations; or enable operating energy infrastructure to avoid, reduce, utilize, or sequester air pollutants or anthropogenic emissions of greenhouse gases.” This program is exceptionally versatile for expanding existing sites, including nuclear and fossil fuel sites, upgrading equipment, and replacing legacy equipment with advanced energy technologies.

How LPO Reduces Americans’ Energy Costs

Whether financing new energy generation, grid enhancements, or energy supply chains, LPO’s fundamental value is low-interest financing and enhanced capital accessibility. LPO provides debt that commercial lenders either won't provide or offers this debt at a lower cost than available in commercial markets. This value is essential for the growth of emerging advanced energy technologies that typically struggle to overcome the “valley of death”—the difficult stage between innovation and commercial-scale deployment, where private financing is hard to secure. By providing inexpensive loan financing, LPO helps to bridge this gap and ensure that new technologies have a path to become commercially bankable.

The Fundamentals of Interest Rates

Lower interest rates mean lower overall project costs. Lower project costs mean fewer costs are passed along to consumers and therefore a smaller impact on monthly electric bills. This effect is amplified for more capital-intensive projects. For this reason, LPO is especially beneficial for financing emerging advanced energy technologies such as advanced nuclear, geothermal, and advanced fossil projects, as early deployments are substantially more expensive than later projects of the same technology due to a lack of efficiencies from learning and supply chain development. Low-interest financing helps constrain the impact of these risk factors on project’s overall cost, helping industry to develop order books and grow to scale.

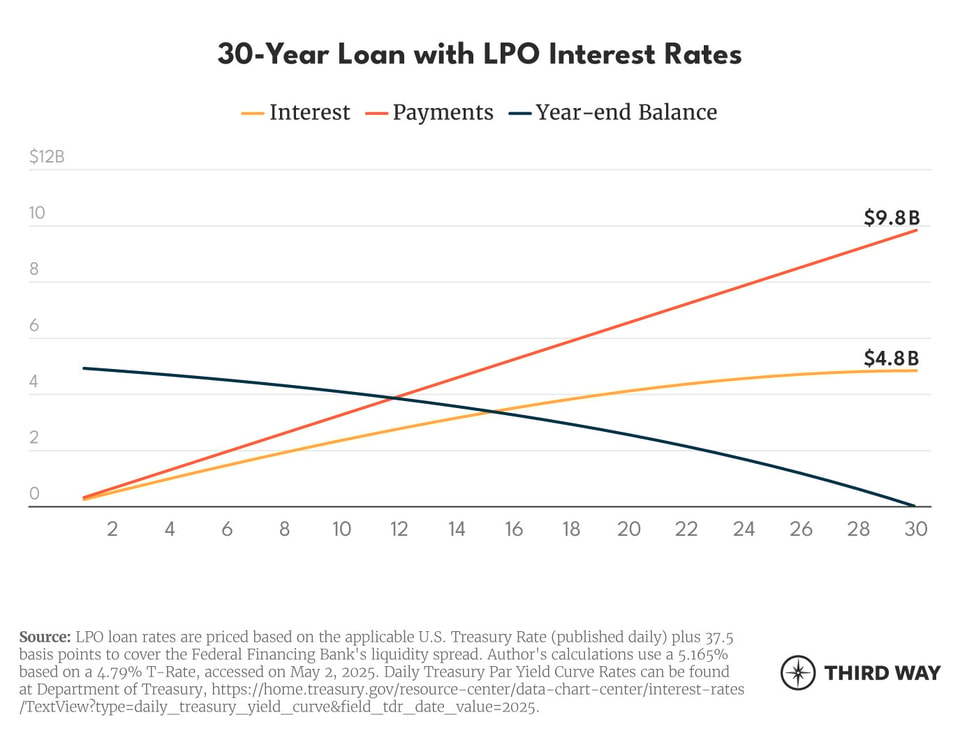

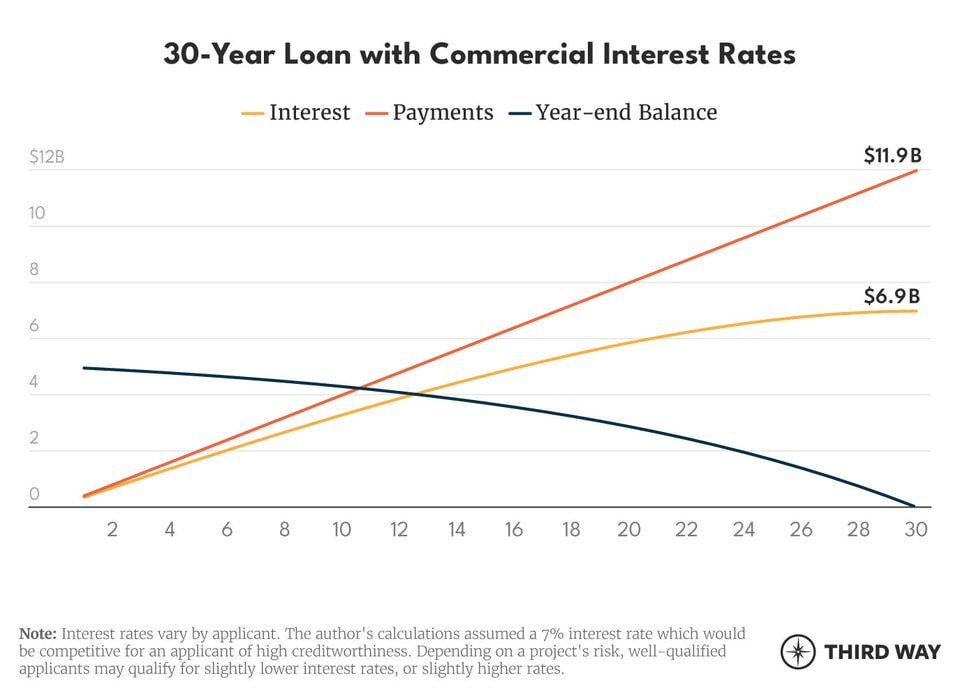

Below are two charts that show how access to LPO’s low-cost financing can avoid billions in additional costs, thereby saving money for companies trying to address growing energy demands and consumers trying to power their businesses and keep their lights on at home.

Picture this: you’re a company developing a $5 billion advanced reactor project. You go to LPO, apply for a Section 1706 Loan, and get a term-sheet for a 30-year loan at 5% interest.3 After all is said and done, you would pay off the loan plus an additional $4.8B in interest. That’s nearly double the construction costs, but it’s a cost that you’re prepared to absorb given the strong market outlook for 24/7, reliable, and clean power. But, your CFO is diligent and they want options. So, next you go to a commercial bank. You crack open your balance sheet, give them a list of your lenders, and you get another term sheet for a 30-year loan at 7% interest–a pretty solid rate for this endeavor.

You find that the commercial market is less enthusiastic about new tech than LPO. This time, you would pay off the loan plus an additional $7B in interest. That’s more than double the construction costs, and your shareholders start to get a bit skeptical that this project is worthy of tying up debt on. So, what's the moral of this story?

Low interest rates can substantially reduce the costs of large projects

- In this scenario, under identical tenors and terms (high-creditworthiness; facility and maintenance fees excluded), LPO financing could reduce a recipient's monthly payment by $6 million per month and reduce the total loan costs by over $2 billion.

- This capital access can directly reduce the burden on ratepayers by shrinking their share of new project costs.

- The comparative savings offered by LPO can be even more substantial depending on an applicant's credit and loan risks, because LPO’s credit subsidy can be used to cover loan risk-based costs that would otherwise need to be paid by the applicant.

The Importance of LPO for Nuclear Energy

For technologies like advanced nuclear, LPO is often the only game in town to finance new projects. The role of the Office has been to “build a bridge to bankability” by providing capital access (either directly or through guarantees) for projects that would otherwise struggle to secure financing due to inherent risks (credit risks, technology risks, etc). LPO’s loan guarantees provide a powerful form of credit enhancement for these projects by reducing a commercial lender’s risks–thereby making it easier for private lenders to reach a “yes” investment decision where they otherwise might not. Further, the office’s deep technology expertise helps them to more accurately price in risks associated with emerging technology thereby driving lower financing costs for projects that might even be bankable in the private market.

LPO’s Title 17 programs can finance a variety of projects across the nuclear industry, including nuclear reactor supply chain and manufacturing, new small modular reactor (SMR) and microreactor deployment, new large Gen III+ reactor deployment, and even nuclear fuel cycle projects. LPO can finance almost every type of new nuclear project, from innovative greenfield plant builds to energy infrastructure retrofits, such as Holtec’s Palisades Plant restart. The most recent new nuclear projects in the United States, Units 3 and 4 at Plant Vogtle, were financed with over $12 billion in loan guarantees, awarded during both the Obama and Trump Administrations. These loans are estimated to save Georgia Power’s customers $500 million through averted costs while also generating over $1B in interest returns for the US government to date.4

Looking ahead, the pipeline of potential nuclear projects is rapidly growing. In September of 2024, LPO identified $65B in existing or incoming advanced nuclear project applications to be funded through the program's existing loan authority. This includes a suite of innovative projects, such as the restart of Constellation’s Three Mile Island, which could be one of the first nuclear projects brought online to serve America’s AI boom.

Many other advanced nuclear developers, utilities, and data center developers are counting on LPO funding to finance the construction of nuclear projects in the next few years. The potential in this stream of projects is vast. In September 2024, DOE released a report finding that more than 60 GW of new nuclear capacity could potentially be built at operating or recently retired nuclear power plant sites across the country.5 LPO’s 1706 program is perfectly fit for this type of energy infrastructure reinvestment, and critical to enabling new projects to develop at the speed necessary to meet our booming energy demands.

The Importance of LPO for Grid Modernization

LPO is also accelerating the deployment of a variety of innovative technologies to modernize the electric grid, support the resilience and reliability of our power system, and help meet electricity demand growth. US industry can take advantage of Title 17 to deploy the advanced grid solutions that we need to modernize our grid for the challenges of the 21st-century.

For example, power providers and infrastructure owners can access LPO financing for critical infrastructure, such as the Grain Belt Express high-voltage interregional transmission line project spanning Kansas to Missouri. By connecting neighboring regions, interregional transmission projects, like the Grain Belt Express, provide significant benefits to grid reliability and affordability. Important studies from NERC, DOE, and MIT all converge on these findings: additional transmission links between neighboring regions would reduce system costs by billions, increase grid reliability by reducing outages during extreme events, and reduce emissions by bringing more low-cost renewable generation online.

Even within a specific region, US power providers are turning to LPO to help save money for customers on transmission projects and other grid enhancements. Earlier this year, PacifiCorp and LPO announced a conditional commitment for Project Wire, a slate of grid projects that will enhance the capacity and reliability of the Northwestern network by deploying~700 miles of new high-voltage transmission, which will increase transmission capacity, improve grid operational flexibility, and is expected to reduce overall system costs for consumers.

Beyond greenfield transmission expansion, deploying modern grid solutions, such as advanced conductors and grid-enhancing technologies (GETs), can increase the capacity of the existing grid in cost-effective ways and support incremental peak demand. However, they can often be more costly for power producers to finance as grid enhancement projects are not typically eligible for cost-sharing with ratepayers. This means utilities have to foot proportionally higher costs for these projects as opposed to new generation projects, which are rate base eligible. The accessibility of LPO financing provides customers flexibility to address demand gaps through grid efficiency that they might not otherwise opt for under typical market conditions. For example, LPO estimated that “PacifiCorp customers could benefit from approximately $1 billion in total savings over the life of the loan” for Project Wire.

From Pacific Gas & Electric’s (PG&E) loan to refurbish hydroelectric infrastructure and associated transmission lines, to DTE Energy’s loan to upgrade Michigan’s energy system with pipeline replacements and new energy projects, LPO has served as a vital partner for utilities across the US. Several other utilities, including Georgia Power, have expressed interest in securing financing from Title 17 to enhance grid performance at a reduced cost for customers, illustrating the ongoing need and opportunity for this program.

Enabling Energy Abundance

After decades of flat electricity demand, annual load growth is surging to levels not seen since the 1970s. Meeting this generational challenge will require the rapid expansion of our electric grid alongside a dramatic deployment of advanced generation technologies needed to power the 21st-century economy. At the same time, increased extreme weather events and the expanding potential of cyber attacks on critical infrastructure are ratcheting up the complexities of modern grid management.

The US needs to significantly reduce the burden on states, utilities, and industry to procure new technologies and expand grid capacity, not exacerbate such efforts and drive up energy costs for Americans. LPO directly serves this purpose by reducing the cost of financing for a variety of critical energy projects and providing capital access for innovation where the private market isn’t.

By leaning into LPO’s toolkit, the US can enable energy abundance and support cost-effective uses of public capital. To do this, the Admin must follow through on over $41 billion in conditional commitments for projects that meet the goals of improving our energy system and making energy more affordable, reliable, and secure. More broadly, LPO must be empowered with the staffing and loan authorities needed to process, vet, and close new agreements at the pace our energy system requires. Anything less would impair our deployment of advanced energy technologies to address the current energy emergency, squander substantial economic gains from returns on LPO’s public debt investments, and drive higher energy prices by subjecting American companies to higher-cost debt in private markets.