Blog Published April 4, 2019 · 3 minute read

Analyzing The Saving for the Future Act

Zach Moller

Half of all workers go to their job every day and don’t earn a single dime for retirement besides Social Security. That will all change if the far-sighted legislation introduced today by Senators Chris Coons (D-DE) and Amy Klobuchar (D-MN) becomes law. Representatives Scott Peters (D-CA), Lucy McBath (D-GA), and Lisa Blunt Rochester (D-DE) introduced a companion measure in the House.

The Saving for the Future Act will reverse the widening wealth gap in America and make a comfortable retirement the rule, not the exception, for all working Americans. As an added benefit, it will create a small rainy day fund to help ordinary people cover simple emergency costs like a fender bender or replacing cracked plumbing pipes.

The bill establishes Universal Personal savings and retirement accounts for all employees who are currently not receiving retirement contributions from their employer.

The proposal, similar to Third Way’s Universal Private Retirement Account,1 would create a powerful tool for employees to save for both retirement and emergencies. Third Way analyzed the bill and found that The Saving for the Future Act could provide over three quarters of a million dollars for retirement and emergencies for a typical high school-educated worker. For a married working couple, savings would exceed a million dollars.

Here’s some of what’s in The Saving for the Future Act:

- The bill establishes a minimum employer contribution of 50 cents an hour to a retirement plan.

- For businesses that do not offer traditional pensions or retirement plans, the contribution can be done via payroll into Universal Personal accounts which are automatically invested in low-fee, life-cycle funds.

- These accounts have a default employee contribution of 4%, rising to 10% over time with the ability for all workers to opt out.

- $2,500 in contributions would go to a savings account for emergencies before contributions would go toward retirement.

- The bill provides a tax credit for employers to offset part of their minimum contributions.

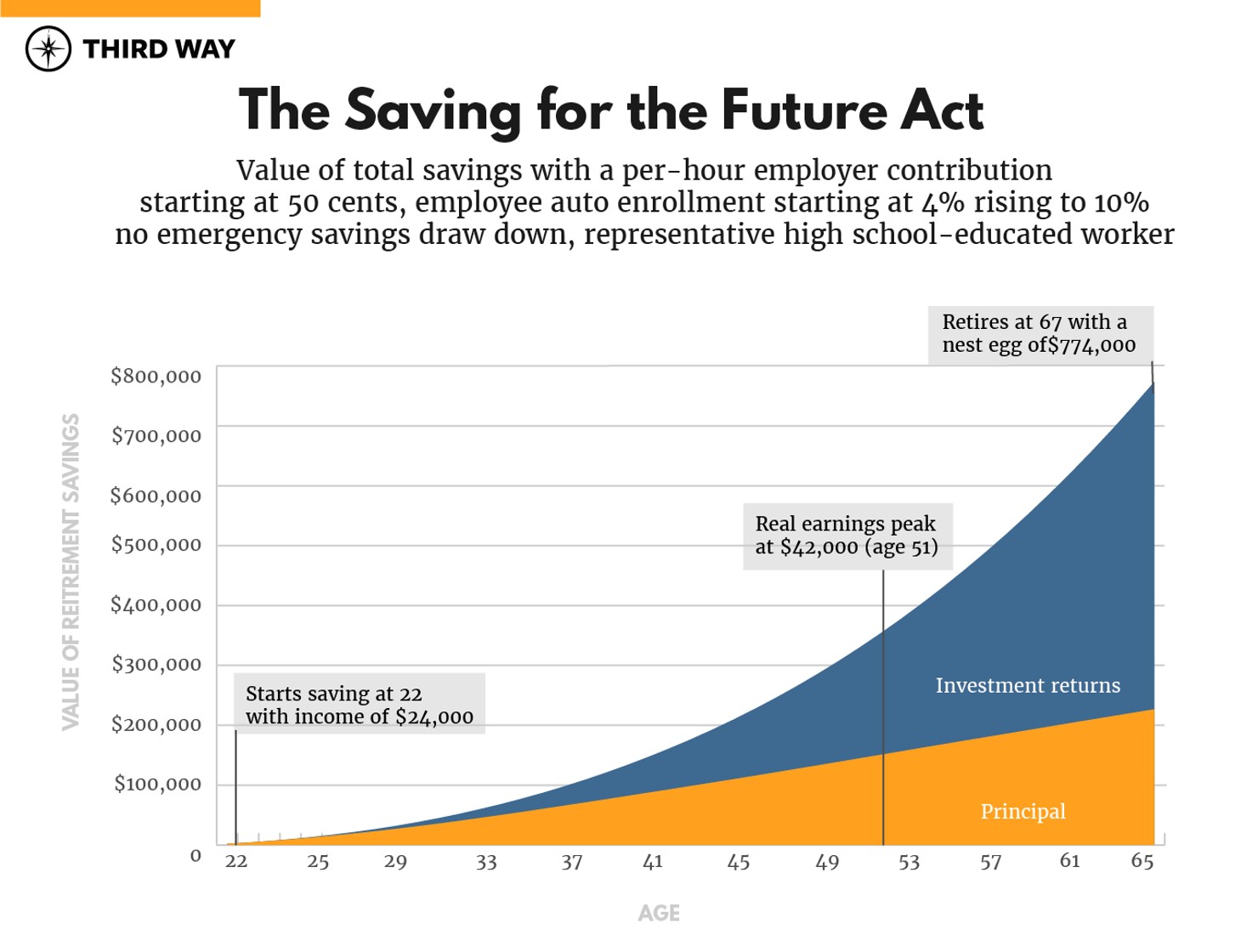

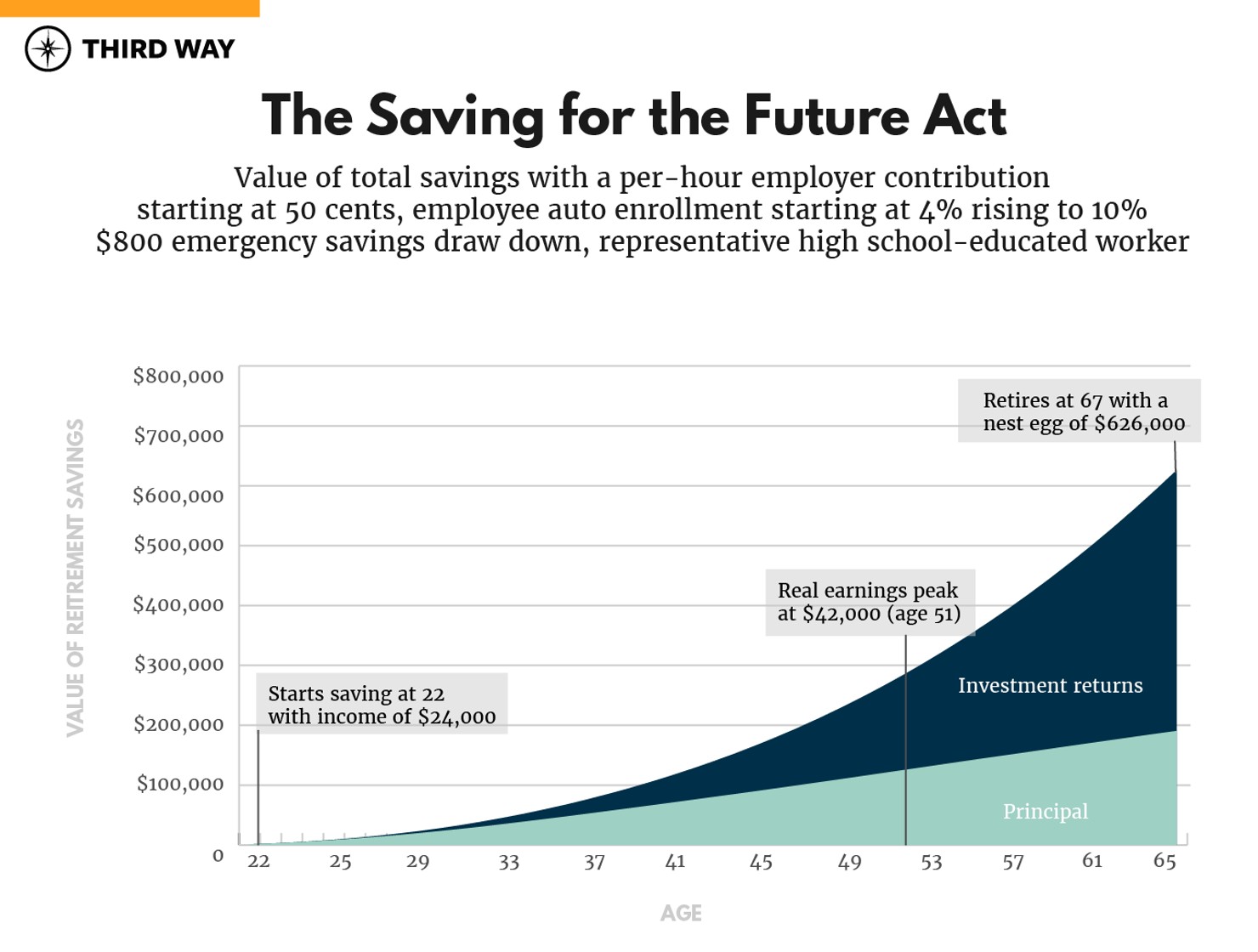

Third Way analyzed the bill by simulating the earnings of a representative high school-educated worker and using the last 45 years of financial market returns. The simulation methods are the same as Third Way’s Universal Personal Savings Account proposal.

Under the standard contributions of the bill (employer contribution and 4% employee contribution rising to 10% over time) Third Way estimates that this proposal would provide $774,000 in 2018 dollars for retirement (between the two accounts)—enough for roughly $31,000 in annual supplemental income on top of Social Security.

Along with retirement, The Saving for the Future Act provides the opportunity to save for emergencies. If the same individual as above needed to pay for two $400 emergencies every year over the course of a 45 year career, the proposal would provide $626,000 in 2018 dollars for retirement (between the two accounts). This provides for roughly $25,000 in annual supplemental income on top of Social Security.

A lifetime of work should lead to a comfortable, dignified retirement. Third Way applauds Sen. Coons, Sen. Klobuchar, Rep. Peters, Rep. McBath, and Rep. Blunt Rochester for making that promise a reality.