Resource Repository on Gainful Employment

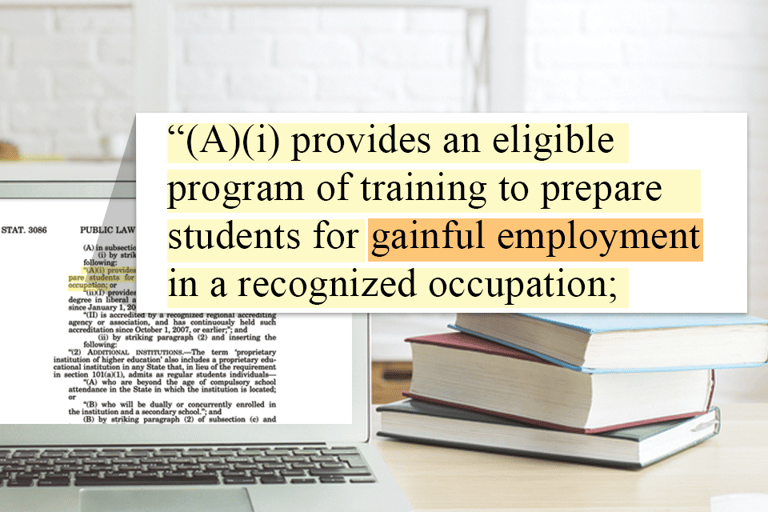

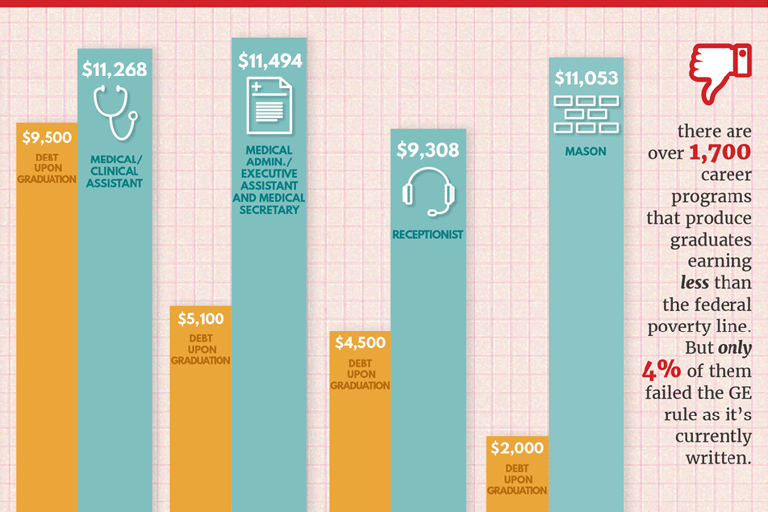

The Higher Education Act stipulates that career education programs must “prepare students for gainful employment in a recognized occupation” to be eligible to receive federal student aid dollars. Through its updated gainful employment (GE) rule, the Department of Education establishes a framework for how career training programs can demonstrate that they meet that bar—setting baseline quality standards for access to federal funding tied to program graduates’ earnings outcomes and the manageability of their student debt. Third Way’s products on GE highlight the need for a strong gainful employment rule to protect student and taxpayer investment in career education.

Filters

Third Way Education