Report Published December 17, 2025 · 12 minute read

How Congress Should Keep Fighting Surprise Medical Bills

Darbin Wofford

Takeaways

The No Surprises Act was a landmark achievement in protecting patients from unexpected and unaffordable medical bills. But the creation of a flawed arbitration process allows certain providers to continue exploiting the system and inflating patients’ costs. These gaps, while technical, have real-world consequences for families and small businesses alike that risk shifting costs to people’s premiums. Without stronger guardrails, the law risks becoming a backdoor for higher premiums, rising deductibles, and continued abuse.

Congress must take urgent action to strengthen and expand the law. Here are options for Congress to consider:

1. Expand protections in the law to cover ground ambulances.

2. Improve fairness in dispute resolution to prevent provider abuse.

3. Benchmark out-of-network bills to the median in-network rate.

4. Cap all out-of-network reimbursement to incentivize network participation.

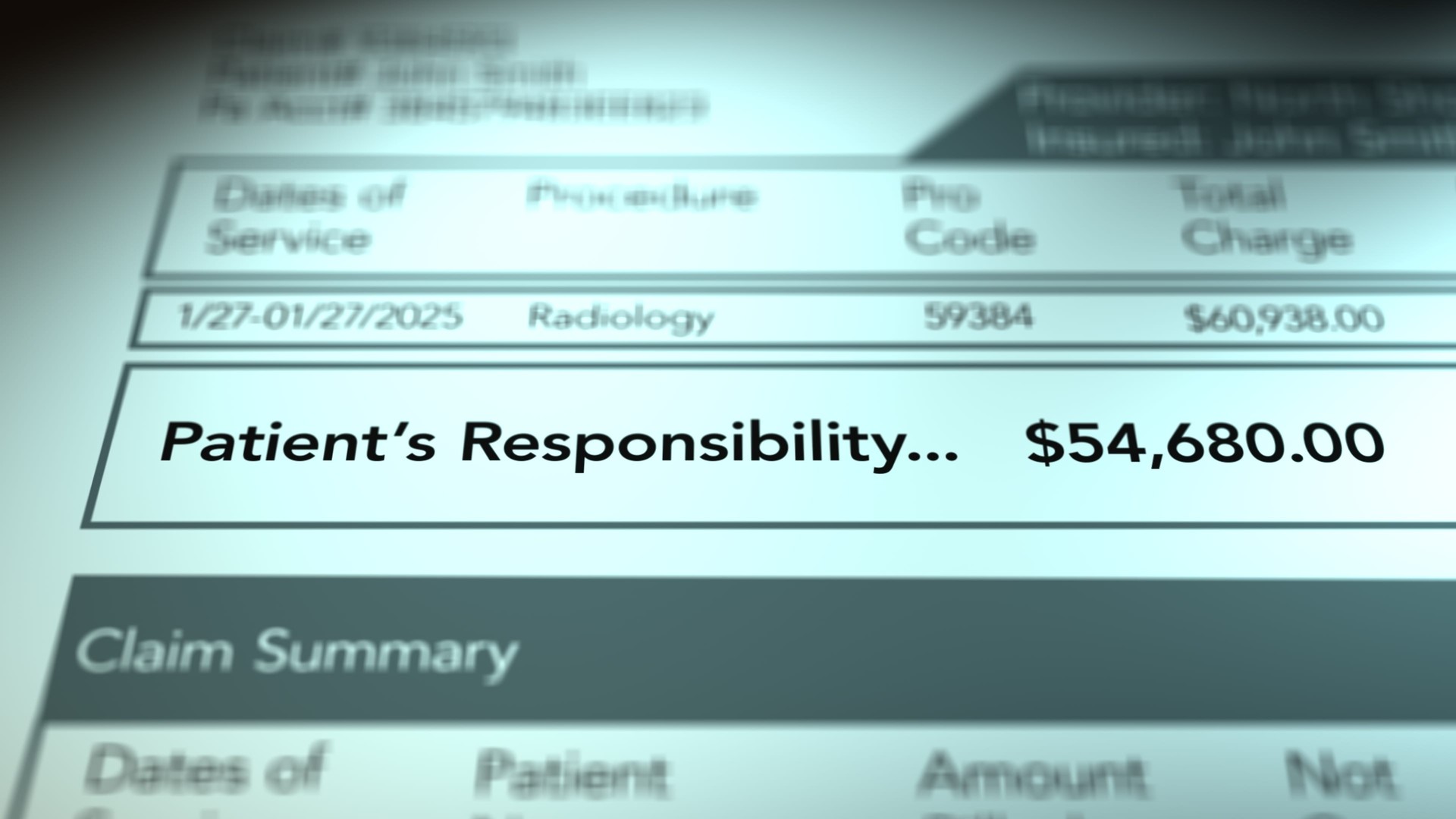

Imagine going to the emergency room thinking your insurance would cover the visit, only to get hit weeks later with a bill from an out-of-network doctor you never met and didn’t choose. That used to be the norm. Even when patients did everything right—having coverage and going to an in-network hospital—they could still end up on the hook for thousands of dollars in surprise bills. Stories like this were the lived experience of millions of Americans before the No Surprises Act’s passage, driving medical debt and forcing difficult choices between paying for care and meeting other essential needs.

Before Congress stepped in, nearly one-in-five emergency room visits and up to 70% of air ambulance rides resulted in surprise medical bills.1 The practice wasn’t just unfair to patients, it was predatory. Patients had no ability to choose the providers who would administer care for them (often in life-or-death situations), no warning that a bill was coming, and no leverage to negotiate after the fact. This meant that even insured individuals—those who had done everything 'right' in the health care system—could be hit with life-altering bills through no fault of their own.

The No Surprises Act protected patients from most surprise medical bills, but problems still persist. Instead of ending surprise medical bills across the board, Congress created a flawed and easily abused Independent Dispute Resolution arbitration process that risks shifting the burden of out-of-pocket costs in a way that increased patient’s premiums and did nothing to protect against surprise bills from ground ambulances. This report looks at how the law works, where it’s falling short, and what policymakers should do next to close loopholes and strengthen protections.

This report is part of a series called Fixing America’s Broken Hospitals, which seeks to explore and modernize a foundation of our health care system. A raft of structural issues, including lack of competition, misaligned incentives, and outdated safety net policies, have led to unsustainable practices. The result is too many instances of hospitals charging unchecked prices, using questionable billing and aggressive debt collection practices, abusing public programs, and failing to identify and serve community needs. Our work will shed light on issues facing hospitals and advance proposals so they can have a financially and socially sustainable future.

Overview of the No Surprises Act

In 2020, Congress passed the No Surprises Act, a landmark law to shield patients from the financial harm of surprise medical bills. Prior to the law, patients frequently received unexpected—and often massive—bills after receiving care at hospitals or clinics where some of the providers involved were not in their insurance network. These bills often came as a shock to patients who had no control over which anesthesiologist, radiologist, or emergency physician treated them.

A staggering 20% of hospital admissions at the time included a surprise medical bill, sometimes totaling tens of thousands of dollars.2 For example, a 44-year-old teacher in Austin, Texas was hit with a $109,000 bill after a heart attack resulted in a four-day hospital stay—all because some of her care was delivered by out-of-network providers.3

The core aim of the No Surprises Act is to protect patients from these unfair charges. The law bans surprise medical bills in three key situations:

- Emergency services

- Nonemergency services performed by certain out-of-network providers at in-network facilities

- Air ambulance services

It requires insurers to cover emergency care without prior authorization and at in-network cost-sharing rates, regardless of the provider's network status. This helps reduce financial burden on patients seeking lifesaving care who may not be in the right condition to ask questions about coverage for the services they are receiving.

For nonemergency situations, like when a patient has surgery at an in-network hospital but unknowingly receives services from an out-of-network provider (such as a surgeon or anesthesiologist), the law prohibits providers from billing patients more than the in-network cost-sharing amount. These protections have significantly reduced the risk of financial devastation from unexpected bills for millions of Americans with private insurance.

To address how providers and insurers settle payment disputes in these scenarios, the law also established a process known as independent dispute resolution, or arbitration. Rather than leaving patients caught in the middle between providers and their insurance, the dispute resolution process allows either the provider or the insurer to initiate a 30-day open negotiation to determine a fair payment. If no agreement is reached during that window, the dispute proceeds to arbitration, where a third-party arbiter selects one party’s proposed payment based on a range of factors.

While intended as a fair and balanced system, arbitration has instead become a high-volume, high-stakes arena—often leveraged by well-funded provider groups to secure rates well above typical in-network levels. As a result, the arbitration process has increasingly become a flashpoint in implementation, with some providers aggressively using arbitration to push for higher payments—which risks driving up premiums and administrative costs.

In the courts, some health care providers are also seeking to undermine the No Surprises Act through lawsuits against the federal government. For example, the Texas Medical Association has sued the federal government four times. In these suits, district-level courts ruled in favor of providers, which made the dispute resolution process more friendly to providers instead of patients.4 The American Hospital Association and the American Medical Association have also sued the federal government to undermine the law and give more preference to providers.

The Problem: Gaps in the Law are Keeping Costs High

While the No Surprises Act rightly protects patients from surprise bills, the law has failed to protect consumers from high costs in two key areas:

1. Excessive provider prices for out-of-network charges.

The heart of the No Surprise Act is an independent dispute resolution process. It was designed to resolve conflicts between providers and health plans over the price of an out-of-network service. The expectation at the time of the law’s passage was that most disputes would be settled during the initial 30-day negotiation window through good-faith negotiations, with only a limited number escalating to arbitration. Instead, the opposite is occurring.5

From the first year of implementation, CMS data revealed that arbitration was being used at volumes far beyond projections. In 2023 alone, over 657,000 disputes were submitted—more than 14 times the initial federal estimate.6 This increased to 586,000 in just the first half of 2024.7 Many of these filings came from a relatively small number of well-resourced provider groups, often owned or represented by large private equity-backed firms.8 One company, HaloMD increased its filings by 600% over two years.9 These corporate providers have developed a deliberate strategy of submitting disputes in bulk, which overwhelms the system and creates pressure on insurers to settle at higher payment amounts rather than incur the costs of prolonged arbitration. In addition, many filings are not eligible in the first place, which also floods the system.10

Further, arbitrators are permitted to consider factors beyond the median in-network rate, such as inflated historical out-of-network charges. This can skew awards toward the higher end of the payment spectrum, even in markets where negotiated in-network rates are much lower. In effect, the process allows providers to secure payments that exceed market norms, which insurers then factor into premium setting for employers and individuals. In 2024, the median prevailing offer when providers won was 445% of the median in-network rate.

Higher out-of-network arbitration awards are likely increasing the overall cost of care and rising premiums for employers—all of which ultimately erodes the affordability gains that the No Surprises Act was meant to achieve. If left unaddressed, the arbitration system risks becoming a permanent cost escalator—one that benefits high-charging providers at the expense of patients and payers alike.

2. Ambulance services.

The No Surprises Act also failed to end surprise medical billing for ground ambulances, even though they are used in 98% of emergency transportation methods.11 Up to 85% of ground ambulance claims are out-of-network, exposing patients to surprise medical bills in emergency situations.12 Despite ground ambulance services being the far more common option in emergency situations, these services continue to operate largely outside the consumer protections in the No Surprises Act, unlike less frequently used air ambulances.

However, the law did establish the Ground Ambulance and Patient Billing Advisory Committee, which developed a report to Congress on how to best solve this problem.13 In the Committee’s report, a number of recommendations were made:

- Include ground ambulance emergency services under essential health benefit emergency services definition of the Affordable Care Act;

- Limit patient cost-sharing to $100 or 10% of the rate of care, whichever is lower; and

- Cap out-of-network ground ambulance prices at a percentage of Medicare determined by Congress if no state, local, or plan-provider contract rate is set.

To date, 18 states have protections against surprise medical billing for ground ambulances.14 In 2024, four states (Indiana, Mississippi, Oklahoma, and Washington) passed laws protecting consumers against surprise billing for ground ambulances, setting rates at a percentage of Medicare.15

How Has Congress Tried to Fix the Problems?

In 2019, the House Committees on Energy & Commerce, Ways and Means, and Education & Labor (now Education & the Workforce) held hearings and markups on surprise medical billing and proposals to end it. Further, the health care related committees in Congress passed competing proposals over how to address surprise medical billing.

In bicameral, bipartisan negotiations, House Energy & Commerce and Senate HELP came to an agreement that would have required health plans to pay out-of-network providers the median in-network rate within the region. This would have ensured providers would be paid what they commonly would if they were in network, while ensuring patients are protected against excessive costs.16 A similar version of this proposal was passed by Education & Labor.

However, right before the legislation was included in the 2019 end-of-year package, a rival bill was introduced that derailed the agreement.17 Supported by hospital and physician groups, this bill favored a heavier reliance on arbitration and provider-friendly processes. As a result, the limits on surprise medical billing were delayed by a whole year, not passing until 2020, and ultimately reflected the provider-backed reforms as opposed to the proposal putting patients first.

The initial debate surrounding surprise medical billing lacked an acknowledgement that the providers choosing to send patients these bills were at fault. Rightfully so, most of the discourse centered on protecting patients from surprise bills but lacked the understanding of who they needed protection against.

Surprise bills occur because certain providers deliberately remain out-of-network to maximize leverage and extract higher payments. By ignoring provider responsibility, the conversation made it seem as though patients were merely caught in a crossfire between two equally responsible parties. In truth, patients became collateral damage in a business model designed by providers to exploit gaps in insurance networks and to force payers into paying inflated charges.

The Solution: Expand the No Surprises Act to Protect Against High Costs.

To better protect patients from gaps in the No Surprises Act, Congress must fix the arbitration process and improve the law. Here are a few options:

First, end surprise billing for emergency ground ambulance services. Congress should enact the recommendations from the Ground Ambulance and Patient Billing Advisory Committee by designating these services as essential health benefits, limiting patient cost-sharing, and capping reimbursement as a percentage of Medicare.

Second, improve the dispute resolution process to even the playing field and limit abuses. Congress should require arbitrators to use the median in-network amount as the most critical consideration in determining payment resolution and add Medicare rates into their consideration. It should also add a screening process and improve the online portal, which starts the dispute process, to weed out ineligible filings like Medicare disputes. Performance metrics for the arbitrators would also help improve eligibility accuracy, timeliness, and fairness. Lastly, arbitrators should be barred from considering previous out-of-network rates, and providers should face harsh penalties for submitting claims that are inconsistent with law including attempts to resubmit a dispute in violation of the mandatory 90-day “cooling-off” period.

Third, replace the dispute resolution process with a benchmark rate based on the in-network median. Return to the original bipartisan idea: set a clear, predictable payment standard based on the median in-network rate. This reduces administrative costs, prevents gaming of arbitration, and reins in out-of-control provider charges. While it may be difficult to immediately replace arbitration, steps can also be made to put a higher emphasis on the median in-network rate throughout the process and make it less biased towards providers.

Fourth, cap all out-of-network reimbursement to incentivize network participation. Congress should implement a hard cap on what providers can charge out-of-network, set as a percentage of Medicare rates to discourage providers from staying out-of-network as a business strategy.

Importantly, Congress should also reject proposals that undermine the law. Efforts are underway, both through legislation and litigation, to weaken the No Surprises Act. In Congress, the No Surprises Enforcement Act was introduced to further tilt the scales towards providers, and it should be opposed.18 While enforcement of the No Surprises Act is important, the legislation only increases penalties for patients’ health plans for failure to meet deadlines, with no changes for how providers comply. While the arbitration process already favors hospital chains and private equity-backed physicians over patients, Congress should reject legislation that would tip the scales further away from the interests of patients.

The Bottom Line

The No Surprises Act was a major win for patients. However, there are significant gaps in the law. Without action to close loopholes within the law and stop abuse of the system, these gaps will play a role in rising costs and patients being hit with astronomical medical bills. Congress must act now to protect patients and lower health care bills.