Memo Published May 16, 2025 · 3 minute read

Tariffs Can’t Pay for the GOP Tax Bill

Annie Shuppy & Zach Moller

As Donald Trump drives the US economy off a cliff, Republicans have a new talking point: tariff revenue will pay for tax cuts.1 There’s a problem with that statement, though. It’s simply not true.

Even Trump’s most aggressive tariffs won’t be able to make up for the lost revenue from extension and expansion of the 2017 Republican tax bill. In fact, tariffs could only raise half of the revenue the federal government would otherwise forgo under very optimistic estimates. At the end of the day, tariffs can’t effectively finance the Republican tax bill for four key reasons:

- The Trump tax cuts are expensive.

- Tariffs don’t raise enough money to finance tax cuts.

- Tariffs raise even less than we think.

- This tariff revenue is also a budget gimmick under the rules.

The Facts

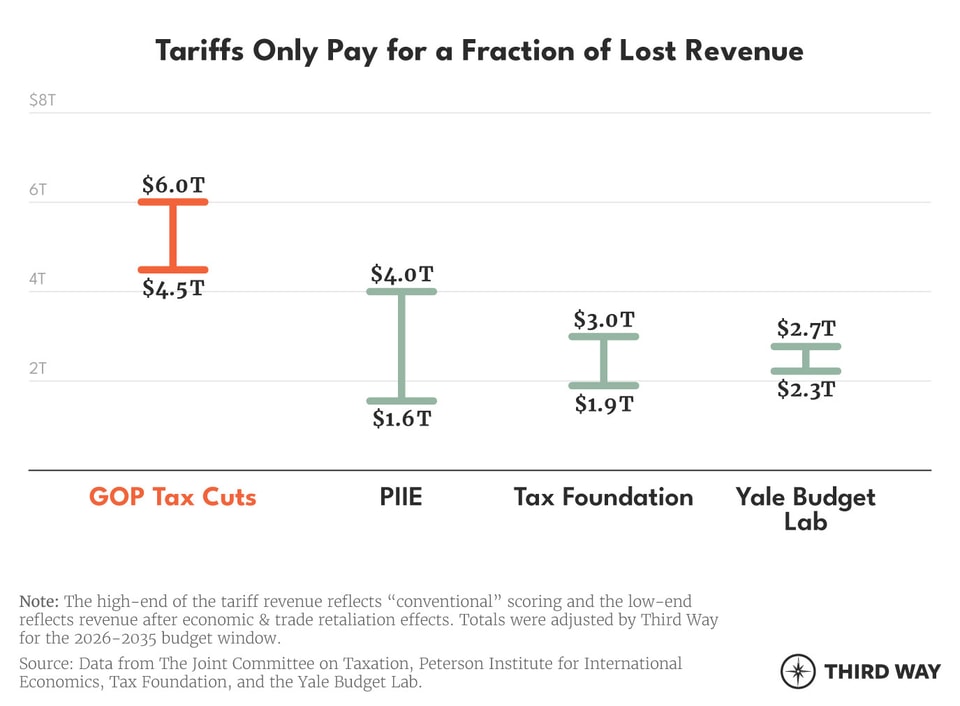

The Trump tax cuts are expensive. The federal government is poised to lose $4.5 trillion in revenue through 2035 if Republicans extend the Tax Cuts and Jobs Act (TCJA) without offsets.2 Reconciliation instructions also allow an additional $1.5 trillion in deficit increases for other Republican tax priorities, like Trump’s proposals to end taxes on tips and overtime.3 That means the federal government could lose $6 trillion in revenue.

Tariffs don’t raise enough money to finance tax cuts. Mainstream economists (Peterson Institute for International Economics, Tax Foundation, and Yale Budget Lab) project that tariffs will generate $2.7 trillion to $4 trillion in revenue over 10 years (FY 2026-2035).4 But that’s the rosy scenario for government coffers. Tariff revenue would only go up between $1.6 trillion to $2.3 trillion when you include the impact on the economy—so-called “dynamic effects”—and expected retaliation from other countries on US goods.5 Since tariffs are a tax on imported goods, dynamic effects account for the economic impact of people and businesses buying less. So, at best, tariffs could only pay for less than 40% of the $6 trillion Republican tax cuts.

Tariffs raise even less than we think. The mainstream projections on tariff revenue are still wildly optimistic because they assume Trump’s tariffs are permanent. But if you listen to the rhetoric from many Congressional Republicans and Treasury Secretary Scott Bessent, tariffs are a tool to get trade deals.6 And these trade deals will theoretically lower tariffs—further reducing the amount of money available to finance Republican tax cuts. For example, some of the tariffs on China have been temporarily shrunk.7 The fact that these tariffs are done by executive order also means they could be removed by a future President or even delayed, as Trump has already done.

This tariff revenue is also a budget gimmick under the rules. If Republicans wanted to raise tariffs to fund the tax cuts, they could do so in the budget reconciliation legislation. The Congressional Budget Office and Joint Committee on Taxation would officially evaluate the legislation and “score” it in terms of how much money would come in. The fact that Trump is pursuing tariffs through executive order means they cannot get counted in the reconciliation bill budget score and be used for budget enforcement purposes. If a member of Congress wants to say that tariffs pay for the tax cuts, it’s a delusion and a budget gimmick.

Note: Both the Trump tariffs and the GOP budget reconciliation bill are changing all the time. The specific numbers modeled and scored may be slightly different in the end. But the fact will remain, tariffs cannot pay for the level of tax cuts being proposed.