Memo Published December 11, 2025 · 5 minute read

What to Know About Interest Spending and Crowd Out

Annie Shuppy & Zach Moller

Last year, the federal government spent nearly $1 trillion on interest due to our $30 trillion national debt (debt held by the public).1 That money did not feed families, strengthen national defense, or invest in our long-term economic growth. It simply had to be paid to bondholders—foreign and domestic—because of past spending decisions. Rising interest costs act as a budgetary anchor, dragging today’s taxpayers down to finance yesterday’s choices at the expense of tomorrow’s opportunities.

Interest spending is now the fastest-growing part of the federal budget, and it is projected to keep climbing as debt accumulates and interest rates remain elevated. Policymakers cannot negotiate these payments or push them off; the federal government must pay its interest or risk default. As a result, higher interest costs squeeze discretionary spending, worsen intergenerational inequities, and leave fewer resources for core national investments like infrastructure, research, education, and support for children and families.

This memo outlines the scale of the interest-spending problem in today’s post-tax cut environment, explains why these costs provide no economic return, and describes how rising federal debt crowds out both public and private investment. Understanding the magnitude of this challenge is essential to charting a new course for our budget future.

OBBBA Made High Interest Spending Worse

As the national debt grows, the federal government must devote more of the budget to interest spending. Interest is currently the third-largest budget item ($881 billion in FY 2024, $970 billion in FY 2025), larger than Medicaid ($618 billion in FY 2024, $688 billion in FY 2025) and defense ($874 billion in FY 2024, $917 billion in FY 2025).2 Only Medicare and Social Security exceed interest spending, for now.

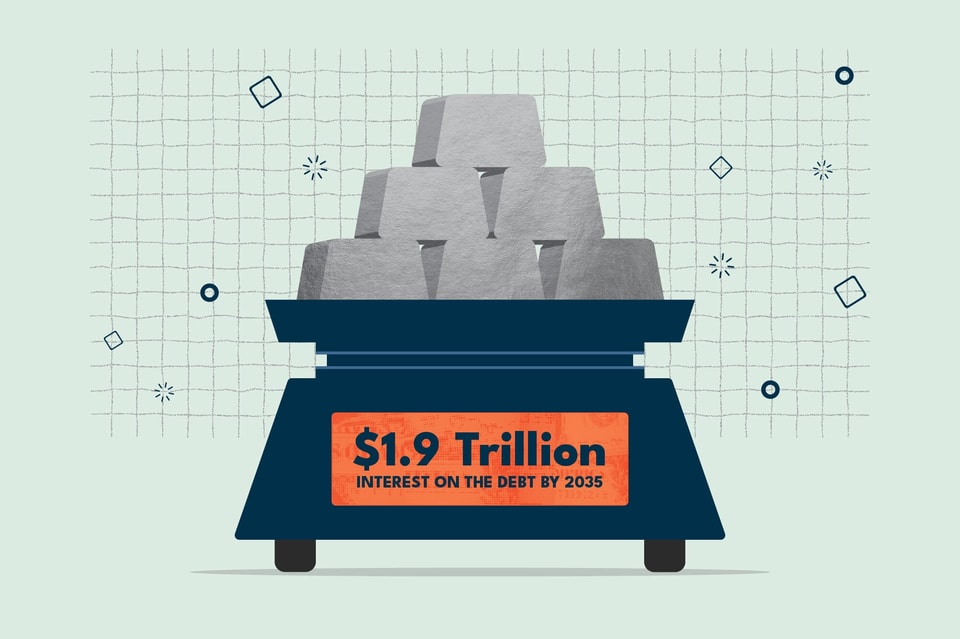

Interest spending on the debt is projected to be 4.4% of GDP ($1.924 trillion) by 2035.3 This total increased by 0.3% of GDP due to the One Big Beautiful Bill Act (OBBBA).4 A one-third percentage point may sound small, but it adds up to $141 billion in additional interest costs in 2035—almost as much as the amount the federal government is projected to spend on Affordable Care Act premium tax credits that year.5 In total, between now and 2035, we will need to pay $14.7 trillion in interest costs.6 For each additional dollar OBBBA added to the primary deficit, it added roughly $0.21 in interest costs.7 CBO officially scored OBBBA over the 2025-2034 budget window—a combined $4.1 trillion debt increase with $3.4 trillion in deficit increases and $718 billion in interest costs.8

Let’s look at interest spending over the long term. As the debt-to-GDP ratio increased in the 1980s and early 1990s, interest costs rose to between 3.0%-3.2% of GDP and remained high until the late 1990s when the national debt also began to decline.9 The combination of higher interest costs and increasing mandatory spending driven by Social Security and health care means that Congress simply has less control over how money is spent year-to-year. In 1974, the federal budget consisted of 8% interest costs, 41% mandatory, and 51% discretionary spending. In 2024, the federal budget was 13% interest costs, 60% mandatory, 27% discretionary.10 Even in the 1980s and 1990s when interest rates (and thus interest costs) were high, the rest of the budget was more balanced between mandatory and discretionary spending.11 By 2035, we project interest to be nearly 19% of all spending.12

Three Reasons Why High Interest Spending Hurts

1. It shortchanges investment in future generations. Rising interest costs force today’s taxpayers to finance past decisions instead of investing in the future. As interest takes up more of the budget, pressure intensifies on the discretionary spending—the very spending which supports long-term national investments like infrastructure, research, and education. These programs rely on annual appropriations and annual decision-making, which makes them more likely to feel the squeeze than mandatory spending.

Even a cross-cutting analysis of federal investment spending shows its decline in recent decades.13 The federal government averaged 21% of the budget on total investment spending in the 1960s and 12% of the budget in the 1970s before declining to less than 6% of the budget by 2024.14 All while interest spending, since 1962, more than doubled as a share of the budget from 6% to 13%.15

2. It squeezes out support for today’s children and families. The federal government now spends more on interest costs than on children.16 By 2034, spending on children will decline to 6% of the budget while interest costs increase to 17% in that year.17 Federal spending on children includes both mandatory and discretionary spending, tax credits that benefit families, and portions of major safety net programs like Medicaid and SNAP that are spent on benefits to children.

3. It weakens private-sector growth. Interest on the debt not only crowds out public investment, but it also crowds out private investment. Each additional percentage point in the debt-to-GDP ratio increases long-term interest rates between 1.5-4.7 basis points.18 In turn, higher interest rates discourage borrowing for private investment by as much as a third of each dollar of debt, reducing capital formation and economic output.19 Another way for private sector crowd-out is called portfolio substitution, where investors further divert capital from productive private-sector uses into safer government securities.20